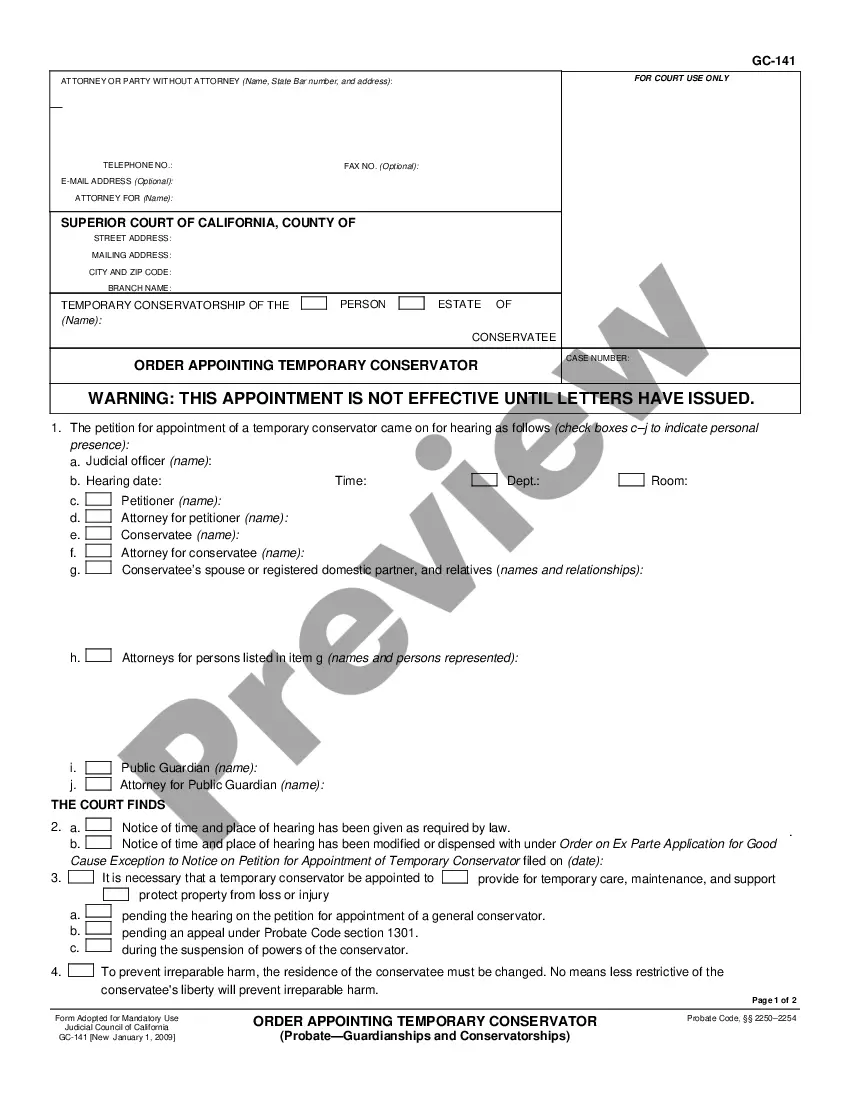

Boston Massachusetts Voluntary Administration refers to a legal process that allows financially distressed individuals or entities in Boston, Massachusetts, to seek relief from their creditors. It is a form of debt consolidation or restructuring, providing a systematic way for debtors to address their financial obligations and potentially avoid bankruptcy. One type of Boston Massachusetts Voluntary Administration is the Individual Voluntary Administration. This is typically utilized by individuals who are unable to meet their financial obligations, such as credit card debts, personal loans, or medical bills. Individuals opting for this type of voluntary administration work closely with a licensed insolvency practitioner to create a proposal for the repayment of their debts over a defined period, usually three to five years. This proposal is then presented to the creditors for approval. If the proposal is accepted, the debtor can make affordable monthly payments towards their debts, and the creditors are legally bound to cease any collection activities. Another type of Boston Massachusetts Voluntary Administration is the Company Voluntary Administration. As the name suggests, this type is specifically designed for financially troubled companies operating in Boston, Massachusetts. Under this form, the company directors appoint an insolvency practitioner who takes control of the company's affairs to review its financial situation. The appointed practitioner then proposes a voluntary administration to the creditors, which includes a plan for the company's reorganization and debt repayment. The process of Boston Massachusetts Voluntary Administration involves various key steps and legal requirements. Initially, the debtor must seek professional advice from a licensed insolvency practitioner who will assess their financial situation and determine if voluntary administration is the most suitable solution. The practitioner helps in the preparation and submission of a proposal to the creditors, outlining the debtor's financial position, proposed repayment plan, and the expected outcome for creditors. After the proposal is lodged, a meeting of creditors is held, where they have the opportunity to vote for or against the proposal. To pass, the proposal must be approved by a majority in number of creditors representing at least 75% in value of the total debt owed to creditors. If the proposal is accepted, the voluntary administration commences, and the debtor must adhere to the agreed-upon repayment plan. It is important to note that Boston Massachusetts Voluntary Administration provides a formal mechanism for debt resolution and allows debtors to regain control of their financial situation. However, it is crucial to seek professional advice from an insolvency practitioner or a licensed attorney experienced in bankruptcy and insolvency laws to navigate the process effectively.

Boston Massachusetts Voluntary Administration

Description

How to fill out Boston Massachusetts Voluntary Administration?

Are you looking for a trustworthy and affordable legal forms supplier to get the Boston Massachusetts Voluntary Administration? US Legal Forms is your go-to choice.

Whether you need a basic agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and frameworked based on the requirements of separate state and county.

To download the document, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Boston Massachusetts Voluntary Administration conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is good for.

- Restart the search in case the template isn’t good for your legal situation.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Boston Massachusetts Voluntary Administration in any available format. You can get back to the website at any time and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal papers online once and for all.