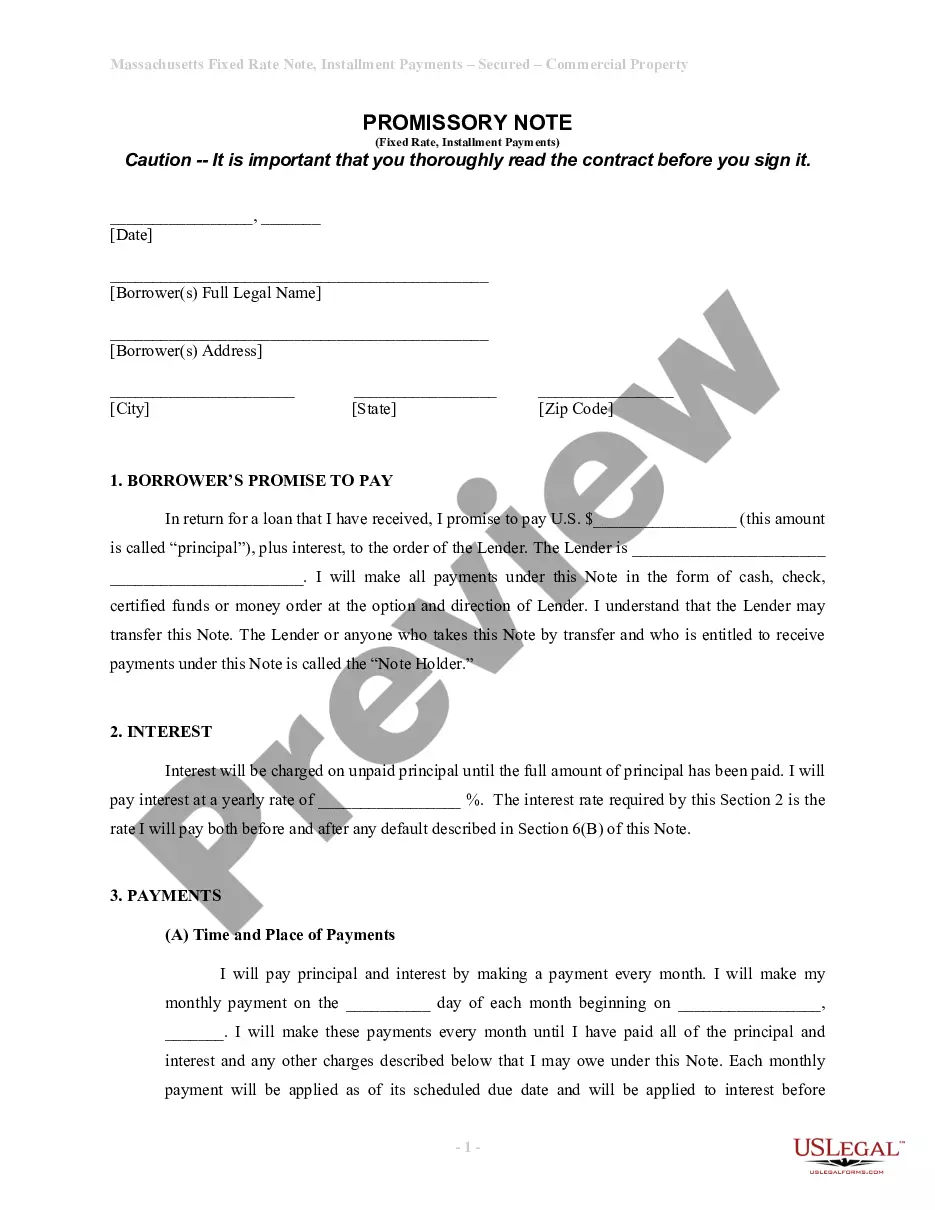

Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

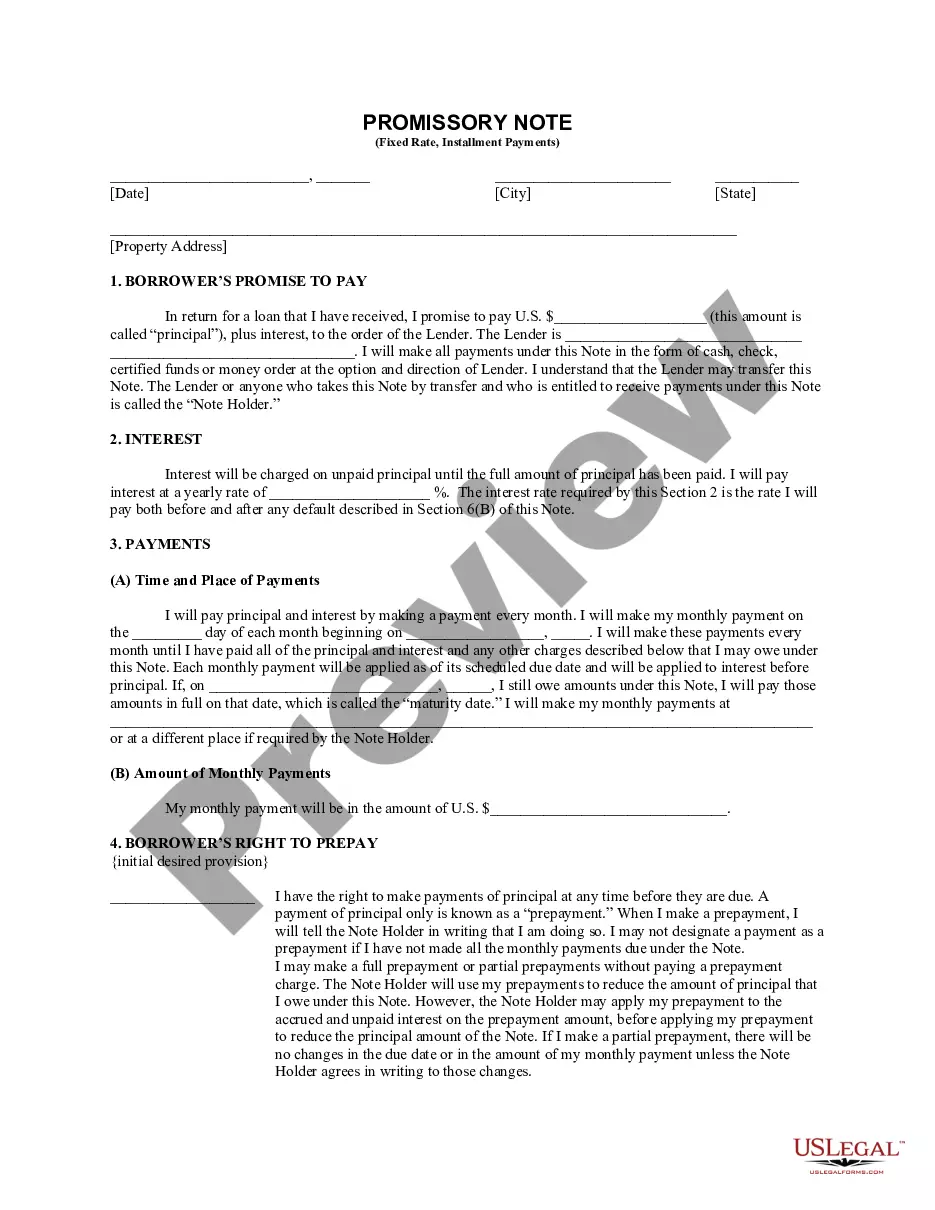

How to fill out Massachusetts Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are seeking a legitimate form, it’s exceedingly challenging to locate a more user-friendly platform than the US Legal Forms website – one of the largest online repositories.

Here you can find thousands of document templates for both organizational and personal use categorized by type and state, or by key terms.

Utilizing our sophisticated search feature, uncovering the latest Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as simple as 1-2-3.

Obtain the form. Select the file format and save it to your device.

Make adjustments. Complete, alter, print, and sign the acquired Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

- If you are already familiar with our platform and hold a registered account, all you need to do to obtain the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just follow the steps outlined below.

- Ensure you have accessed the template you need. Review its description and utilize the Preview option (if available) to inspect its contents. If it doesn’t satisfy your requirements, use the Search field at the top of the page to locate the desired document.

