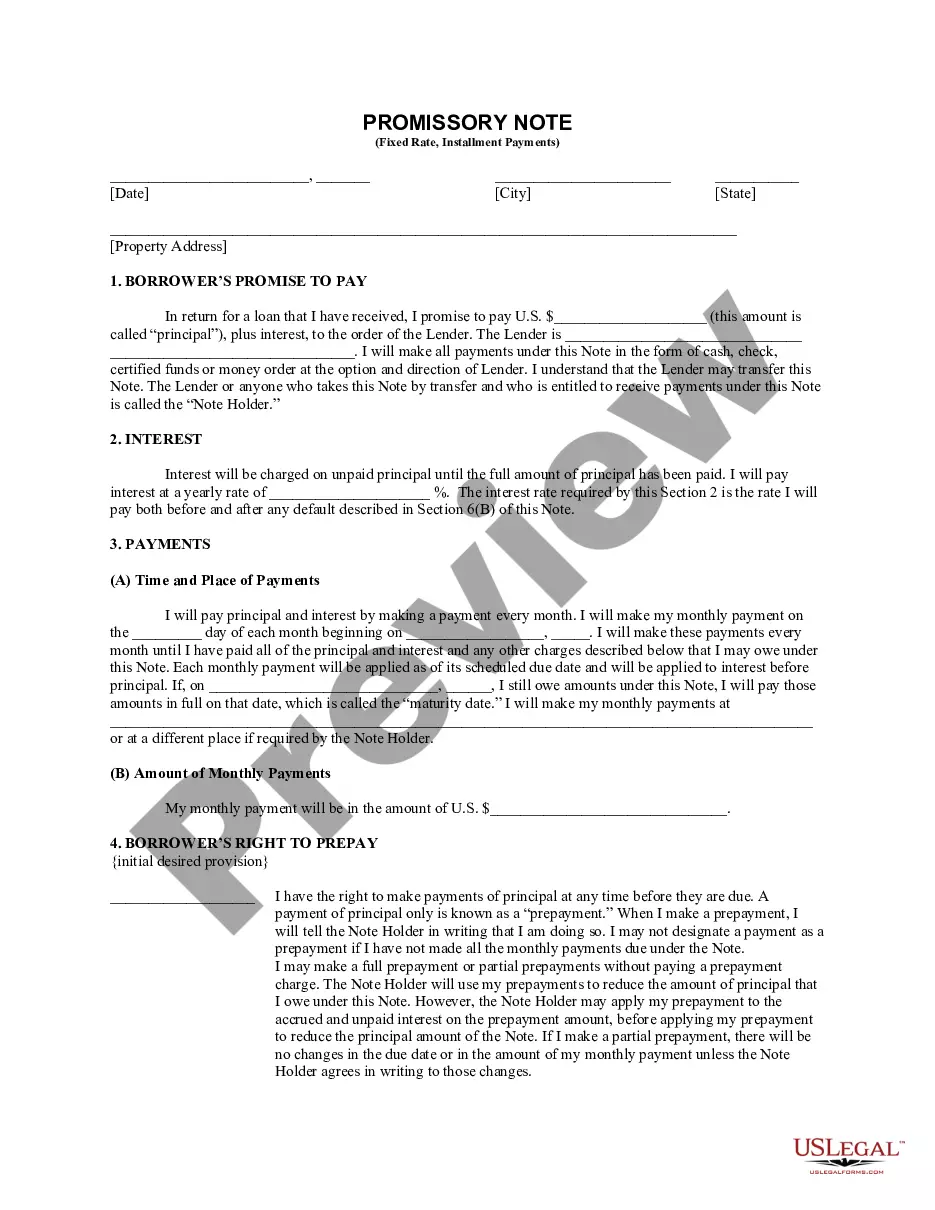

Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Acquiring verified templates tailored to your local laws can be difficult unless you utilize the US Legal Forms repository.

It’s an online assortment of over 85,000 legal documents for both personal and business requirements and various real-world situations.

