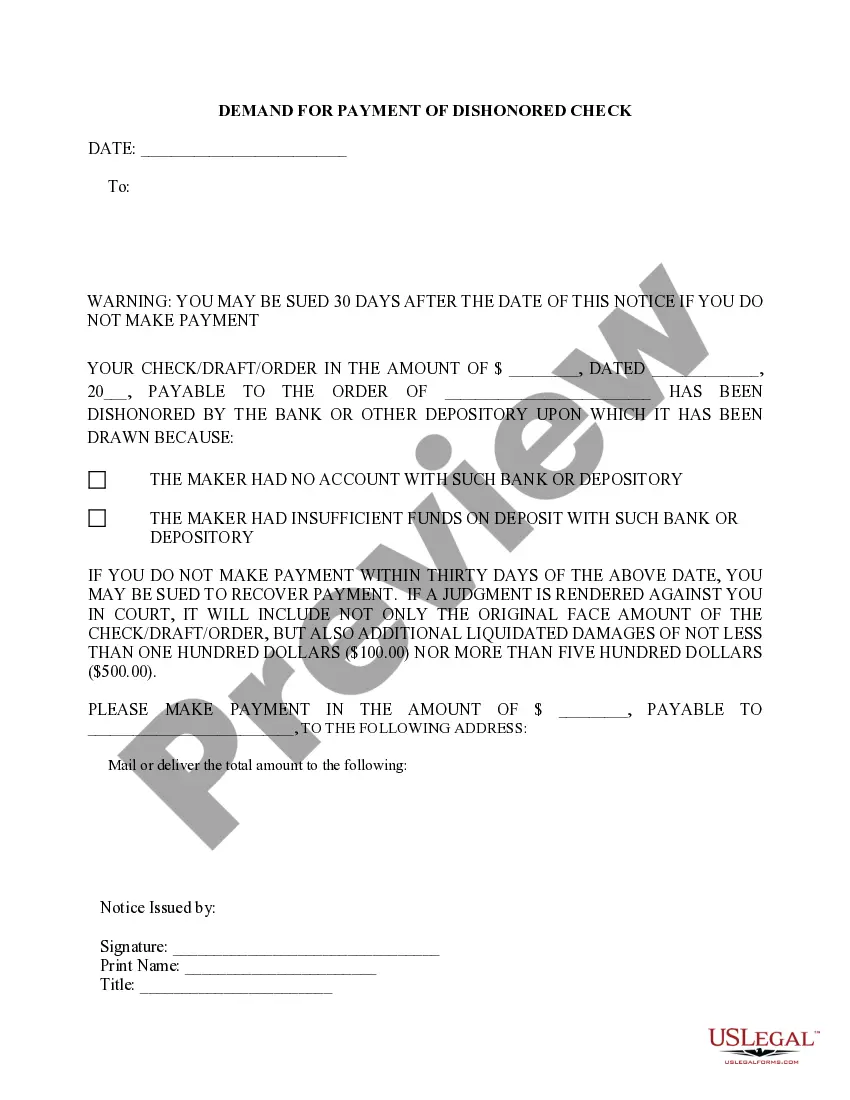

Lowell Massachusetts Notice of Dishonored Check — Civil A bad check or bounced check is a payment instrument that has been returned unpaid by the bank due to insufficient funds in the account or other reasons. In Lowell, Massachusetts, the use of a bad check is considered a civil offense, and a Notice of Dishonored Check is issued to inform the check writer about the dishonored payment. This notice serves as an official communication from the recipient of the check to the issuer, notifying them about the check's rejection. There are different types of Lowell Massachusetts Notices of Dishonored Check — Civil, depending on the severity and intentionality of the offense: 1. Accidental bounced check: These notices are issued in cases where the issuer unintentionally writes a check without sufficient funds in their account, resulting in it being dishonored. The purpose of this type of notice is to inform the check writer about the bounced check incident and request payment or resolution of the matter. 2. Intentional bad check: When a person knowingly writes a check with the intention of deceiving the recipient, such as intentionally drawing a check on a closed account, it is considered an intentional bad check. This notice is sent to inform the check writer about the intentional nature of their offense and to emphasize the legal consequences that may follow. 3. Repeat offender: In situations where the check writer has a history of writing bad checks, a specific notice may be sent to address their repeat offending behavior. This notice typically highlights the check writer's past offenses, informs them about the potential legal actions that may be taken, and encourages them to rectify the situation by reimbursing the payee. The Lowell Massachusetts Notice of Dishonored Check — Civil generally includes the following information: — Date of the notice: The date when the notice is issued. — Check details: Information about the dishonored check, such as the check number, date, amount, and the bank it was drawn from. — Payee information: Name and address of the recipient to whom the dishonored check was issued. — Check writer information: Name, address, contact details, and any other relevant identifying information about the check writer. — Reason for dishonor: Explanation of why the check bounced, typically due to insufficient funds or a closed account. — Resolution options: Instructions for the check writer on how to rectify the situation, including providing an alternative payment method or reimbursing the payee with a certified check or money order. — Legal consequences: A statement outlining the potential legal actions that may be taken if the matter is not resolved promptly, such as civil penalties, monetary fines, or even criminal charges. It is important to note that the content and structure of the Notice of Dishonored Check may vary depending on the issuer, local regulations, and specific circumstances of the case. It is advisable for both the payee and the check writer to consult legal professionals to better understand their rights and obligations in relation to a bad check incident in Lowell, Massachusetts.

Lowell Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

State:

Massachusetts

City:

Lowell

Control #:

MA-401N

Format:

Word;

Rich Text

Instant download

Description

