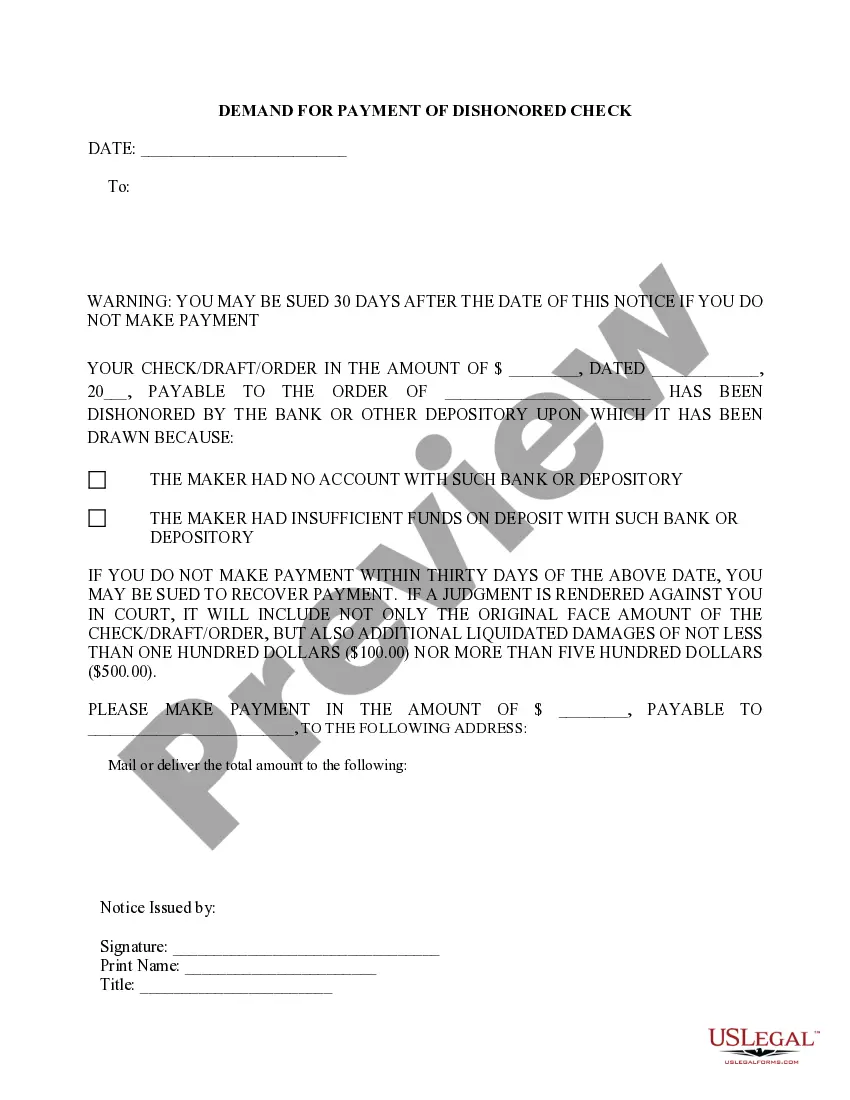

Cambridge Massachusetts Notice of Dishonored Check — Civil: All You Need to Know A bad check or bounced check refers to a check that has been presented to a bank for payment but is ultimately rejected due to insufficient funds or other reasons. In Cambridge, Massachusetts, the Notice of Dishonored Check — Civil process comes into play when such an incident occurs. This notice serves as an official communication to the check writer, alerting them of the failed transaction and outlining the legal consequences they may face. Types of Cambridge Massachusetts Notice of Dishonored Check — Civil: 1. Initial Notification: After the bank notifies the payee that the check has bounced, they will typically send an Initial Notification letter to the check writer. This letter notifies them of the dishonored check, providing details such as the check amount, date, and the reason for dishonor, which could be due to insufficient funds or a closed account. 2. Payment Demand Letter: If the check writer fails to respond or fails to make good on the bounced check within a specified period, the payee, also known as the creditor, may proceed to send a Payment Demand Letter. This letter states the amount owed for the dishonored check, including any additional fees, and sets a deadline for payment. If the check writer fails to comply, legal actions may be pursued. 3. Legal Actions: In situations where the check writer continues to neglect their financial responsibility, the payee may escalate the matter by filing a civil suit or grievance against them. The court will issue a Cambridge Massachusetts Notice of Dishonored Check — Civil, at which point the check writer becomes a defendant in a legal case. This notice serves as a formal summons to appear in court regarding the bounced check, with the potential for further penalties and consequences if the case is ruled against them. The legal repercussions for writing bad checks vary depending on the circumstances, the number of prior offenses, and the amount involved. Penalties can range from fines to imprisonment, with additional fees, court costs, and restitution to the payee. Furthermore, a stained credit history and potential damage to personal reputation can result from such incidents. To resolve a Cambridge Massachusetts Notice of Dishonored Check — Civil, it is crucial for the check writer to take prompt action. They should communicate with the payee, cooperating to settle the debt, including any accrued fees and additional charges within the specified time frame. Seeking legal advice and understanding their rights and obligations can also assist in navigating the situation effectively. In conclusion, a bad check or bounced check can result in a Cambridge Massachusetts Notice of Dishonored Check — Civil, leading to legal consequences for the check writer. It is imperative to promptly address such issues, aiming to resolve them amicably to avoid severe penalties and potential damage to personal and financial standing.

