Lowell Massachusetts Recreational Land Tax Liens are legal claims placed against property owners who have unpaid recreational land taxes in the city of Lowell, Massachusetts. These liens are filed by the local government or taxing authorities to recover the overdue taxes and ensure that the property owners fulfill their tax obligations. Recreational land tax liens in Lowell Massachusetts are specifically imposed on properties intended for recreational use, such as parks, playgrounds, sports facilities, and other outdoor recreational areas. These properties are often owned by the city or the state government and are maintained for public enjoyment and leisure activities. When property owners fail to pay their recreational land taxes, the local government may initiate a tax lien on the property, creating a legal claim against it. The tax lien gives the government the right to seize and sell the property if the taxes remain unpaid for an extended period of time. There are different types of Lowell Massachusetts Recreational Land Tax Liens, including: 1. General Tax Liens: These liens are placed on properties with unpaid recreational land taxes. Once a general tax lien is filed, the property owner must either pay the outstanding taxes or risk losing their property through a tax foreclosure sale. 2. Subordinate Tax Liens: Subordinate tax liens are secondary liens that are filed against the property, typically when the property already has an existing tax lien or mortgage. These liens hold a lower priority compared to general tax liens and are paid off after the higher-priority liens when the property is sold. 3. Redemption Liens: When a property owner fails to pay their recreational land taxes within a specific period, the government may issue a redemption lien. These liens give the property owner an additional limited time to pay the taxes and redeem their property before it is sold at a tax foreclosure auction. 4. Tax Deed Sales: If the recreational land taxes remain unpaid even after the issuance of a tax lien, the government may proceed with a tax deed sale. The property is auctioned off, and the proceeds are used to cover the outstanding taxes, penalties, and associated expenses. The highest bidder receives ownership of the property. It is important for property owners in Lowell, Massachusetts to stay updated on their recreational land tax obligations to avoid the potential consequences of tax liens. Paying taxes on time helps ensure the maintenance and availability of recreational areas for public benefit while also avoiding the risk of losing valuable property.

Lowell Massachusetts Recreational Land Tax Lien

Category:

State:

Massachusetts

City:

Lowell

Control #:

MA-LR0105

Format:

Word;

