A Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates is a legal instrument crafted to address the specific needs of individuals with significant assets and complex family situations in Middlesex County, Massachusetts. This type of will ensures that your estate plan is structured in a way that maximizes tax benefits and protects your wealth for the benefit of your loved ones. The Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates incorporates various estate planning strategies tailored to the unique circumstances of high-net-worth individuals and families. It aims to provide financial security for surviving spouses while also preserving wealth for future generations. By utilizing the credit shelter and marital trusts, this will effectively reduce estate taxes and ensures efficient wealth transfer after the death of the testator. The key components of a Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates may include: 1. Credit Shelter Trust: Also known as a bypass trust, a credit shelter trust is designed to utilize the deceased spouse's estate tax exemption to shelter a certain amount of assets from estate taxes. These assets are then distributed to named beneficiaries, typically the children or other heirs, while providing the surviving spouse with income or other benefits for their lifetime. 2. Marital Trust: This trust, also referred to as a TIP (Qualified Terminable Interest Property) trust, allows the testator to leave property and assets for the benefit of the surviving spouse while maintaining control over the ultimate distribution of those assets. The surviving spouse receives income from the trust during their lifetime, and the remaining assets are then distributed to the beneficiaries named by the deceased spouse upon the surviving spouse's death. 3. Large Estates Considerations: A Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust is specifically designed for estates with substantial assets that may be subject to federal and state estate taxes. By employing sophisticated tax planning techniques, such as lifetime gifting, asset valuation discounts, and charitable giving provisions, the will aims to minimize tax liability and preserve the integrity of the estate. 4. Decreasing Tax Burdens: Furthermore, this complex will enable the utilization of various estate tax exemptions, including the federal estate tax exemption, Massachusetts state estate tax exemption, and applicable exclusions. By structuring the estate in a way that optimizes these exemptions, significant tax benefits can be achieved, ensuring that more of the estate's value is retained by the beneficiaries rather than being lost to taxes. In summary, a Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates provides comprehensive estate planning solutions specifically designed for high-net-worth individuals in the Middlesex County area. By incorporating credit shelter and marital trusts, this will helps reduce estate taxes and establish a clear distribution plan for preserving wealth, ensuring financial well-being for both surviving spouses and future generations.

Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates

Category:

State:

Massachusetts

County:

Middlesex

Control #:

MA-COMPLEX2

Format:

Word;

