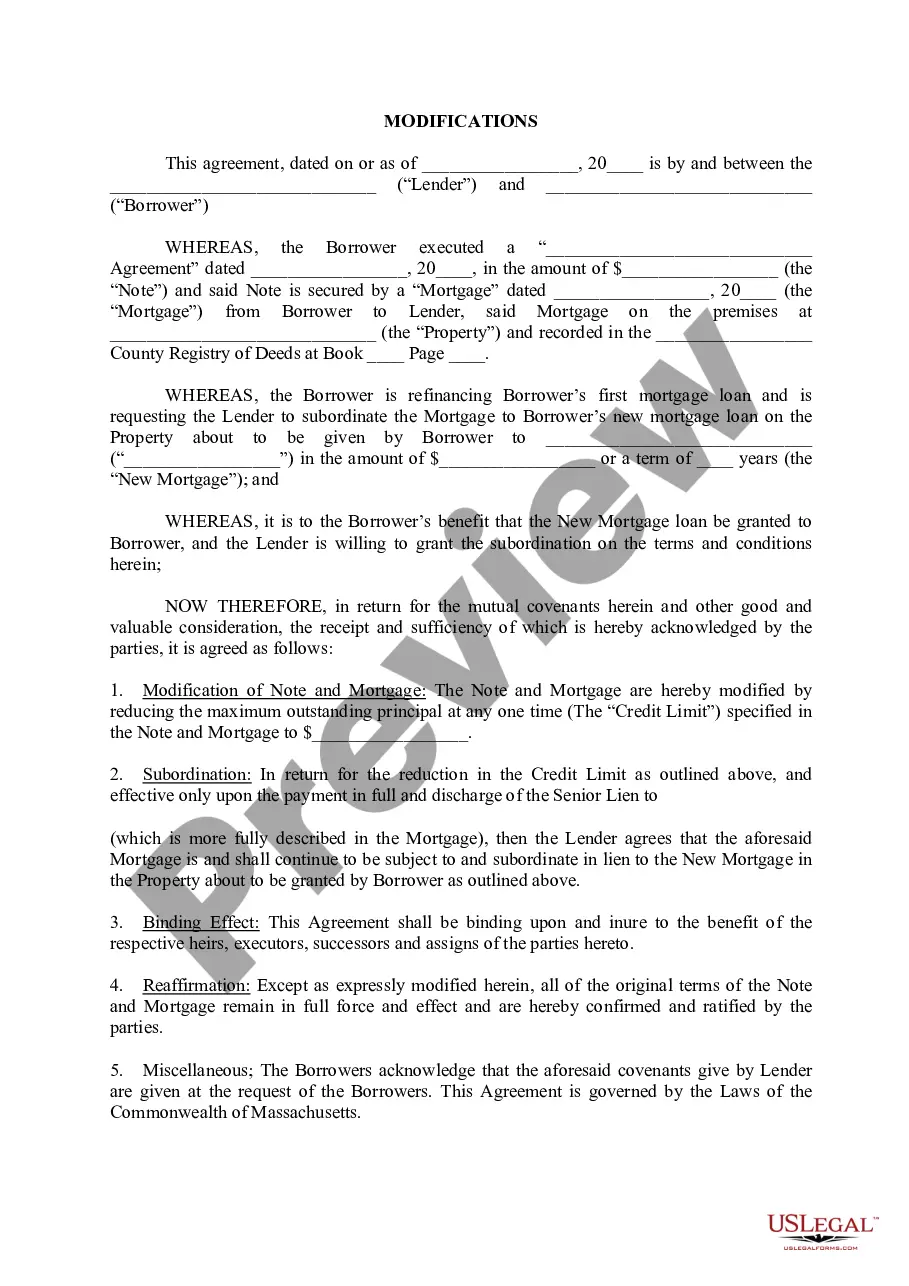

Lowell Massachusetts Loan Modifications: A Comprehensive Overview Loan modifications are a financial arrangement between lenders and borrowers that alter the terms and conditions of an existing loan to facilitate affordable mortgage payments. In Lowell, Massachusetts, loan modifications aim to assist homeowners in avoiding foreclosure and staying in their homes. By renegotiating the loan's interest rate, repayment period, or other terms, borrowers can obtain more manageable monthly payments, preventing potential financial burdens and potential housing insecurity. Understanding the key types of Lowell Massachusetts Loan Modifications: 1. Interest Rate Reduction: One of the most common types of loan modifications is an interest rate reduction. Lenders may agree to lower the interest rate on the loan, helping borrowers decrease their monthly repayments and overall debt burden. This reduction can be temporary or permanent, depending on the lender's policies and the borrower's financial situation. 2. Term Extension: Another available option for Lowell homeowners is a loan modification that extends the loan's repayment period. By lengthening the loan term, borrowers can spread out their payments over a more extended period, resulting in reduced monthly obligations. This modification proves beneficial when homeowners face temporary financial setbacks or need to improve their cash flow. 3. Principal Balance Reduction: In some cases, lenders may agree to reduce the principal balance of a loan, effectively lowering the overall amount owed. This type of modification requires substantial negotiation and documentation, considering its substantial impact on the lender's finances. Principal balance reduction can significantly alleviate the burden for borrowers struggling with significant mortgage debt. 4. Forbearance Agreement: A forbearance agreement allows borrowers to temporarily suspend or reduce their mortgage payments during a financial hardship. In Lowell, Massachusetts, if homeowners face a short-term financial crisis such as medical emergencies, job loss, or natural disasters, lenders may agree to a forbearance agreement, providing temporary relief until the borrower can resume the full payment amount. 5. Combination Modifications: In certain situations, borrowers might benefit from a combination of loan modifications tailored to meet their unique financial needs. For example, lenders may reduce both the interest rate and the principal balance or extend the loan term and offer a temporary forbearance agreement. These comprehensive approach solutions intend to ensure the long-term sustainability of the loan and homeownership for borrowers in Lowell. It is essential for borrowers in Lowell, Massachusetts, to engage in open communication with their lenders to explore available loan modification options. Seeking professional guidance from housing counselors, attorneys, or loan modification specialists can offer invaluable assistance throughout the process, ensuring the best possible outcome. By understanding the various types of loan modifications and effectively utilizing them, Lowell homeowners can overcome financial difficulties, avoid foreclosure, and secure their properties for the future.

Lowell Massachusetts Loan Modifications

Description

How to fill out Lowell Massachusetts Loan Modifications?

Benefit from the US Legal Forms and get instant access to any form you need. Our useful website with a huge number of documents makes it simple to find and get virtually any document sample you need. It is possible to export, complete, and certify the Lowell Massachusetts Loan Modifications in just a matter of minutes instead of browsing the web for many hours looking for the right template.

Using our collection is a superb strategy to improve the safety of your form filing. Our professional legal professionals on a regular basis review all the records to make sure that the forms are appropriate for a particular region and compliant with new acts and regulations.

How do you get the Lowell Massachusetts Loan Modifications? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can get all the previously saved files in the My Forms menu.

If you don’t have an account yet, stick to the tips below:

- Find the template you need. Make certain that it is the form you were looking for: examine its title and description, and make use of the Preview function when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the saving process. Click Buy Now and select the pricing plan you prefer. Then, create an account and pay for your order using a credit card or PayPal.

- Export the file. Select the format to obtain the Lowell Massachusetts Loan Modifications and modify and complete, or sign it for your needs.

US Legal Forms is one of the most extensive and reliable form libraries on the web. We are always happy to help you in any legal procedure, even if it is just downloading the Lowell Massachusetts Loan Modifications.

Feel free to benefit from our form catalog and make your document experience as convenient as possible!