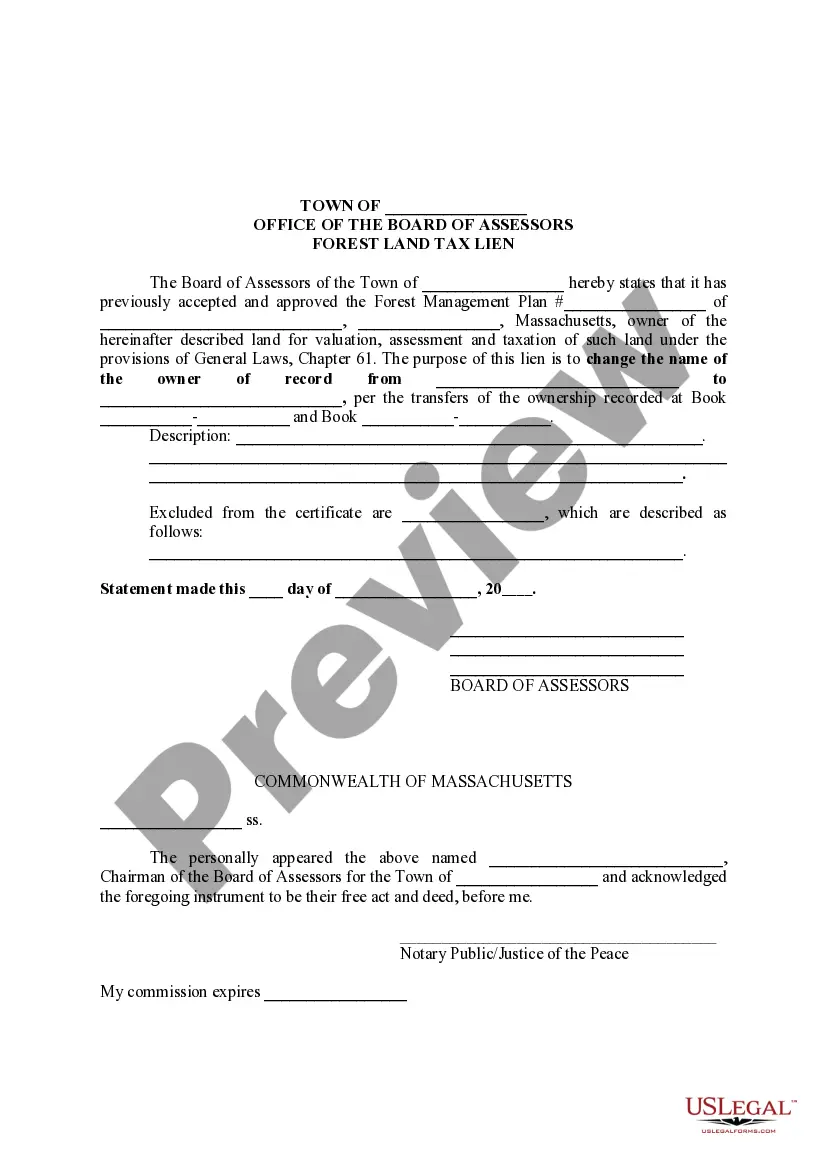

A Boston Massachusetts Forest Land Tax Lien refers to a legal claim against a property owner's forest land due to unpaid taxes. When a property owner fails to pay their property taxes, the government may place a tax lien on the property, which can ultimately lead to a foreclosure if the taxes remain unpaid. The Forest Land Tax Lien specifically applies to forested areas in Boston, Massachusetts. These may include private forests, woodlands, or other forested parcels of land located within the city limits. The purpose of this lien is to ensure that property owners fulfill their obligation to pay the required property taxes for their forested land. There are different types of Forest Land Tax Liens that can be imposed in Boston, Massachusetts. These liens may differ based on the jurisdiction, regulations, and specific circumstances of the forest land. Some possible types of Forest Land Tax Liens in Boston, Massachusetts could include: 1. General Forest Land Tax Lien: This is the standard type of tax lien imposed on forested properties in Boston, Massachusetts when the property owner fails to pay their property taxes. It acts as a first priority claim on the property. 2. Redemption Period: The state may establish a redemption period during which the property owner has the opportunity to pay off the tax debt and remove the lien from their forest land. The length of this redemption period varies depending on the local legislation and may differ from case to case. 3. Auction or Foreclosure: If the property owner fails to pay the outstanding taxes within the redemption period, the forest land may be subjected to an auction or foreclosure sale. This allows the government to recoup the unpaid taxes by selling the property to the highest bidder. The proceeds from the sale are used to satisfy the tax debt. It is essential for property owners with forested land in Boston, Massachusetts to ensure they stay up to date with their property tax payments to avoid the imposition of a Forest Land Tax Lien. Failing to pay property taxes can result in significant financial consequences, including the loss of ownership of the forest land through foreclosure or auction. Being aware of the specific regulations and deadlines regarding forest land tax liens is crucial to protect one's property rights and maintain their ownership of forested land in Boston, Massachusetts.

