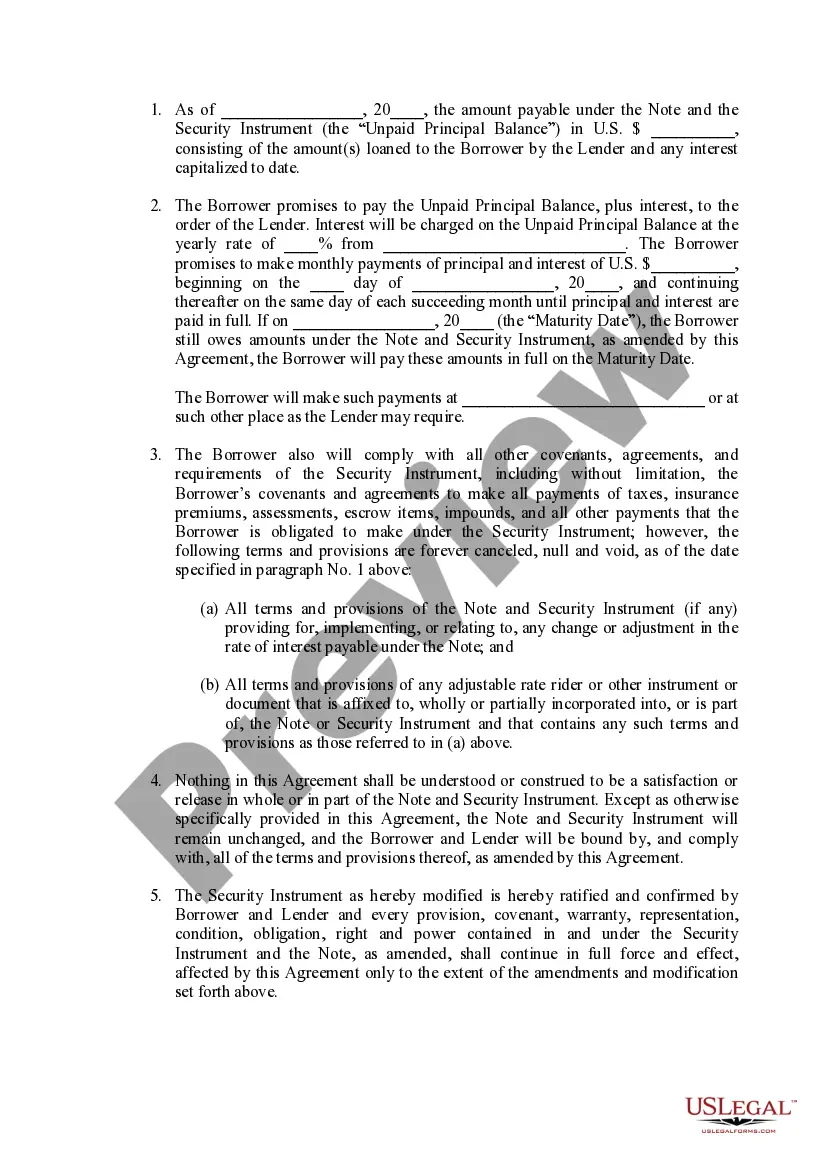

A Lowell Massachusetts Loan Modification Agreement refers to a legal contract between a borrower and a lender, typically a mortgage company or bank, that aims to modify the terms of an existing loan. This modification agreement is specific to Lowell, Massachusetts, and focuses on fixing the interest rate for the loan. In Lowell, there are various types of Loan Modification Agreements available, each catering to different needs and circumstances. These types include: 1. Fixed Interest Rate Modification: This type of loan modification agreement provides borrowers with the opportunity to lock in a fixed interest rate for the remainder of their loan term. Fixed interest rates offer stability and predictability, as the interest rate remains constant, regardless of market fluctuations. This allows borrowers to budget more effectively, as they will have a consistent monthly payment. 2. Temporary Fixed Interest Rate Modification: Some loan modification agreements in Lowell may offer a temporary fixed interest rate. In this case, the fixed rate is only applicable for a specific period, typically for a few years. After this period expires, the interest rate may revert to a variable rate or follow a predetermined adjustment schedule. 3. Hybrid Loan Modification: A hybrid loan modification combines elements of both fixed and adjustable interest rates. Borrowers may have a fixed interest rate for an initial period, after which it converts to an adjustable rate loan. This type of modification can be ideal for those who seek the benefits of fixed rates in the short term, while also being open to potential future adjustments. 4. Government-Sponsored Loan Modification Programs: Lowell, Massachusetts also offers loan modification programs initiated by the government, such as the Home Affordable Modification Program (CAMP). These programs aim to assist homeowners who are struggling to make their mortgage payments by providing various modification options, including fixed interest rate modifications. When entering into a Lowell Massachusetts Loan Modification Agreement (Fixed Interest Rate), it is crucial for borrowers to thoroughly review the terms and conditions. They should consider consulting a legal professional or a housing counselor to understand the implications and ensure they make an informed decision.

Lowell Massachusetts Loan Modification Agreement (Fixed Interest Rate)

Description

How to fill out Lowell Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Lowell Massachusetts Loan Modification Agreement (Fixed Interest Rate) gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Lowell Massachusetts Loan Modification Agreement (Fixed Interest Rate) takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Lowell Massachusetts Loan Modification Agreement (Fixed Interest Rate). Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!