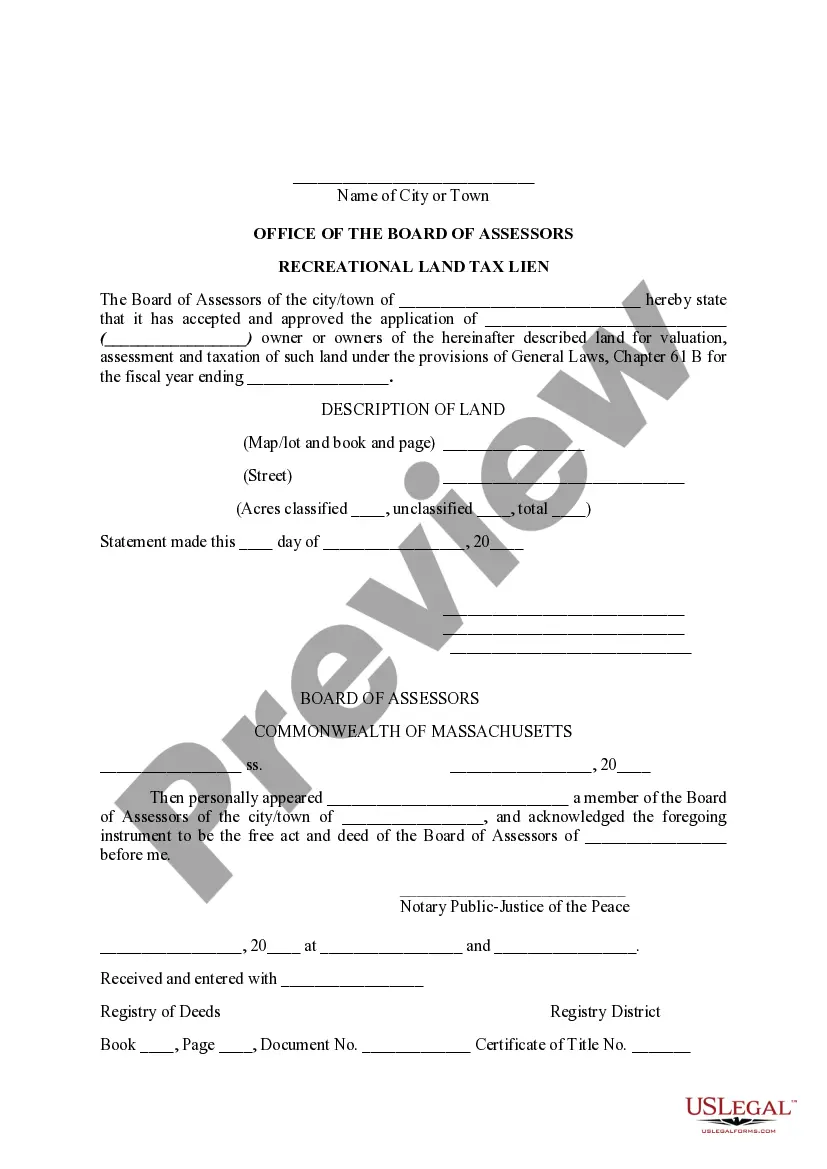

Middlesex Massachusetts Recreational Land Tax Lien represents a legal claim imposed on recreational land properties located in Middlesex County, Massachusetts, due to unpaid taxes. This lien is applicable to recreational lands that are used for leisure and entertainment purposes, such as parks, campgrounds, hiking trails, and sports facilities. The Middlesex Massachusetts Recreational Land Tax Lien is a mechanism employed by the local government to ensure property owners fulfill their tax obligations. When owners fail to pay their property taxes, the county government places a lien on the recreational land, granting them the right to collect the outstanding tax amount along with any associated interest and penalties. Different types of Middlesex Massachusetts Recreational Land Tax Liens may include: 1. Standard Tax Lien: This is the most common type of lien placed on recreational land properties when owners fail to pay their property taxes on time. It entitles the government to collect the unpaid taxes through foreclosure or auction, allowing the county to recoup the owed amount. 2. In Rem Tax Lien: This lien is specific to recreational land properties and is filed against the property itself instead of the owner. In other words, the lien remains attached to the recreational land irrespective of ownership changes. It enables the county government to feasibly recover the unpaid taxes even if the property changes hands. 3. Redemption Period: In Middlesex County, there is a redemption period associated with tax liens. Property owners who could not pay their delinquent taxes have a certain period of time to settle the outstanding amount to prevent a tax foreclosure or auction. This grace period allows owners to rectify their tax payment and retain ownership of their recreational land. 4. Auction or Foreclosure: In cases where the delinquent taxes on recreational land remain unpaid beyond the redemption period, the county government has the right to initiate a tax foreclosure or auction. During the auction, interested buyers, investors, or individuals have the opportunity to bid on the property and pay off the outstanding taxes, potentially acquiring ownership of the recreational land. It is crucial for recreational landowners in Middlesex County, Massachusetts, to promptly fulfill their property tax obligations to avoid the Middlesex Massachusetts Recreational Land Tax Lien, as it can lead to financial burdens, legal complications, and potential loss of property ownership.

Middlesex Massachusetts Recreational Land Tax Lien

Description

How to fill out Middlesex Massachusetts Recreational Land Tax Lien?

If you are searching for a valid form template, it’s impossible to choose a better service than the US Legal Forms site – probably the most comprehensive libraries on the web. Here you can get thousands of document samples for business and individual purposes by categories and states, or keywords. With our advanced search option, discovering the most recent Middlesex Massachusetts Recreational Land Tax Lien is as elementary as 1-2-3. Additionally, the relevance of each and every record is confirmed by a team of expert lawyers that regularly check the templates on our website and update them according to the most recent state and county regulations.

If you already know about our platform and have an account, all you need to get the Middlesex Massachusetts Recreational Land Tax Lien is to log in to your user profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the form you need. Read its description and utilize the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the needed document.

- Affirm your selection. Click the Buy now button. After that, select your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Obtain the form. Select the format and download it to your system.

- Make modifications. Fill out, revise, print, and sign the received Middlesex Massachusetts Recreational Land Tax Lien.

Each form you add to your user profile does not have an expiration date and is yours permanently. You can easily access them using the My Forms menu, so if you need to have an additional copy for editing or creating a hard copy, feel free to return and download it once more at any time.

Make use of the US Legal Forms professional collection to gain access to the Middlesex Massachusetts Recreational Land Tax Lien you were seeking and thousands of other professional and state-specific samples in a single place!