Rich Text

Instant download

Description

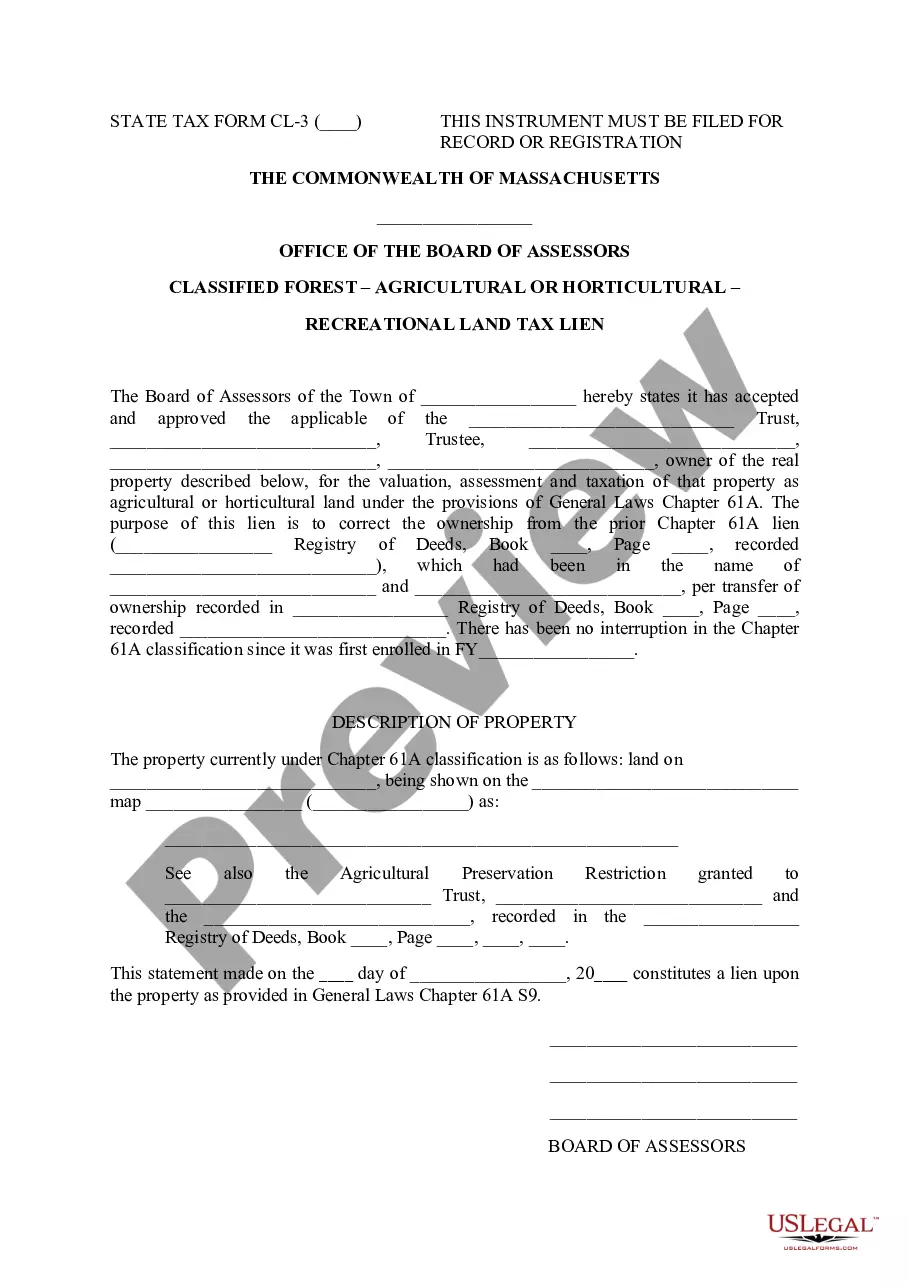

This form is an agreement where the Board of Assessors of a Town accepts and approves the Owner's valuation, assessment and taxation of the property as agricultural or horticultural land. The purpose of this lien is to correct the ownership from a prior lien in the Registry of Deeds.

Lowell Massachusetts Recreational Land Tax Liens are legal claims placed against property owners who have unpaid recreational land taxes in the city of Lowell, Massachusetts. These liens are filed by the local government or taxing authorities to recover the overdue taxes and ensure that the property owners fulfill their tax obligations. Recreational land tax liens in Lowell Massachusetts are specifically imposed on properties intended for recreational use, such as parks, playgrounds, sports facilities, and other outdoor recreational areas. These properties are often owned by the city or the state government and are maintained for public enjoyment and leisure activities. When property owners fail to pay their recreational land taxes, the local government may initiate a tax lien on the property, creating a legal claim against it. The tax lien gives the government the right to seize and sell the property if the taxes remain unpaid for an extended period of time. There are different types of Lowell Massachusetts Recreational Land Tax Liens, including: 1. General Tax Liens: These liens are placed on properties with unpaid recreational land taxes. Once a general tax lien is filed, the property owner must either pay the outstanding taxes or risk losing their property through a tax foreclosure sale. 2. Subordinate Tax Liens: Subordinate tax liens are secondary liens that are filed against the property, typically when the property already has an existing tax lien or mortgage. These liens hold a lower priority compared to general tax liens and are paid off after the higher-priority liens when the property is sold. 3. Redemption Liens: When a property owner fails to pay their recreational land taxes within a specific period, the government may issue a redemption lien. These liens give the property owner an additional limited time to pay the taxes and redeem their property before it is sold at a tax foreclosure auction. 4. Tax Deed Sales: If the recreational land taxes remain unpaid even after the issuance of a tax lien, the government may proceed with a tax deed sale. The property is auctioned off, and the proceeds are used to cover the outstanding taxes, penalties, and associated expenses. The highest bidder receives ownership of the property. It is important for property owners in Lowell, Massachusetts to stay updated on their recreational land tax obligations to avoid the potential consequences of tax liens. Paying taxes on time helps ensure the maintenance and availability of recreational areas for public benefit while also avoiding the risk of losing valuable property.

Free preview

How to fill out Lowell Massachusetts Recreational Land Tax Lien?

If you’ve already used our service before, log in to your account and download the Lowell Massachusetts Recreational Land Tax Lien on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Lowell Massachusetts Recreational Land Tax Lien. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!