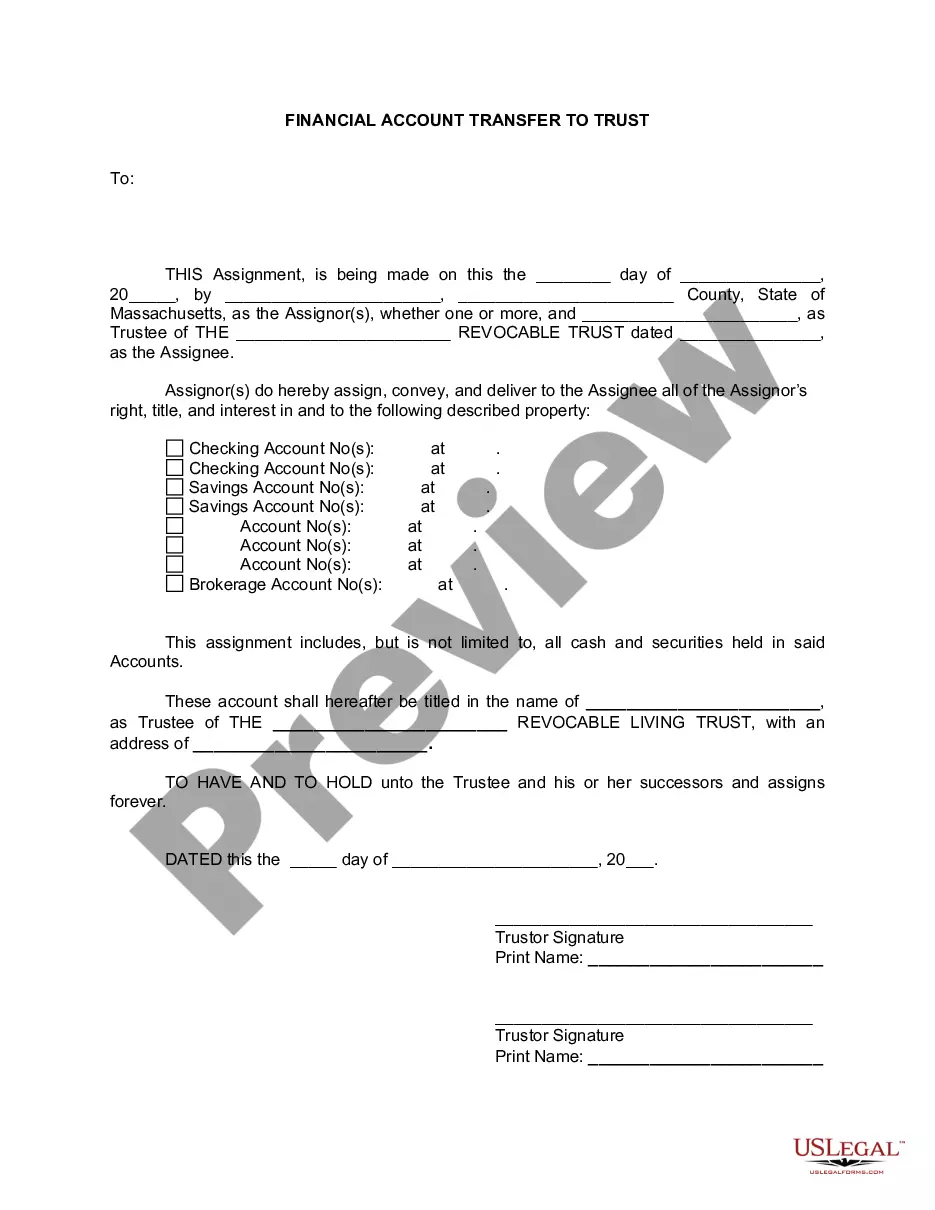

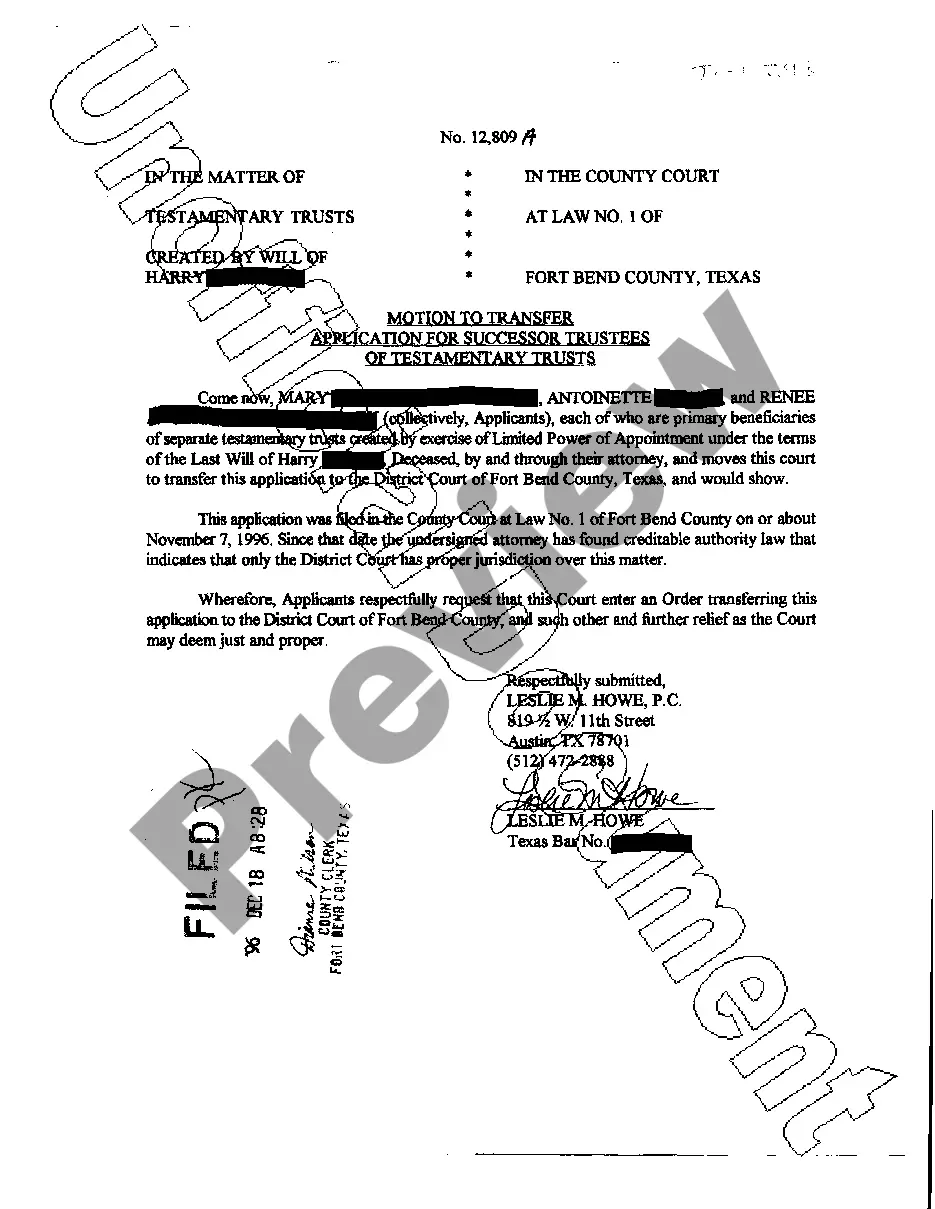

Middlesex Massachusetts Financial Account Transfer to Living Trust is a process through which individuals residing in Middlesex County, Massachusetts, can transfer their financial accounts to a living trust. This legal arrangement allows them to manage their assets more efficiently, protect their wealth, and ensure a smoother transfer of assets after their demise. The living trust is a revocable trust created by the granter(s) during their lifetime, which allows them to maintain control over their assets. By transferring their financial accounts, such as checking accounts, savings accounts, investment accounts, and retirement accounts, into the trust, individuals can extend the benefits of this legal structure to their finances. The main objective of Middlesex Massachusetts Financial Account Transfer to Living Trust is to avoid probate, a potentially time-consuming and expensive legal process that determines the validity of a will and the distribution of assets upon death. By transferring financial accounts to a living trust, individuals can ensure that their assets are managed and distributed according to their wishes, without the need for court intervention. There are different types of Middlesex Massachusetts Financial Account Transfer to Living Trust, each suited to specific needs and circumstances: 1. Revocable Living Trust: This type of living trust allows the granter(s) to maintain control over their financial accounts and make changes to the trust during their lifetime. It offers flexibility and allows for modifications in case of changing circumstances or estate planning goals. 2. Irrevocable Living Trust: Unlike the revocable trust, the irrevocable living trust cannot be modified or revoked once established. This type of trust relinquishes control over the financial accounts to the trustee, offering stronger protection against creditors and potential estate taxes. 3. Testamentary Trust: This trust is created within a will and only takes effect after the death of the granter(s). Financial accounts can be transferred to this trust upon the granter's demise, passing the assets to the designated beneficiaries according to the instructions outlined in the will. 4. Special Needs Trust: Designed for individuals with special needs, this trust enables the granter(s) to preserve government benefit