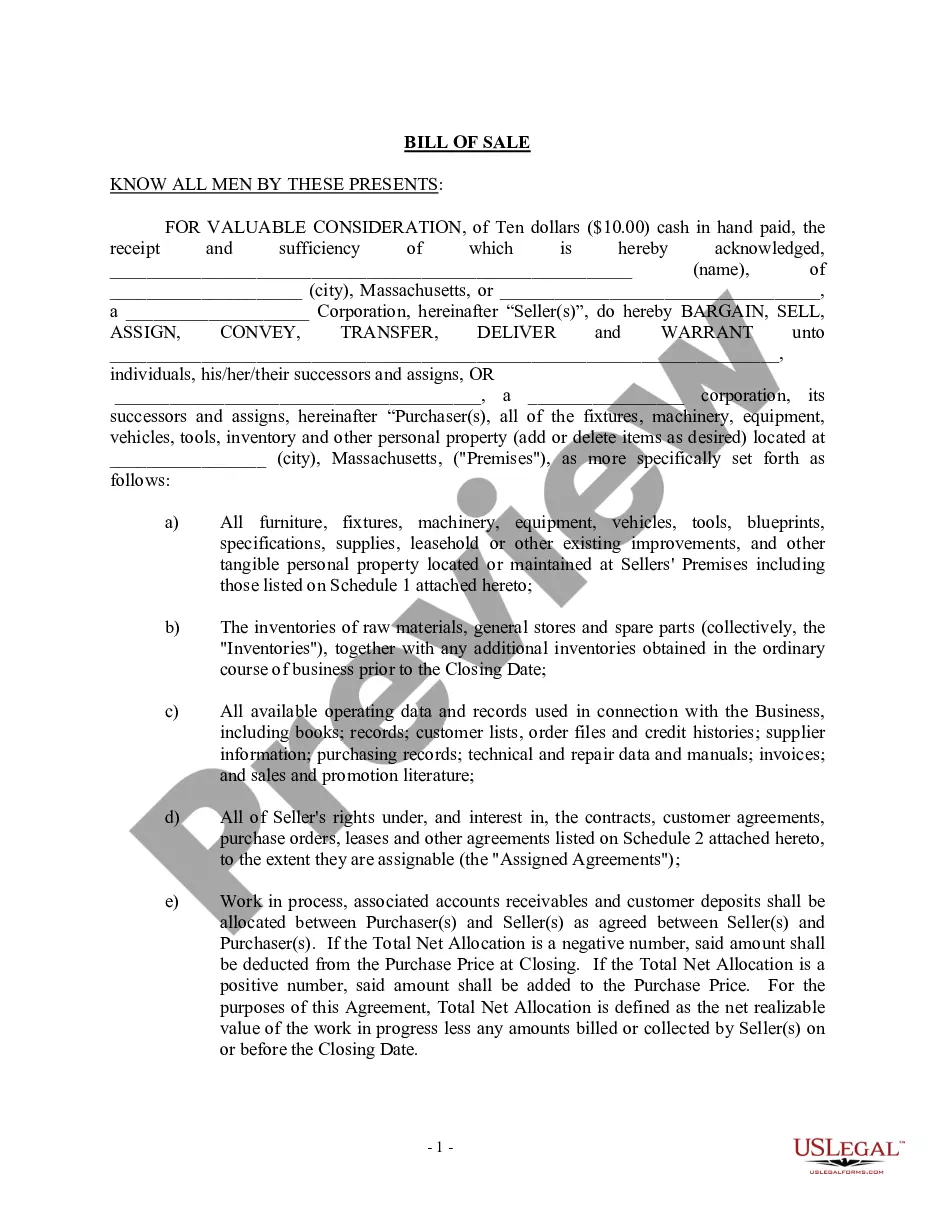

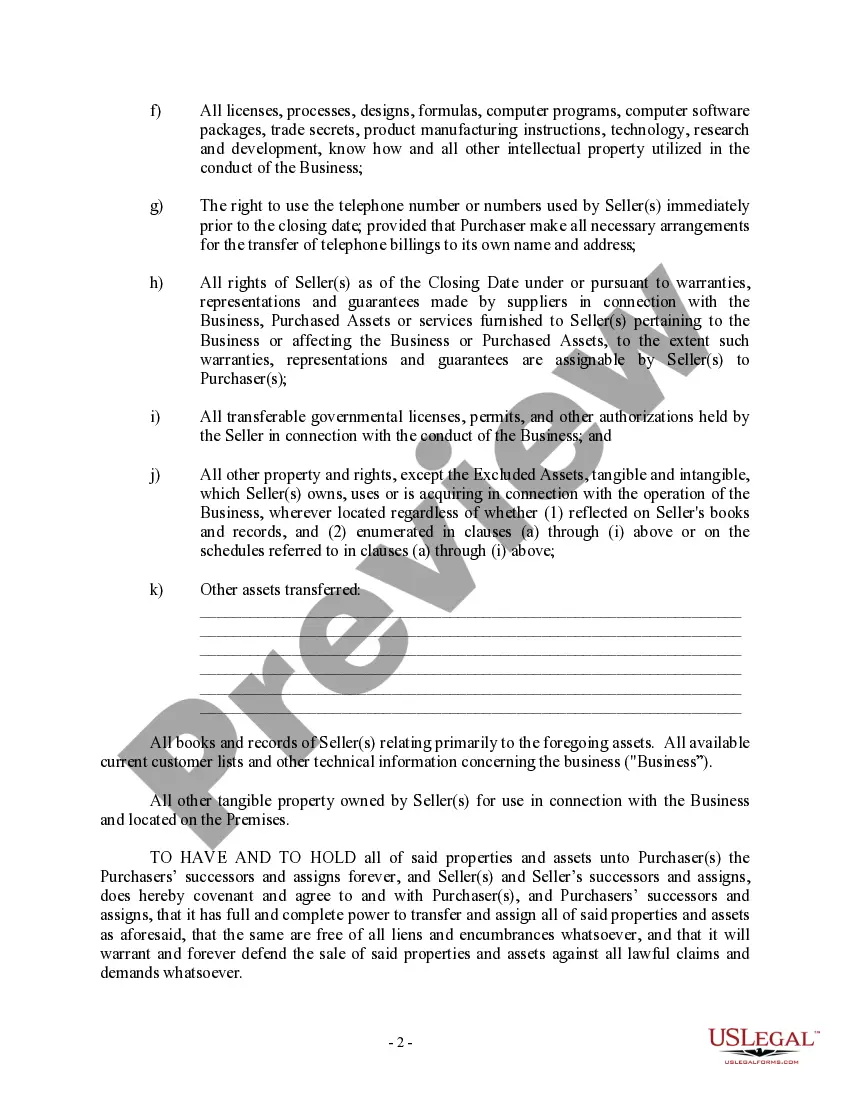

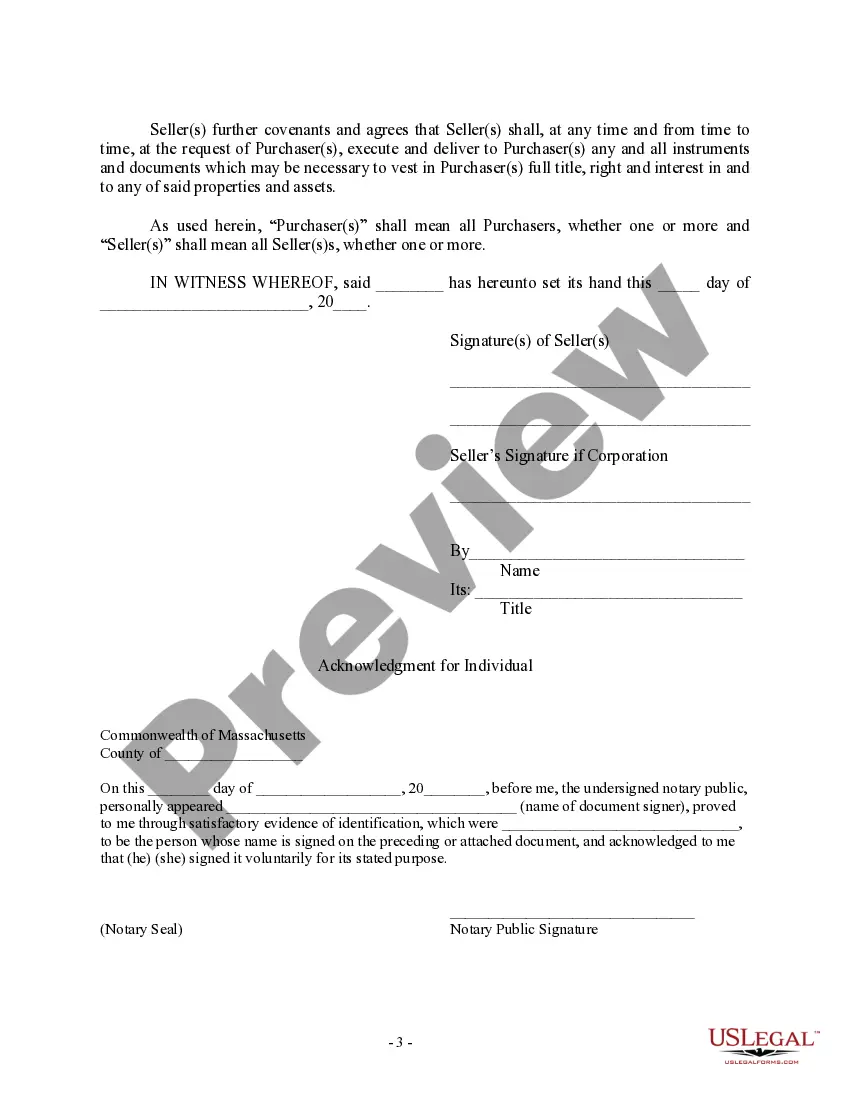

The Middlesex Massachusetts Bill of Sale in Connection with the Sale of Business by an Individual or Corporate Seller is a legal document that is used to facilitate the transfer of ownership rights and responsibilities from one party to another. This bill of sale is particularly important when conducting business transactions in Middlesex County, Massachusetts. It encompasses the terms and conditions agreed upon by both the buyer and the seller and serves as evidence of the transaction. The Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller contains several key elements: 1. Identification of the parties involved: The bill of sale must clearly state the full legal names and contact information of both the seller and the buyer. In the case of a corporate seller, the document should specify the business name, address, and relevant contact information. 2. Description of the business: The bill of sale must provide a precise and detailed description of the business being sold. This includes the business's name, location, assets, inventory, customer base, and any other pertinent details that may impact the sale. 3. Purchase price and payment terms: The bill of sale needs to state the agreed-upon purchase price for the business. Furthermore, it should outline the payment terms, including any down payments, installment plans, or financing arrangements. 4. Assets and liabilities: This document should clearly outline all the assets being transferred as part of the sale. This includes physical property, equipment, intellectual property, contracts, leases, and any other relevant assets. Additionally, any pertinent liabilities, such as outstanding debts or legal obligations, should be disclosed. 5. Representations and warranties: The bill of sale may include representations and warranties from the seller regarding the business being sold. This ensures that the buyer has accurate information about the business's condition, financial performance, and legal standing. 