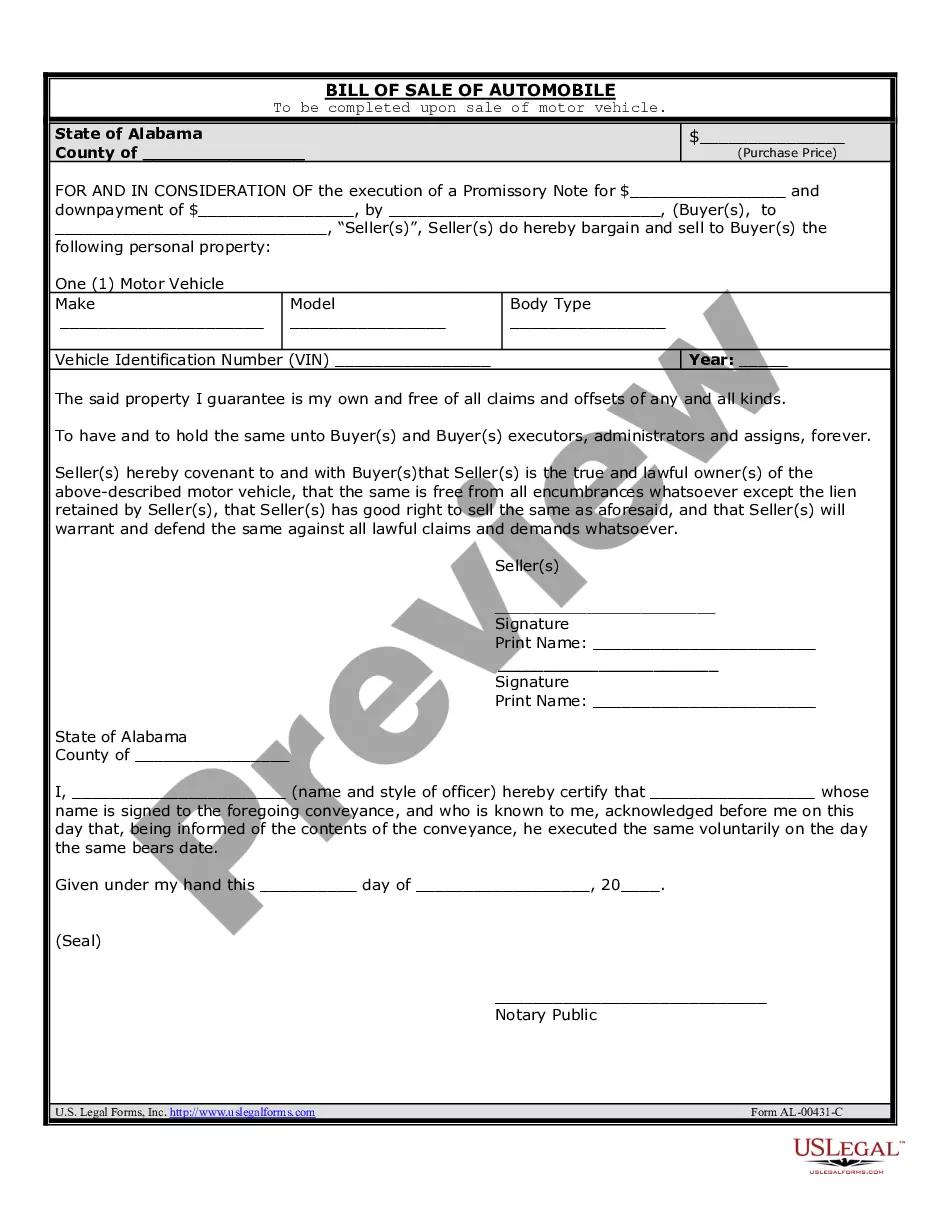

Boston Massachusetts Forest Land Tax Lien

Description

