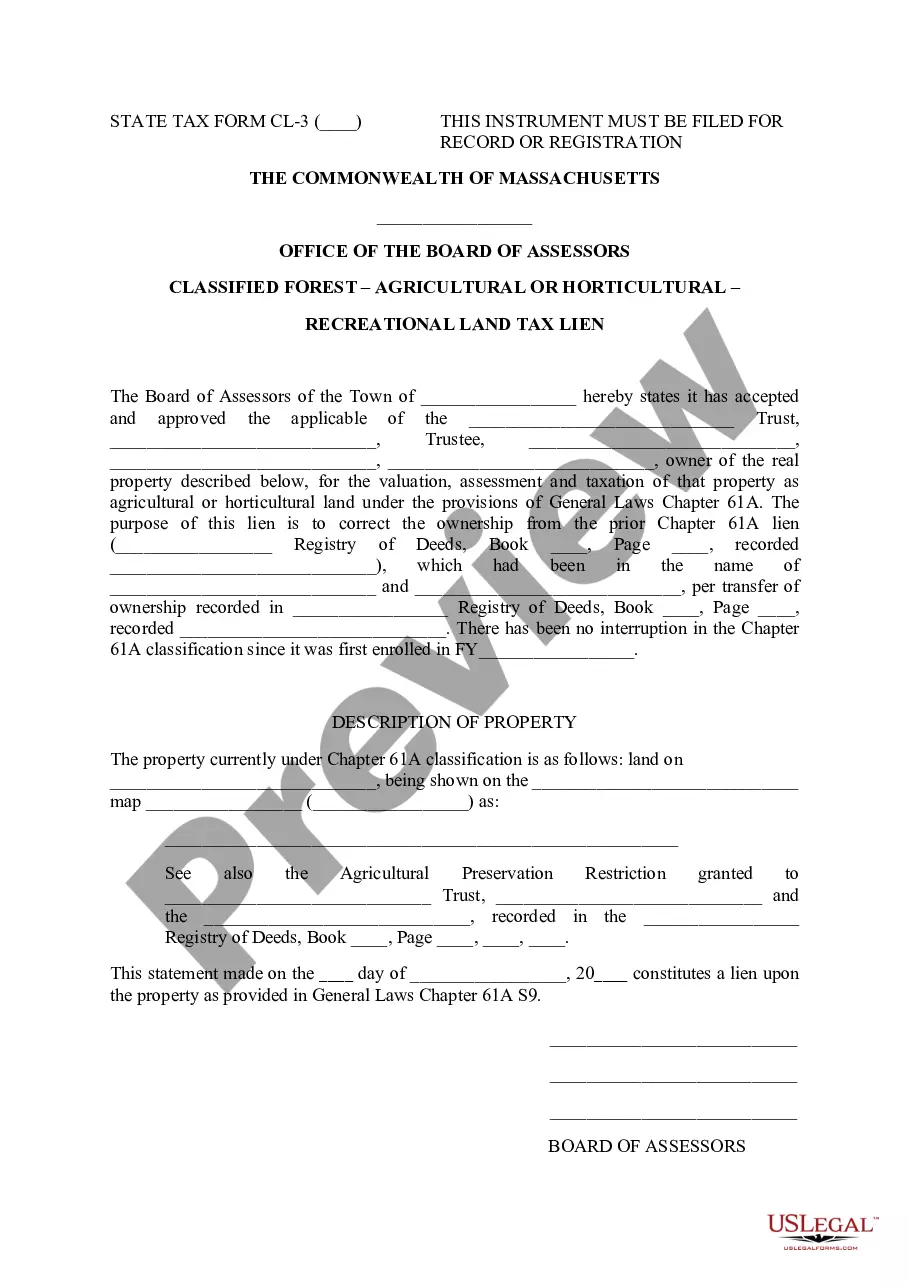

Middlesex Massachusetts Recreational Land Tax Lien is a legal mechanism used to secure unpaid taxes on recreational land located in Middlesex County, Massachusetts. It is important to understand the various aspects of this tax lien and how it can affect property owners. A Middlesex Massachusetts Recreational Land Tax Lien, also known as a recreational property tax lien, refers to the legal claim placed on recreational land by the county government or municipality when the property owner fails to pay their property taxes. This lien serves as a guarantee that the delinquent taxes will be paid, either through the property owner's payment or the sale of the property. The Middlesex Massachusetts Recreational Land Tax Lien typically includes the unpaid amount of property taxes, accumulated interest, and any penalties imposed by the municipality or county. The lien becomes attached to the property's title, giving the government the right to foreclose and sell the land if the taxes remain unpaid for an extended period. There are two main types of Middlesex Massachusetts Recreational Land Tax Liens: 1. Traditional Tax Lien: This type of lien occurs when a property owner fails to pay their property taxes for a specific period. The county government or municipality places a lien on the recreational land, allowing them to recover the unpaid taxes through a tax sale auction if the owner doesn't settle the debt within a designated redemption period. 2. Tax Deed Sale or Tax Foreclosure: If the property owner does not redeem the unpaid taxes within the redemption period, the Middlesex Massachusetts Recreational Land Tax Lien may result in a tax deed sale. In this scenario, the county government or municipality auctions off the property to recover the outstanding taxes. The highest bidder at the auction becomes the new owner of the recreational land while assuming the responsibility for any remaining liens or encumbrances. It is important for property owners to understand the implications of a Middlesex Massachusetts Recreational Land Tax Lien. Failure to address unpaid taxes promptly can result in legal actions, foreclosure, and potential loss of property. Property owners should keep track of their tax obligations, promptly address any delinquencies, and seek professional advice to navigate the complexities of tax liens.

Middlesex Massachusetts Recreational Land Tax Lien

Description

How to fill out Middlesex Massachusetts Recreational Land Tax Lien?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Middlesex Massachusetts Recreational Land Tax Lien or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Middlesex Massachusetts Recreational Land Tax Lien adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Middlesex Massachusetts Recreational Land Tax Lien is proper for your case, you can pick the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!