The Boston Massachusetts Sale of Trust Estate refers to the process of selling assets held in a trust in the state of Massachusetts, specifically in the city of Boston. A trust estate typically consists of various properties and assets that have been placed in a trust by a granter for the benefit of specific beneficiaries. The sale of a trust estate in Boston, Massachusetts involves following a set of legal procedures and regulations to ensure that the sale is in compliance with state laws and the terms outlined in the trust document. The purpose of the sale is to liquidate the assets and distribute the proceeds among the beneficiaries as directed by the granter. There can be different types of Boston Massachusetts Sale of Trust Estate, depending on the nature of the assets held in the trust. Common types include residential or commercial real estate properties, such as houses, apartments, or office buildings. These properties may be sold individually or as a portfolio. Other types of assets that can be part of a trust estate sale in Boston, Massachusetts include stocks, bonds, mutual funds, cash, and personal belongings. The sale of these assets may involve the assistance of financial professionals or estate liquidators to ensure a fair market value is obtained. It is important to note that the sale of a trust estate requires proper documentation and legal procedures to protect the interests of both the beneficiaries and the buyers. This may involve obtaining court approval, hiring appraisers, conducting title searches, and ensuring compliance with tax laws and regulations. Overall, the Boston Massachusetts Sale of Trust Estate is a complex process involving the sale of various assets held in a trust in the city of Boston. It requires legal expertise, compliance with state laws, and adherence to the terms outlined in the trust document. The objective is to distribute the proceeds of the sale to the beneficiaries as directed by the granter, ensuring a fair and efficient transfer of assets.

Boston Massachusetts Sale of Trust Estate

State:

Massachusetts

City:

Boston

Control #:

MA-C3P82

Format:

