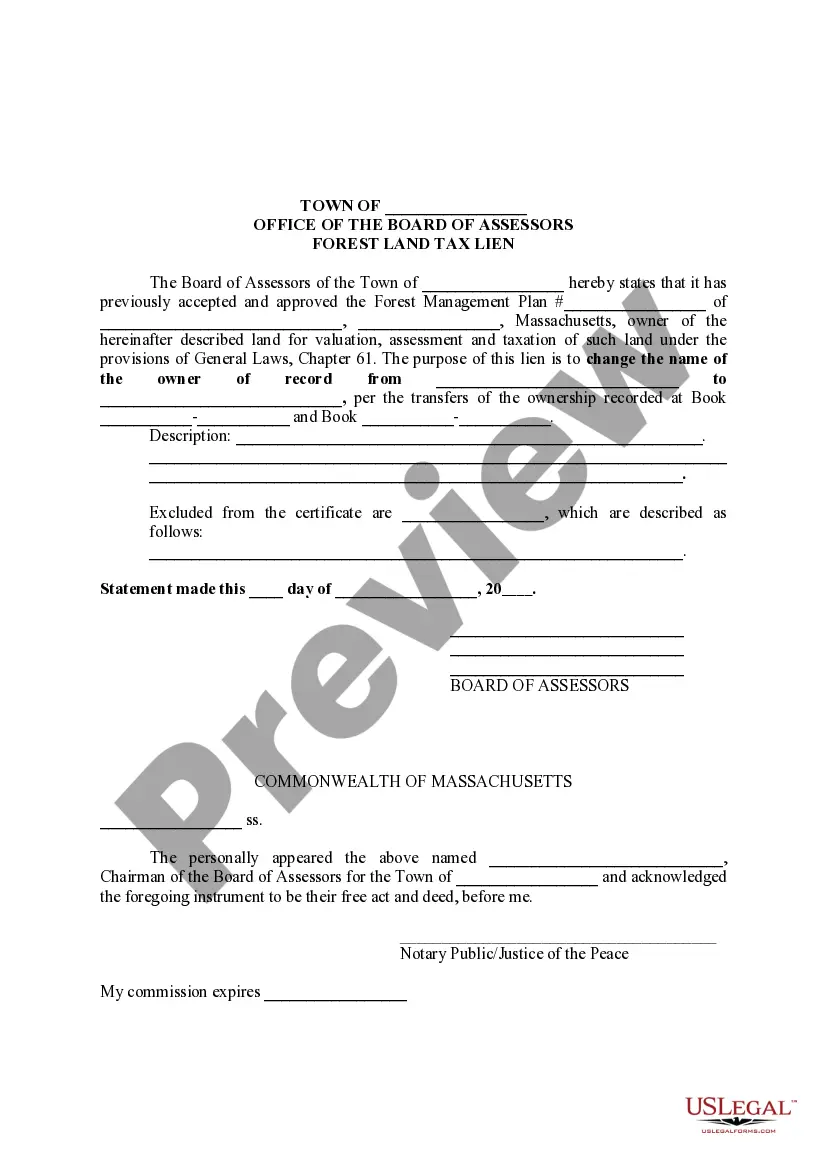

Cambridge Massachusetts Forest Land Tax Lien is a type of lien imposed on forested lands in Cambridge, Massachusetts by the local government authorities. This lien is applicable to properties that are specifically designated as forest land and are subject to certain taxation regulations. Here, "Cambridge Massachusetts Forest Land Tax Lien" would be an important keyword combination to highlight the specific topic. This tax lien serves as a means for the government to ensure the preservation and conservation of forested areas within the jurisdiction. The primary objective behind this lien is to protect and manage the natural resources offered by these forest lands by imposing financial obligations. In regard to different types of Cambridge Massachusetts Forest Land Tax Lien, there can be various categories based on the specific tax obligations and regulations. Some notable types include: 1. Annual Forest Land Tax Lien: This type of lien imposes an annual tax assessment on qualifying forested properties. The tax amount is generally determined based on factors such as the size of the property, its classification as forest land, and its assessed value. Property owners must meet their tax obligations regularly to avoid penalties and potential consequences. 2. Penalty and Interest Lien: When property owners fail to pay their forest land tax within the designated deadlines, the government may impose penalty fees and interest on the outstanding amount. In such cases, a penalty and interest lien may be placed on the property, requiring the payment of additional charges along with the underlying tax liability. 3. Prioritized Forest Land Tax Lien: In some instances, a priority status may be given to the forest land tax lien over other general liens on the property. This means that when the property is sold or transferred, this particular lien takes precedence over other debts or obligations, ensuring its repayment before other creditors. 4. Redemption Lien: If the property owner fails to fulfill their tax obligations, an additional redemption lien may be placed on the property. This lien offers interested parties the opportunity to pay off the outstanding taxes and redeem the property. The redemption period allows the property owner to reclaim their property by satisfying the outstanding tax debts along with any associated interests, penalties, or fees. It's important to note that the specific types and processes related to Cambridge Massachusetts Forest Land Tax Lien may vary over time due to legislative changes or updates. Therefore, property owners and interested parties should consult with local authorities or legal professionals for the most accurate and up-to-date information regarding forest land tax liens in Cambridge, Massachusetts.