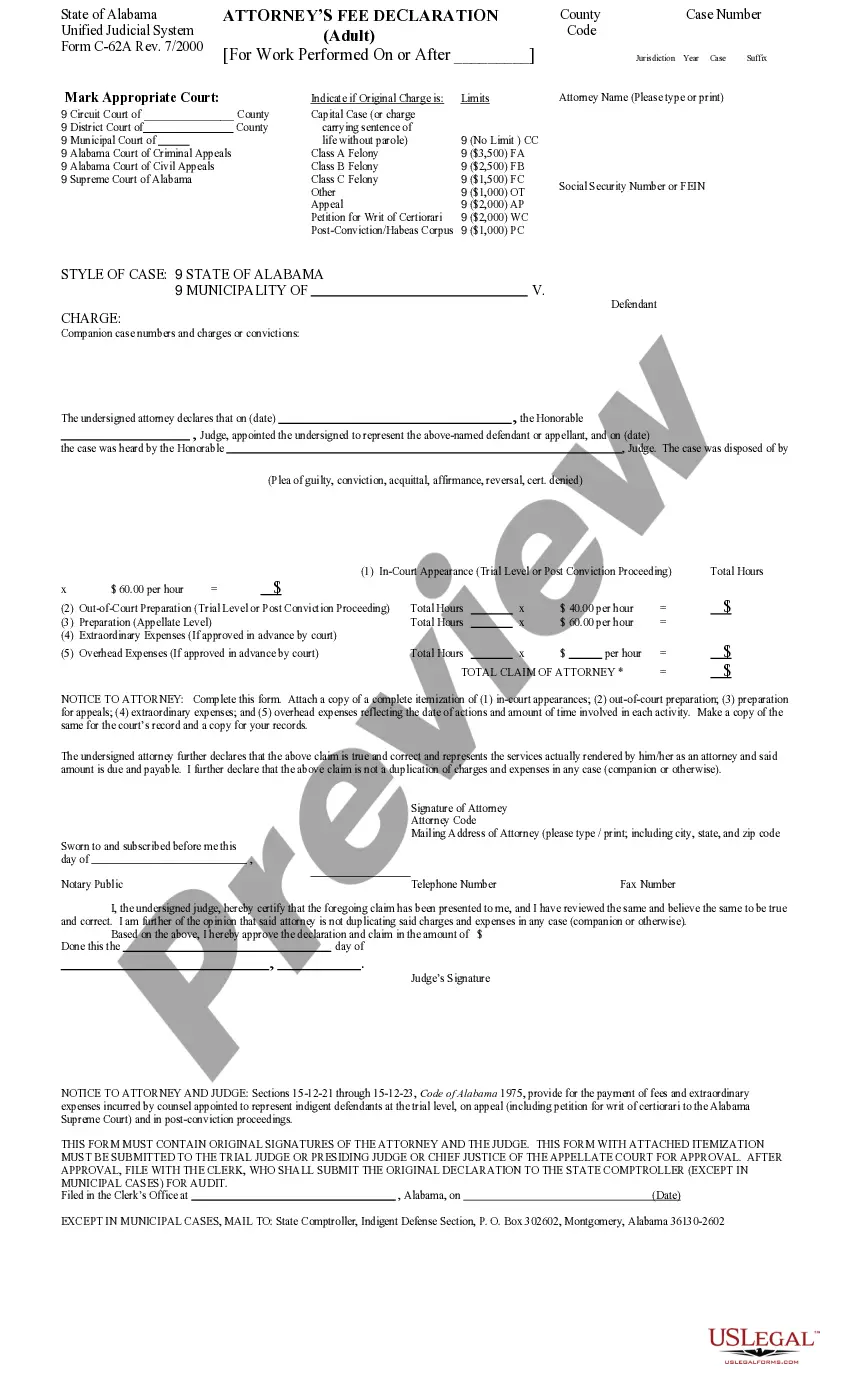

How to fill out Boston Massachusetts Forest Land Tax Lien?