All the papers are accurately organized by usage area and jurisdictional domains, making the search for the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate as swift and straightforward as 123.

Being organized and compliant with legal mandates is crucial. Leverage the US Legal Forms library to always have vital document templates readily available!

- Inspect the Preview mode and document description.

- Confirm you've selected the appropriate one that satisfies your needs and fully aligns with your local jurisdiction standards.

- Search for an alternative template, if necessary.

- Upon noticing any discrepancies, utilize the Search tab above to find the right one.

- If it fits your requirements, proceed to the next step.

Form popularity

FAQ

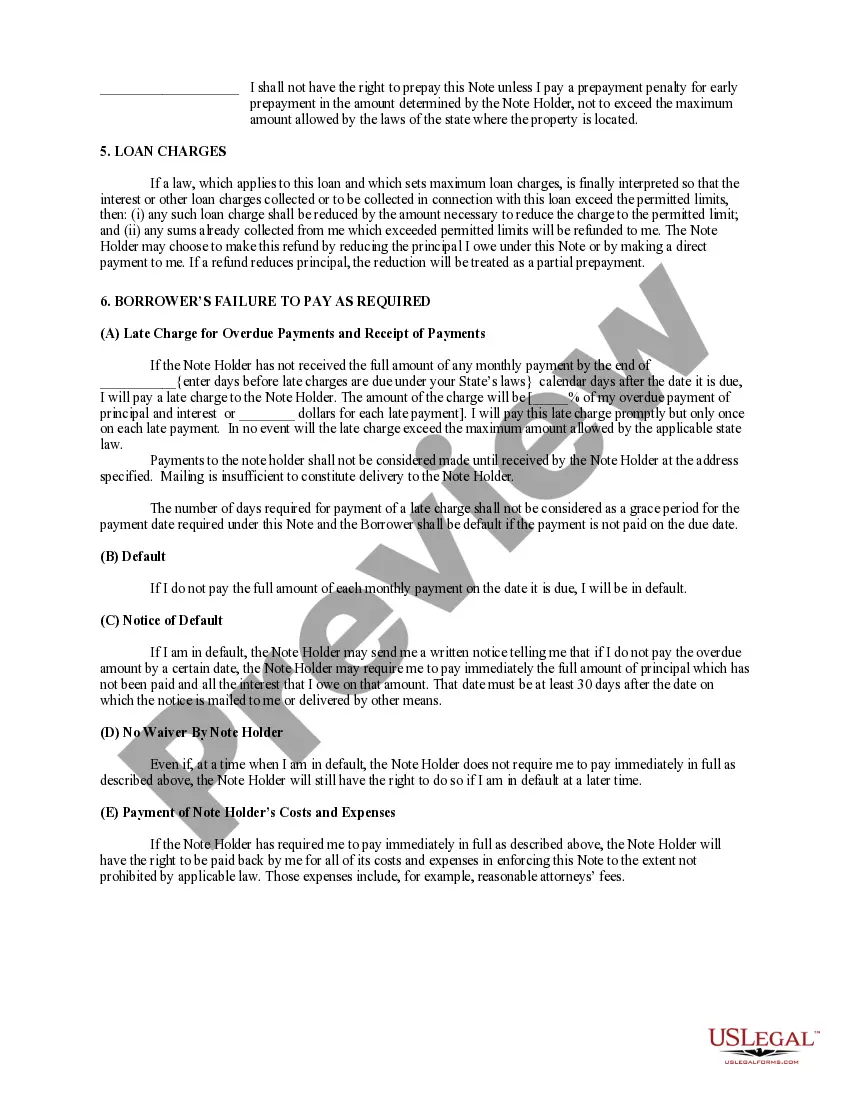