Rich Text

Instant download

Description

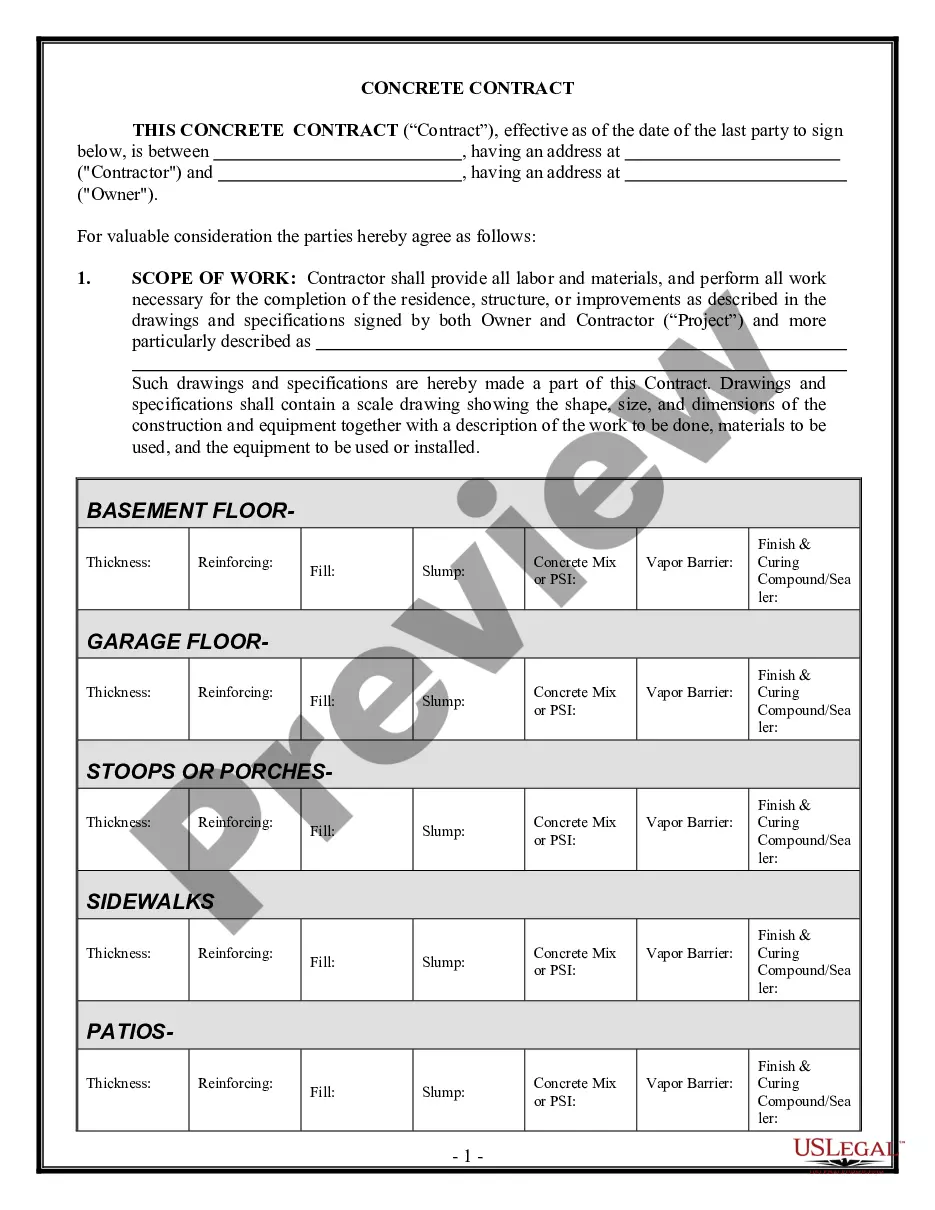

This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

A Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates is a legal instrument crafted to address the specific needs of individuals with significant assets and complex family situations in Middlesex County, Massachusetts. This type of will ensures that your estate plan is structured in a way that maximizes tax benefits and protects your wealth for the benefit of your loved ones. The Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates incorporates various estate planning strategies tailored to the unique circumstances of high-net-worth individuals and families. It aims to provide financial security for surviving spouses while also preserving wealth for future generations. By utilizing the credit shelter and marital trusts, this will effectively reduce estate taxes and ensures efficient wealth transfer after the death of the testator. The key components of a Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates may include: 1. Credit Shelter Trust: Also known as a bypass trust, a credit shelter trust is designed to utilize the deceased spouse's estate tax exemption to shelter a certain amount of assets from estate taxes. These assets are then distributed to named beneficiaries, typically the children or other heirs, while providing the surviving spouse with income or other benefits for their lifetime. 2. Marital Trust: This trust, also referred to as a TIP (Qualified Terminable Interest Property) trust, allows the testator to leave property and assets for the benefit of the surviving spouse while maintaining control over the ultimate distribution of those assets. The surviving spouse receives income from the trust during their lifetime, and the remaining assets are then distributed to the beneficiaries named by the deceased spouse upon the surviving spouse's death. 3. Large Estates Considerations: A Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust is specifically designed for estates with substantial assets that may be subject to federal and state estate taxes. By employing sophisticated tax planning techniques, such as lifetime gifting, asset valuation discounts, and charitable giving provisions, the will aims to minimize tax liability and preserve the integrity of the estate. 4. Decreasing Tax Burdens: Furthermore, this complex will enable the utilization of various estate tax exemptions, including the federal estate tax exemption, Massachusetts state estate tax exemption, and applicable exclusions. By structuring the estate in a way that optimizes these exemptions, significant tax benefits can be achieved, ensuring that more of the estate's value is retained by the beneficiaries rather than being lost to taxes. In summary, a Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates provides comprehensive estate planning solutions specifically designed for high-net-worth individuals in the Middlesex County area. By incorporating credit shelter and marital trusts, this will helps reduce estate taxes and establish a clear distribution plan for preserving wealth, ensuring financial well-being for both surviving spouses and future generations.

Free preview

How to fill out Middlesex Massachusetts Complex Will With Credit Shelter Marital Trust For Large Estates?

If you’ve already used our service before, log in to your account and save the Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Middlesex Massachusetts Complex Will with Credit Shelter Marital Trust for Large Estates. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!