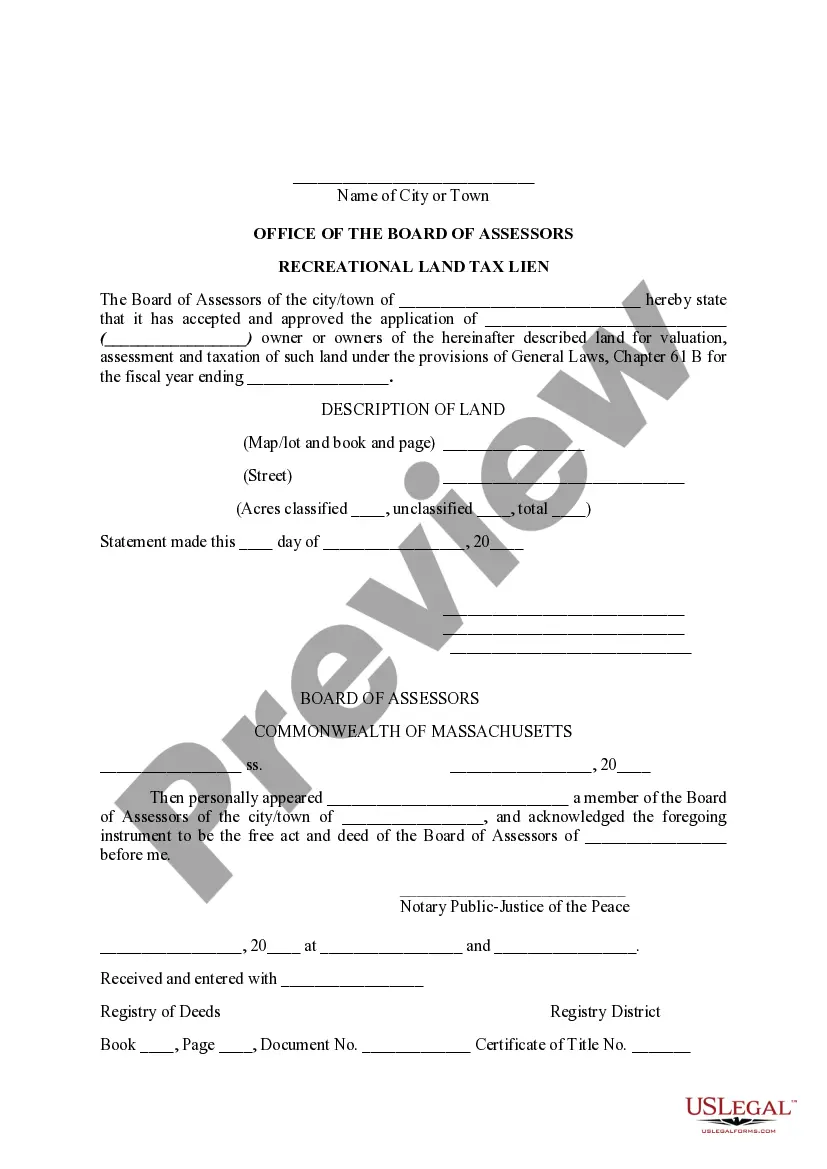

Lowell Massachusetts Recreational Land Tax Lien refers to a legal claim placed on a recreational land property by the government due to unpaid property taxes. When property owners fail to pay their property taxes, the local government can enforce a tax lien, which is essentially a legal claim against the property. In Lowell, Massachusetts, recreational land tax liens are specifically aimed at properties used for recreational purposes such as parks, sports fields, golf courses, and other leisure activities. These tax liens are initiated by the local tax authority, typically the County Treasurer's Office or the Tax Collector's Office. The government sells these tax liens to investors in order to recoup the unpaid taxes. Investors purchase these liens with the hope of earning interest on the delinquent taxes owed by the property owner. Lowell Massachusetts may have different types of recreational land tax liens, including: 1. General Recreational Land Tax Lien: This type of tax lien applies to recreational land properties that are not specifically designated for a particular purpose. It encompasses a wide range of recreational properties, such as public parks or open spaces. 2. Sports Facility Tax Lien: This type of tax lien pertains to recreational land properties used for sporting activities, including stadiums, sports complexes, or any land designated for professional or amateur sports. 3. Golf Course Tax Lien: This specific tax lien applies to recreational land properties used as golf courses and related facilities. It includes the land, golf courses, driving ranges, clubhouses, and any other amenities associated with the golfing activity. It is important to note that the specific types of recreational land tax liens in Lowell, Massachusetts may vary, as they depend on local regulations and classifications. Furthermore, the exact process and timelines for initiating and resolving tax liens are governed by state laws and regulations, which may differ from other regions. Property owners must address these tax liens promptly to avoid potential consequences, including foreclosure on the property. It is advisable for property owners to reach out to the local tax authority or seek legal advice to understand their options for resolving the outstanding tax debts related to recreational land tax liens in Lowell, Massachusetts.

Lowell Massachusetts Recreational Land Tax Lien

Description

How to fill out Lowell Massachusetts Recreational Land Tax Lien?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we apply for legal services that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Lowell Massachusetts Recreational Land Tax Lien or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can create your account within minutes.

- Make sure to check if the Lowell Massachusetts Recreational Land Tax Lien complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Lowell Massachusetts Recreational Land Tax Lien is suitable for your case, you can pick the subscription plan and make a payment.

- Then you can download the form in any available format.

For over 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!