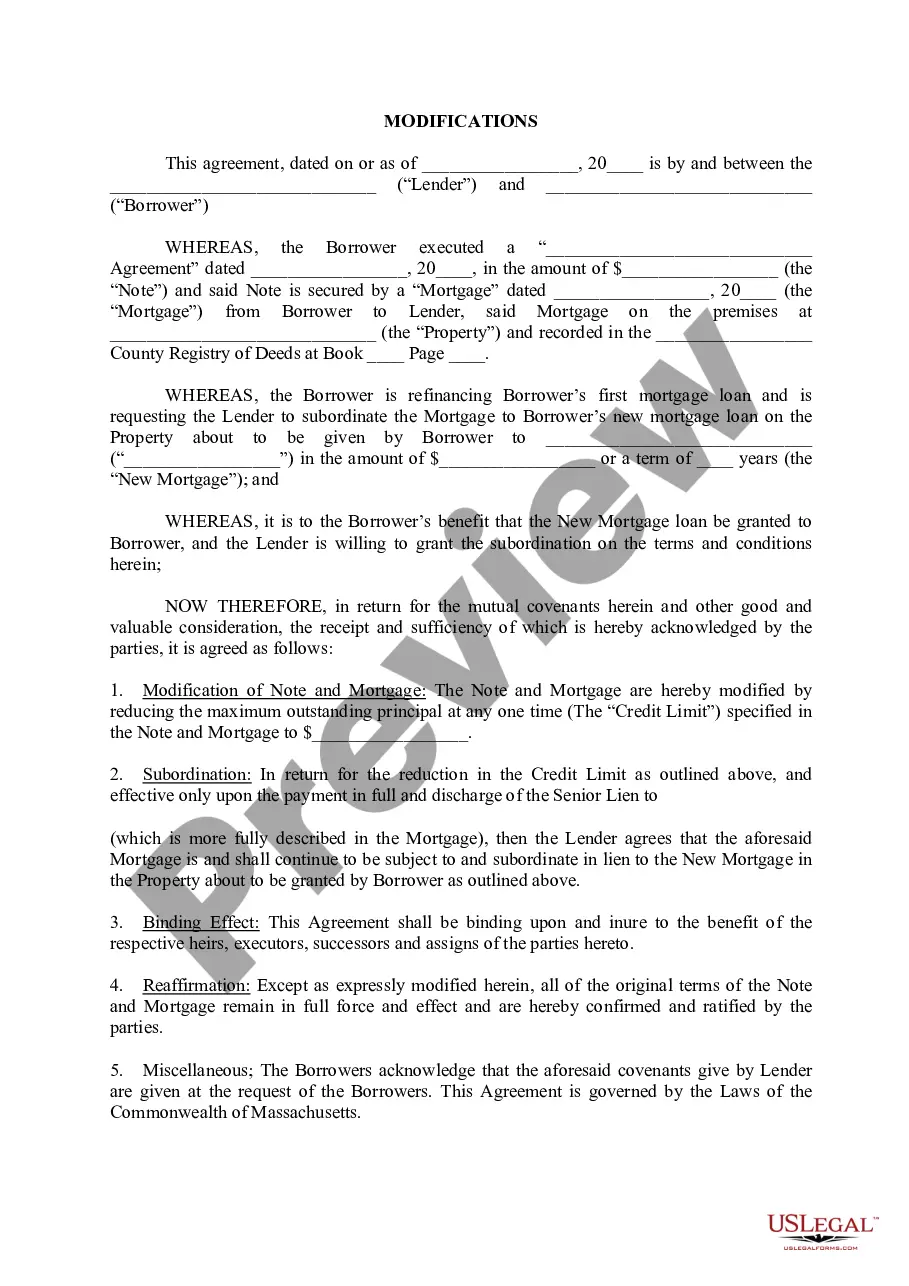

Cambridge Massachusetts Loan Modifications refer to the process of altering the terms and conditions of an existing loan agreement to provide relief and assistance to borrowers facing financial hardships in the Cambridge, Massachusetts area. These loan modifications are designed to help homeowners in Cambridge avoid foreclosure, reduce interest rates, extend loan terms, or change the loan type. Loan modifications in Cambridge, Massachusetts can be categorized into various types based on the specific changes made to the original loan agreement. These include: 1. Interest Rate Reduction: This type of loan modification involves lowering the interest rate charged on the mortgage loan. By reducing the interest rate, borrowers can achieve lower monthly payments, making it more affordable to continue repaying the loan. 2. Loan Term Extension: In this modification, the loan tenure is extended, allowing borrowers to spread the outstanding debt over a longer period. By doing so, the monthly payments are reduced, providing borrowers with additional breathing room in their budgets. 3. Principal Forbearance: A principal forbearance modification involves temporarily reducing or suspending a portion of the principal balance owed on the mortgage. This allows borrowers in Cambridge, Massachusetts, to focus on repaying a reduced amount of the loan, making it more manageable during financial difficulties. 4. Loan Type Conversion: This modification involves changing the loan type, such as converting an adjustable-rate loan to a fixed-rate loan. This type of modification offers stability and predictability to borrowers as they no longer have to worry about fluctuating interest rates. 5. Partial Claim: A partial claim modification assists homeowners in Cambridge by facilitating a one-time payment to bring their mortgage payments up-to-date if they have fallen behind. This option requires borrowers to meet specific criteria set by lenders or government programs. Cambridge Massachusetts Loan Modifications are a vital resource for homeowners struggling to meet their mortgage obligations during challenging financial circumstances. These modifications aim to provide sustainable solutions that prevent foreclosure and help borrowers regain control of their financial well-being.

Cambridge Massachusetts Loan Modifications

Description

How to fill out Cambridge Massachusetts Loan Modifications?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Cambridge Massachusetts Loan Modifications becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, obtaining the Cambridge Massachusetts Loan Modifications takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Cambridge Massachusetts Loan Modifications. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!