Cambridge Massachusetts Financial Account Transfer to Living Trust: A Comprehensive Guide If you are a resident of Cambridge, Massachusetts, and considering securing your financial future, transferring your accounts to a living trust can be a sensible option. A living trust is a legal entity that holds assets, including financial accounts, for the benefit of the trust's creator and beneficiaries. This detailed description aims to provide you with comprehensive information about Cambridge Massachusetts Financial Account Transfer to Living Trust, including the different types available. Benefits of Financial Account Transfer to Living Trust in Cambridge Massachusetts: 1. Avoiding Probate: One of the primary advantages of transferring financial accounts to a living trust is bypassing the probate process. Probate can be a time-consuming and costly legal procedure that involves validating a will and distributing assets. By transferring your accounts to a living trust, you ensure a smoother and faster transfer of assets to your beneficiaries. 2. Privacy: Unlike wills, living trusts are kept private and do not become public record. By utilizing a living trust, you can maintain privacy regarding the distribution of your financial accounts. 3. Disability Planning: A living trust enables you to plan for incapacity or disability. In the event you become unable to manage your financial affairs, a successor trustee can step in, adhering to the trust's predetermined guidelines. 4. Continuity: A living trust allows for seamless continuity in managing your financial accounts even after your demise or incapacity. Additionally, it ensures a smoother transition to your chosen beneficiaries, reducing the chances of confusion or disputes. Types of Cambridge Massachusetts Financial Account Transfer to Living Trust: 1. Revocable Living Trust: The most common type of living trust, a revocable living trust, allows you to retain control over your financial accounts during your lifetime. You have the flexibility to make changes or cancel the trust at any time, providing you with ultimate control and management. 2. Irrevocable Living Trust: In contrast to the revocable living trust, an irrevocable living trust cannot be altered or revoked once established. By transferring your financial accounts to an irrevocable living trust, you remove them from your estate, potentially reducing estate taxes and protecting assets from creditors. 3. Testamentary Living Trust: A testamentary living trust is established through a will and only becomes effective upon your passing. It allows for the transfer of financial accounts to the trust and subsequent distribution to beneficiaries according to your instructions. When considering a Cambridge Massachusetts Financial Account Transfer to Living Trust, consulting with an experienced estate planning attorney is highly recommended. They can guide you through the process, ensuring compliance with state laws and providing personalized advice based on your unique financial situation and goals. In conclusion, transferring your financial accounts to a living trust in Cambridge, Massachusetts, offers numerous benefits, including avoiding probate, ensuring privacy, and providing seamless continuity. The available types of living trusts, including revocable, irrevocable, and testamentary, offer different advantages depending on your specific needs. Embracing this estate planning strategy can help secure your financial future and provide peace of mind for yourself and your loved ones.

Cambridge Massachusetts Financial Account Transfer to Living Trust

Category:

State:

Massachusetts

City:

Cambridge

Control #:

MA-E0178C

Format:

Word;

