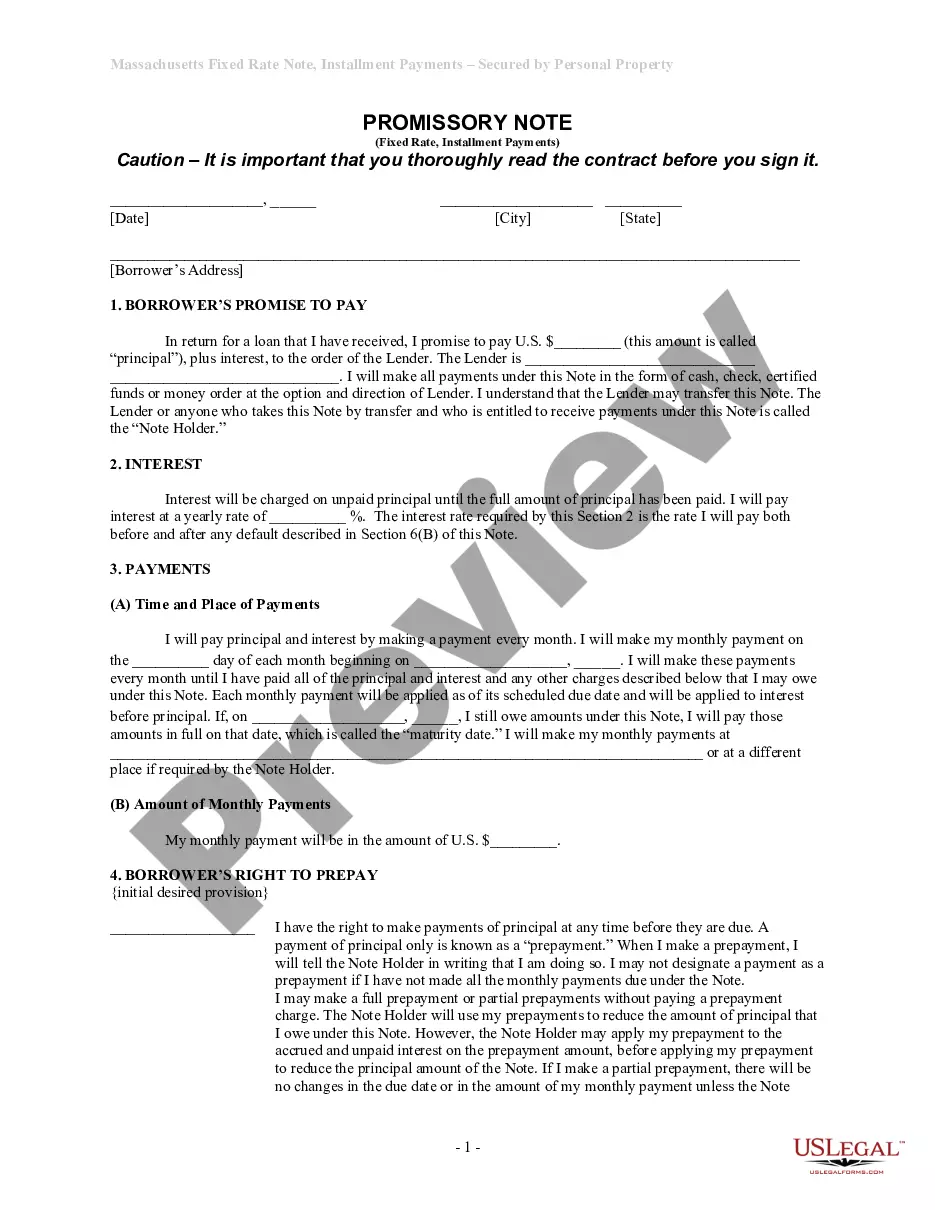

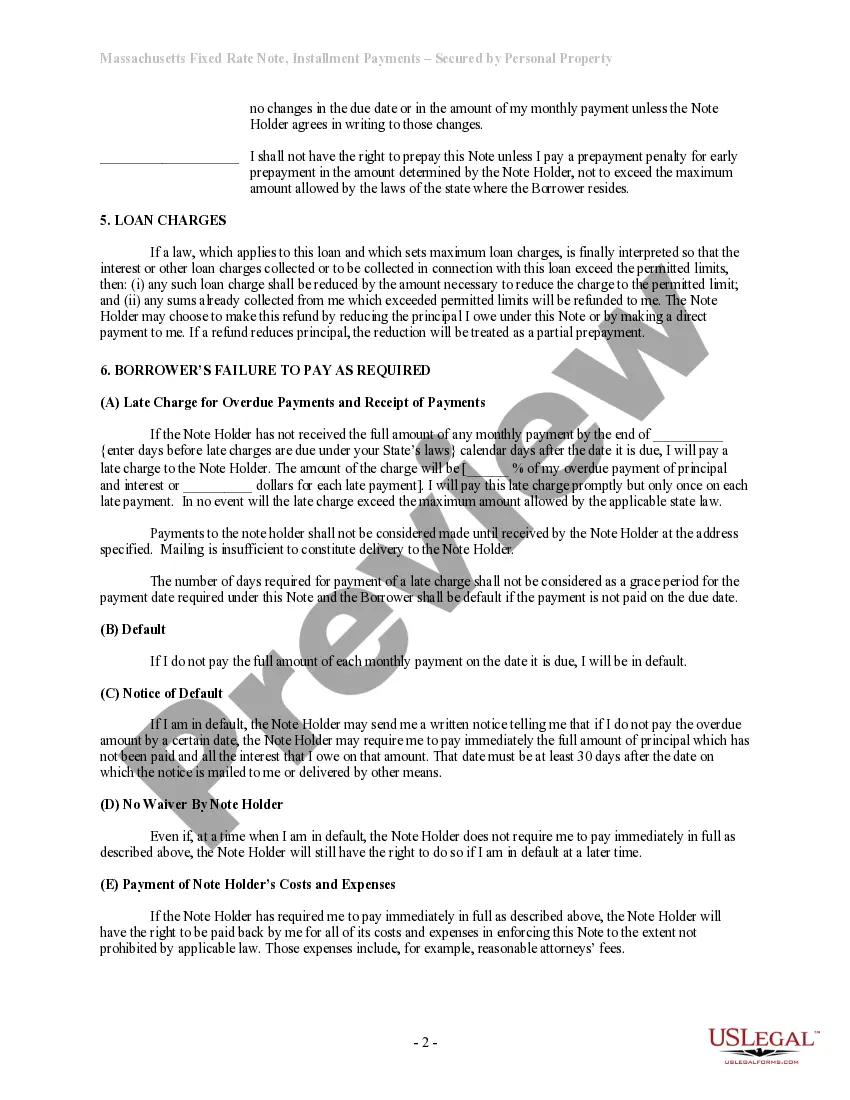

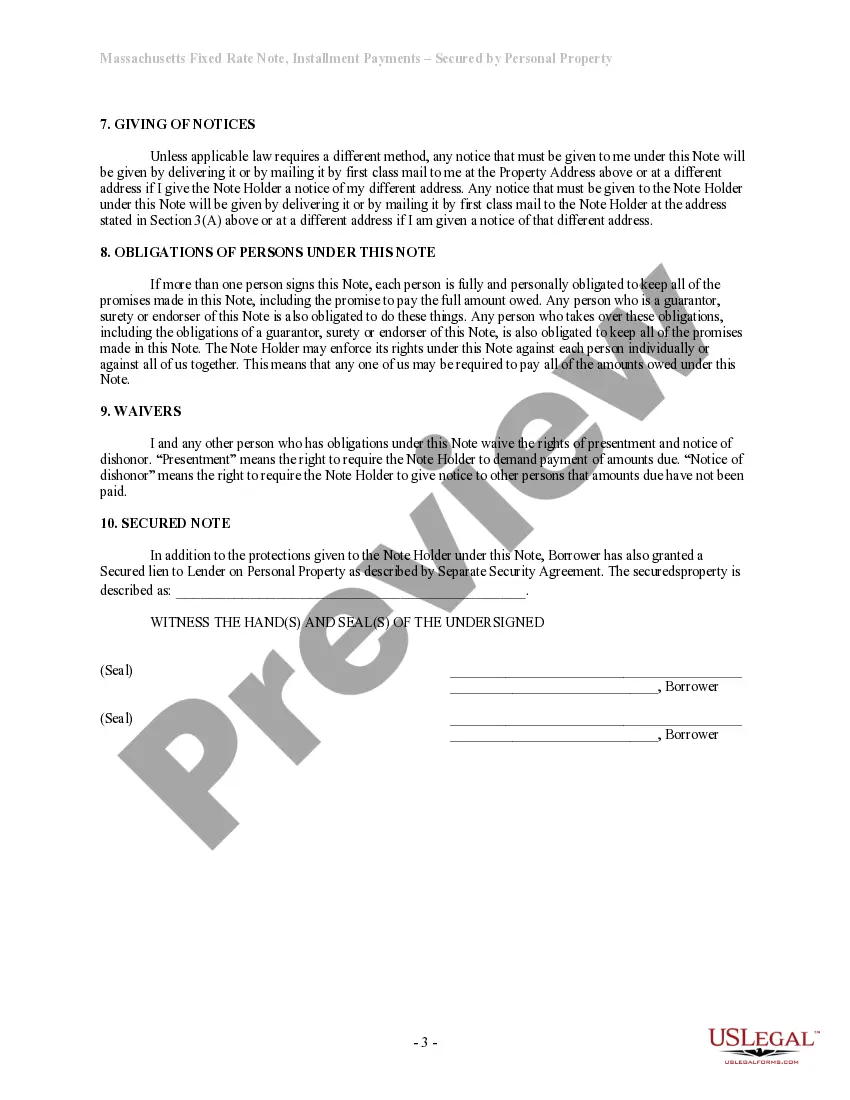

A Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding contract that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Cambridge, Massachusetts. This type of promissory note allows for repayment in regular, predetermined installments, with a fixed interest rate attached to it. To ensure loan repayment, the borrower pledges personal property as collateral, thereby securing the loan. There are various types of Cambridge Massachusetts Installments Fixed Rate Promissory Notes Secured by Personal Property available, each with its own unique features and requirements. Some common types include: 1. Residential Property Promissory Note: This type of promissory note is specifically designed for residential properties in Cambridge, Massachusetts. It allows homeowners to secure a loan by pledging their property as collateral while ensuring repayment through scheduled installments and a fixed rate of interest. 