PDF

Instant download

Public form

Description

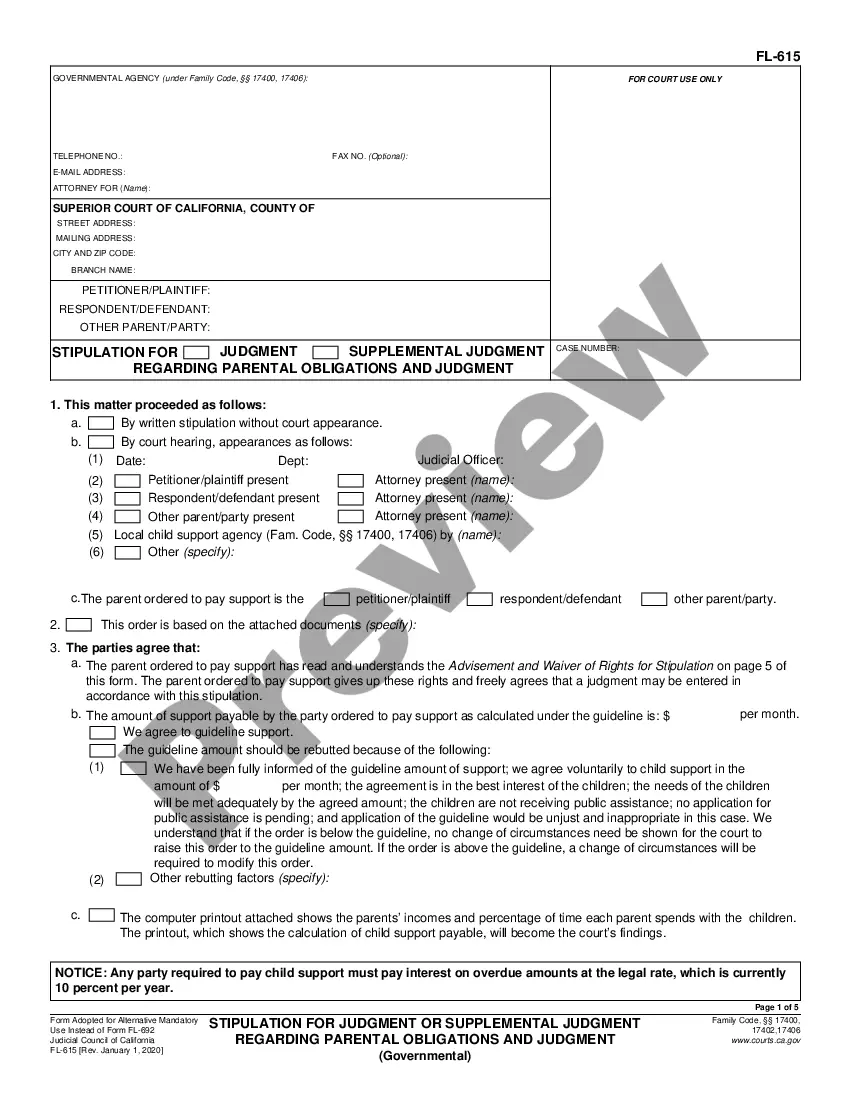

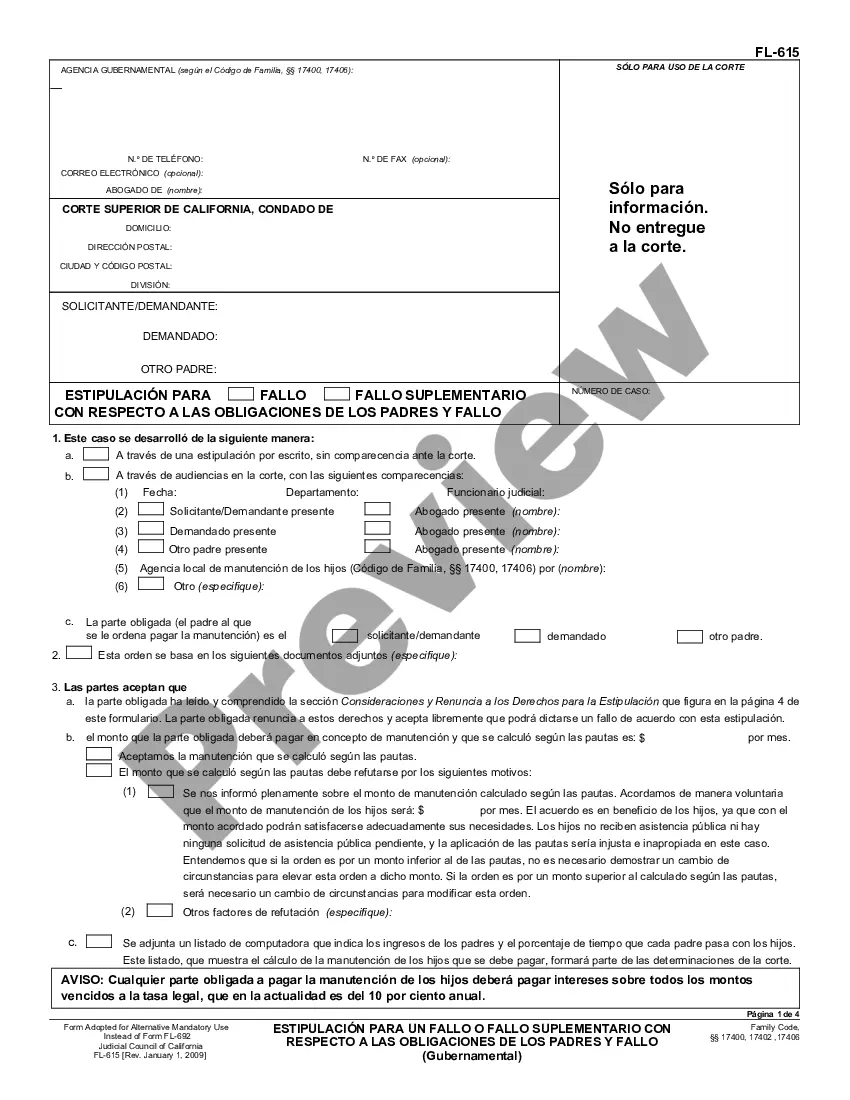

This form is a Sale of Trust Estate filing for use in the Massachusetts Probate and Family Court. When it is determined that a Trust Estate will be sold in the course of settling the affairs of a deceased individual, this form is submitted to the court for the judge to approve.

The Boston Massachusetts Sale of Trust Estate refers to the process of selling assets held in a trust in the state of Massachusetts, specifically in the city of Boston. A trust estate typically consists of various properties and assets that have been placed in a trust by a granter for the benefit of specific beneficiaries. The sale of a trust estate in Boston, Massachusetts involves following a set of legal procedures and regulations to ensure that the sale is in compliance with state laws and the terms outlined in the trust document. The purpose of the sale is to liquidate the assets and distribute the proceeds among the beneficiaries as directed by the granter. There can be different types of Boston Massachusetts Sale of Trust Estate, depending on the nature of the assets held in the trust. Common types include residential or commercial real estate properties, such as houses, apartments, or office buildings. These properties may be sold individually or as a portfolio. Other types of assets that can be part of a trust estate sale in Boston, Massachusetts include stocks, bonds, mutual funds, cash, and personal belongings. The sale of these assets may involve the assistance of financial professionals or estate liquidators to ensure a fair market value is obtained. It is important to note that the sale of a trust estate requires proper documentation and legal procedures to protect the interests of both the beneficiaries and the buyers. This may involve obtaining court approval, hiring appraisers, conducting title searches, and ensuring compliance with tax laws and regulations. Overall, the Boston Massachusetts Sale of Trust Estate is a complex process involving the sale of various assets held in a trust in the city of Boston. It requires legal expertise, compliance with state laws, and adherence to the terms outlined in the trust document. The objective is to distribute the proceeds of the sale to the beneficiaries as directed by the granter, ensuring a fair and efficient transfer of assets.

How to fill out Boston Massachusetts Sale Of Trust Estate?

If you’ve already utilized our service before, log in to your account and save the Boston Massachusetts Sale of Trust Estate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Boston Massachusetts Sale of Trust Estate. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!