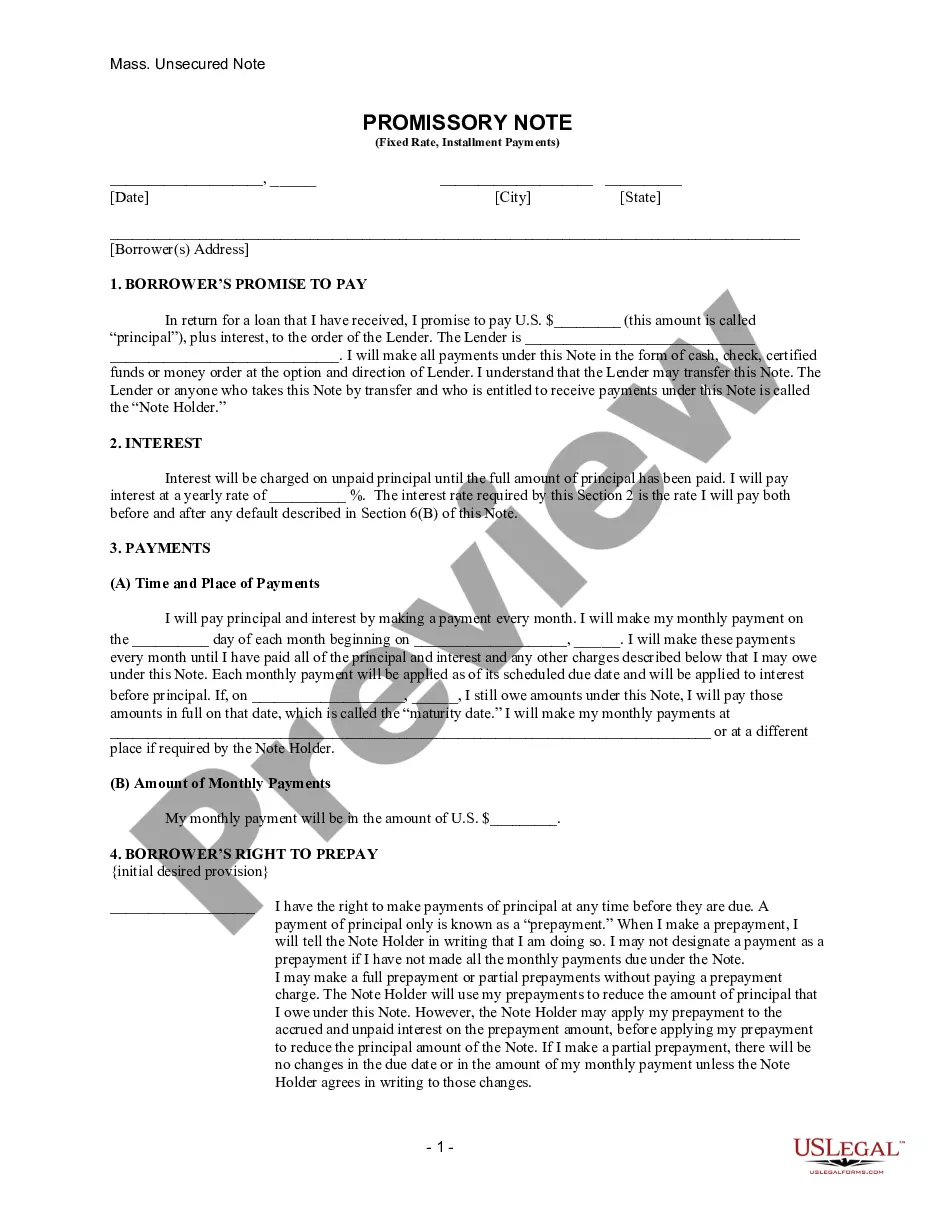

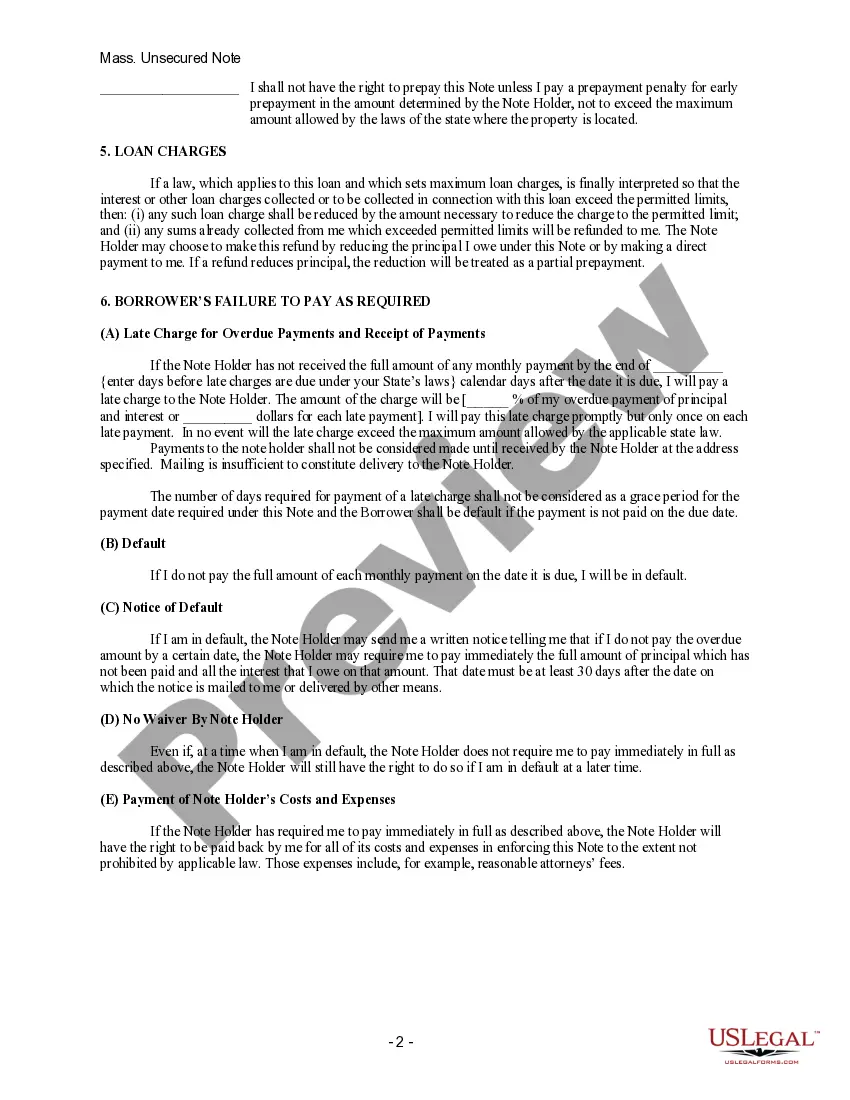

Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document used in financing agreements to define the terms and conditions of a loan between two parties. This type of promissory note specifically applies to loans in Lowell, Massachusetts, and is unsecured, meaning it does not require collateral. The promissory note outlines the obligations of the borrower (also known as the promise) to repay the lender (also known as the promise) over a specified period in regular installments. The fixed interest rate ensures that the interest charged on the loan remains constant throughout the repayment term. Keywords: Lowell Massachusetts, unsecured, installment payment, promissory note, fixed rate, loan, financing agreements, legal document, terms and conditions, borrower, lender, interest rate, collateral, repayment term. Different types of Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate may include variations based on specific loan purposes or features, such as: 1. Personal Loan Promissory Note: This type of promissory note is used when the loan is granted to an individual for personal reasons, such as debt consolidation, home improvements, or education expenses. 2. Business Loan Promissory Note: When the loan is taken by a business entity, this type of promissory note is used. It could be to fund working capital, purchase equipment, or expand the business. 3. Student Loan Promissory Note: Specifically designed to facilitate educational financing, this type of promissory note is widely used by students to cover tuition fees, accommodation expenses, and other educational costs. 4. Car Loan Promissory Note: Used for financing the purchase of a vehicle, this type of promissory note specifies the loan amount, repayment schedule, fixed interest rate, and other relevant terms for the auto loan. 5. Mortgage Promissory Note: When financing a real estate property, this type of promissory note is typically used. It outlines the loan amount, repayment terms, fixed interest rate, and the mortgage property as collateral. 6. Small Business Loan Promissory Note: This variation caters specifically to small businesses seeking loans for various purposes, such as funding startups, expansion, or working capital. Each type of Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate maintains the same fundamental structure and purpose but may have specific clauses or terms tailored to the nature of the loan.

Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Lowell Massachusetts Unsecured Installment Payment Promissory Note For Fixed Rate?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for a person with no legal background to create such paperwork from scratch, mainly because of the convoluted terminology and legal subtleties they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is a great asset for associates or legal counsels who want to save time utilizing our DYI tpapers.

No matter if you want the Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate quickly using our trusted platform. In case you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our library, ensure that you follow these steps prior to obtaining the Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate:

- Be sure the form you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Preview the document and read a short description (if provided) of cases the paper can be used for.

- If the form you selected doesn’t suit your needs, you can start over and search for the needed document.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your login information or create one from scratch.

- Choose the payment method and proceed to download the Lowell Massachusetts Unsecured Installment Payment Promissory Note for Fixed Rate as soon as the payment is completed.

You’re all set! Now you can proceed to print out the document or fill it out online. Should you have any problems locating your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.