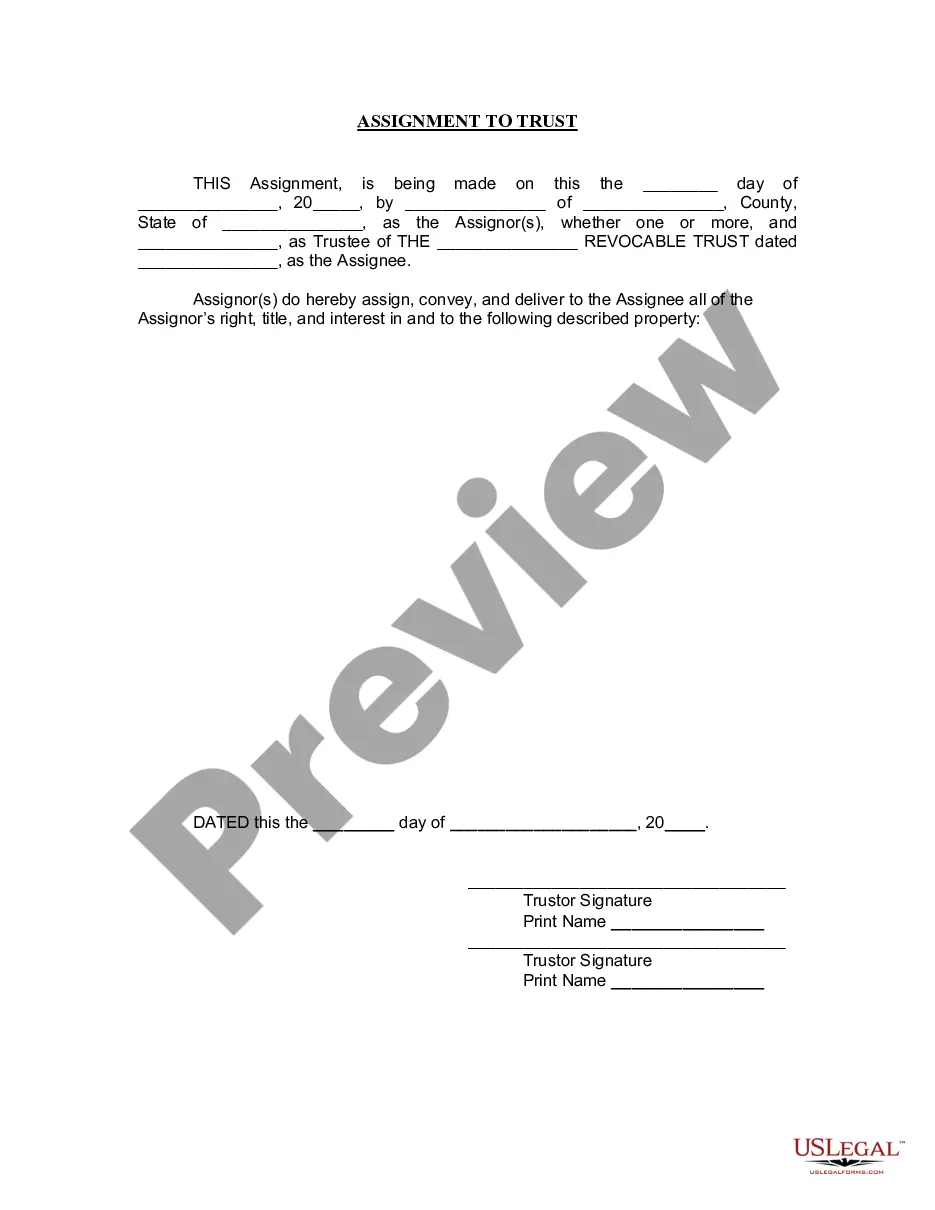

Lowell Massachusetts Assignment to Living Trust is a legal process in which a person's assets and properties are transferred into a living trust during their lifetime. This type of trust is common in estate planning and allows individuals to maintain control over their assets while ensuring a smooth distribution to beneficiaries after their passing. In Lowell, Massachusetts, there are several types of Assignments to Living Trust, also known as Living Trust Agreements. The most common types include: 1. Revocable Living Trust: This is the most flexible type of trust, allowing the settler (the person creating the trust) to make changes or revoke the trust at any time during their lifetime. It provides versatility and allows the settler to retain control and use of the assets while alive. 2. Irrevocable Living Trust: Unlike a revocable trust, this type of trust cannot be modified, amended, or revoked once it is established. The assets transferred into an irrevocable trust are considered separate from the settler's personal assets, offering potential tax benefits and asset protection. 3. Special Needs Trust: This type of trust is specifically designed to provide financial support for individuals with disabilities without affecting their eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI). It ensures that the disabled person's care and quality of life are maintained even after the settler's passing. 4. Testamentary Trust: Unlike the aforementioned living trusts, a testamentary trust is created through a will and takes effect only after the settler's death. It specifies how the assets will be managed and distributed to the beneficiaries mentioned in the will. When assigning assets to a living trust in Lowell, Massachusetts, it is crucial to consult with an experienced attorney who specializes in estate planning. They can guide individuals through the legal requirements, assist in drafting the necessary documents, and ensure proper administration of the trust in accordance with state laws. Overall, Lowell Massachusetts Assignment to Living Trust offers individuals a valuable tool to protect and manage their assets during their lifetime while providing a comprehensive plan for the distribution of those assets to loved ones upon their passing.

