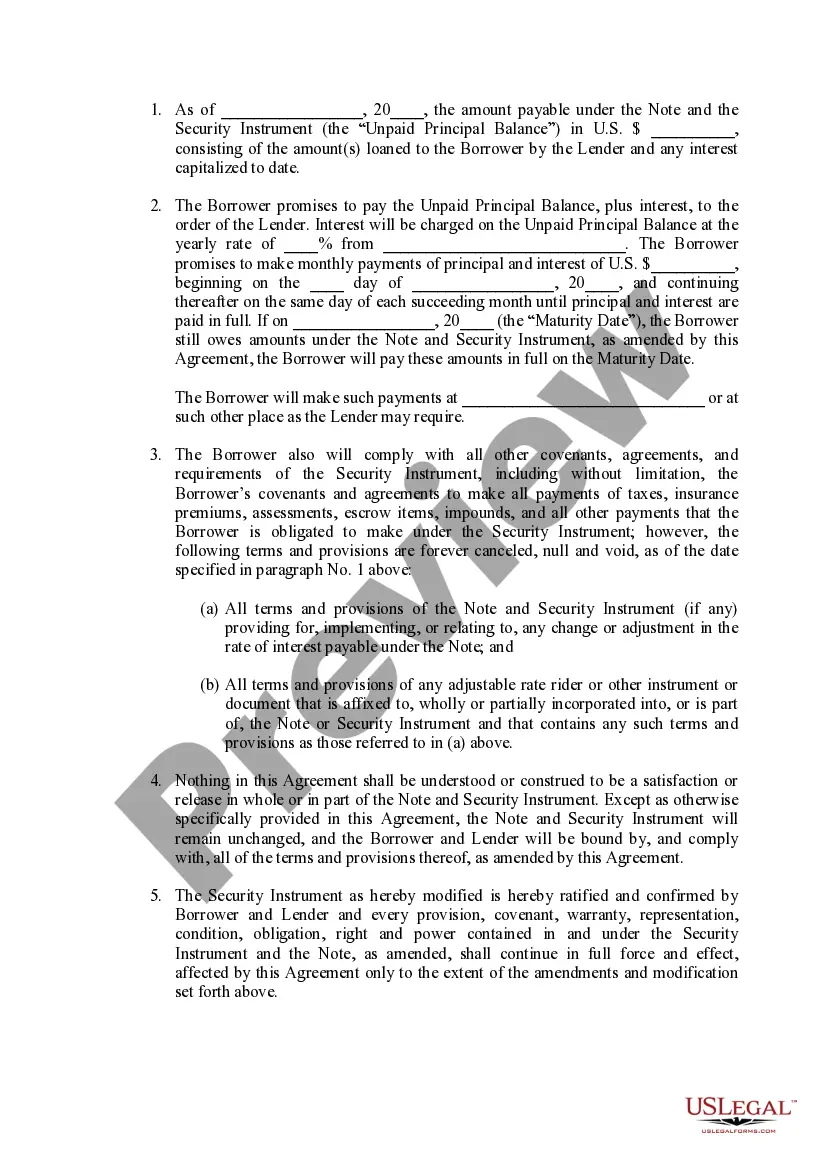

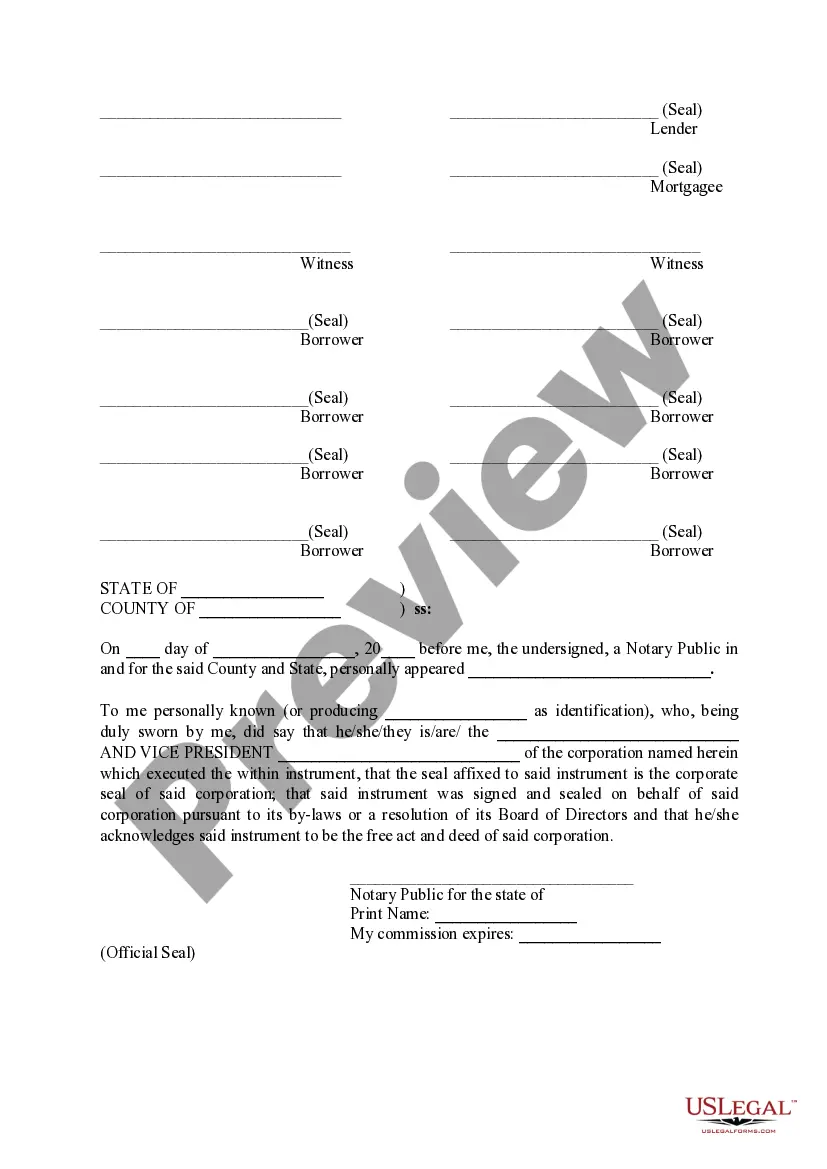

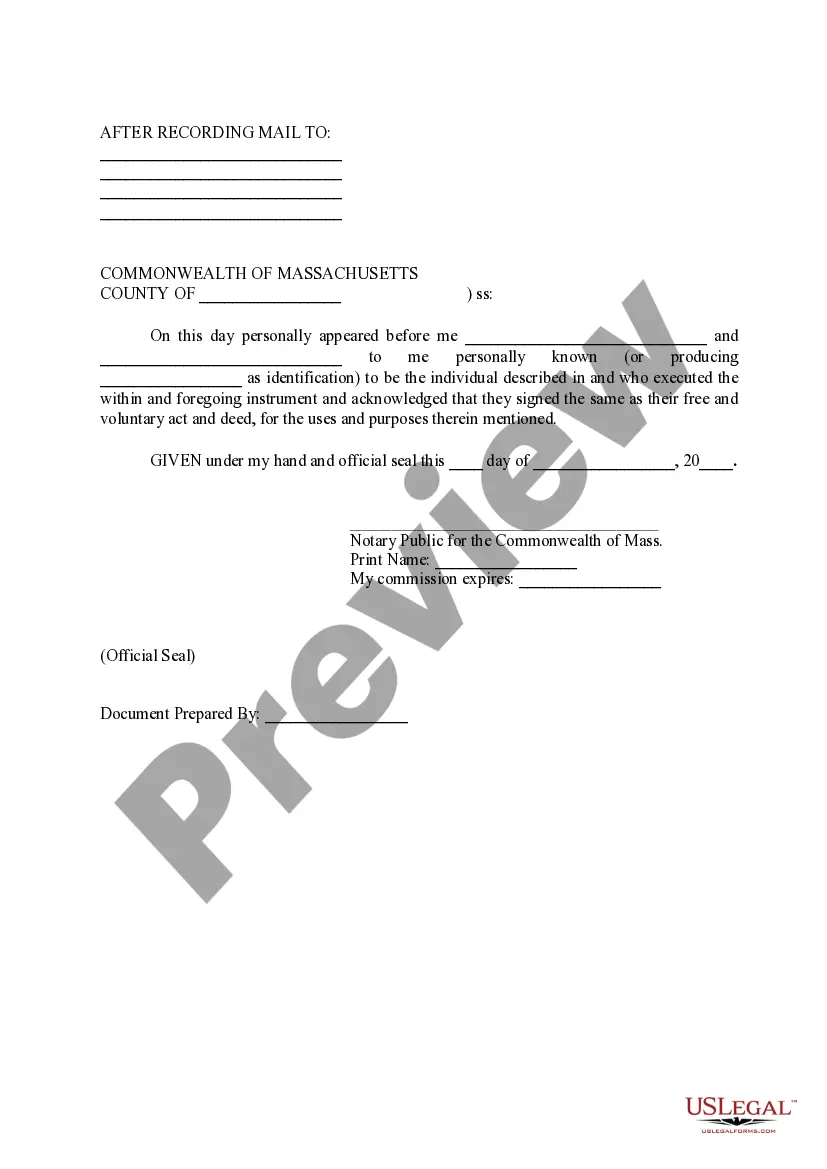

Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate) is a legal document that outlines the terms and conditions for a loan modification in the Middlesex County of Massachusetts. This agreement specifically focuses on loan modifications with a fixed interest rate. A loan modification is a process through which the terms of an existing loan are altered to make it more affordable for the borrower. In Middlesex County, Massachusetts, loan modifications with fixed interest rates provide borrowers with stability and predictable monthly payments. The Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate) includes key details such as the names of the parties involved, loan modification effective date, and the terms of the modified loan. These terms typically cover the new fixed interest rate, the duration of the fixed rate period, and any adjustments that may occur after the fixed rate period ends. This agreement also includes information on the loan modification process, including the necessary documentation, potential fees, and any deadlines that must be adhered to. It is crucial for both the borrower and the lender to carefully review and understand the agreement to ensure compliance with its terms. Different types of Middlesex Massachusetts Loan Modification Agreements can vary based on the specifics of the loan and the borrower's financial situation. While this particular description emphasizes loan modifications with fixed interest rates, it's worth noting that other types of loan modifications may also exist in Middlesex County, including those with adjustable interest rates or principal reductions. These different types of loan modifications are designed to address varying financial circumstances and assist borrowers in avoiding foreclosure. In conclusion, the Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate) is a legal document that outlines the terms and conditions for modifying a loan in Middlesex County, Massachusetts. It aims to provide borrowers with more favorable and affordable loan terms, primarily by establishing a fixed interest rate for a set period. It is essential for borrowers to understand the specifics of their loan modification agreement and consult with legal or financial professionals for guidance.

Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate)

