Boston Massachusetts Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Massachusetts Dissolution Package To Dissolve Limited Liability Company LLC?

Take advantage of the US Legal Forms and gain instant access to any template you need.

Our user-friendly website featuring a wide array of document templates simplifies the process of locating and obtaining almost any document example you need.

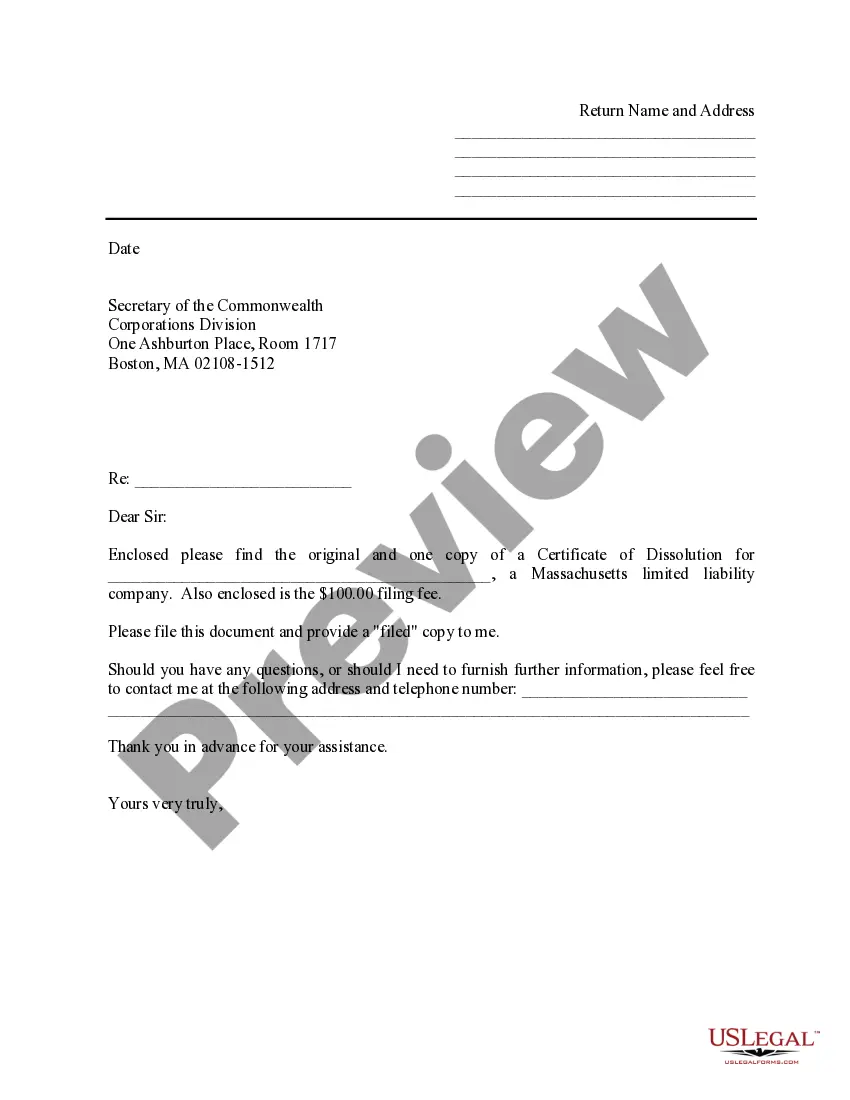

You can save, complete, and endorse the Boston Massachusetts Dissolution Package to Terminate Limited Liability Company LLC in just a few minutes rather than spending hours scouring the internet for a suitable template.

Utilizing our collection is an excellent means to enhance the security of your document submission.

If you are yet to create an account, follow the instructions below.

Access the page with the template you need. Ensure it is the form you were looking for: verify its title and description, and utilize the Preview option if available. Alternatively, use the Search box to find the correct one.

