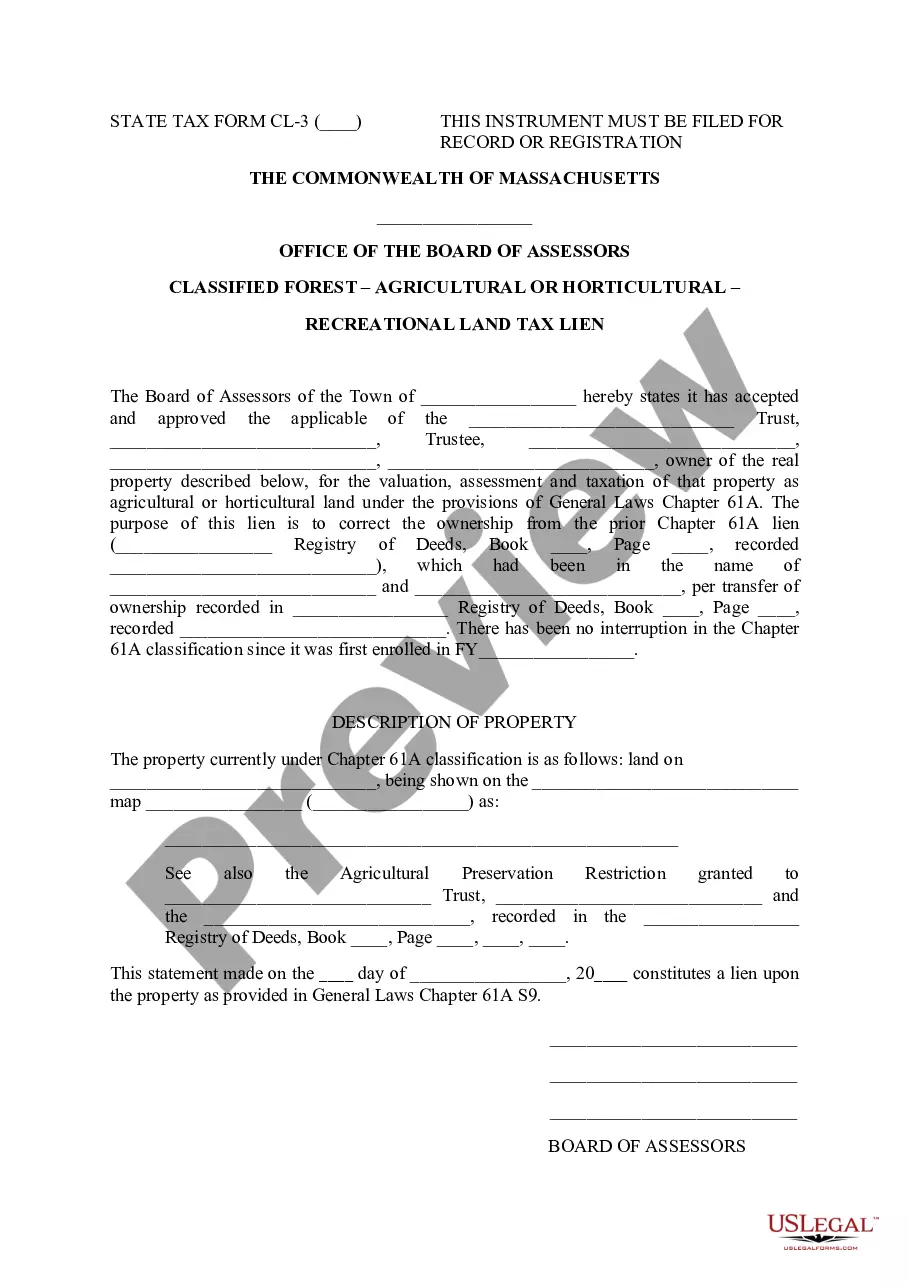

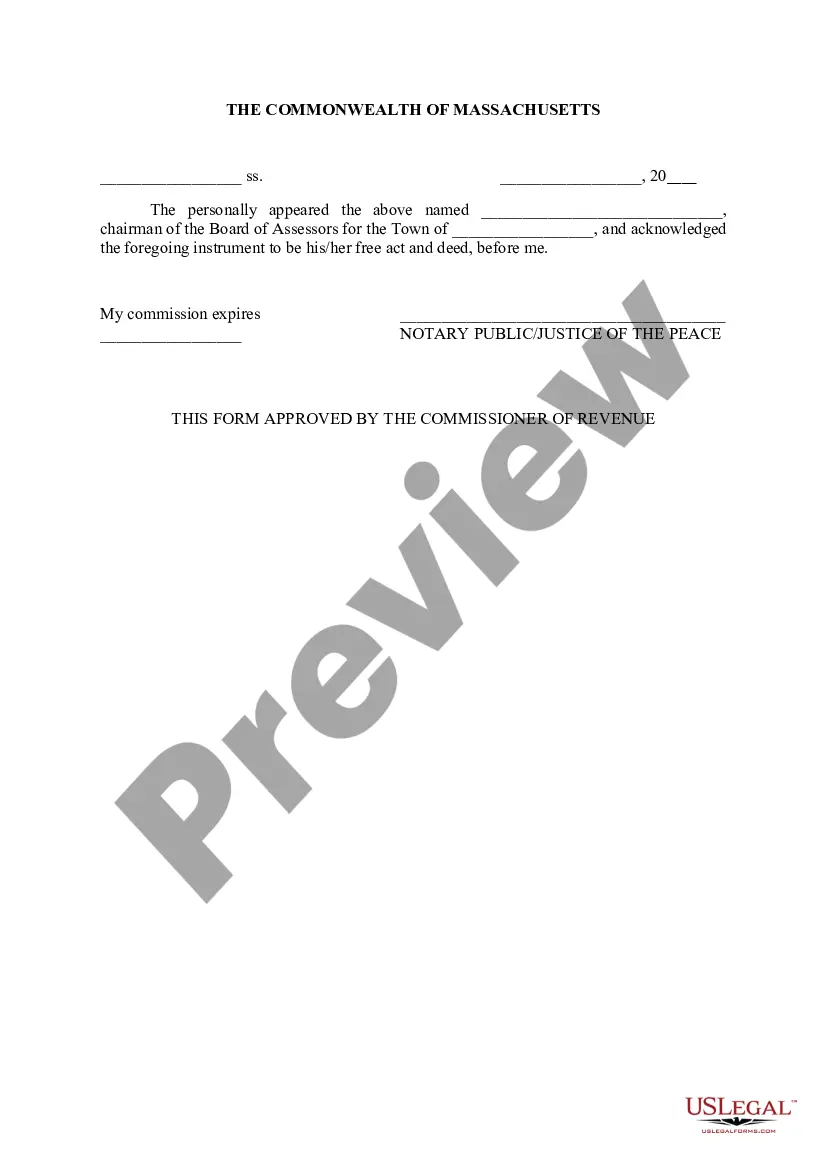

Cambridge Massachusetts Recreational Land Tax Lien: A Comprehensive Overview Introduction: Cambridge, Massachusetts, renowned for its prestigious universities and cultural diversity, is a city that embraces recreational land development while diligently maintaining its tax system. To ensure the proper redistribution of tax revenue, the city imposes liens on recreational land properties with delinquent taxes. This article aims to provide a detailed description of Cambridge Massachusetts Recreational Land Tax Lien, including its purpose, process, and potential implications. Keywords: Cambridge, Massachusetts, recreational land, tax lien, delinquent taxes, tax revenue, purpose, process, implications. 1. Purpose of Cambridge Massachusetts Recreational Land Tax Lien: The primary objective of the Cambridge Massachusetts Recreational Land Tax Lien is to encourage timely tax payments by landowners while funding essential city services and recreational projects. By imposing a tax lien on delinquent recreational properties, the city ensures consistent revenue generation and maintains the overall integrity of its tax system. Keywords: objective, tax payments, landowners, city services, recreational projects, revenue generation, tax system. 2. Process of Cambridge Massachusetts Recreational Land Tax Lien: When a landowner fails to pay property taxes on their recreational land in Cambridge, the city initiates a tax lien process. This involves filing a notice of tax lien with the county, signaling the property's delinquency status. The tax lien is then publicly recorded and serves as a legal claim against the property. This step effectively alerts potential investors or interested parties about the property's tax delinquency. Keywords: property taxes, tax lien process, filing, notice, delinquency status, recorded, legal claim, investors, interested parties. 3. Implications of Cambridge Massachusetts Recreational Land Tax Lien: Once a recreational property is subjected to a tax lien in Cambridge, certain implications follow. Firstly, the property may become ineligible for mortgage refinancing or securing new loans until the outstanding tax debt is resolved. Additionally, the tax lien can lead to the eventual public auction of the property to recover the unpaid taxes. In extreme cases, if the owner fails to redeem the property within a specified period, the lien holder may acquire ownership rights. Keywords: implications, ineligible, mortgage refinancing, loans, unpaid taxes, public auction, redeem, ownership rights. Types of Cambridge Massachusetts Recreational Land Tax Liens: 1. Standard Tax Liens: A standard tax lien is initiated when the property owner fails to pay the required taxes within the specified timeframe. This lien, placed on recreational land, ensures the city's tax revenue collection is not compromised. Keywords: standard tax liens, required taxes, specified timeframe, tax revenue. 