Do you need a trustworthy and inexpensive legal forms provider to get the Boston Massachusetts Forest Land Tax Lien? US Legal Forms is your go-to solution.

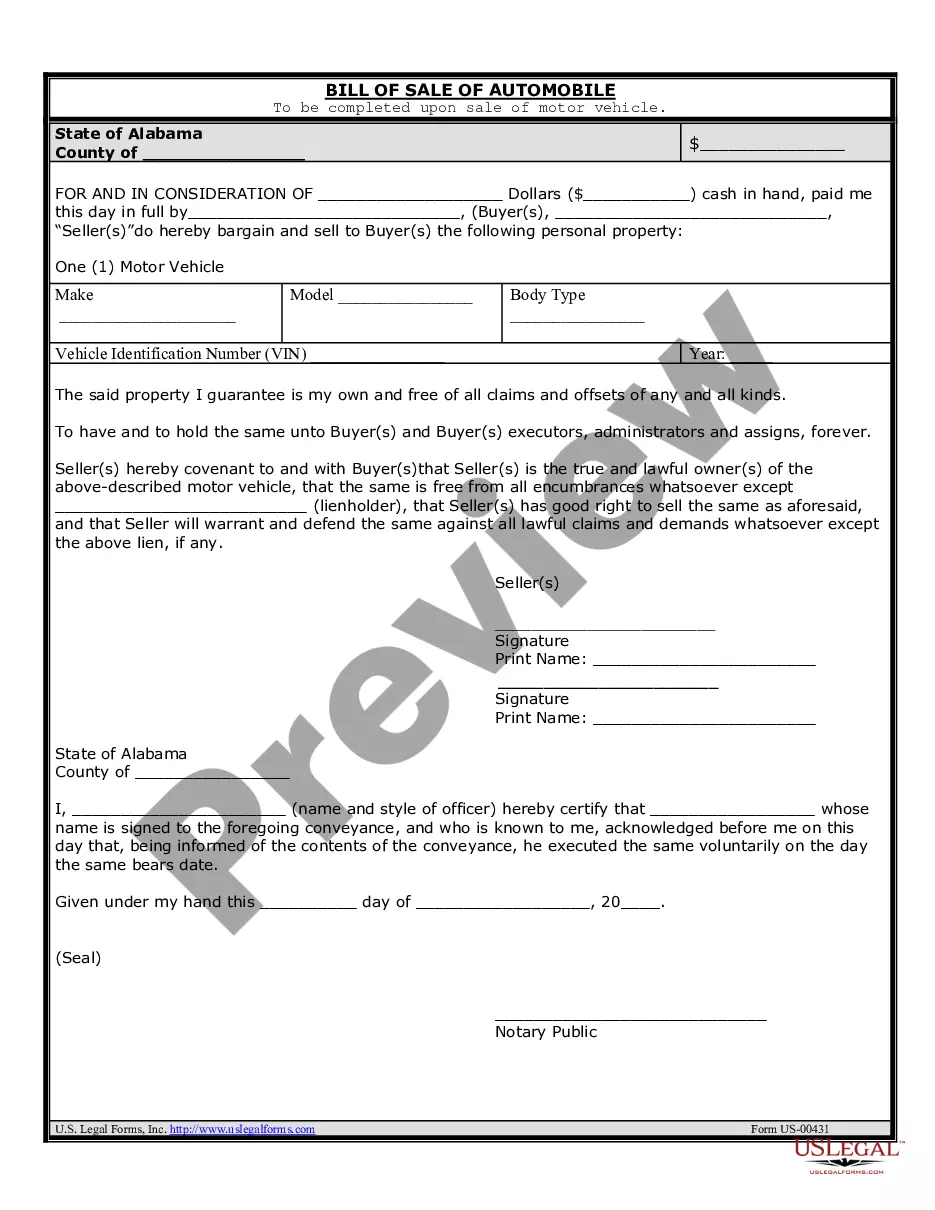

No matter if you require a simple agreement to set regulations for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed based on the requirements of separate state and area.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Boston Massachusetts Forest Land Tax Lien conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the document is intended for.

- Restart the search if the template isn’t suitable for your legal situation.

Now you can register your account. Then choose the subscription plan and proceed to payment. As soon as the payment is completed, download the Boston Massachusetts Forest Land Tax Lien in any available format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time researching legal papers online for good.