- Our qualified legal experts routinely evaluate all the documents to ensure that the templates are suitable for a specific state and adhere to current laws and regulations.

- How can you acquire the Boston Massachusetts Dissolution Package to Terminate Limited Liability Company LLC.

- If you possess an account, simply Log In to your profile.

- The Download option will be visible on all the documents you access.

- Moreover, you can retrieve all the previously saved documents in the My documents section.

Form popularity

FAQ

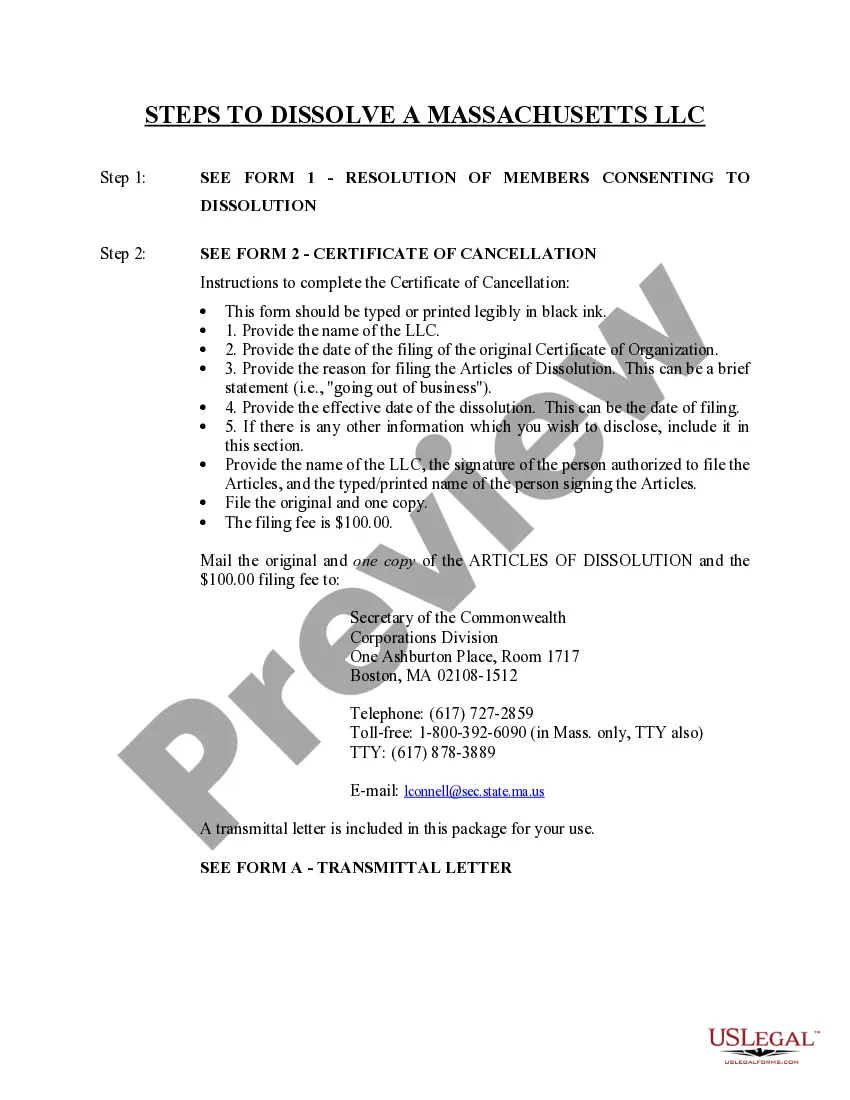

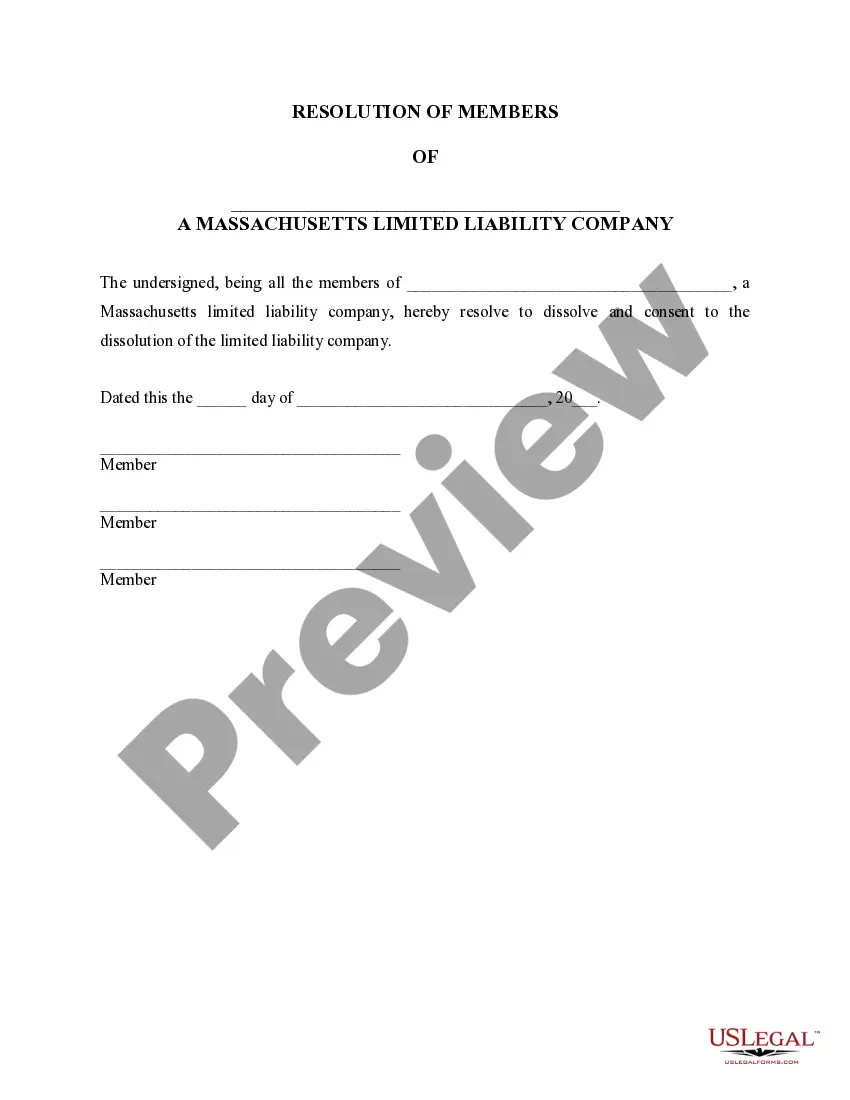

Articles of Dissolution, known in Massachusetts as Certificate of Cancellation, are the forms that you file to voluntarily dissolve your LLC. Once this document has been filed and processed, your LLC will no longer legally exist.

There is a $100 fee to file the articles of dissolution. Articles filed by mail are usually processed in 3-5 business days, filings delivered by hand usually require 1-2 business days, and faxed documents generally are processed the same day.

Corporations Division Filing Fees Domestic Profit and Professional CorporationsCertificate of Dissolution$7.00Certificate of Good Standing$12.00 (This is not a Tax Good Standing)Foreign and Foreign Professional CorporationsRegistration in Massachusetts$400.00 ($375 if filed by fax)138 more rows

There is a $100 filing fee to dissolve your Massachusetts Limited Liability Company. If you file by fax, you will have to pay an additional $9 fee for expedited processing.

Termination: All that must be done has been done This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Corporation Filing Requirements (Includes S Corporations) You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.

Corporations must complete a Form 966, Corporate Dissolution or Liquidation, and file it with the final corporate return. Partnerships must file the final Form 1065 and Schedule K-1s. Sole proprietors stop filing the Schedule C with the individual income tax return.