eligibility while providing financial support for the beneficiary. Middlesex Massachusetts Financial Account Transfer to Living Trust is an essential estate planning strategy that allows individuals to safeguard their financial accounts, avoid probate, minimize estate taxes, and efficiently pass on their assets to their chosen beneficiaries. Consulting with an experienced estate planning attorney is crucial to ensure the accurate establishment and successful administration of the living trust.

Middlesex Massachusetts Financial Account Transfer to Living Trust

Description

How to fill out Middlesex Massachusetts Financial Account Transfer To Living Trust?

Do you need a reliable and inexpensive legal forms provider to get the Middlesex Massachusetts Financial Account Transfer to Living Trust? US Legal Forms is your go-to option.

Whether you require a simple arrangement to set regulations for cohabitating with your partner or a package of documents to advance your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and framed based on the requirements of specific state and area.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Middlesex Massachusetts Financial Account Transfer to Living Trust conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Start the search over if the form isn’t suitable for your specific scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. Once the payment is completed, download the Middlesex Massachusetts Financial Account Transfer to Living Trust in any provided format. You can return to the website when you need and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal paperwork online once and for all.

Form popularity

FAQ

Living Trusts in Massachusetts A living trust in Massachusetts is created by the grantor, the person putting things into trust. As the grantor you must choose a trustee who is charged with managing the trust for your benefit while you are alive and distributing your assets to your beneficiaries after your death.

To make a living trust in Massachusetts, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

What Type of Assets Go into a Trust? Bonds and stock certificates. Shareholders stock from closely held corporations. Non-retirement brokerage and mutual fund accounts. Money market accounts, cash, checking and savings accounts. Annuities. Certificates of deposit (CD) Safe deposit boxes.

