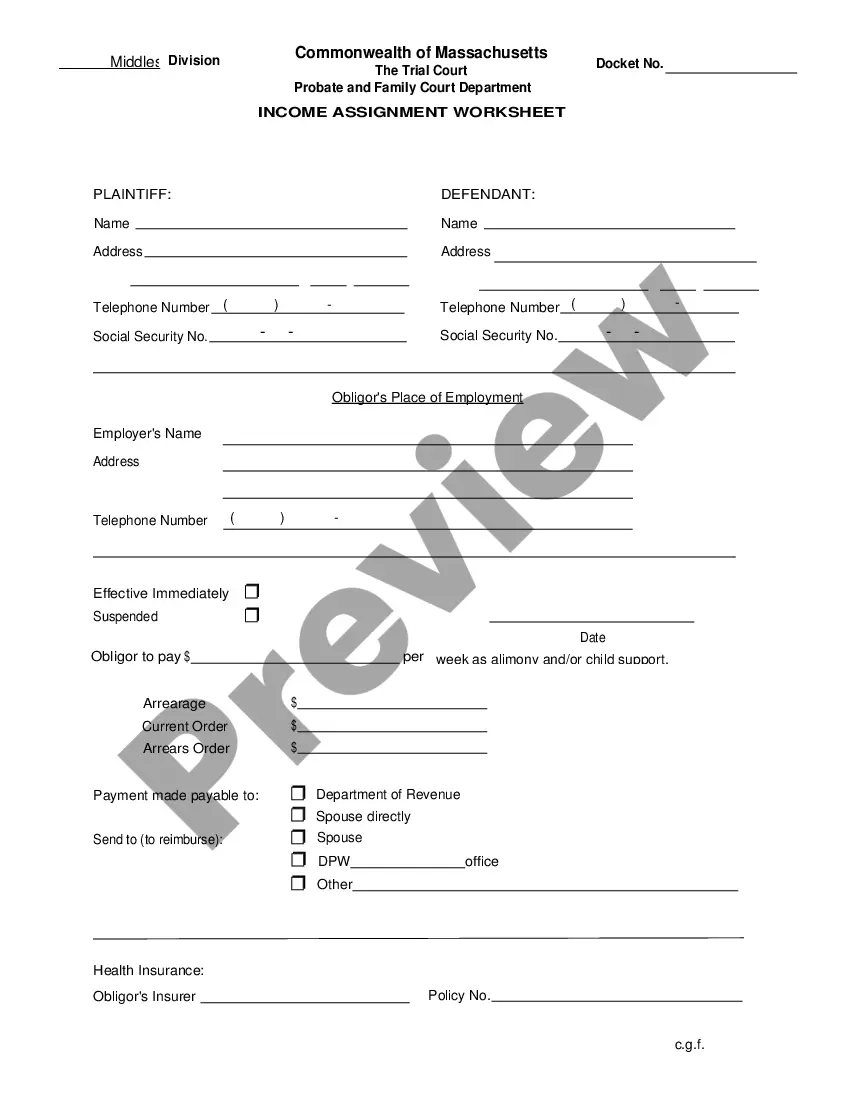

Cambridge Massachusetts Income Assignment Worksheet is a document used to determine and allocate income for various purposes within the city of Cambridge, Massachusetts. This worksheet helps individuals, businesses, and government agencies to track and allocate their income accurately while complying with local tax regulations. The Cambridge Massachusetts Income Assignment Worksheet is primarily used for calculating income for tax purposes. It provides a comprehensive breakdown of various income sources, deductions, and exemptions that need to be considered while determining the taxable income within Cambridge. Some relevant keywords for this topic include: 1. Income Assignment Worksheet 2. Cambridge Massachusetts 3. Taxable Income 4. Income Sources 5. Deductions 6. Exemptions 7. Tax Regulations 8. Financial Tracking 9. Income Allocation 10. Local Taxes In addition to the general Cambridge Massachusetts Income Assignment Worksheet, there might be variations or specific worksheets tailored for different entities, such as individuals, businesses, or government agencies. These variations ensure that the worksheet aligns with the specific needs and requirements of each entity. For example: 1. Individual Income Assignment Worksheet: This version is designed specifically for individuals residing in Cambridge, Massachusetts, who need to calculate and allocate their personal income for tax purposes. 2. Business Income Assignment Worksheet: Businesses operating within Cambridge would utilize this variant to accurately determine their taxable income, including revenue, expenses, and deductions related to their specific business activities. 3. Government Agency Income Assignment Worksheet: Local government agencies in Cambridge might have a unique worksheet tailored to their specific income-generating activities, ensuring transparency and compliance with tax regulations. These variations allow for customization and specificity, enabling individuals, businesses, and government agencies in Cambridge, Massachusetts, to accurately track, allocate, and report their income based on their respective needs and circumstances.

Cambridge Massachusetts Income Assignment Worksheet

Description

How to fill out Cambridge Massachusetts Income Assignment Worksheet?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone with no law background to draft this sort of papers cfrom the ground up, mostly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a massive collection with over 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Cambridge Massachusetts Income Assignment Worksheet or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Cambridge Massachusetts Income Assignment Worksheet in minutes employing our reliable platform. If you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our library, ensure that you follow these steps before downloading the Cambridge Massachusetts Income Assignment Worksheet:

- Ensure the template you have chosen is suitable for your location since the regulations of one state or county do not work for another state or county.

- Review the form and go through a quick outline (if available) of scenarios the document can be used for.

- If the form you selected doesn’t meet your requirements, you can start again and look for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- Log in to your account credentials or create one from scratch.

- Pick the payment method and proceed to download the Cambridge Massachusetts Income Assignment Worksheet once the payment is through.

You’re good to go! Now you can go ahead and print out the form or complete it online. If you have any problems getting your purchased documents, you can quickly find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.