The Boston Massachusetts Declaration of Homestead is a legal protection available to homeowners in the state of Massachusetts. Homestead protection allows homeowners to protect their property from certain debts, creditors, and legal judgments. The purpose of the Boston Massachusetts Declaration of Homestead is to safeguard a homeowner's primary residence and provide them with certain rights and exemptions. By filing a Declaration of Homestead with the appropriate registry of deeds, homeowners can protect their property up to a specified amount from attachment, levy, or sale to satisfy debts or obligations. There are two main types of Massachusetts Declaration of Homestead: the regular and the elderly or disabled. The regular Declaration of Homestead provides protection up to $500,000 in home equity. It is available to any homeowner in Massachusetts, regardless of age or disability status. This type of homestead protection shields the property from forced sale due to general unsecured debt, such as credit card debt or medical bills. On the other hand, the elderly or disabled Declaration of Homestead offers enhanced protection for homeowners who are 62 years old or older, or who are disabled. It provides protection of up to $1,000,000 in home equity. This type of homestead protection offers additional safeguards, such as protection from attachment, levy, or sale to satisfy debts arising from certain legal judgments. By filing a Declaration of Homestead, homeowners ensure that their primary residence is protected and exempt from creditors' actions to a certain extent. It is important to note that the protection only applies to the homeowner's primary residence and does not apply to other real estate or properties. Additionally, the homestead protection does not cover certain specific debts, such as mortgages, property taxes, or liens related to construction work or materials. Overall, the Boston Massachusetts Declaration of Homestead serves as a crucial legal tool for homeowners to safeguard their primary residence from various creditors and legal judgments. It provides peace of mind and financial security by allowing homeowners to maintain their homes even during challenging financial situations.

Massachusetts Release Of Homestead Form

Description

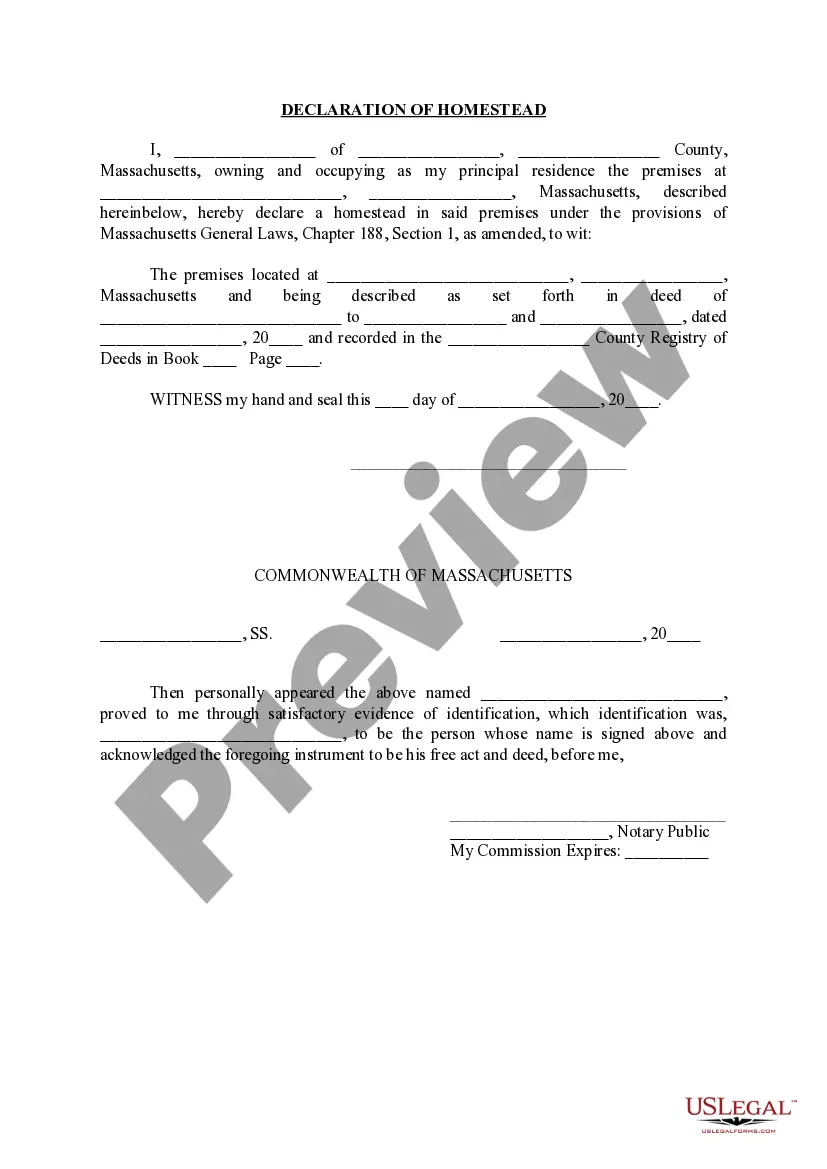

How to fill out Boston Massachusetts Declaration Of Homestead?

Benefit from the US Legal Forms and have instant access to any form template you require. Our helpful website with a huge number of document templates simplifies the way to find and obtain virtually any document sample you want. It is possible to save, fill, and certify the Boston Massachusetts Declaration of Homestead in a few minutes instead of surfing the Net for hours attempting to find the right template.

Utilizing our library is a superb way to increase the safety of your form submissions. Our experienced legal professionals regularly review all the documents to ensure that the templates are relevant for a particular region and compliant with new acts and regulations.

How do you obtain the Boston Massachusetts Declaration of Homestead? If you have a subscription, just log in to the account. The Download button will be enabled on all the samples you view. Moreover, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, stick to the tips listed below:

- Find the form you require. Ensure that it is the form you were hoping to find: examine its title and description, and utilize the Preview function if it is available. Otherwise, use the Search field to look for the needed one.

- Start the saving procedure. Select Buy Now and select the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Choose the format to obtain the Boston Massachusetts Declaration of Homestead and change and fill, or sign it for your needs.

US Legal Forms is probably the most significant and reliable form libraries on the internet. Our company is always happy to help you in any legal case, even if it is just downloading the Boston Massachusetts Declaration of Homestead.

Feel free to make the most of our service and make your document experience as convenient as possible!