Middlesex Massachusetts Forest Land Tax Lien refers to a legal claim imposed by the local government on forested properties in Middlesex County, Massachusetts, for unpaid property taxes. This lien is applicable to landowners who have outstanding tax obligations specifically related to forested properties. Forest Land Tax Liens are a mechanism employed by the county government to collect the due taxes and ensure compliance with tax payment regulations. These tax liens are levied on forested lands to ensure that landowners contribute their fair share toward local public services, such as schools, infrastructure development, and maintenance of county facilities. Failure to pay property taxes prompts the local government to initiate the tax lien process, placing a claim against the forested property. The lien remains in force until the property owner fulfills their tax obligations, including any accrued interest and penalties. There may be different types of Middlesex Massachusetts Forest Land Tax Liens, including: 1. General Forest Land Tax Lien: This type of lien applies to forested properties owned by individuals or entities who have failed to pay their property taxes. It encompasses all forested land within Middlesex County and targets properties solely based on their classification as forested land. 2. Forest Conservation Land Tax Lien: This lien type encompasses properties classified as conservation land or those subject to specific regulations governing forest conservation within Middlesex County. Owners of forest conservation land who fail to meet their tax obligations may face this specific type of lien. 3. Non-Compliance Forest Land Tax Lien: This lien type is applicable to forested properties where landowners have violated specific regulations or requirements related to forest management, conservation plans, or land use practices. These liens are imposed to enforce compliance and ensure adherence to forest management guidelines within Middlesex County. 4. Abandoned Forest Land Tax Lien: If a forested property is deemed abandoned or neglected, and the owner fails to pay property taxes, the local government may impose this type of lien. It is intended to motivate the owner to address any outstanding issues related to the property and fulfill their tax obligations. To summarize, Middlesex Massachusetts Forest Land Tax Lien is a legal claim placed on forested properties within Middlesex County for unpaid property taxes. The different types of liens may vary based on the specific circumstances leading to the tax delinquency, including general tax liens, conservation land liens, non-compliance liens, and abandoned property liens. These liens are crucial in upholding the financial well-being of the county and ensuring fair contributions from forested landowners towards local public services.

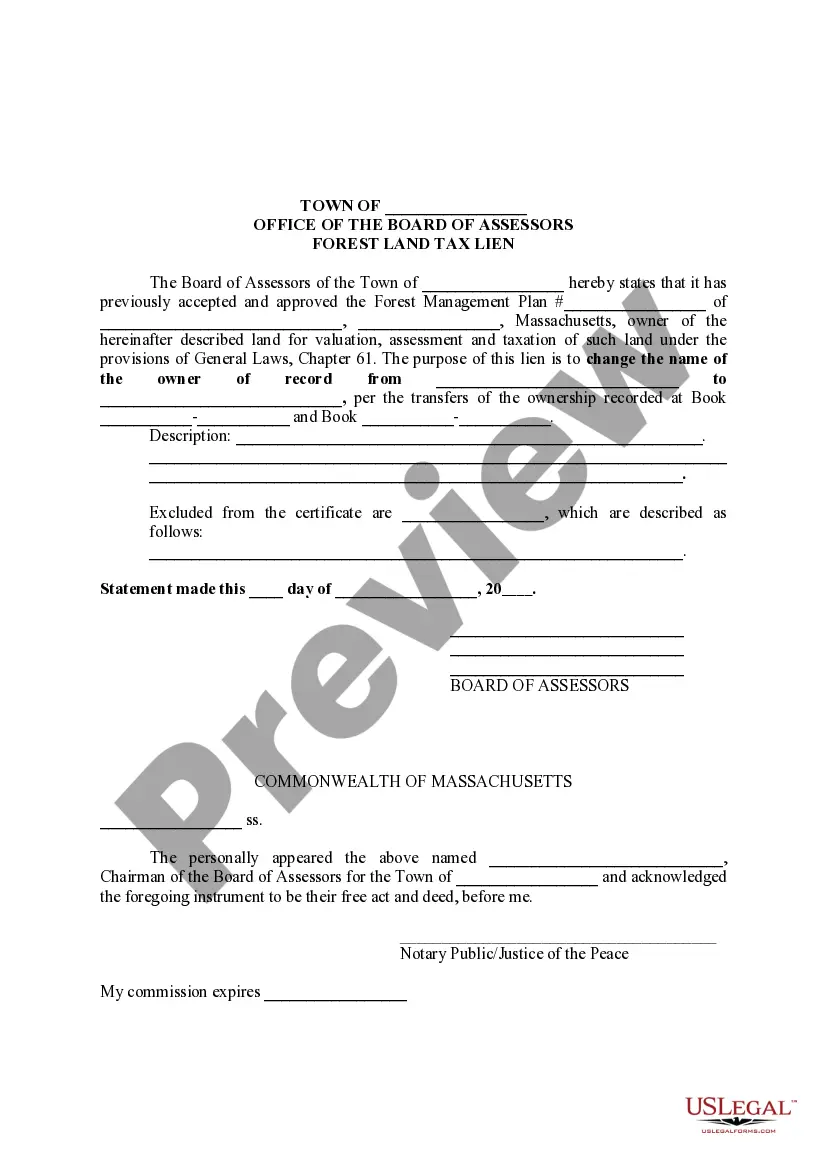

Middlesex Massachusetts Forest Land Tax Lien

Description

How to fill out Middlesex Massachusetts Forest Land Tax Lien?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Middlesex Massachusetts Forest Land Tax Lien? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t generic and framed in accordance with the requirements of specific state and area.

To download the document, you need to log in account, find the required form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Middlesex Massachusetts Forest Land Tax Lien conforms to the laws of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is intended for.

- Restart the search if the form isn’t good for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is completed, download the Middlesex Massachusetts Forest Land Tax Lien in any provided format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time researching legal paperwork online for good.