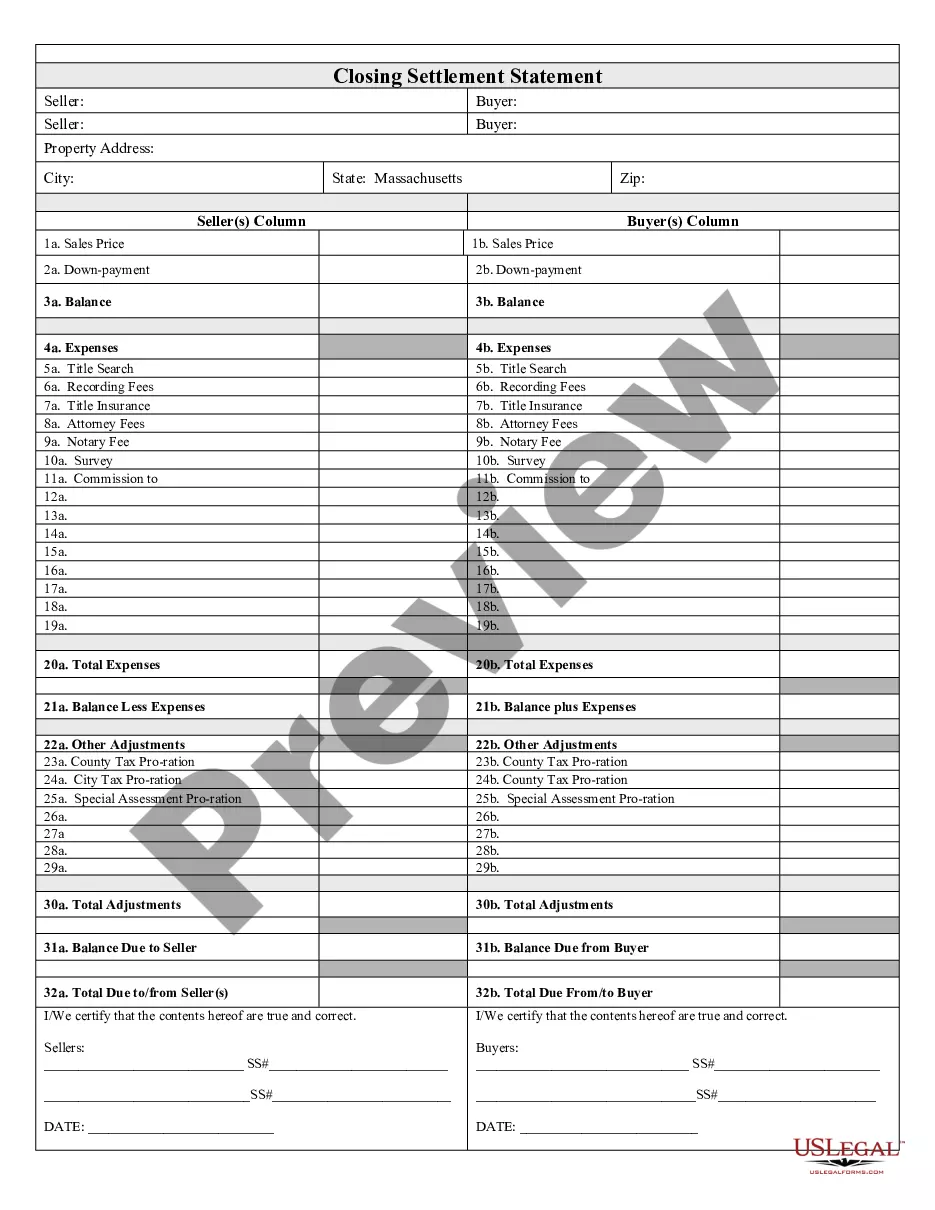

Middlesex Massachusetts Closing Statement is a legal document that summarizes the transaction and financial details of a real estate transaction in Middlesex County, Massachusetts. It serves as the final step in the closing process and is provided by the settlement agent or attorney involved in the transaction. The Middlesex Massachusetts Closing Statement provides a detailed breakdown of all the costs and fees associated with the real estate transaction, ensuring transparency for both the buyer and seller. It includes information such as the purchase price, taxes, loan amount, and any prorated costs. This document outlines the financial obligations of both parties involved, ensuring that all funds have been accounted for accurately. Different types of Middlesex Massachusetts Closing Statements may include: 1. Residential Closing Statement: This type of closing statement is used for residential real estate transactions, such as the sale or purchase of a single-family home, condominium, or townhouse in Middlesex County, Massachusetts. 2. Commercial Closing Statement: A commercial closing statement is used for commercial real estate transactions, including retail spaces, office buildings, or industrial properties in Middlesex County, Massachusetts. These statements often include additional financial considerations related to business operations and leasing. 3. Refinance Closing Statement: Refinancing a mortgage involves replacing an existing loan with a new one. A refinancing closing statement details the revised terms and costs associated with the new loan, such as interest rates, loan fees, and any additional funding required. 4. Short Sale Closing Statement: When a property is sold for less than the outstanding mortgage balance, it is known as a short sale. The short sale closing statement outlines the financial implications of a short sale, including any deficiency judgments or forgiven debt. In conclusion, the Middlesex Massachusetts Closing Statement is a comprehensive document that summarizes the financial aspects of a real estate transaction in Middlesex County, Massachusetts. It provides a clear breakdown of costs and fees, ensuring transparency and accountability for both parties involved. Different types of closing statements may be used depending on the nature of the real estate transaction, such as residential, commercial, refinance, or short sale.

Middlesex Massachusetts Closing Statement

Description

How to fill out Middlesex Massachusetts Closing Statement?

If you are looking for a relevant form template, it’s difficult to choose a more convenient platform than the US Legal Forms site – probably the most considerable libraries on the internet. Here you can find a huge number of form samples for business and personal purposes by categories and regions, or key phrases. With our advanced search function, getting the newest Middlesex Massachusetts Closing Statement is as easy as 1-2-3. Moreover, the relevance of each file is confirmed by a group of expert attorneys that regularly review the templates on our platform and revise them according to the latest state and county laws.

If you already know about our platform and have an account, all you need to receive the Middlesex Massachusetts Closing Statement is to log in to your user profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have opened the sample you require. Check its information and make use of the Preview function to check its content. If it doesn’t suit your needs, utilize the Search field near the top of the screen to get the appropriate record.

- Confirm your selection. Click the Buy now option. Following that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your bank card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the acquired Middlesex Massachusetts Closing Statement.

Each and every template you save in your user profile has no expiration date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to receive an extra duplicate for modifying or creating a hard copy, feel free to return and download it once more anytime.

Make use of the US Legal Forms extensive library to gain access to the Middlesex Massachusetts Closing Statement you were seeking and a huge number of other professional and state-specific templates on one website!