Boston Massachusetts Assignment to Living Trust is a legal process in which an individual designates and transfers their assets and property to a trust during their lifetime, to be managed by a chosen trustee for the benefit of named beneficiaries. This assignment is governed by specific provisions and regulations under Massachusetts law. The purpose of a Living Trust is to ensure that the individual's assets are protected, preserved, and efficiently distributed according to their wishes upon their incapacity or demise, thus avoiding the probate process. Unlike a will, a living trust becomes effective immediately after creation and can provide continuous management of assets in case the individual becomes incapacitated. There are two primary types of Boston Massachusetts Assignment to Living Trust: 1. Revocable Living Trust: As the name suggests, this type of trust can be altered, modified, or revoked during the lifetime of the individual who established the trust (known as the granter or settler). In a revocable living trust, the granter also commonly serves as the initial trustee and maintains full control over the assets. They can amend or terminate the trust at will, adding or removing assets, changing beneficiaries, or making other alterations as circumstances change. A revocable living trust allows for flexibility and avoids the need for court proceedings if modifications are required. 2. Irrevocable Living Trust: In contrast to a revocable living trust, the granter relinquishes control over the assets and property placed within an irrevocable living trust. This means that once the assignment is made, it cannot be changed or revoked without the consent of the beneficiaries. The main advantage of an irrevocable living trust is the potential to minimize estate taxes and protect assets from creditors. However, the granter must carefully consider the implications of transferring ownership and control permanently to the trust. In both types of trusts, the granter must execute a legally binding document known as a "Declaration of Trust." This document outlines the terms and conditions of the trust, identifies the trustee(s), beneficiaries, assets, and instructions for managing and distributing those assets. In the state of Massachusetts, the Boston Massachusetts Assignment to Living Trust must comply with Massachusetts General Laws Chapter 203E, which governs the creation, administration, and termination of trusts. These laws provide guidance on trustee duties, beneficiary rights, and other important aspects of trust administration. It is essential to consult with an experienced attorney specializing in estate planning and trust administration to properly execute a Boston Massachusetts Assignment to Living Trust. The attorney can guide the granter through the process, ensuring compliance with all legal requirements and customizing the trust to meet the individual's specific goals and objectives.

Boston Massachusetts Assignment to Living Trust

Category:

State:

Massachusetts

City:

Boston

Control #:

MA-E0178E

Format:

Word;

