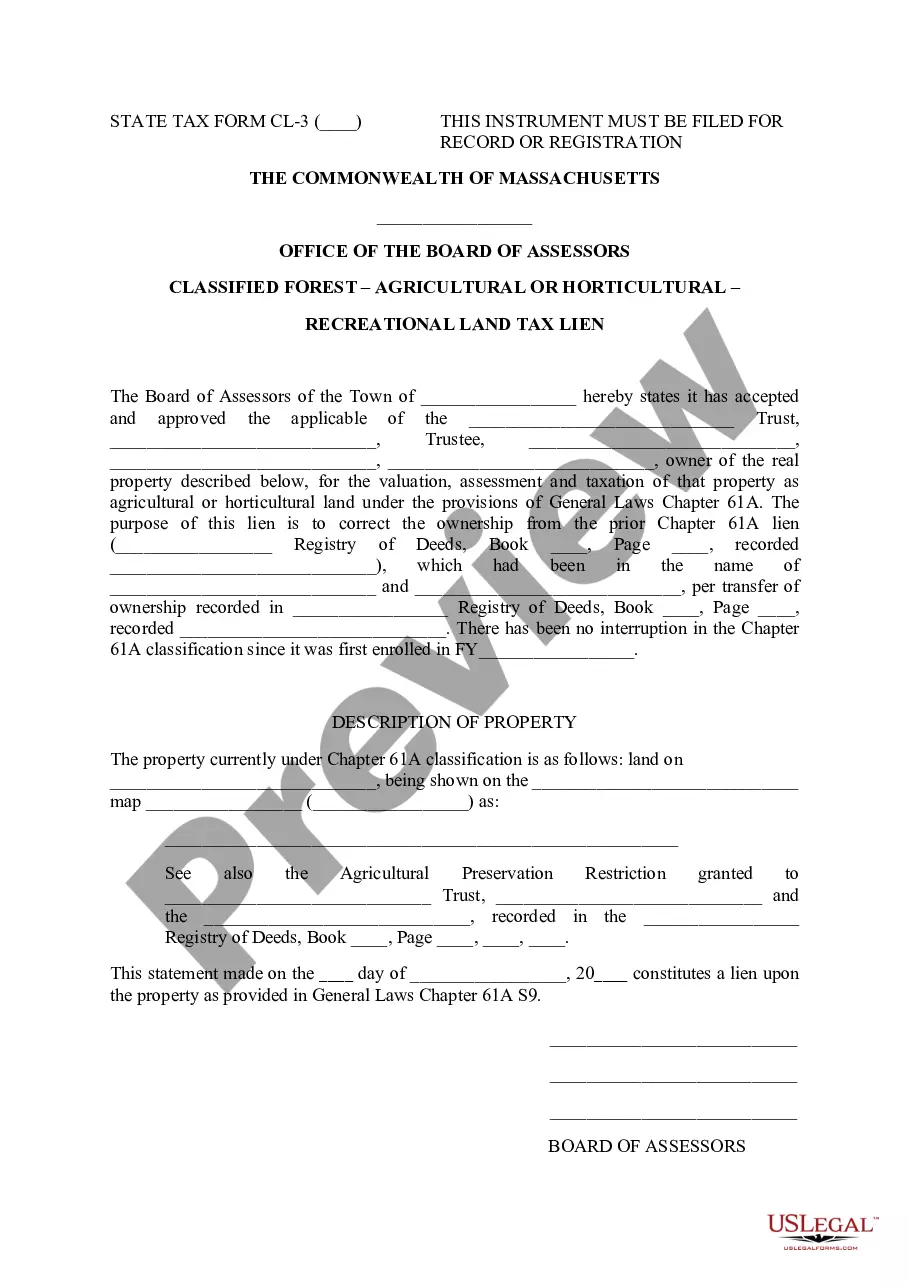

A Boston Massachusetts Recreational Land Tax Lien refers to a legal claim placed on a property that is in default of its taxes. It is specifically associated with recreational land within the city of Boston, Massachusetts. A tax lien is typically imposed by the local government when the property owner fails to pay their property taxes within a specified period. In the case of Boston, this lien specifically targets properties that are designated as recreational land, which may include parks, nature reserves, sporting complexes, or any other public recreational area. The purpose of a tax lien is to protect the interests of the government and ensure that property taxes are paid in a timely manner. By placing a lien on a property, the government gains a legal right to the property, allowing them to eventually sell it to recover the unpaid taxes. There are different types of tax liens that can be placed on recreational land in Boston, depending on the circumstances. These may include general tax liens, which are imposed on all properties with delinquent taxes, as well as specific tax liens that are tailored for recreational land specifically. The exact classification of the tax lien may vary depending on the nature and usage of the land. It is important to note that tax liens on recreational land can have serious consequences for property owners. They can hinder the property owner's ability to sell or transfer the land until the taxes are paid off, and in extreme cases, may result in foreclosure and the loss of the property. Therefore, it is crucial for property owners to stay updated on their tax obligations and promptly pay their property taxes to avoid the imposition of a tax lien on their recreational land in Boston, Massachusetts.

