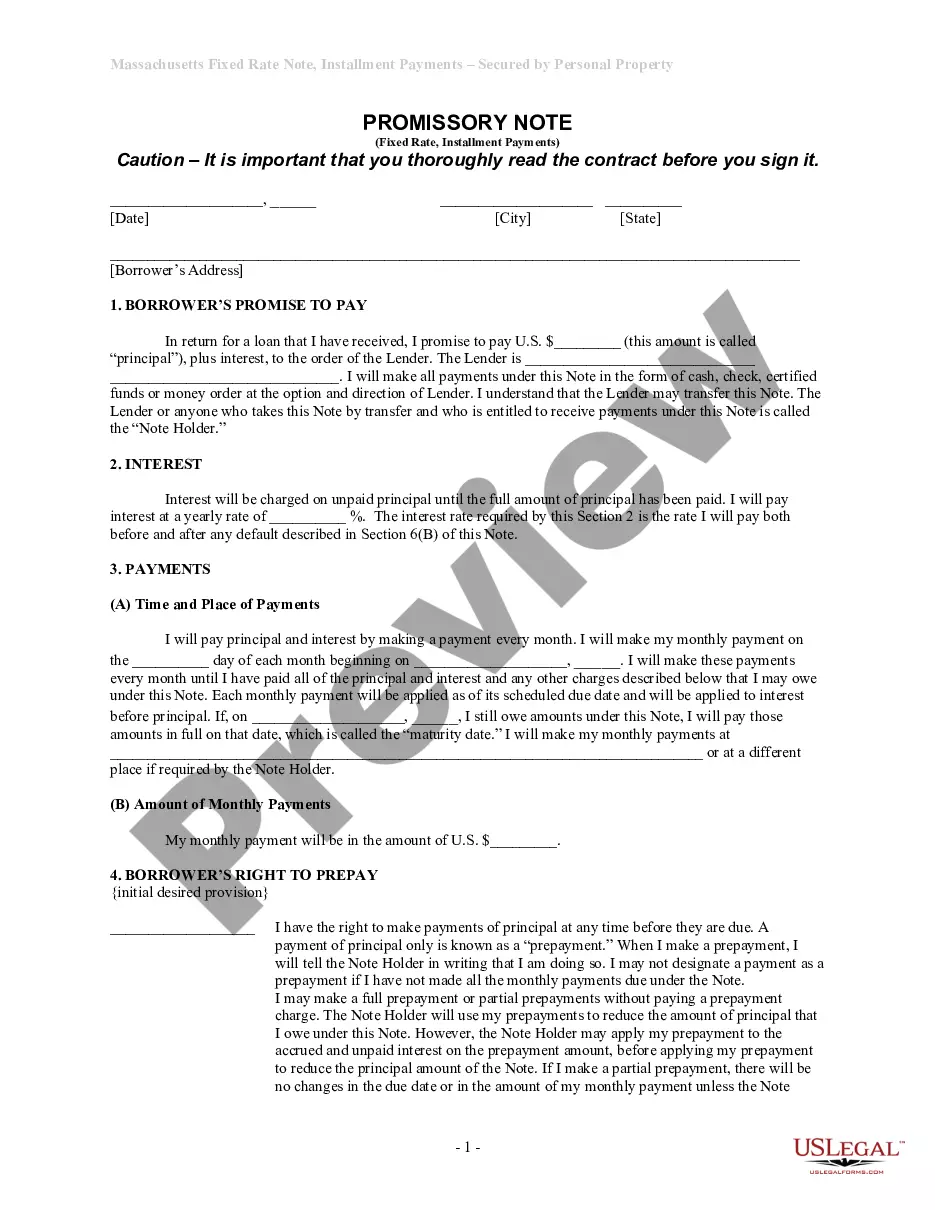

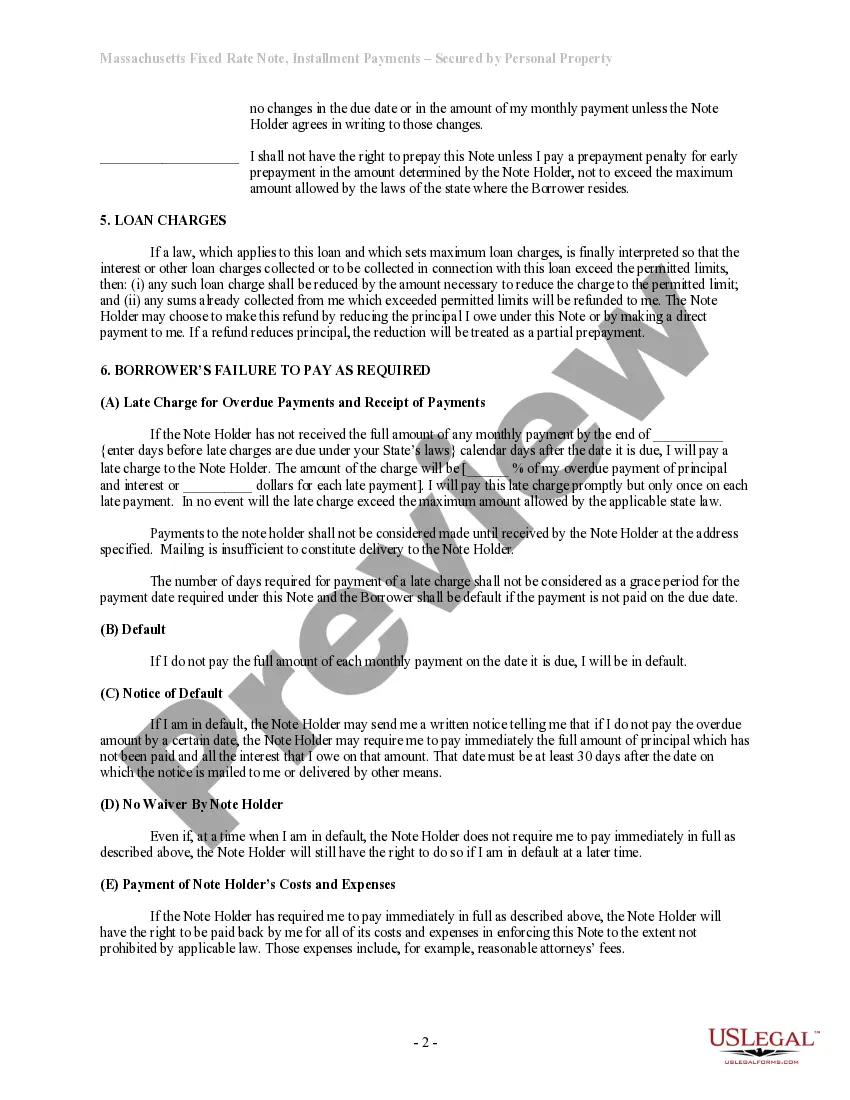

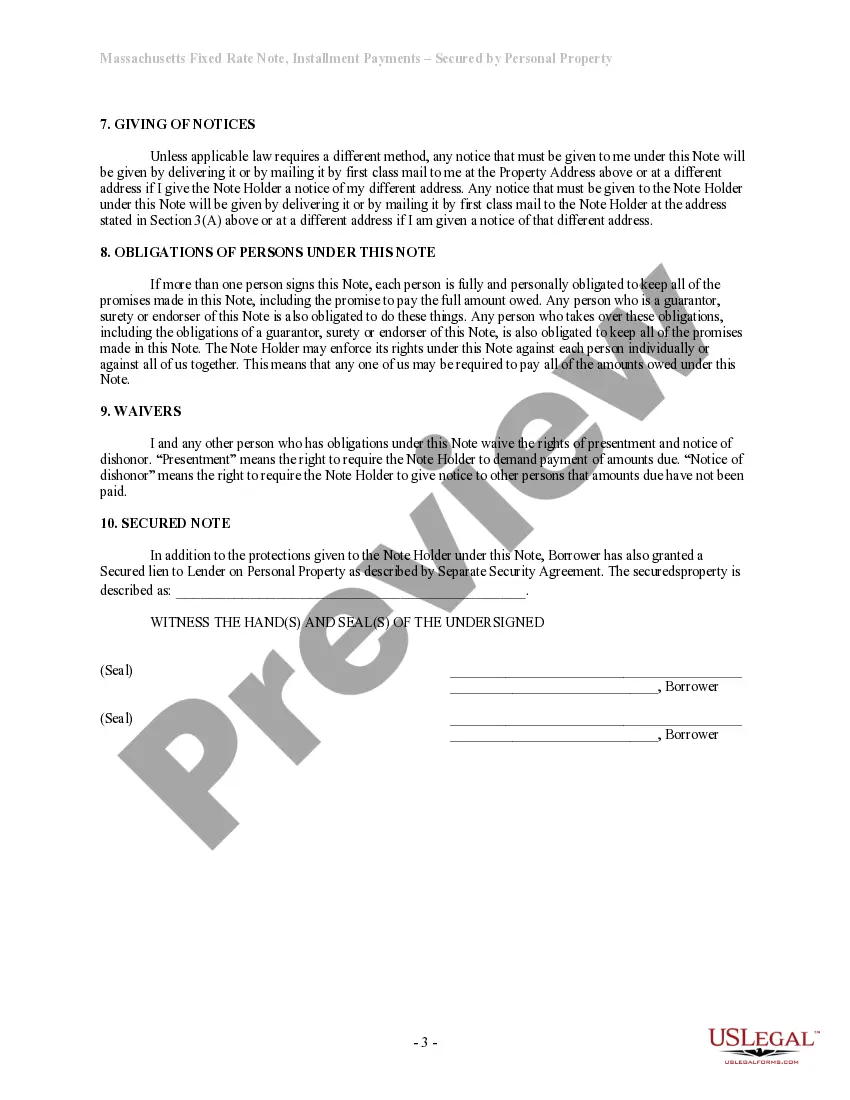

A Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines a loan agreement between a borrower and a lender in the state of Massachusetts. This type of promissory note is used when a borrower wants to obtain a loan and pledges personal property as collateral to secure the loan. The note specifies that the loan will be repaid in fixed installments over a certain period of time, with a predetermined interest rate. The borrower agrees to make regular payments on the loan, which are distributed evenly across the loan term, ensuring a consistent payment schedule. The interest rate remains fixed throughout the loan term, providing stability to both parties involved. The note explicitly mentions that personal property is being used as collateral to secure the loan. Personal property can include movable assets such as vehicles, equipment, or valuable items that can be easily converted into cash. The borrower transfers legal ownership of this personal property to the lender until the loan is fully repaid, ensuring that the lender has a form of security in case the borrower defaults on the loan payments. It is important to note that there may be different types of Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property, each tailored to specific loan requirements or preferences. These variations could include options for specific types of personal property to be used as collateral, such as a car or jewelry, or additional terms and conditions that are unique to the loan agreement. Overall, a Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property serves as a legal contract that protects the interests of both the borrower and the lender in a loan transaction. It ensures that the borrower receives the necessary funds while demonstrating a commitment to repay the loan in a structured manner. Meanwhile, the lender gains reassurance through the collateral provided by the borrower, reducing their risk in case of default.

Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property

Category:

State:

Massachusetts

City:

Boston

Control #:

MA-NOTESEC2

Format:

Word;

Rich Text

Instant download

Description

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

A Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines a loan agreement between a borrower and a lender in the state of Massachusetts. This type of promissory note is used when a borrower wants to obtain a loan and pledges personal property as collateral to secure the loan. The note specifies that the loan will be repaid in fixed installments over a certain period of time, with a predetermined interest rate. The borrower agrees to make regular payments on the loan, which are distributed evenly across the loan term, ensuring a consistent payment schedule. The interest rate remains fixed throughout the loan term, providing stability to both parties involved. The note explicitly mentions that personal property is being used as collateral to secure the loan. Personal property can include movable assets such as vehicles, equipment, or valuable items that can be easily converted into cash. The borrower transfers legal ownership of this personal property to the lender until the loan is fully repaid, ensuring that the lender has a form of security in case the borrower defaults on the loan payments. It is important to note that there may be different types of Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property, each tailored to specific loan requirements or preferences. These variations could include options for specific types of personal property to be used as collateral, such as a car or jewelry, or additional terms and conditions that are unique to the loan agreement. Overall, a Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property serves as a legal contract that protects the interests of both the borrower and the lender in a loan transaction. It ensures that the borrower receives the necessary funds while demonstrating a commitment to repay the loan in a structured manner. Meanwhile, the lender gains reassurance through the collateral provided by the borrower, reducing their risk in case of default.

Free preview

How to fill out Boston Massachusetts Installments Fixed Rate Promissory Note Secured By Personal Property?

Regardless of social or professional standing, completing legal documents is a regrettable requirement in today’s professional landscape.

Frequently, it’s nearly unfeasible for someone lacking legal training to generate such paperwork from scratch, predominantly due to the intricate language and legal nuances involved.

This is where US Legal Forms proves to be useful.

Ensure that the template you have found is appropriate for your region since the laws of one state or locality do not apply to another.

Review the document and check a brief summary (if available) of the situations the form can be utilized for.

- Our platform offers an extensive library of over 85,000 ready-to-use state-specific documents that are applicable to nearly any legal situation.

- US Legal Forms also represents a valuable resource for associates or legal advisors seeking to enhance their efficiency with our DYI forms.

- Whether you need the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property or any other suitable document for your state or locality, US Legal Forms has it all.

- Here’s how you can acquire the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property in just a few minutes using our reliable platform.

- If you are already a customer, you can proceed to Log In/">Log In to your account and download the necessary form.

- If you are new to our platform, make sure to follow these steps before acquiring the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property.