Description

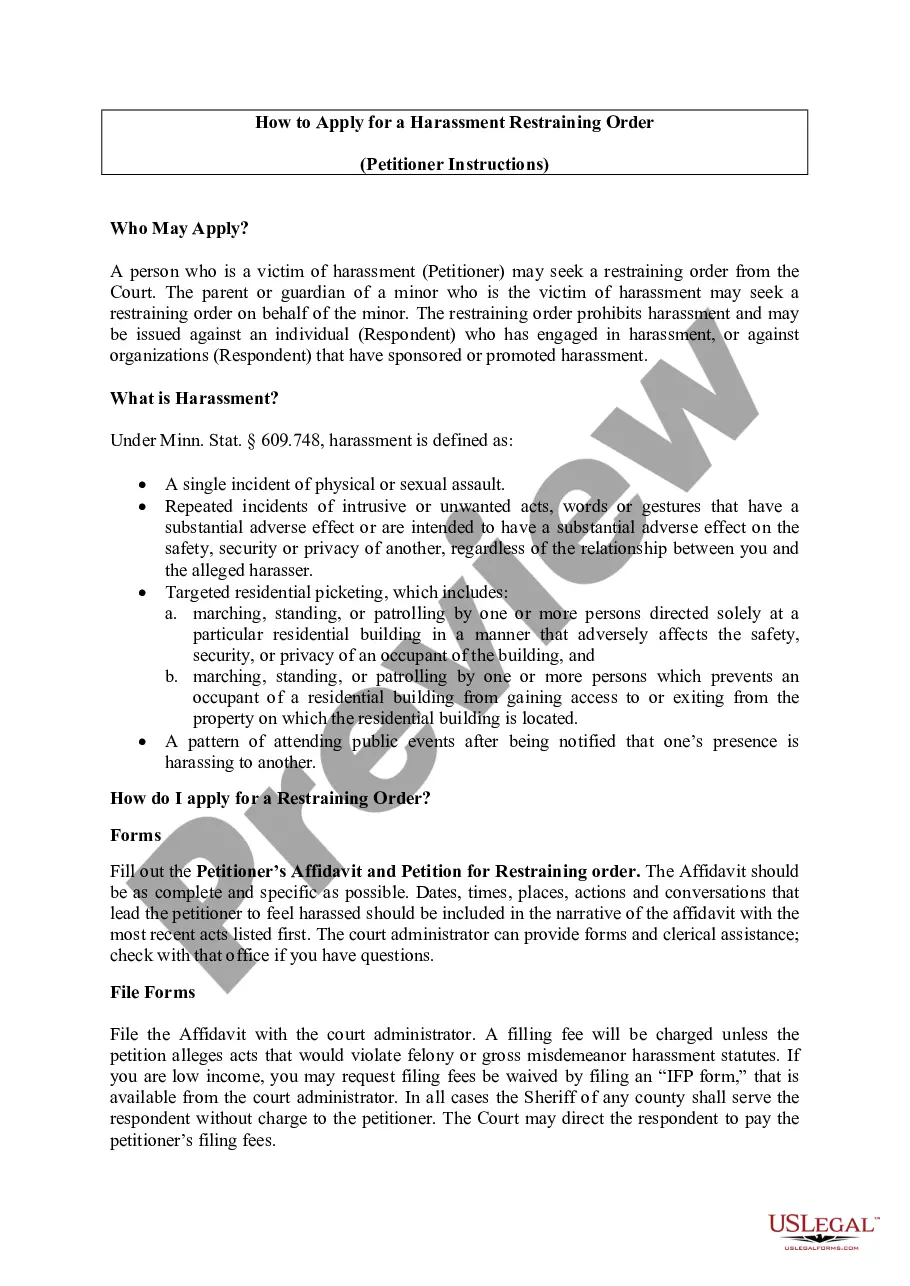

How to fill out Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate)?

If you’ve already utilized our service before, log in to your account and save the Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate) on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Middlesex Massachusetts Loan Modification Agreement (Fixed Interest Rate). Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!

Form popularity

FAQ

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

You do not pay closing costs when you modify your mortgage. A loan modification changes the underlying terms of your existing deed of trust. In almost all cases, it does not cost any money to receive a loan modification with your lender.

When you take a loan modification, you change the terms of your loan directly through your lender. Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

Unlike forbearance, mortgage loan modification is a permanent plan that changes the rate or terms of your loan.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

The modified internal rate of return (MIRR) assumes that positive cash flows are reinvested at the firm's cost of capital and that the initial outlays are financed at the firm's financing cost.

More info

B. Backs up your records with proof to the contrary, such as, the original signed Loan Modification Agreement, as well as your current loan documents. C. Provides you with a clear understanding of terms, such as, “All current payments become legally binding and become due immediately.” D. Provides you with specific terms if you wish to have your loan altered. E. You will have full legal rights, such as seeking out a lawyer and filing a claim as outlined by the law. F. Your original Loan Modification Agreement is not altered; the Loan Agreement is simply made legal. This should put all current claims about your loan being too high to settle to rest. G. Allows you to have your loans reviewed by a judge before settling. Any amount between five and ninety-nine thousand dollars may be allowed for legal settlement. H. Protects your rights and allows you to appeal any settlement. I. Protects all of your property by requiring all current loans to be paid back. J.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.