Boston Massachusetts Recreational Land Tax Lien

Description

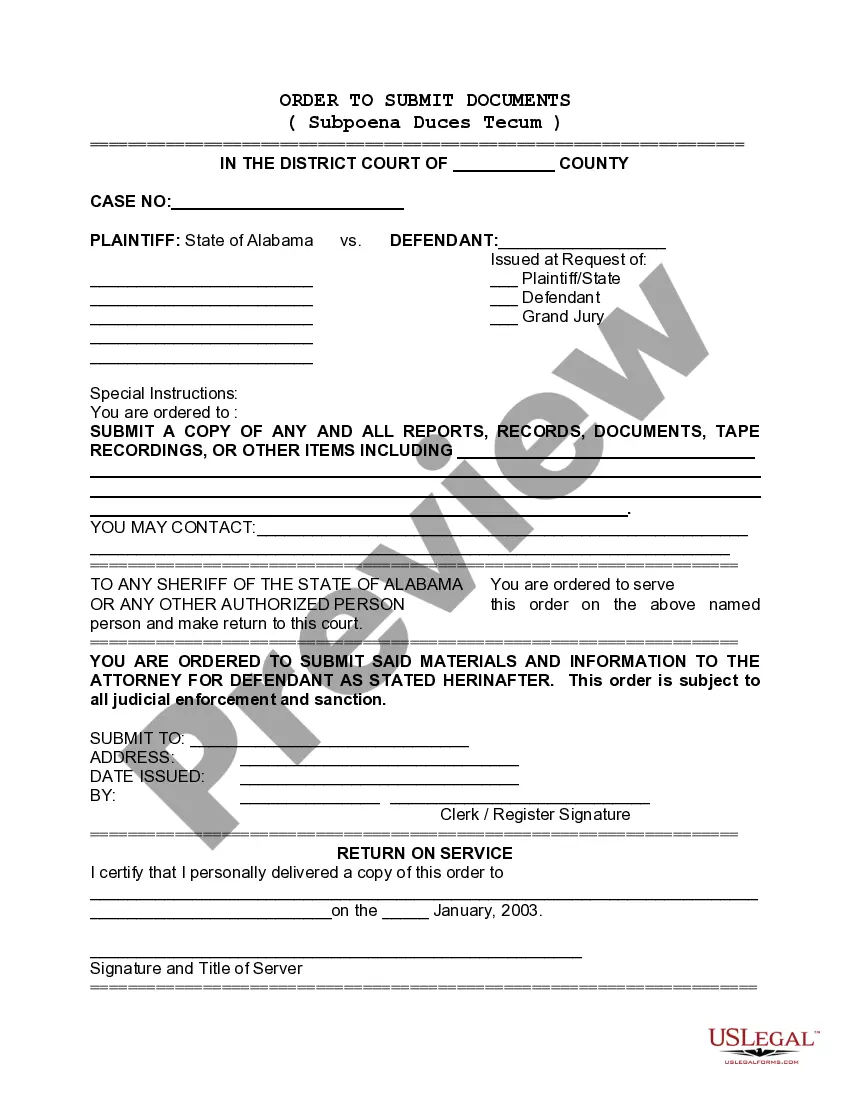

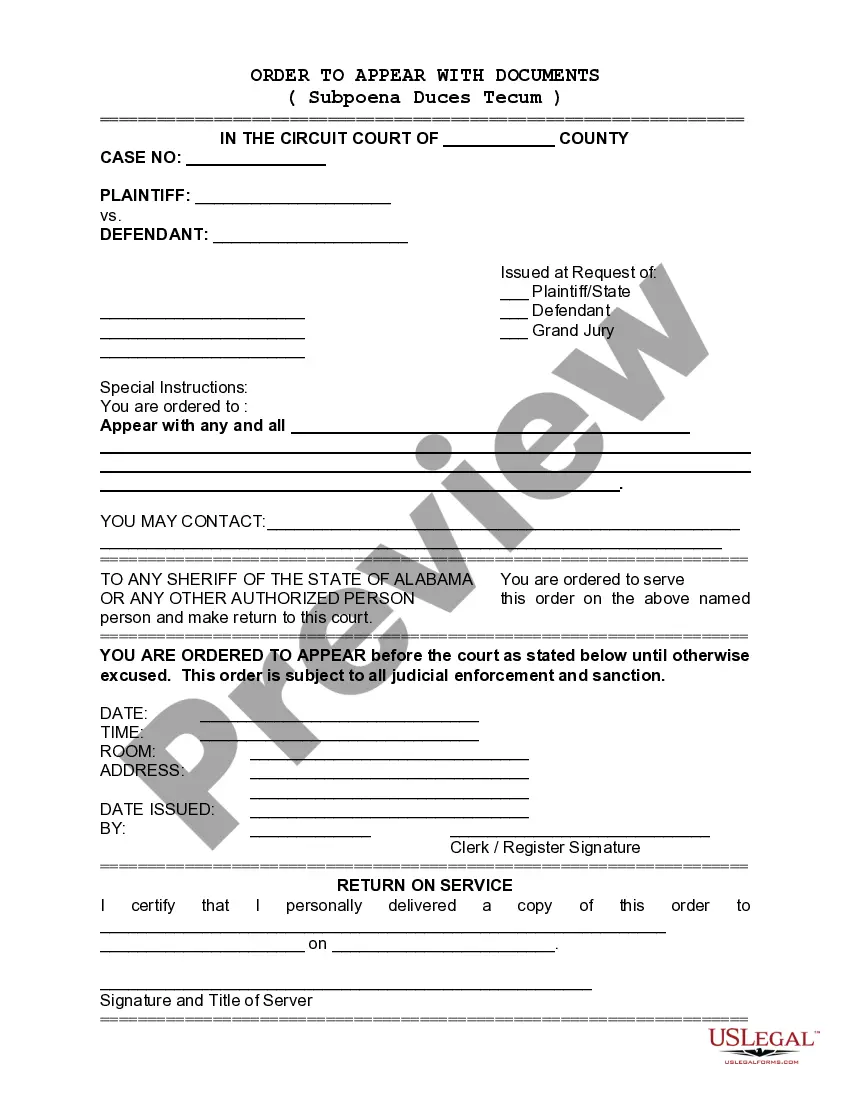

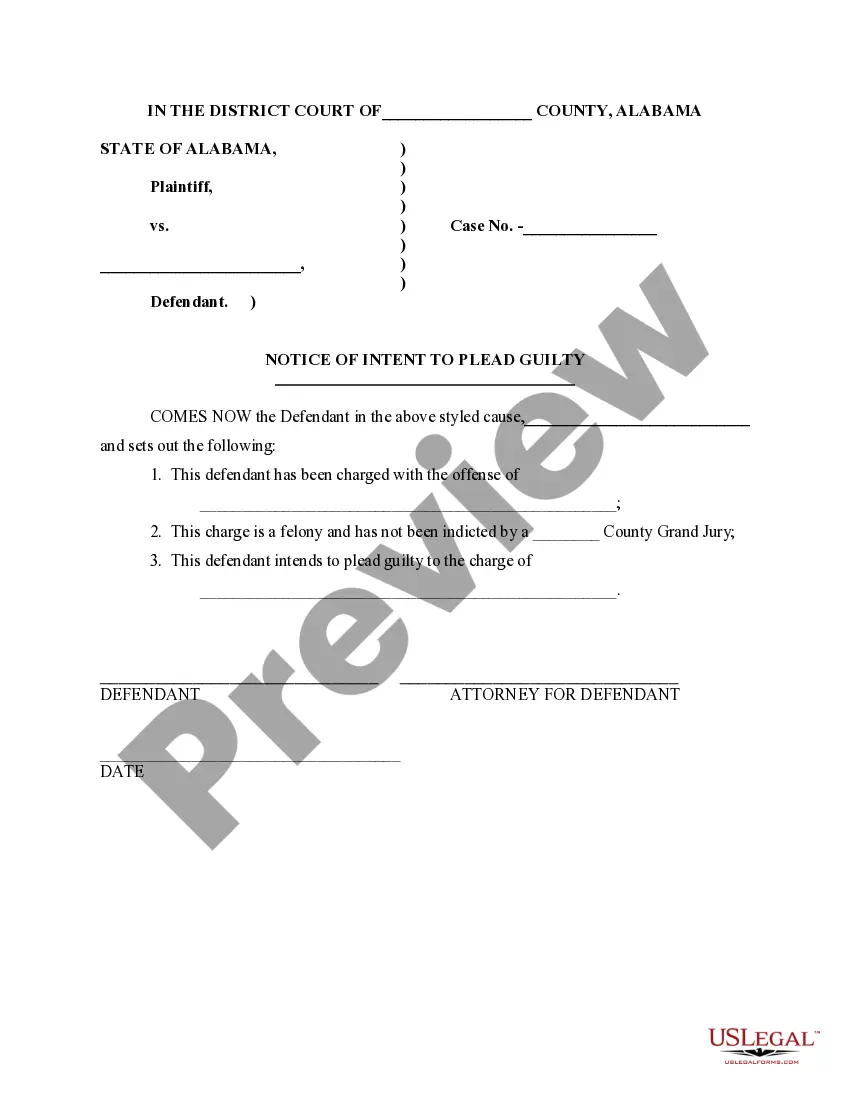

How to fill out Boston Massachusetts Recreational Land Tax Lien?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person without any law background to create this sort of papers cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes to the rescue. Our service provides a huge collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you need the Boston Massachusetts Recreational Land Tax Lien or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Boston Massachusetts Recreational Land Tax Lien quickly using our trusted service. If you are presently an existing customer, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps before downloading the Boston Massachusetts Recreational Land Tax Lien:

- Ensure the template you have chosen is suitable for your area because the regulations of one state or county do not work for another state or county.

- Review the document and read a quick outline (if provided) of cases the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start again and search for the suitable document.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Boston Massachusetts Recreational Land Tax Lien once the payment is completed.

You’re good to go! Now you can go on and print out the document or fill it out online. If you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.