6. Closing and transfer of ownership: The bill of sale should specify the date of closing or transfer of ownership, indicating when the buyer assumes control over the business and its assets. It may also outline any necessary transition periods or support from the seller in facilitating the transfer. Different types of Middlesex Massachusetts Bill of Sale in Connection with the Sale of Business by Individual or Corporate Seller may include variations based on specific types of businesses or industries. Some examples may include: 1. Middlesex Massachusetts Bill of Sale for Retail Business: This type of bill of sale would focus on the transfer of ownership rights and responsibilities specific to retail establishments, including the transfer of any licenses or permits. 2. Middlesex Massachusetts Bill of Sale for Restaurant or Food Service Business: This bill of sale would address unique considerations related to the sale and transfer of a restaurant business, such as health department compliance, equipment condition, and menu recipes. 3. Middlesex Massachusetts Bill of Sale for Professional Services Business: This type of bill of sale would encompass the transfer of ownership for businesses that provide professional services, such as law firms, accounting practices, or consulting agencies. It may also include protections for client confidentiality and client account transfers. 4. Middlesex Massachusetts Bill of Sale for Manufacturing Business: This bill of sale would cover the transfer of ownership for businesses involved in manufacturing, including the transfer of production facilities, equipment, patents, and material suppliers. It is important to consult with a legal professional to ensure that the Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is tailored to the specific needs and circumstances of the transaction.

Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller

Description

