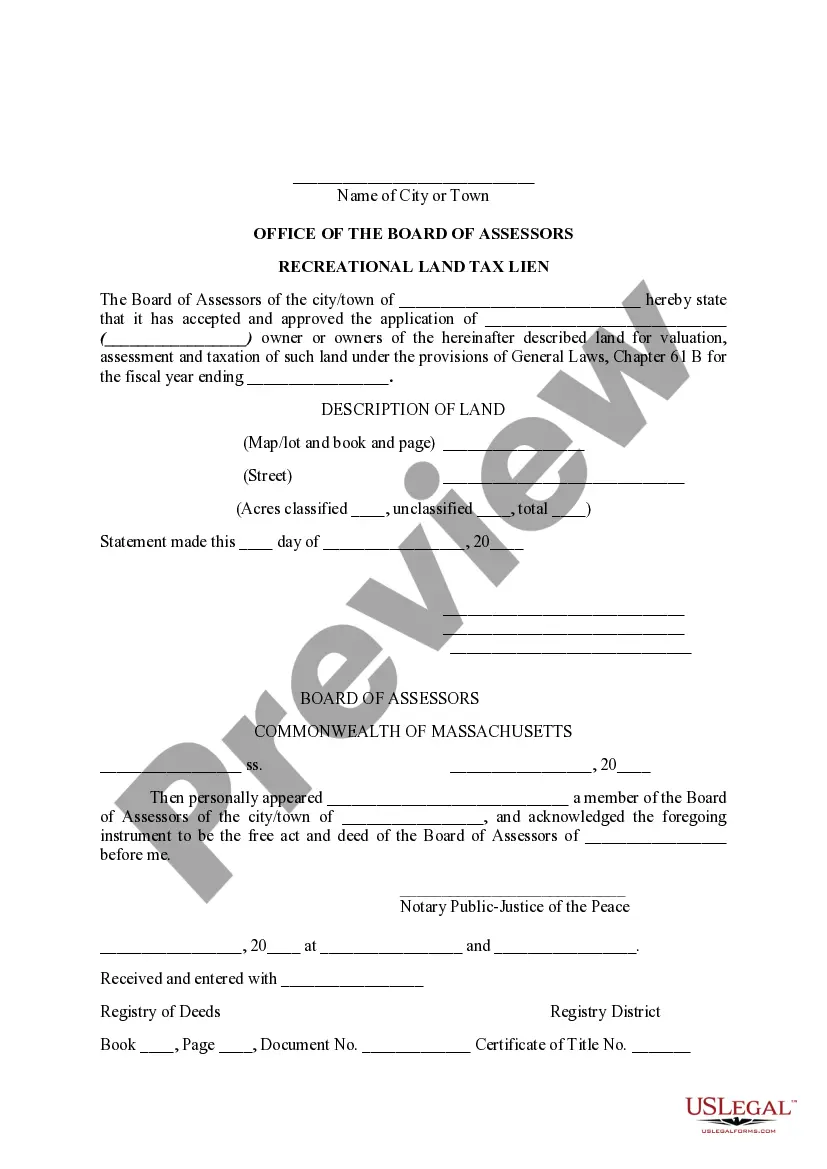

Cambridge Massachusetts Recreational Land Tax Lien is a legal mechanism utilized by the city of Cambridge, Massachusetts to collect outstanding property taxes on recreational land properties. This type of tax lien is specifically associated with recreational land parcels and is implemented to ensure the timely payment of property taxes on these properties. A tax lien is placed on recreational land when the property owner fails to pay the required property taxes. This lien grants the city certain rights and interests in the property, allowing them to collect the unpaid taxes through legal means. This can include the sale of the property through a tax lien auction or the initiation of legal proceedings to recover the owed taxes. The Cambridge Massachusetts Recreational Land Tax Lien serves as an important revenue collection tool for the city, ensuring that property owners fulfill their tax obligations. The revenue generated from these tax liens plays a crucial role in funding essential city services and infrastructure improvements. It is worth noting that there are no specific types of Cambridge Massachusetts Recreational Land Tax Lien, as it is a general mechanism employed for all recreational land properties within the city. The tax lien process and procedures followed for recreational land are similar to those for other types of properties in Cambridge subject to tax liens. Property owners in Cambridge should be aware of their responsibilities to pay property taxes on time to avoid the placement of a tax lien on their recreational land. Failure to pay property taxes may lead to penalties, interest charges, and the potential loss of ownership rights over the property. It is advisable for property owners to stay informed about their tax obligations and promptly address any outstanding payments to prevent the occurrence of a Cambridge Massachusetts Recreational Land Tax Lien.

Cambridge Massachusetts Recreational Land Tax Lien

Description

How to fill out Cambridge Massachusetts Recreational Land Tax Lien?

No matter the social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone without any law education to draft such paperwork from scratch, mostly due to the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our service provides a huge catalog with more than 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the Cambridge Massachusetts Recreational Land Tax Lien or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Cambridge Massachusetts Recreational Land Tax Lien in minutes employing our trusted service. In case you are presently an existing customer, you can go ahead and log in to your account to download the needed form.

However, in case you are new to our library, ensure that you follow these steps prior to downloading the Cambridge Massachusetts Recreational Land Tax Lien:

- Be sure the template you have found is suitable for your area considering that the rules of one state or county do not work for another state or county.

- Review the document and go through a short description (if available) of cases the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start over and search for the needed form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Cambridge Massachusetts Recreational Land Tax Lien once the payment is done.

You’re good to go! Now you can go ahead and print out the document or fill it out online. Should you have any problems getting your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.