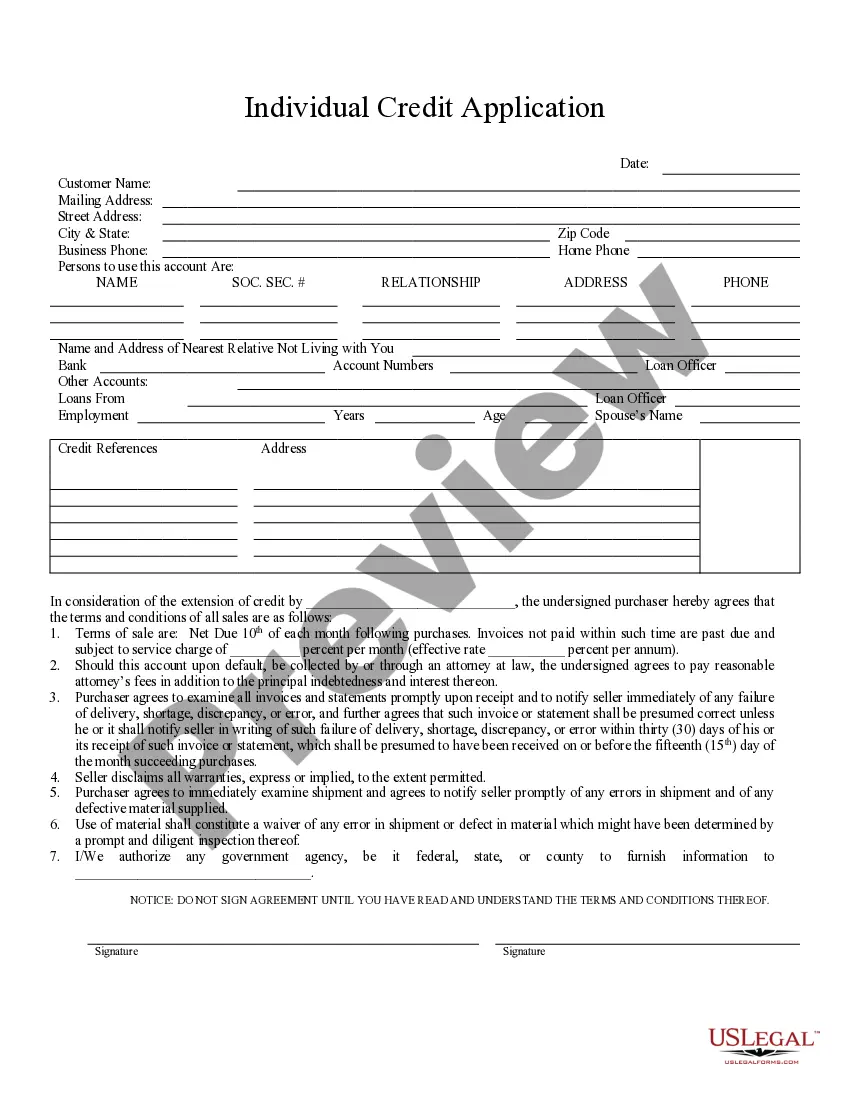

Lowell, Massachusetts Individual Credit Application is a form that individuals residing in Lowell, Massachusetts complete when applying for credit from various financial institutions, such as banks or credit unions. This detailed application gathers important personal and financial information to assess an individual's creditworthiness and determine whether they qualify for a loan, credit card, mortgage, or other types of credit. The application typically requires the applicant to provide their full name, contact information (address, phone number, and email), social security number, date of birth, and employment details, including current and previous employers, job titles, and income information. Additionally, the application collects information about the applicant's current debts, such as outstanding loans or credit card balances, as well as their monthly expenses, including rent/mortgage payments, utilities, and other regular financial obligations. Furthermore, the Lowell, Massachusetts Individual Credit Application may ask for details regarding the applicant's previous credit history, including any delinquencies, bankruptcies, or other negative remarks that may impact their creditworthiness. It also often includes a section where the applicant can list any assets they own, such as real estate, vehicles, savings, or investments. By gathering all this information, financial institutions can carefully evaluate an individual's financial situation and assess their ability to repay the borrowed funds. The application is particularly important for lenders, as it helps them mitigate risks and make informed decisions based on an applicant's creditworthiness. It is worth noting that there may be different types or variations of the Lowell, Massachusetts Individual Credit Application, depending on the specific financial institution or the type of credit being applied for. For example, there could be separate applications for personal loans, business loans, car loans, credit cards, or mortgage loans. Each application may have slightly different questions or sections tailored to the specific type of credit being sought. Overall, the Lowell, Massachusetts Individual Credit Application plays a crucial role in the credit assessment process, enabling financial institutions to determine a borrower's suitability for credit by analyzing their financial profile, credit history, and ability to repay the borrowed funds.

Lowell Massachusetts Individual Credit Application

Description

How to fill out Lowell Massachusetts Individual Credit Application?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Lowell Massachusetts Individual Credit Application gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Lowell Massachusetts Individual Credit Application takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a couple of more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Lowell Massachusetts Individual Credit Application. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!