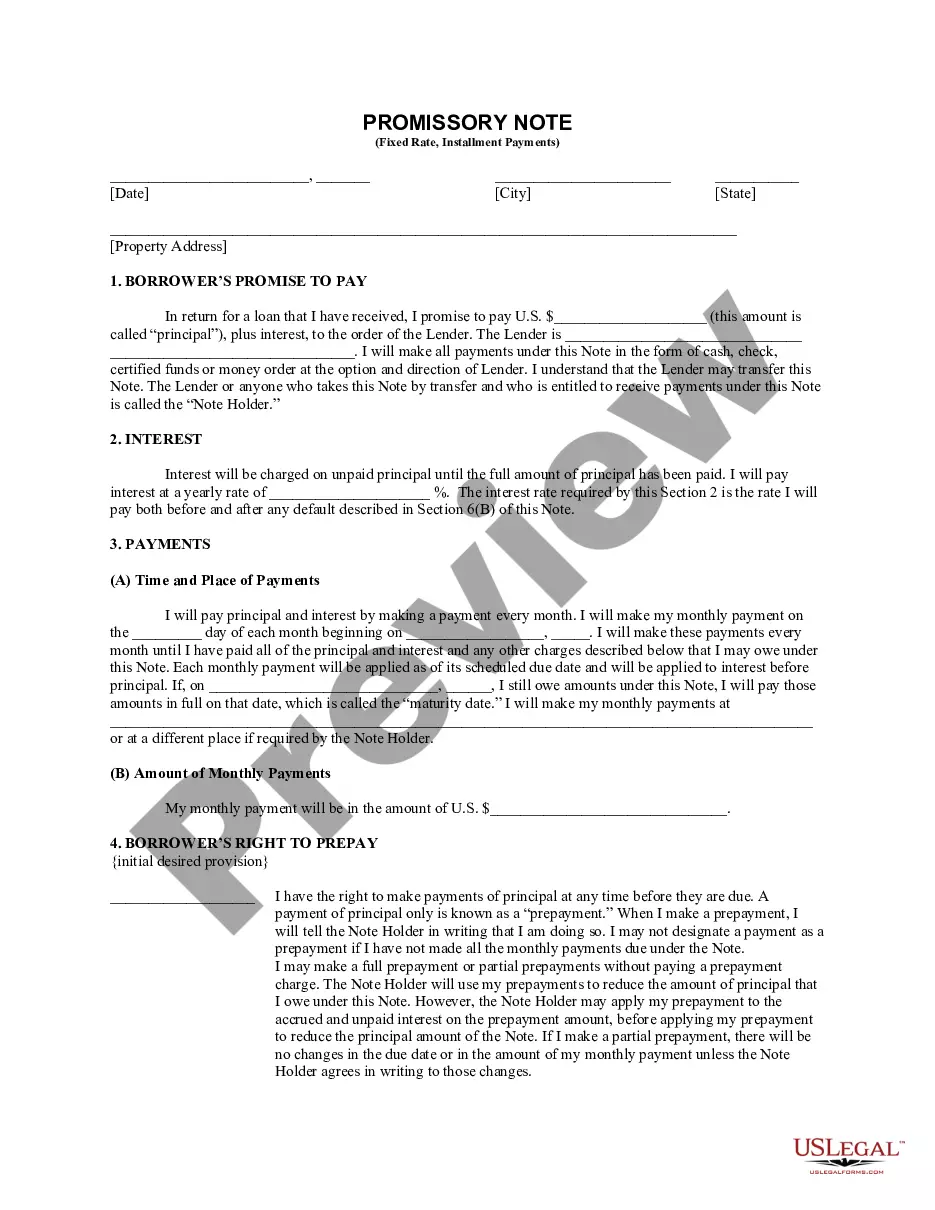

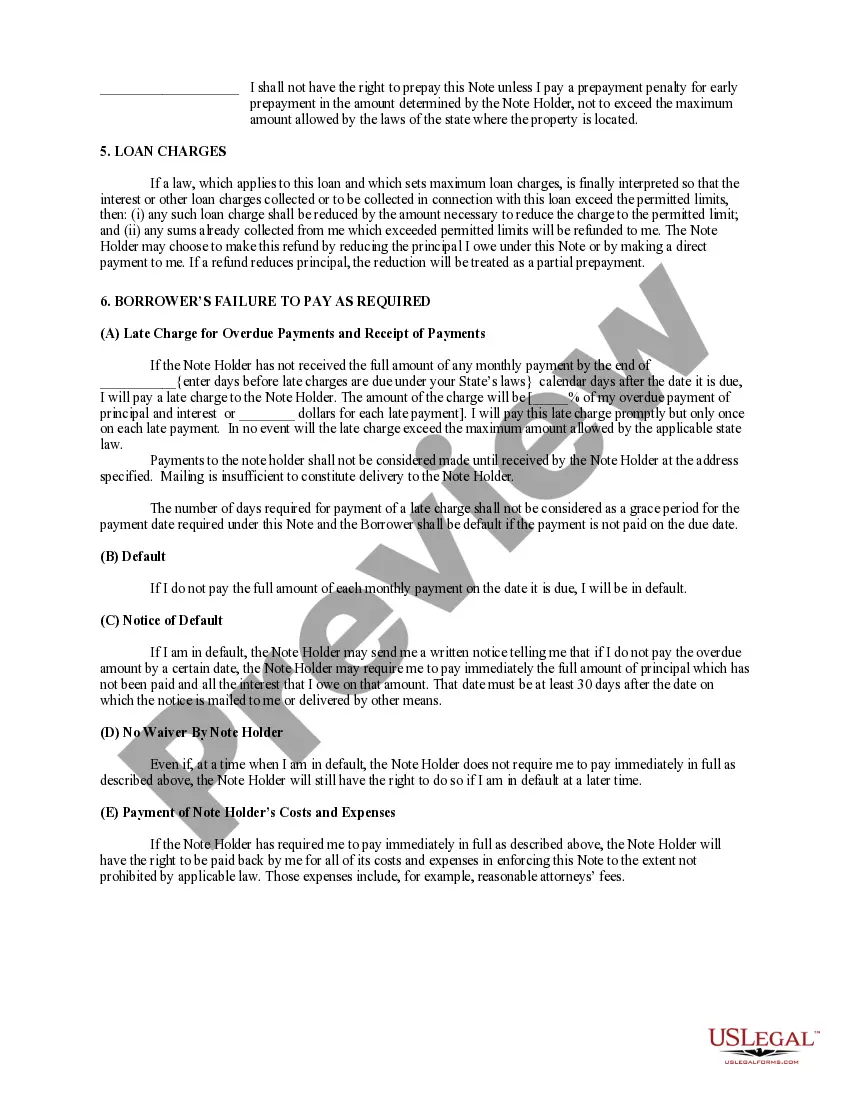

A Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding agreement between a borrower and a lender in Middlesex County, Massachusetts, which outlines the terms and conditions for borrowing money for the purchase or refinancing of residential real estate. This type of promissory note provides stability and predictability to both parties involved. The note specifies that the loan will be repaid through regular installments over a predetermined period of time, usually on a monthly basis. The fixed rate aspect ensures that the interest rate remains constant throughout the loan term, providing the borrower with a steady repayment amount. In addition to the fixed rate and installment structure, this particular promissory note secures the loan with residential real estate property. This means that in the event of default, the lender has the right to exercise various remedies, including foreclosure, to recover the outstanding loan balance. Different types of Middlesex Massachusetts Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may include variations in loan duration, interest rates, and property types. Some common variations include: 1. Short-term fixed rate promissory note: This type of promissory note typically has a loan term of less than 5 years. It is suitable for borrowers looking for a quick repayment schedule or those who plan to sell or refinance the property in the near future. 2. Long-term fixed rate promissory note: This type of promissory note spans over a longer period, typically 10 to 30 years. It suits borrowers looking for a more extended repayment term and stability in their monthly payments. 3. Adjustable-rate fixed term promissory note: Unlike traditional fixed-rate notes, this type of promissory note starts with an initial fixed interest rate for a specific period (e.g., 3, 5, or 7 years). After the initial fixed period, the interest rate may adjust periodically based on a predetermined index, such as the LIBOR or U.S. Treasury rate. 4. Condominium promissory note: This type of promissory note specifically applies to loans secured by residential condominium units. It may include additional clauses related to condominium association fees, bylaws, and special assessments. 