Rich Text

Instant download

Description

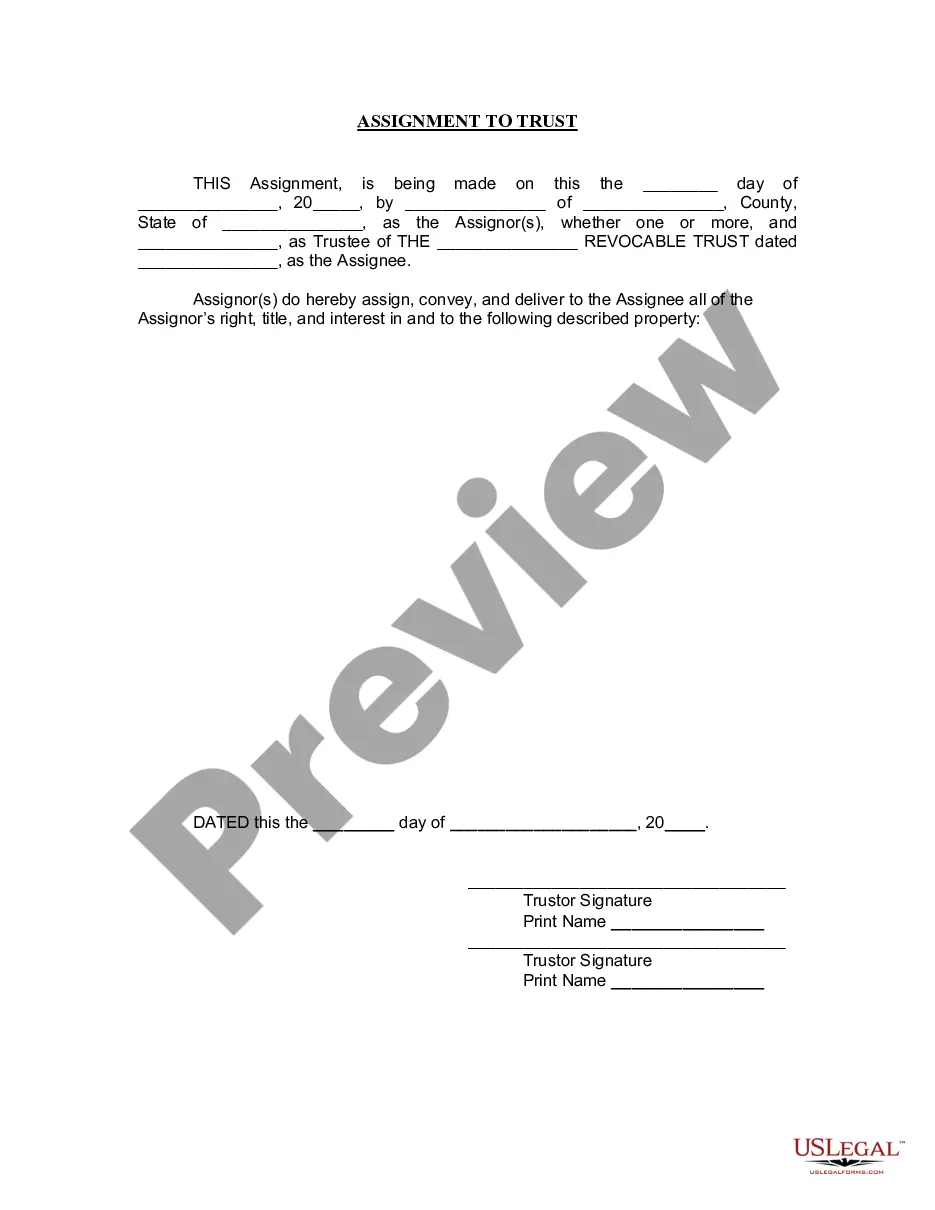

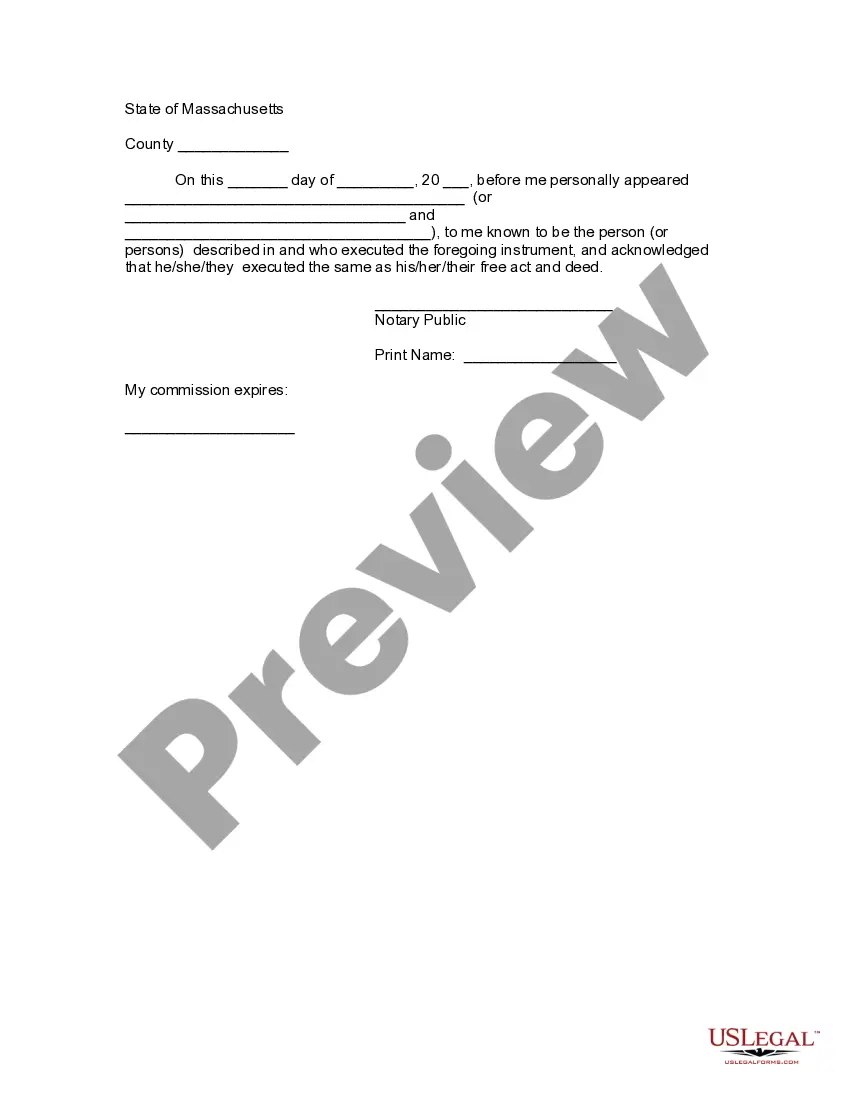

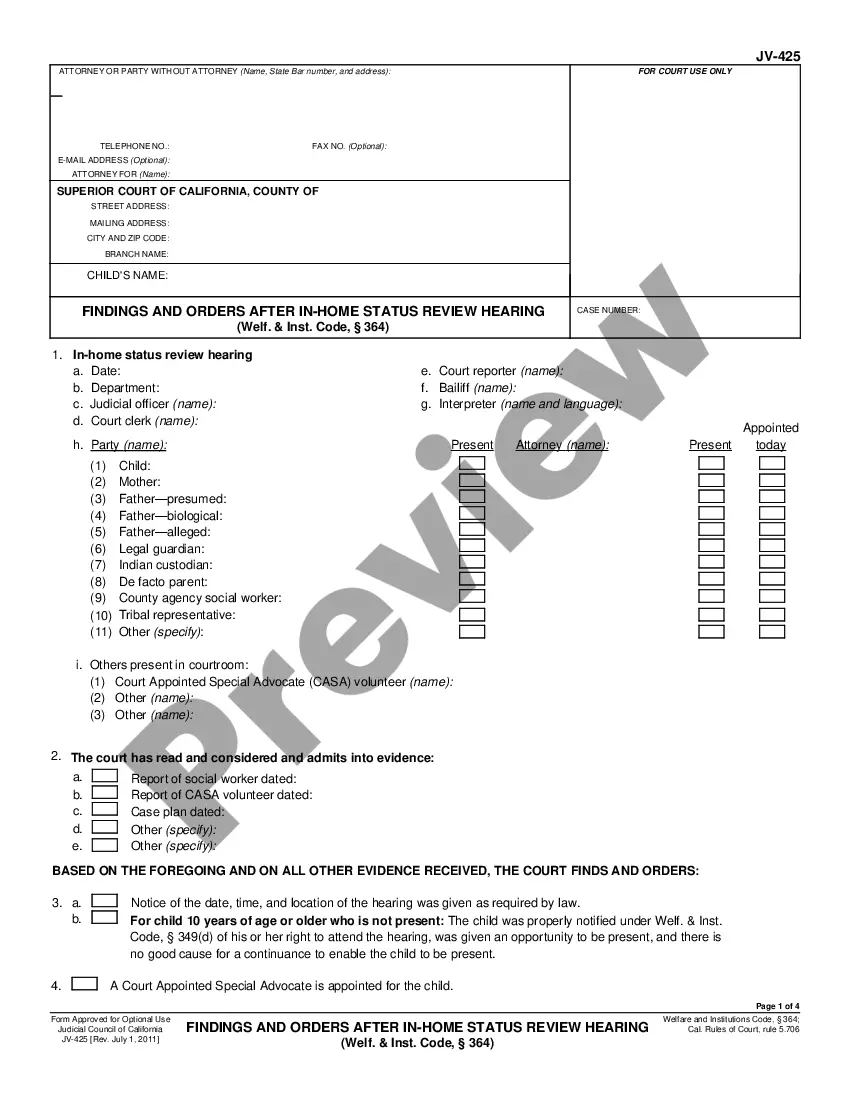

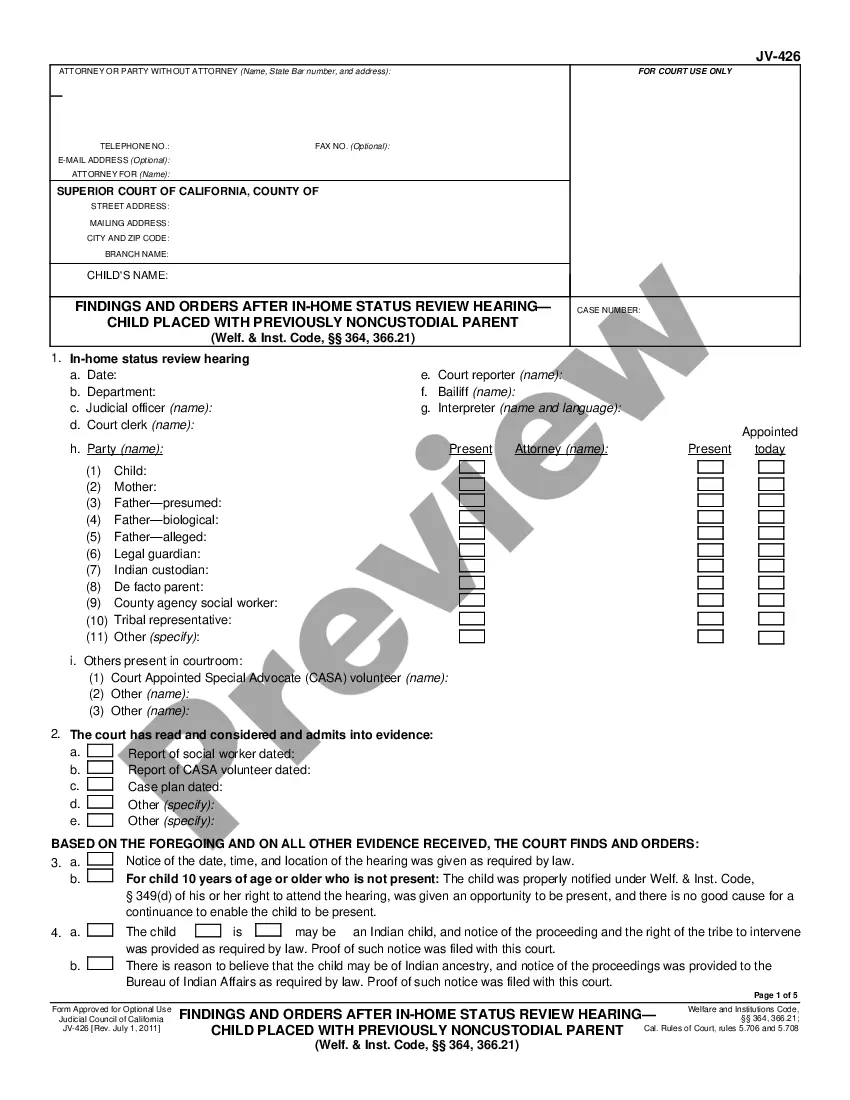

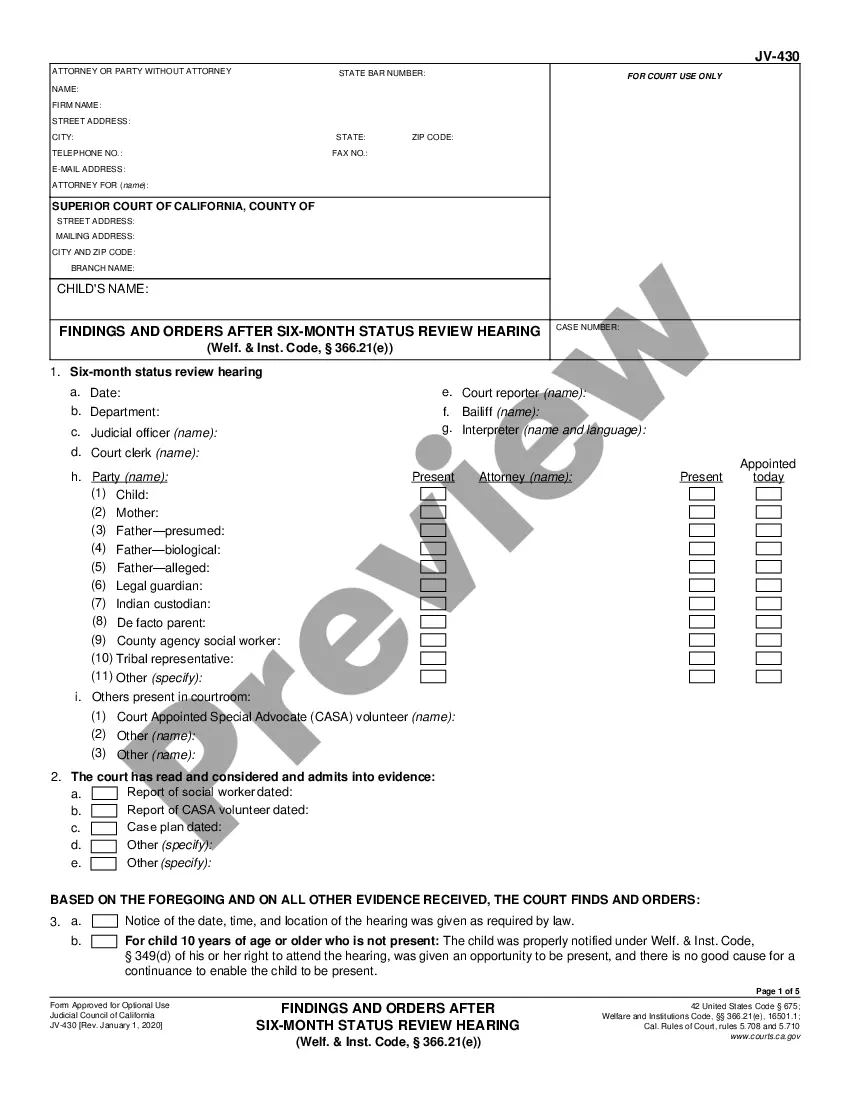

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Boston Massachusetts Assignment to Living Trust is a legal process in which an individual designates and transfers their assets and property to a trust during their lifetime, to be managed by a chosen trustee for the benefit of named beneficiaries. This assignment is governed by specific provisions and regulations under Massachusetts law. The purpose of a Living Trust is to ensure that the individual's assets are protected, preserved, and efficiently distributed according to their wishes upon their incapacity or demise, thus avoiding the probate process. Unlike a will, a living trust becomes