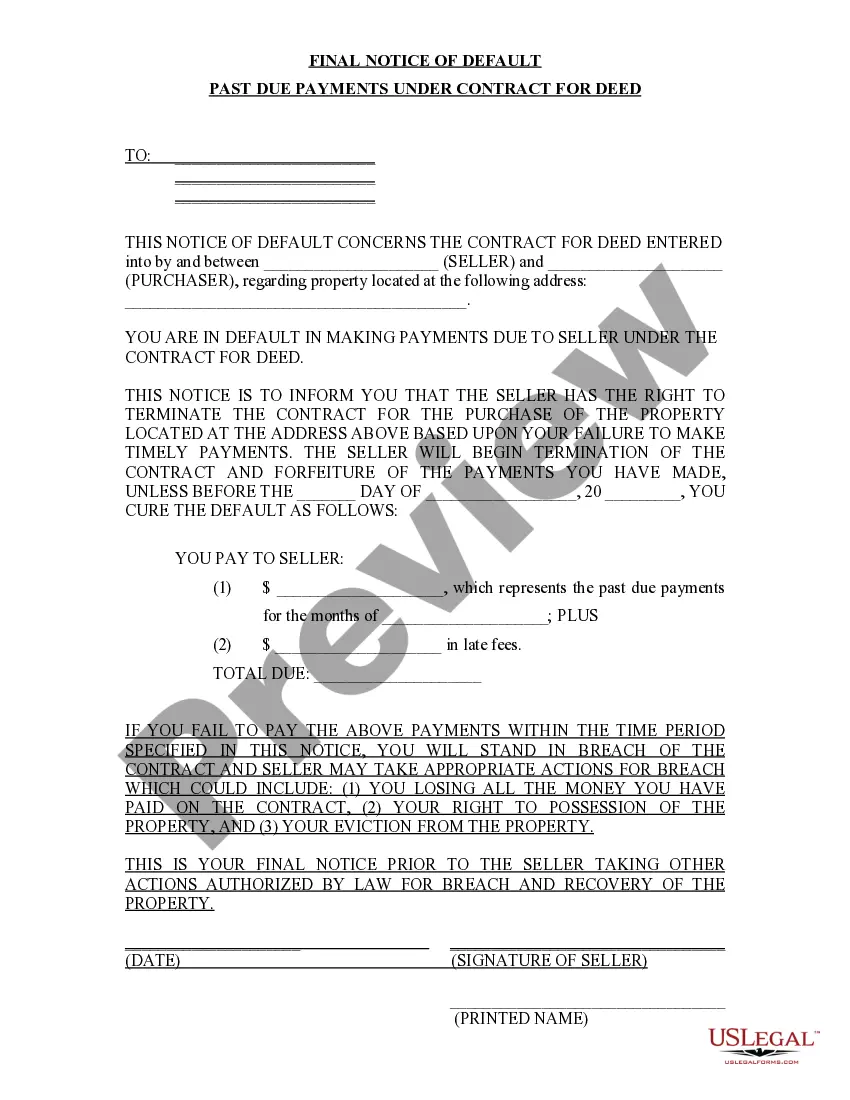

The Boston Massachusetts Resident Estate Tax Return is a tax form that needs to be filed by residents of Boston, Massachusetts after the death of an individual. This tax return is specific to Boston residents and is separate from the Massachusetts Estate Tax Return. The purpose of the Boston Massachusetts Resident Estate Tax Return is to calculate and pay any estate taxes owed to the city of Boston. Estate taxes are levied on the net value of an individual's estate after their death. The tax is imposed on the transfer of the deceased person's assets to their heirs or beneficiaries. There are different types of Boston Massachusetts Resident Estate Tax Returns, depending on the size and value of the estate. These types may include: 1. Small Estate Exemption: This refers to estates that fall below a certain threshold value, typically determined by the Boston tax authorities. If the estate's value is below this threshold, the executor or personal representative may be exempt from filing the estate tax return. 2. Standard Estate Tax Return: For estates that exceed the small estate exemption threshold, a standard estate tax return must be filed. This involves providing detailed information about the deceased person's assets, liabilities, and any deductions or exemptions available. The Boston Massachusetts Resident Estate Tax Return requires information such as the deceased person's personal details, date of death, and information about their beneficiaries. It also requires a comprehensive inventory of the deceased person's assets, including real estate, bank accounts, investments, and personal property. Once the estate's value is determined, the tax authorities will calculate the estate tax owed based on the current tax rates and exemptions applicable in Boston. The executor or personal representative is responsible for paying this tax from the assets of the estate. It is important to note that the Boston Massachusetts Resident Estate Tax Return is separate from the federal estate tax return, which is filed with the Internal Revenue Service (IRS). Both returns may have their own specific requirements, deadlines, and tax rates. In summary, the Boston Massachusetts Resident Estate Tax Return is a tax form that Boston residents must file to fulfill their tax obligations related to the transfer of assets after a person's death. Different types of returns may exist based on the estate's value, and careful attention must be given to accurately report assets and calculate the estate tax owed.

Boston Massachusetts Resident Estate Tax Return

Description

How to fill out Boston Massachusetts Resident Estate Tax Return?

We always want to minimize or prevent legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of legal counsel. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Boston Massachusetts Resident Estate Tax Return or any other document quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Boston Massachusetts Resident Estate Tax Return complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Boston Massachusetts Resident Estate Tax Return is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!