Cambridge Massachusetts Forest Land Tax Lien

Description

How to fill out Cambridge Massachusetts Forest Land Tax Lien?

Obtaining verified forms tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal documents for both personal and professional purposes, covering a variety of real-world situations.

All the files are efficiently organized by usage area and jurisdiction, making it as straightforward as ABC to find the Cambridge Massachusetts Forest Land Tax Lien.

Download the Cambridge Massachusetts Forest Land Tax Lien. Store the template on your device to continue with its completion and gain access to it in the My documents menu of your profile whenever you need it again.

- Review the Preview mode and form description.

- Ensure you’ve selected the correct template that fulfills your needs and completely aligns with your local jurisdiction standards.

- Look for another template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to locate the appropriate one. If it meets your requirements, proceed to the next step.

- Proceed with the purchase.

- Click on the Buy Now button and select your preferred subscription plan. You will need to register for an account to gain access to the library’s resources.

Form popularity

FAQ

Seniors may stop paying property taxes in Massachusetts when they qualify for 100% exemption based on their income and age, typically after turning 70. However, eligibility largely depends on local regulations and assistance programs. Those dealing with the Cambridge Massachusetts Forest Land Tax Lien should seek guidance to understand their options for tax relief. Resources from U.S. Legal Forms can help seniors navigate the various programs available.

Yes, senior citizens in Massachusetts can qualify for property tax breaks, particularly if they meet income and residency requirements. This includes tax relief programs that help alleviate the financial burden of property taxes. For those in or near Cambridge, it’s important to understand how these tax breaks apply within the context of the Cambridge Massachusetts Forest Land Tax Lien. U.S. Legal Forms provides important information to navigate and apply for these tax relief options.

In Massachusetts, certain groups are exempt from paying property taxes, including veterans, people with disabilities, and seniors meeting specific income qualifications. Additionally, religious institutions and charitable organizations often receive tax exemptions. Understanding these exemptions can significantly impact your financial planning, especially concerning properties linked to Cambridge Massachusetts Forest Land Tax Lien. U.S. Legal Forms can guide you in determining eligibility and applying for exemptions.

In Massachusetts, the statute of limitations for a tax lien is generally 20 years. This means that the tax authority has two decades to collect the owed tax before the lien is considered inactive. However, certain actions taken by the taxing authority can extend this period. Understanding these timelines can provide clarity when dealing with a Cambridge Massachusetts Forest Land Tax Lien.

One main disadvantage of a tax lien, such as the Cambridge Massachusetts Forest Land Tax Lien, is that it can affect your credit score and property value. Owning a property with a lien may restrict your ability to sell or refinance until the debt is resolved. Additionally, tax liens can lead to potential foreclosure if not addressed promptly. It’s beneficial to understand these drawbacks to make informed decisions.

A tax lien can last for a significant time, generally up to 20 years in Massachusetts. This duration applies to liens like the Cambridge Massachusetts Forest Land Tax Lien and is governed by state law. If the lien is not cleared through payment or satisfaction, it will remain on record, potentially impacting property transactions. Staying informed about these timelines will help you navigate property ownership more effectively.

In Massachusetts, seniors may be eligible to stop paying property taxes through programs available for those aged 65 and older. These programs often include exemptions that can reduce the property tax burden significantly. However, eligibility typically depends on income and asset limits, among other factors. It's important to check with local authorities for details that pertain to Cambridge Massachusetts Forest Land Tax Lien situations.

Purchasing a house with unpaid taxes, such as one associated with a Cambridge Massachusetts Forest Land Tax Lien, can lead to several complications. You may inherit the tax debt, making you responsible for paying it off. This scenario could potentially lead to foreclosure by the taxing authority if the debt is not resolved. It's wise to conduct thorough research and seek legal advice before proceeding with such transactions.

To file a lien on a property in Massachusetts, you must first gather the necessary documentation, including the details of the debt owed. Then, you will need to complete the appropriate lien form, which can often be found on local municipal websites or through platforms like US Legal Forms. After filling out the form, submit it to the Registry of Deeds in the county where the property is located. This process establishes your claim, including any matters related to Cambridge Massachusetts Forest Land Tax Lien.

You can look up a tax lien in Massachusetts by contacting your local tax collector's office or visiting their website. Many municipalities provide online resources where you can search for tax lien information, including those for Cambridge Massachusetts Forest Land Tax Liens. It’s important to gather as much property information as possible for accurate results. Utilizing tools from uslegalforms can simplify your search and help you understand the details better.