Lowell Massachusetts Assignment to Living Trust

Description

How to fill out Lowell Massachusetts Assignment To Living Trust?

If you’ve already utilized our service before, log in to your account and download the Lowell Massachusetts Assignment to Living Trust on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Lowell Massachusetts Assignment to Living Trust. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!

Form popularity

FAQ

It is generally advisable to place your bank accounts into your living trust as part of your Lowell Massachusetts Assignment to Living Trust. This can help avoid probate and ensure a smoother transition of your assets upon your passing. However, always consult with a financial advisor or legal professional to make the best decision for your specific situation. Resources like US Legal Forms can help you navigate these important choices.

A trust is a legal arrangement where one party holds property for the benefit of another, while a certification of trust is a document that verifies the existence and details of a trust. When managing your Lowell Massachusetts Assignment to Living Trust, the certification serves as proof to third parties, such as banks, that the trust exists. Understanding this distinction can help you manage your estate planning effectively.

Yes, you can create your own certificate of trust for your Lowell Massachusetts Assignment to Living Trust. It’s important to include all necessary elements, like trust details and trustee powers. However, to avoid potential mistakes, using templates from trusted sources like US Legal Forms can provide you with a clear framework to follow.

Filling out a trust certification involves listing essential information, such as the trust's name, the date it was created, and details about the trustees. Ensure that you specify the powers and responsibilities given to the trustee. For a step-by-step guide tailored for your Lowell Massachusetts Assignment to Living Trust, consider accessing resources available through US Legal Forms.