5. Single-family residence promissory note: This type of promissory note pertains to loans secured by single-family homes. It is the most common type of residential real estate promissory note. It is crucial for both borrowers and lenders to thoroughly understand the terms and conditions of the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate before entering into the agreement. Consulting with legal and financial professionals is strongly recommended ensuring compliance with all applicable laws and regulations.

Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are looking for a valid form, it’s extremely hard to find a more convenient platform than the US Legal Forms website – one of the most comprehensive online libraries. Here you can get thousands of document samples for organization and individual purposes by categories and states, or key phrases. Using our advanced search option, discovering the latest Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as elementary as 1-2-3. In addition, the relevance of each and every document is verified by a group of skilled lawyers that on a regular basis check the templates on our platform and update them in accordance with the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to log in to your user profile and click the Download button.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have opened the sample you require. Read its explanation and make use of the Preview option (if available) to explore its content. If it doesn’t meet your needs, use the Search field at the top of the screen to find the needed file.

- Confirm your choice. Select the Buy now button. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the transaction. Use your bank card or PayPal account to finish the registration procedure.

- Receive the form. Choose the file format and save it to your system.

- Make modifications. Fill out, modify, print, and sign the acquired Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

Each and every form you add to your user profile does not have an expiry date and is yours forever. It is possible to access them using the My Forms menu, so if you want to get an additional duplicate for editing or creating a hard copy, you may return and export it once again anytime.

Take advantage of the US Legal Forms extensive library to get access to the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate you were seeking and thousands of other professional and state-specific samples in one place!