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Lowell Massachusetts Notice of Dishonored Check — Civil A bad check or bounced check is a payment instrument that has been returned unpaid by the bank due to insufficient funds in the account or other reasons. In Lowell, Massachusetts, the use of a bad check is considered a civil offense, and a Notice of Dishonored Check is issued to inform the check writer about the dishonored payment. This notice serves as an official communication from the recipient of the check to the issuer, notifying them about the check's rejection. There are different types of Lowell Massachusetts Notices of Dishonored Check — Civil, depending on the severity and intentionality of the offense: 1. Accidental bounced check: These notices are issued in cases where the issuer unintentionally writes a check without sufficient funds in their account, resulting in it being dishonored. The purpose of this type of notice is to inform the check writer about the bounced check incident and request payment or resolution of the matter. 2. Intentional bad check: When a person knowingly writes a check with the intention of deceiving the recipient, such as intentionally drawing a check on a closed account, it is considered an intentional bad check. This notice is sent to inform the check writer about the intentional nature of their offense and to emphasize the legal consequences that may follow. 3. Repeat offender: In situations where the check writer has a history of writing bad checks, a specific notice may be sent to address their repeat offending behavior. This notice typically highlights the check writer's past offenses, informs them about the potential legal actions that may be taken, and encourages them to rectify the situation by reimbursing the payee. The Lowell Massachusetts Notice of Dishonored Check — Civil generally includes the following information: — Date of the notice: The date when the notice is issued. — Check details: Information about the dishonored check, such as the check number, date, amount, and the bank it was drawn from. — Payee information: Name and address of the recipient to whom the dishonored check was issued. — Check writer information: Name, address, contact details, and any other relevant identifying information about the check writer. — Reason for dishonor: Explanation of why the check bounced, typically due to insufficient funds or a closed account. — Resolution options: Instructions for the check writer on how to rectify the situation, including providing an alternative payment method or reimbursing the payee with a certified check or money order. — Legal consequences: A statement outlining the potential legal actions that may be taken if the matter is not resolved promptly, such as civil penalties, monetary fines, or even criminal charges. It is important to note that the content and structure of the Notice of Dishonored Check may vary depending on the issuer, local regulations, and specific circumstances of the case. It is advisable for both the payee and the check writer to consult legal professionals to better understand their rights and obligations in relation to a bad check incident in Lowell, Massachusetts.

How to fill out Lowell Massachusetts Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check?

If you’ve already used our service before, log in to your account and save the Lowell Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Lowell Massachusetts Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!