2. Secondary Tax Liens: Under certain circumstances, the city may impose secondary tax liens on recreational land properties that are already subjected to a primary tax lien. Secondary tax liens act as additional safeguards, securing the city's interests and ensuring the collection of outstanding tax debt. Keywords: secondary tax liens, additional safeguards, primary tax lien, outstanding tax debt, city's interests. Conclusion: The implementation of the Cambridge Massachusetts Recreational Land Tax Lien reflects the city's commitment to maintaining a fair and efficient tax system. By imposing tax liens on delinquent recreational properties, the city aims to secure its tax revenue while encouraging landowners to fulfill their tax obligations promptly. Understanding the purpose, process, and implications of these tax liens is crucial for both property owners and potential investors in Cambridge, Massachusetts. Keywords: fair, efficient tax system, tax liens, delinquent properties, secure tax revenue, tax obligations, property owners, potential investors.

Cambridge Massachusetts Recreational Land Tax Lien

Description

How to fill out Cambridge Massachusetts Recreational Land Tax Lien?

Benefit from the US Legal Forms and get instant access to any form template you need. Our beneficial website with thousands of document templates makes it simple to find and get virtually any document sample you need. You can save, fill, and certify the Cambridge Massachusetts Recreational Land Tax Lien in a matter of minutes instead of surfing the Net for several hours looking for the right template.

Using our collection is a great strategy to improve the safety of your form filing. Our professional lawyers regularly check all the documents to ensure that the templates are relevant for a particular region and compliant with new laws and polices.

How can you obtain the Cambridge Massachusetts Recreational Land Tax Lien? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, follow the instructions below:

- Open the page with the form you require. Make certain that it is the form you were seeking: examine its name and description, and take take advantage of the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Launch the downloading process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Save the file. Pick the format to get the Cambridge Massachusetts Recreational Land Tax Lien and change and fill, or sign it according to your requirements.

US Legal Forms is among the most considerable and trustworthy document libraries on the internet. Our company is always ready to help you in any legal case, even if it is just downloading the Cambridge Massachusetts Recreational Land Tax Lien.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!