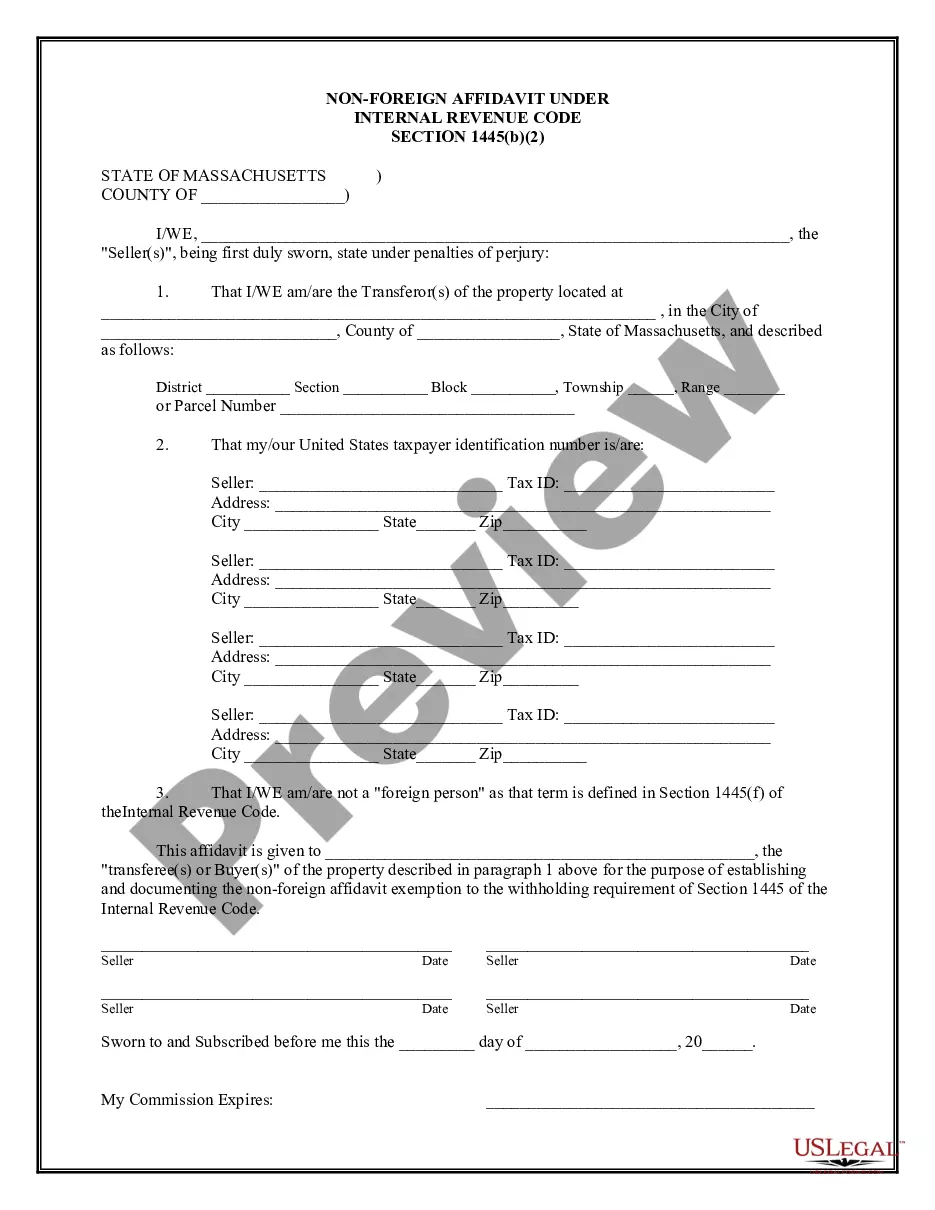

Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 is a legal document used in real estate transactions to determine the tax liabilities of non-U.S. citizens or non-resident aliens selling real property in Middlesex County, Massachusetts. This affidavit is required by the Internal Revenue Code (IRC) Section 1445. The purpose of the Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 is to certify the seller's status as a non-foreign person and ensure compliance with the tax laws of the United States. By signing this affidavit, the seller confirms that they are either a U.S. citizen, a U.S. resident alien, or a foreign person who is exempt from federal withholding. The key information provided in the affidavit includes the seller's name, address, and taxpayer identification number. The affidavit also requires the seller to declare their status as per the IRC guidelines. Depending on the taxpayer's situation, there are different variations or types of Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445. Some common types include: 1. Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 for U.S. Citizens: This affidavit is used when the seller is a U.S. citizen, meaning they were born in the United States, have obtained U.S. citizenship through naturalization, or acquired citizenship through other legal means. 2. Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 for U.S. Resident Aliens: This affidavit is applicable when the seller is a resident alien, which means they hold a lawful permanent residence status (green card) in the United States. 3. Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 for Foreign Persons with Exemptions: In some cases, a foreign person may be exempt from federal withholding requirements. This affidavit is used when the seller qualifies for exemptions based on the provisions outlined in IRC 1445 or other applicable tax treaties. It is crucial to complete the Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 accurately and truthfully, as any falsification or incorrect information may lead to legal consequences. This affidavit is typically prepared by the seller's attorney or tax professional to ensure compliance with IRS regulations and to facilitate a smooth real estate transaction.

Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445

Description

How to fill out Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445?

Do you need a trustworthy and inexpensive legal forms provider to get the Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of forms to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, locate the needed form, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates at any time in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is intended for.

- Start the search over if the form isn’t good for your specific scenario.

Now you can create your account. Then pick the subscription plan and proceed to payment. Once the payment is completed, download the Middlesex Massachusetts Non-Foreign Affidavit Under IRC 1445 in any available file format. You can get back to the website when you need and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal papers online once and for all.