- Verify your selection. Click the Buy now button. Following that, choose your desired subscription plan and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

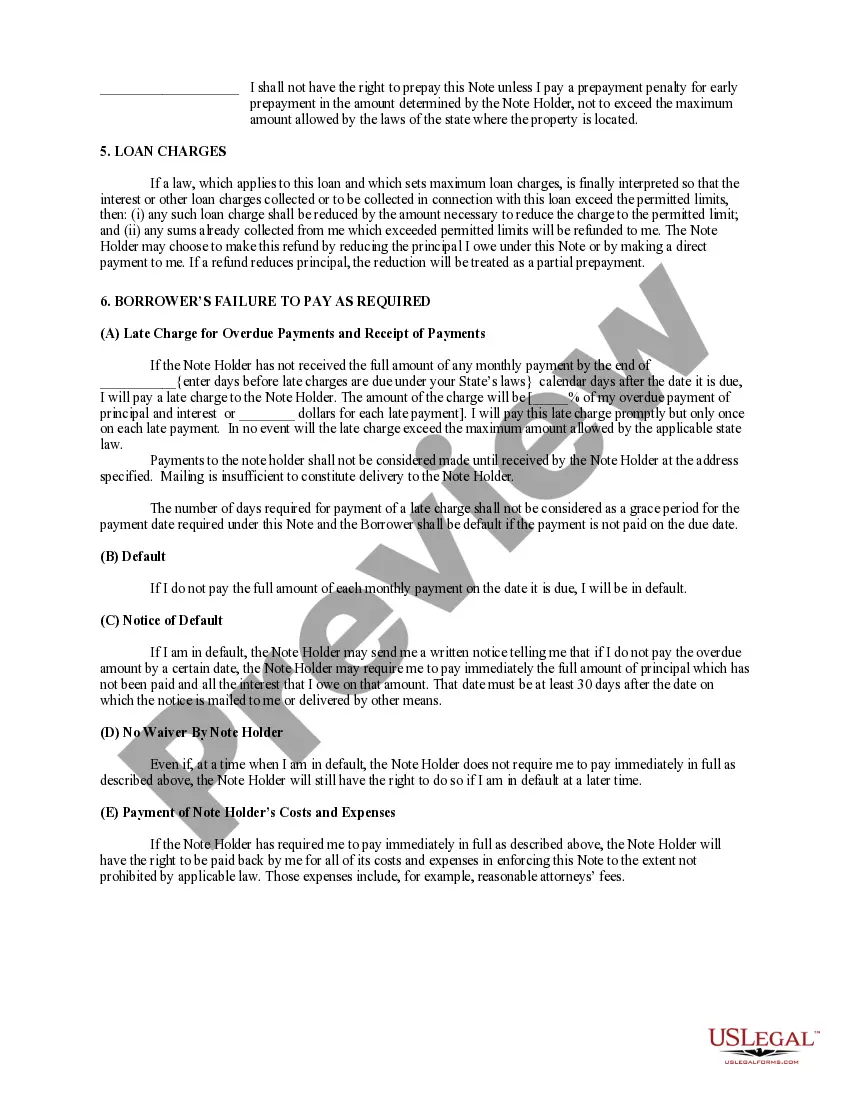

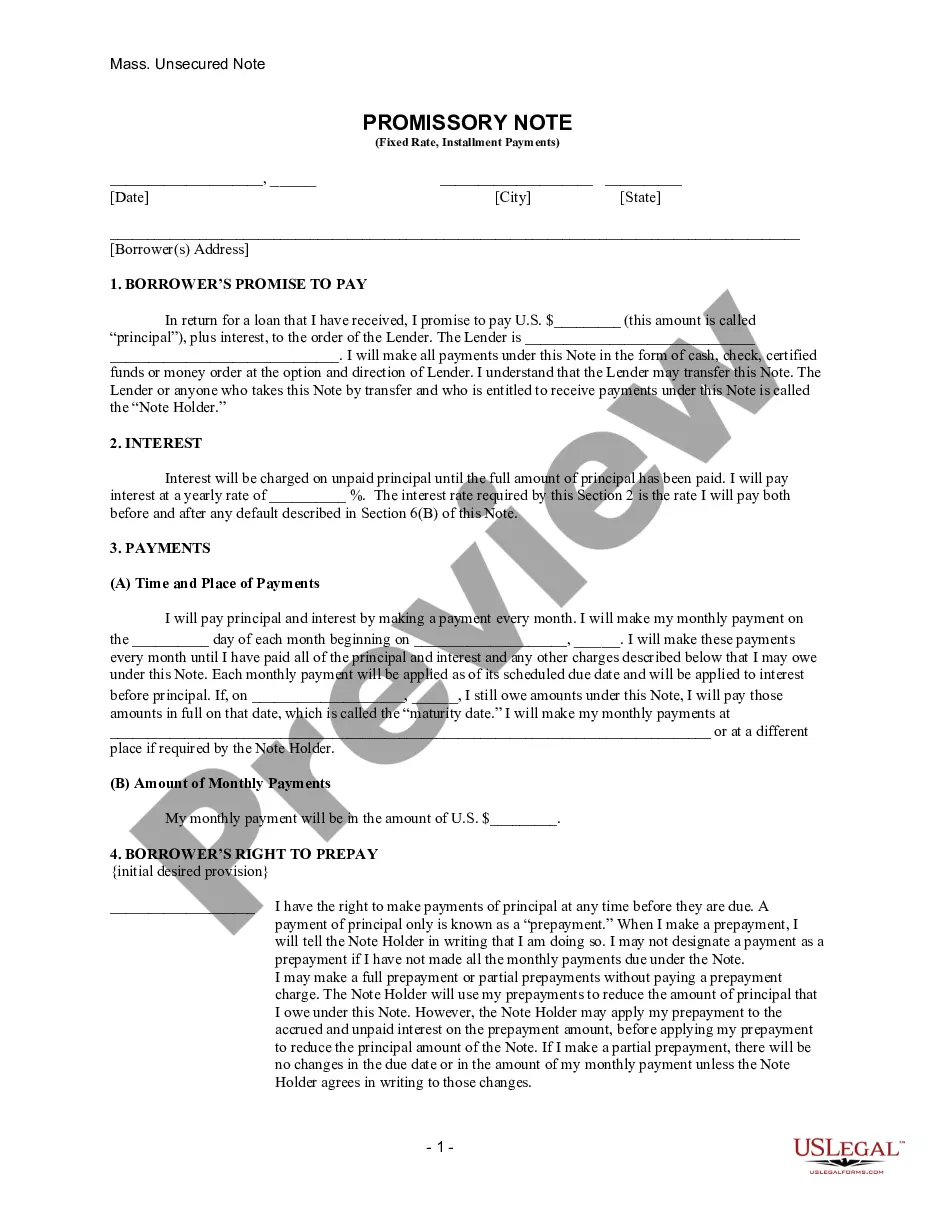

The entry of a promissory note includes essential details such as the date, the amount borrowed, the interest rate, and the repayment timeline. In the case of a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it’s crucial to document the property used as security. This ensures that both parties have a clear understanding of the terms and obligations.

You typically file a promissory note at the county recorder's office where the property is located, such as in Middlesex, Massachusetts. After execution, ensure you provide necessary documentation to hold the note securely. A Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate allows for better tracking and enforcement of the agreement. For streamlined forms and guidance, consider utilizing the UsLegalForms platform to simplify this process.

Yes, a promissory note can appear on your credit report if the lender reports it to credit agencies. Specifically, a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate could impact your credit score based on your repayment history. Failing to make payments on this note may lead to negative implications for your creditworthiness. Therefore, staying consistent with your payments is important.

When reporting a promissory note on your taxes, include any interest income you receive as part of your gross income. With a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate, keep detailed records of payments received and interest accrued. Consult a tax professional to ensure compliance with IRS regulations. They can guide you on how to report your income accurately and optimize your tax benefits.

A reasonable interest rate for a promissory note varies based on market conditions and the creditworthiness of the borrower. Typically, interest rates for a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate are competitive with local mortgage rates. Research local averages and consider consulting financial professionals to determine an appropriate rate for your situation. This careful consideration can help avoid disputes later.

