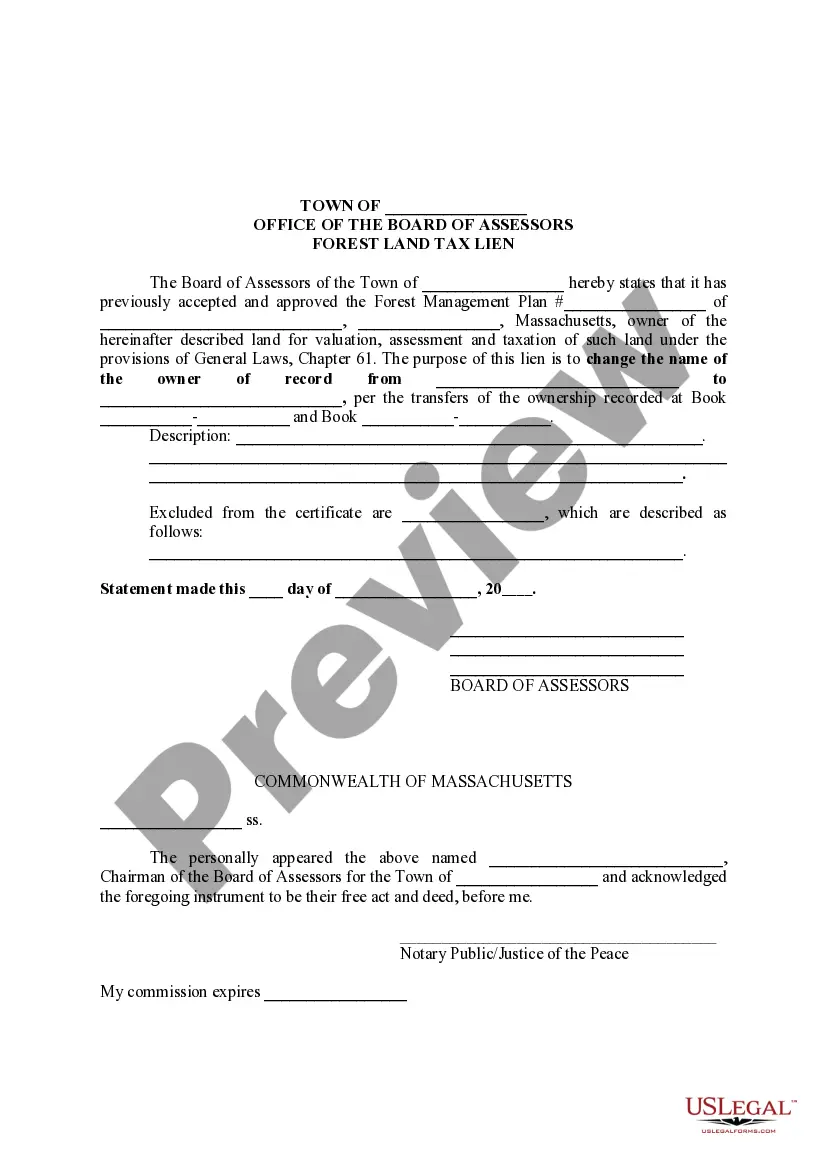

Lowell Massachusetts Forest Land Tax Lien is a legal claim placed on a property owner's forested land in Lowell, Massachusetts, for unpaid taxes. When property owners fail to pay their property taxes, the government has the authority to place a tax lien on the forested land, ensuring that the outstanding taxes are eventually paid. This type of tax lien applies specifically to forested lands located within the Lowell, Massachusetts area. Forest land tax liens are utilized to collect delinquent property taxes owed by owners of forested properties. The primary purpose of the Lowell Massachusetts Forest Land Tax Lien is to ensure that the city can collect the revenue owed to it in the form of property taxes. When a property owner fails to pay their taxes, the government can place a lien against the property, including any forested land it encompasses. This lien represents a legal claim on the property, often leading to a public auction if the taxes remain unpaid for an extended period. There are various types of Lowell Massachusetts Forest Land Tax Liens, including: 1. General Forest Land Tax Lien: This is the most common type of tax lien that applies to any forested property that has unpaid property taxes. It allows the government to collect the tax owed through various means, including potentially selling the property at a public auction. 2. Delinquent Forest Land Tax Lien: This type of tax lien is placed on forested land when the property owner fails to pay their property taxes for an extended period. The government can enforce the lien by selling the property to recover the unpaid taxes. 3. Redemption of Forest Land Tax Lien: In some cases, property owners may have the opportunity to redeem their forested land by paying off the unpaid taxes and any additional penalties or interest accrued. This enables the property owner to retain ownership of the forested land and clear the tax lien against it. 4. Auctioned Forest Land Tax Lien: When a property owner fails to redeem their tax lien, the government may proceed to auction off the forested land to the highest bidder. Proceeds from the auction are then used to satisfy the outstanding tax debt. It is essential for property owners in Lowell, Massachusetts, to stay informed about their property tax obligations and ensure timely payment to avoid the risk of a forest land tax lien. Failure to address unpaid property taxes may result in the imposition of a Lowell Massachusetts Forest Land Tax Lien, subjecting the property to potential sale and transfer of ownership to satisfy the delinquent tax debt.

Lowell Massachusetts Forest Land Tax Lien

Description

How to fill out Lowell Massachusetts Forest Land Tax Lien?

Make use of the US Legal Forms and obtain immediate access to any form you need. Our beneficial platform with a large number of document templates makes it simple to find and obtain almost any document sample you require. You can export, fill, and certify the Lowell Massachusetts Forest Land Tax Lien in just a couple of minutes instead of browsing the web for many hours searching for a proper template.

Utilizing our catalog is a superb strategy to increase the safety of your form submissions. Our professional attorneys regularly review all the documents to make certain that the forms are relevant for a particular state and compliant with new laws and polices.

How do you get the Lowell Massachusetts Forest Land Tax Lien? If you already have a subscription, just log in to the account. The Download button will be enabled on all the documents you look at. In addition, you can get all the previously saved files in the My Forms menu.

If you don’t have an account yet, follow the tips listed below:

- Find the form you need. Make sure that it is the template you were hoping to find: verify its title and description, and utilize the Preview feature if it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the downloading process. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and process your order using a credit card or PayPal.

- Save the document. Pick the format to obtain the Lowell Massachusetts Forest Land Tax Lien and revise and fill, or sign it for your needs.

US Legal Forms is among the most considerable and trustworthy form libraries on the internet. Our company is always happy to assist you in any legal procedure, even if it is just downloading the Lowell Massachusetts Forest Land Tax Lien.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!