A Trust Provides More Privacy Than a Will or Intestacy If you prefer that the details of who inherits from you remain private, a trust is a better way to accomplish that end. A trust in Massachusetts is a private document that handles your estate without court intervention.

No Asset Protection ? A revocable living trust does not protect assets from the reach of creditors. Administrative Work is Needed ? It takes time and effort to re-title all your assets from individual ownership over to a trust. All assets that are not formally transferred to the trust will have to go through probate.

From your house to your financial accounts, there are many assets you'll likely want to include in your living trust: Bank accounts.Real estate property.Insurance policies.Stocks, bonds, and other investment assets.Tangible personal property.Limited liability company (LLCs)Cryptocurrency.

As legal owner of the real estate, the nominee trust instrument or a certificate that sets forth information about the trust must be recorded with the registry of deeds.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

In order to create a general petition for the creation of a trust, the filing fee is $375 with a surcharge of $15. Once the trust has been created, there will be a great deal of paperwork involved, since every asset that is added to the trust will need to be signed for.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Interesting Questions

More info

Read the Trustee Advice and Understanding a Will to help you understand this process. You could instead use a will, but wills must go through probate—the court process that oversees the transfer of your property to your beneficiaries. Read the Trustee Advice and Understanding a Will to help you understand this process. Revocable living trust. With revocable living trusts, you can revoke the trust or revoke the revocable trust itself, without any action by you or your representative, in the event you die or no longer have the ability to control your assets. If the revocable trust is a designated beneficiary account, you can revoke the account, which would revoke all accounts holding income or funds with you. With revocable living trusts, you can revoke the trust or revoke the revocable trust itself, without any action by you or your representative, in the event you die or no longer have the ability to control your assets.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.