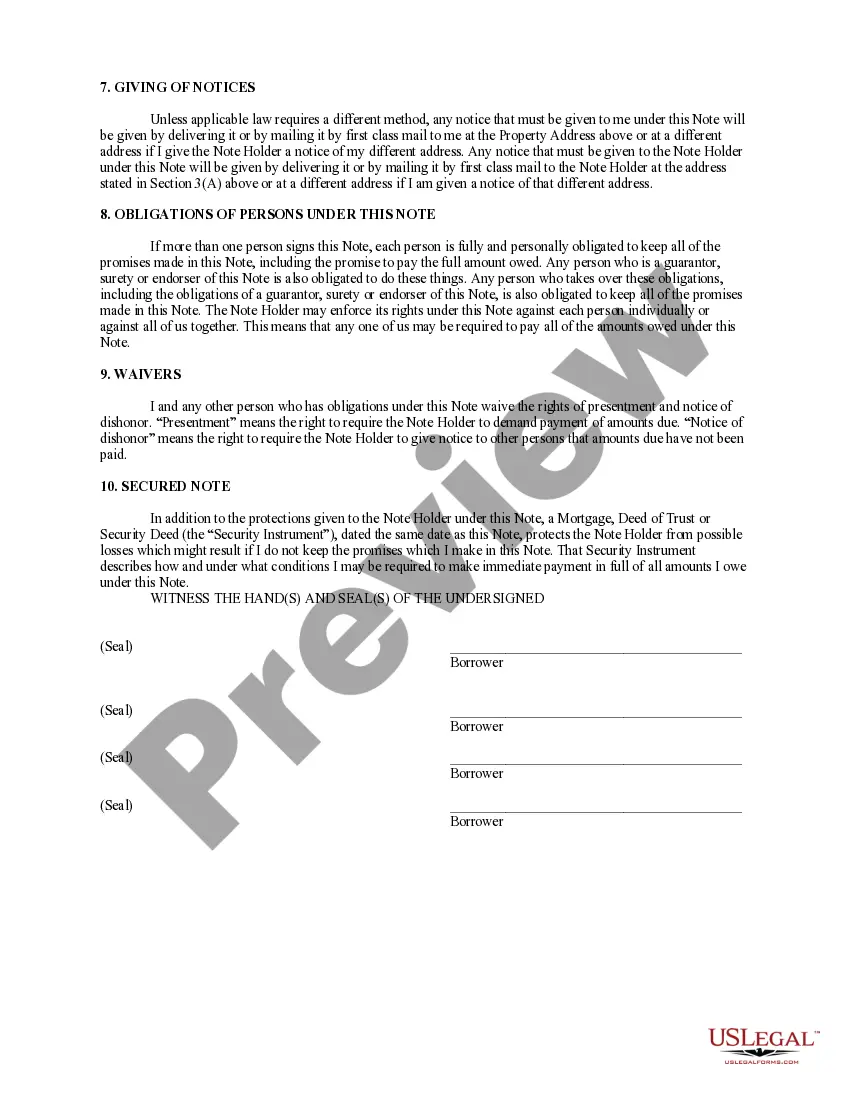

A promissory note can hold up in court if it is properly drafted and executed. Courts typically enforce the terms outlined in the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate, assuming all legal requirements are met. To enhance its enforceability, ensure that all parties sign the document and that it is clear about payment terms. It's wise to consult legal experts for drafting to strengthen your position.

In Massachusetts, it is not strictly necessary for a promissory note to be notarized, but doing so is highly recommended. Notarization adds an extra layer of authenticity and can be particularly useful for the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate, especially in disputes. It is wise to follow standard legal practices to ensure your documents hold up in any legal context.

To obtain a promissory note for a mortgage, you can start by discussing options with your lender or bank. They often provide the necessary documentation for a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate. Alternatively, consider using online services like USLegalForms, where you can access customizable templates suited to your needs.

You can obtain a promissory note for your mortgage from various sources, including lenders, banks, and online platforms. Websites like USLegalForms offer templates specifically for the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate, making it easier to create a compliant and effective document. Ensure you review any document thoroughly before use.

Securing a promissory note with real property involves creating a mortgage or deed of trust against the property. This allows the lender to claim the property if the borrower defaults on payments related to the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It is often advisable to collaborate with a real estate professional to ensure all legalities are satisfied.