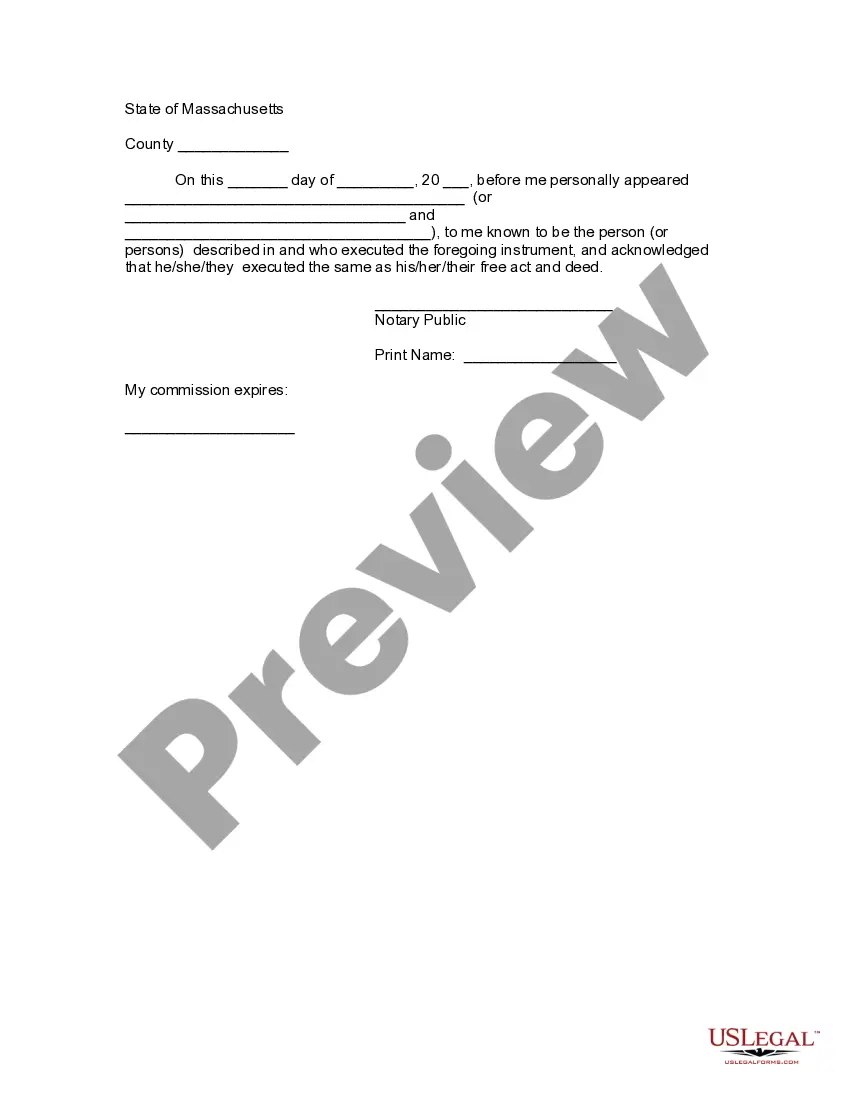

In most cases, you do not need to notarize a certificate of trust as part of your Lowell Massachusetts Assignment to Living Trust. However, specific requirements can vary by state or financial institution. It is wise to check with your local laws or consult with a legal professional to ensure compliance. Using platforms like US Legal Forms can help provide guidance on these requirements.

To fill out a certification of trust form for your Lowell Massachusetts Assignment to Living Trust, start by gathering all necessary information about the trust. Include details such as the name of the trust, the date it was established, and the names of the trustees. Be sure to provide information about the powers granted to the trustee. If you're unsure, consider using resources like US Legal Forms to simplify the process.

Suze Orman advocates for living trusts as effective estate planning tools, especially for those who want to avoid the probate process. She emphasizes that a Lowell Massachusetts Assignment to Living Trust can ensure your wishes are fulfilled after your death while also providing peace of mind during your lifetime. However, she also advises individuals to fully understand the costs and responsibilities before committing to establishing one.

One downside of a living trust is that it does not provide protection from creditors, as assets within a living trust are still considered part of your estate. Moreover, a Lowell Massachusetts Assignment to Living Trust requires you to retitle your assets, which can be a cumbersome process. Additionally, if not properly funded, a living trust may not serve its purpose, making careful management crucial.

Some individuals may choose not to establish a living trust due to the initial legal costs and complexity involved. If your estate is small and straightforward enough, a will might suffice for your needs. Additionally, some people may feel comfortable relying on state laws for asset distribution, thereby omitting the need for a Lowell Massachusetts Assignment to Living Trust altogether. Ultimately, your personal situation will dictate the best approach.

A living trust offers several advantages, such as avoiding probate, maintaining privacy, and providing flexibility in asset management. It allows you to control your assets while you are alive and specifies how they are distributed after your death. However, a Lowell Massachusetts Assignment to Living Trust may require ongoing management and can incur legal fees. Therefore, it's essential to weigh these benefits against the costs and responsibilities involved.