How to fill out Middlesex Massachusetts Bill Of Sale In Connection With Sale Of Business By Individual Or Corporate Seller?

If you are looking for a relevant form, it’s impossible to choose a more convenient service than the US Legal Forms website – probably the most extensive online libraries. Here you can get a large number of document samples for organization and personal purposes by categories and states, or keywords. With the high-quality search function, finding the most recent Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is as easy as 1-2-3. In addition, the relevance of each document is verified by a team of skilled attorneys that regularly review the templates on our website and update them in accordance with the latest state and county demands.

If you already know about our system and have a registered account, all you need to get the Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have discovered the sample you want. Read its information and utilize the Preview function to explore its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to discover the proper document.

- Confirm your decision. Click the Buy now button. After that, choose your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your bank card or PayPal account to complete the registration procedure.

- Receive the form. Choose the file format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the acquired Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller.

Every single form you save in your account does not have an expiry date and is yours permanently. You always have the ability to gain access to them via the My Forms menu, so if you need to get an extra duplicate for modifying or creating a hard copy, feel free to come back and export it once again at any moment.

Take advantage of the US Legal Forms professional collection to gain access to the Middlesex Massachusetts Bill of Sale in Connection with Sale of Business by Individual or Corporate Seller you were seeking and a large number of other professional and state-specific samples in one place!