The Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate) is a legal contract designed to modify the terms and conditions of an existing loan agreement in order to provide relief to borrowers who are facing financial difficulties or struggling with the repayment of their mortgage loan. It specifically focuses on fixing the interest rate associated with the loan. This type of loan modification agreement is particularly beneficial for borrowers who have adjustable-rate mortgages (ARM's) and are looking for more stability and predictability in their monthly mortgage payments. By converting their variable interest rate loan into a fixed interest rate loan, borrowers can have peace of mind knowing that their interest rate will remain unchanged throughout the term of the modified agreement. The Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate) typically involves negotiations between the borrower and the lender to reach a mutual agreement on the revised terms of the loan. The lender may agree to reduce the interest rate to a fixed percentage, which could be lower than the previous rate, making the loan more affordable for the borrower. Relevant keywords for the Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate) include loan modification, fixed interest rate, adjustable-rate mortgage (ARM), stability, predictability, financial difficulties, repayment, negotiations, reduced interest rate, and affordability. It's important to note that there may be variations or specific types of loan modification agreements within the Boston Massachusetts area. These variations could be based on different factors such as borrower's financial situation, loan service's policies, or specific government programs that may be available to assist borrowers with their loan modification needs. It is recommended to consult with a legal or financial professional to understand the specific types and options available in Boston Massachusetts.

Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate)

Description

How to fill out Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial matters. To do so, we apply for attorney solutions that, usually, are extremely expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

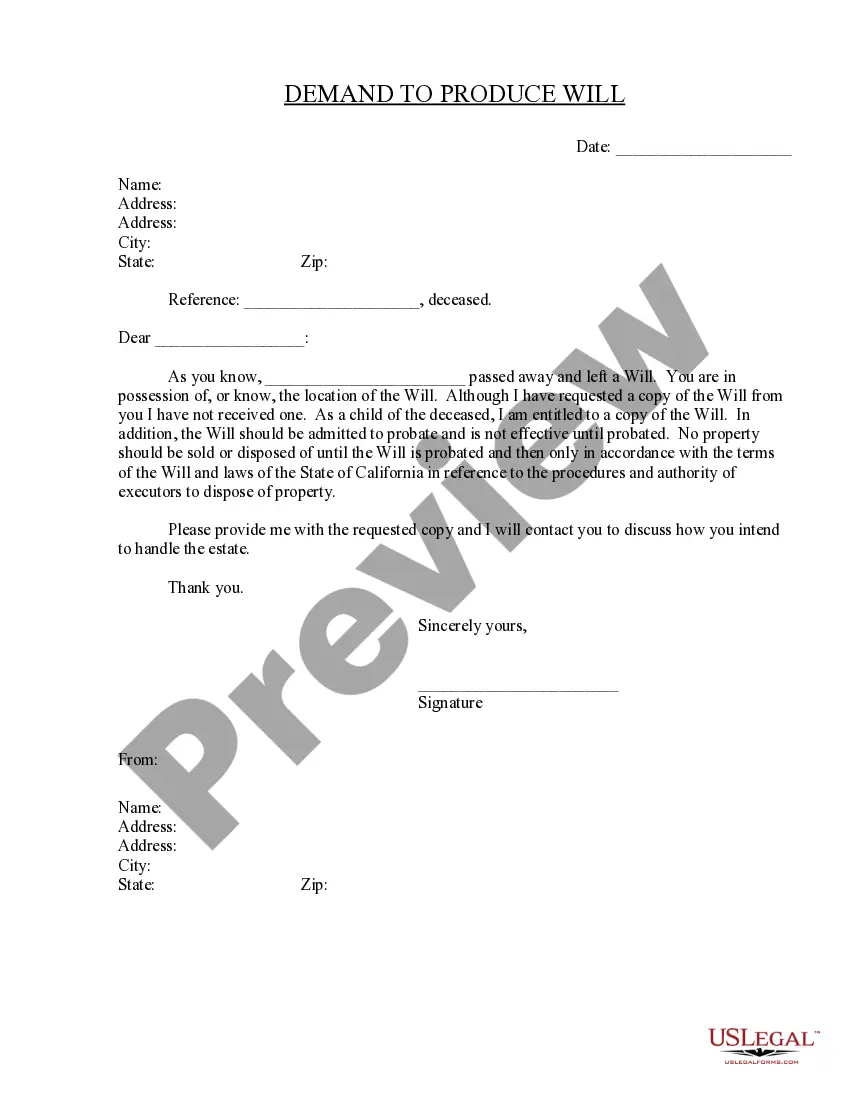

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate) or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate) complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Boston Massachusetts Loan Modification Agreement (Fixed Interest Rate) is suitable for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!