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

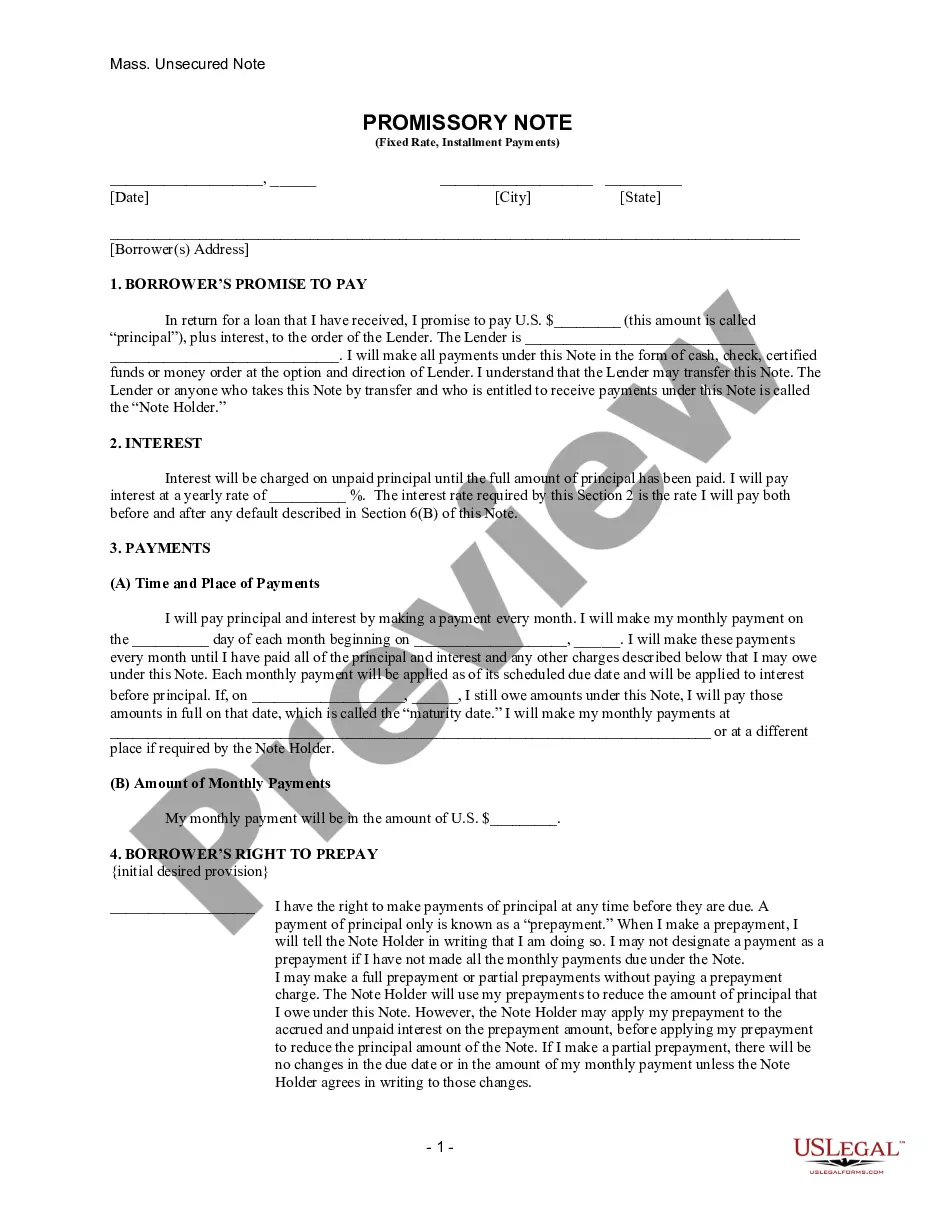

The major difference between a secured and unsecured Promissory Note is collateral. A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

So, what's the difference between secured and unsecured promissory notes? It's actually quite simple. A secured note is any debt collateralized with real property like a first deed of trust or car title. Conversely, an unsecured note is any debt not secured by collateral (or uncollateralized).

The promissory note, a contract separate from the mortgage, is the document that creates the loan obligation. This document contains the borrower's promise to repay the amount borrowed. If you sign a promissory note, you're personally liable for repaying the loan.