Cambridge Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Cambridge Massachusetts Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

Are you searching for a trustworthy and affordable legal forms provider to obtain the Cambridge Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check? US Legal Forms is your ideal option.

Whether you require a simple agreement to establish guidelines for living together with your partner or a set of documents to facilitate your separation or divorce through the court system, we have you covered. Our site offers over 85,000 current legal document templates for individual and business use. All templates provided are not generic and are tailored to meet the standards of individual states and regions.

To acquire the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Remember, you can access and download your previously purchased document templates at any time from the My documents section.

Is this your first visit to our site? No need to worry. You can easily create an account, but beforehand, make sure to do the following.

Now you can register for your account. Then select a subscription plan and move on to payment. Once the payment is complete, download the Cambridge Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check in any of the available formats. You can return to the website at any time and re-download the document free of charge.

Finding current legal documents has never been more straightforward. Try US Legal Forms today, and stop spending hours searching for legal papers online once and for all.

- Check if the Cambridge Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check aligns with the regulations of your state and locality.

- Review the form’s description (if available) to understand its purpose and intended audience.

- Re-start the search if the form does not suit your legal circumstances.

Form popularity

FAQ

In Massachusetts, writing a bad check can be considered a felony, depending on the amount involved and the intent behind it. If the amount exceeds a certain threshold, you could face severe legal repercussions. It's crucial to consider the risks associated with bounced checks and stay informed about your legal obligations in a Cambridge Massachusetts Notice of Dishonored Check situation.

Yes, writing a bad check is illegal in Massachusetts. When you write a check that bounces due to insufficient funds, it is considered a criminal offense. This is particularly relevant when dealing with a Cambridge Massachusetts Notice of Dishonored Check. It's important to understand the potential consequences of writing bad checks, as they can lead to serious legal troubles.

The terms 'bounced check' and 'dishonored check' refer to the same situation but may be used in different contexts. A bounced check typically indicates the check was returned without payment due to insufficient funds, while a dishonored check may include additional reasons, such as a closed account. Understanding these distinctions is important in financial dealings. Utilizing resources like the Cambridge Massachusetts Notice of Dishonored Check - Civil can help clarify any confusion on this topic.

In Massachusetts, writing a bad check is considered a violation of state law, resulting in various penalties. Depending on the situation, individuals may face fines, restitution to the payee, or even criminal charges. It is crucial to understand your rights and responsibilities regarding bounced checks to avoid significant legal and financial consequences. Reviewing the Cambridge Massachusetts Notice of Dishonored Check - Civil can provide essential information.

Typically, the individual who wrote the bounced check faces the majority of the penalties. This might include legal repercussions, fines from the bank, and potential criminal charges for issuing a bad check. Businesses may also pursue action if they incur costs due to accepting a dishonored check. The Cambridge Massachusetts Notice of Dishonored Check - Civil outlines the specific penalties that apply in such cases.

A dishonored check is referred to as a bounced check because it is returned to the issuer rather than being cashed or deposited. This 'bounce' signifies that the bank could not process the check due to issues such as insufficient funds. Awareness of this terminology aids in understanding your legal responsibilities when dealing with bad checks. The Cambridge Massachusetts Notice of Dishonored Check - Civil can provide guidance on how to handle these instances.

The term 'bounced check' comes from the check 'bouncing' back to the issuer when the bank refuses to process it. This refusal typically happens due to insufficient funds or account issues. It’s essential to recognize the consequences of issuing such checks to avoid potential legal trouble. Exploring resources like the Cambridge Massachusetts Notice of Dishonored Check - Civil can help you understand your options.

Another common term for a dishonored check is a bounced check. This label indicates that the issuing bank has refused to honor the check due to various reasons. Understanding these terms can help individuals grasp the legal implications of issuing a bad check. The Cambridge Massachusetts Notice of Dishonored Check - Civil details the process for addressing such situations.

If a post-dated check bounces, the consequences are similar to any dishonored check. The account holder still incurs penalties, even if the check was dated for a future date. This situation can lead to additional fees from the bank and potential legal issues for issuing a bad check. Familiarizing yourself with the Cambridge Massachusetts Notice of Dishonored Check - Civil guidelines can provide clarity.

Generally, the person who wrote the bounced check faces legal consequences. Writing a bad check can lead to penalties, including fines and potential criminal charges, depending on the amount and circumstances. If a business accepts the bad check, they might also incur costs and may seek restitution. To navigate these issues effectively, consult the Cambridge Massachusetts Notice of Dishonored Check - Civil procedures.