Rich Text

Instant download

Description

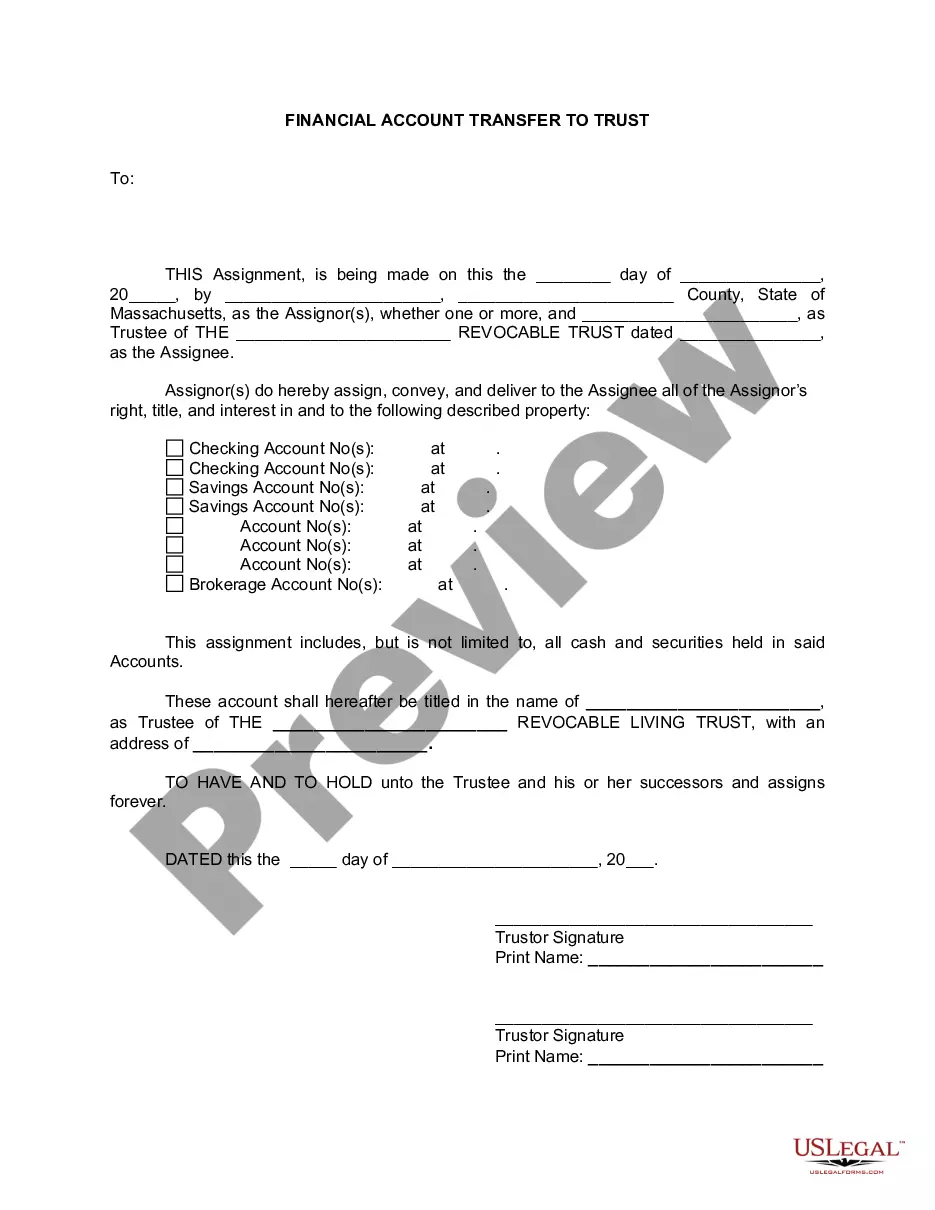

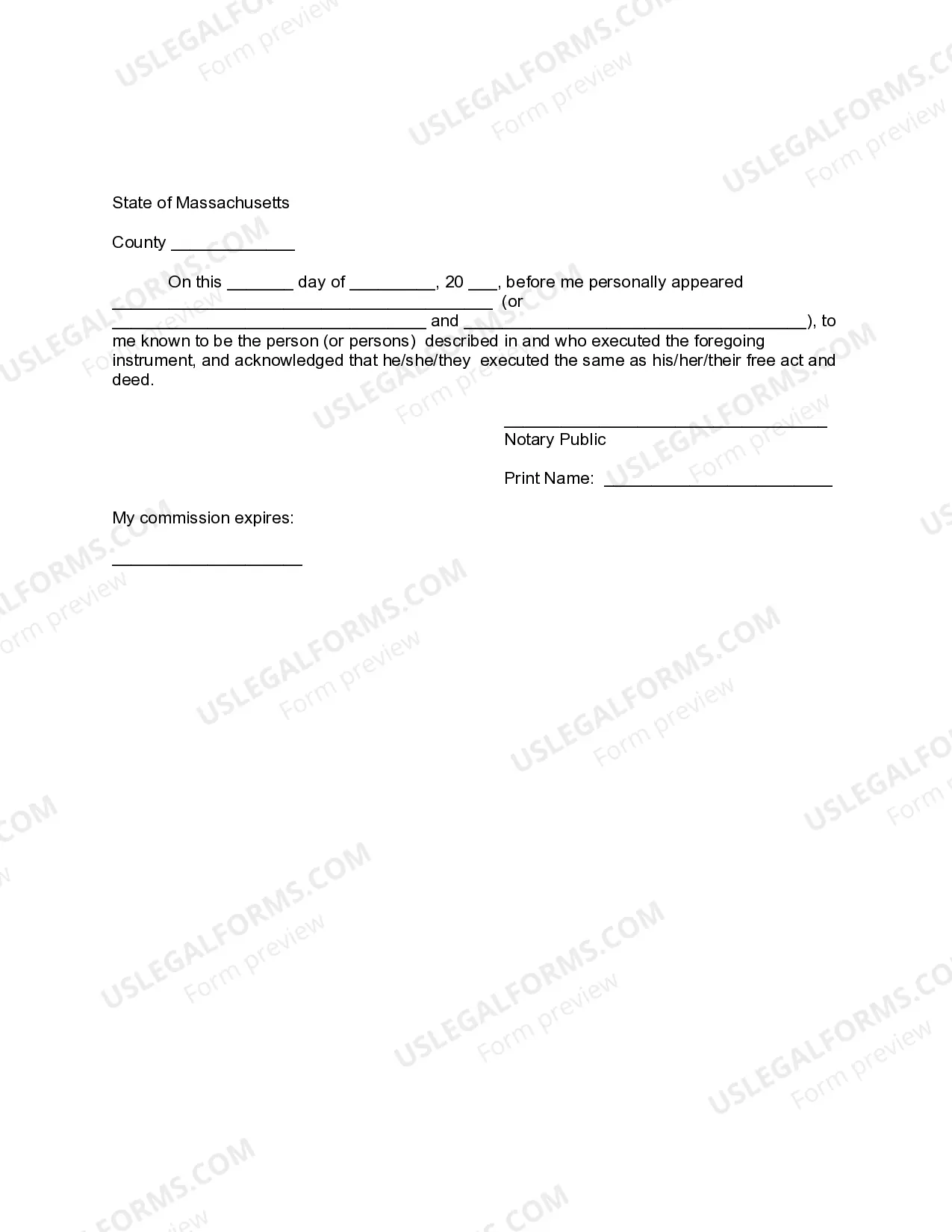

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Cambridge Massachusetts Financial Account Transfer to Living Trust: A Comprehensive Guide If you are a resident of Cambridge, Massachusetts, and considering securing your financial future, transferring your accounts to a living trust can be a sensible option. A living trust is a legal entity that holds assets, including financial accounts, for the benefit of the trust's creator and beneficiaries. This detailed description aims to provide you with comprehensive information about Cambridge Massachusetts Financial Account Transfer to Living Trust, including the different types available. Benefits of Financial Account Transfer to Living Trust in Cambridge Massachusetts: 1. Avoiding Probate: One of the primary advantages of transferring financial accounts to a living trust is bypassing the probate process. Probate can be a time-consuming and costly legal procedure that involves validating a will and distributing assets. By transferring your accounts to a living trust, you ensure a smoother and faster transfer of assets to your beneficiaries. 2. Privacy: Unlike wills, living trusts are kept private and do not become public record. By utilizing a living trust, you can maintain privacy regarding the distribution of your financial accounts. 3. Disability Planning: A living trust enables you to plan for incapacity or disability. In the event you become unable to manage your financial affairs, a successor trustee can step in, adhering to the trust's predetermined guidelines. 4. Continuity: A living trust allows for seamless continuity in managing your financial accounts even after your demise or incapacity. Additionally, it ensures a smoother transition to your chosen beneficiaries, reducing the chances of confusion or disputes. Types of Cambridge Massachusetts Financial Account Transfer to Living Trust: 1. Revocable Living Trust: The most common type of living trust, a revocable living trust, allows you to retain control over your financial accounts during your lifetime. You have the flexibility to make changes or cancel the trust at any time, providing you with ultimate control and management. 