effective immediately after creation and can provide continuous management of assets in case the individual becomes incapacitated. There are two primary types of Boston Massachusetts Assignment to Living Trust: 1. Revocable Living Trust: As the name suggests, this type of trust can be altered, modified, or revoked during the lifetime of the individual who established the trust (known as the granter or settler). In a revocable living trust, the granter also commonly serves as the initial trustee and maintains full control over the assets. They can amend or terminate the trust at will, adding or removing assets, changing beneficiaries, or making other alterations as circumstances change. A revocable living trust allows for flexibility and avoids the need for court proceedings if modifications are required. 2. Irrevocable Living Trust: In contrast to a revocable living trust, the granter relinquishes control over the assets and property placed within an irrevocable living trust. This means that once the assignment is made, it cannot be changed or revoked without the consent of the beneficiaries. The main advantage of an irrevocable living trust is the potential to minimize estate taxes and protect assets from creditors. However, the granter must carefully consider the implications of transferring ownership and control permanently to the trust. In both types of trusts, the granter must execute a legally binding document known as a "Declaration of Trust." This document outlines the terms and conditions of the trust, identifies the trustee(s), beneficiaries, assets, and instructions for managing and distributing those assets. In the state of Massachusetts, the Boston Massachusetts Assignment to Living Trust must comply with Massachusetts General Laws Chapter 203E, which governs the creation, administration, and termination of trusts. These laws provide guidance on trustee duties, beneficiary rights, and other important aspects of trust administration. It is essential to consult with an experienced attorney specializing in estate planning and trust administration to properly execute a Boston Massachusetts Assignment to Living Trust. The attorney can guide the granter through the process, ensuring compliance with all legal requirements and customizing the trust to meet the individual's specific goals and objectives.

Free preview

How to fill out Boston Massachusetts Assignment To Living Trust?

If you’ve already used our service before, log in to your account and save the Boston Massachusetts Assignment to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Boston Massachusetts Assignment to Living Trust. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!