2. Irrevocable Living Trust: In contrast to the revocable living trust, an irrevocable living trust cannot be altered or revoked once established. By transferring your financial accounts to an irrevocable living trust, you remove them from your estate, potentially reducing estate taxes and protecting assets from creditors. 3. Testamentary Living Trust: A testamentary living trust is established through a will and only becomes effective upon your passing. It allows for the transfer of financial accounts to the trust and subsequent distribution to beneficiaries according to your instructions. When considering a Cambridge Massachusetts Financial Account Transfer to Living Trust, consulting with an experienced estate planning attorney is highly recommended. They can guide you through the process, ensuring compliance with state laws and providing personalized advice based on your unique financial situation and goals. In conclusion, transferring your financial accounts to a living trust in Cambridge, Massachusetts, offers numerous benefits, including avoiding probate, ensuring privacy, and providing seamless continuity. The available types of living trusts, including revocable, irrevocable, and testamentary, offer different advantages depending on your specific needs. Embracing this estate planning strategy can help secure your financial future and provide peace of mind for yourself and your loved ones.

Free preview

How to fill out Cambridge Massachusetts Financial Account Transfer To Living Trust?

If you’ve already utilized our service before, log in to your account and save the Cambridge Massachusetts Financial Account Transfer to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Cambridge Massachusetts Financial Account Transfer to Living Trust. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!