2. Commercial Property Promissory Note: This promissory note is tailored for businesses and commercial entities operating within Cambridge, Massachusetts. It enables business owners to secure funding and expand their operations by utilizing their commercial property as collateral. The repayment terms and fixed interest rate are determined by mutual agreement between the lender and borrower. 3. Vehicle Promissory Note: This particular promissory note is meant for individuals seeking financing options to purchase a vehicle in Cambridge, Massachusetts. By pledging the vehicle as collateral, borrowers can secure a loan and repay it in installments, with a fixed interest rate. 4. Inventory Promissory Note: This type of promissory note is suitable for Cambridge-based businesses that need additional capital to expand their inventory. By securing the loan with existing inventory, businesses can benefit from scheduled installments and a fixed interest rate. In conclusion, a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is a versatile financial instrument that provides borrowers in Cambridge, Massachusetts, with the opportunity to secure loans, based on their specific needs. The various types of promissory notes available cater to an array of requirements, from residential and commercial properties to vehicles and inventory. It is important for both lenders and borrowers to carefully read and understand the terms and conditions of these promissory notes before entering into an agreement.

A Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding contract that outlines the terms and conditions of a loan agreement between a lender and a borrower in the city of Cambridge, Massachusetts. This type of promissory note allows for repayment in regular, predetermined installments, with a fixed interest rate attached to it. To ensure loan repayment, the borrower pledges personal property as collateral, thereby securing the loan. There are various types of Cambridge Massachusetts Installments Fixed Rate Promissory Notes Secured by Personal Property available, each with its own unique features and requirements. Some common types include: 1. Residential Property Promissory Note: This type of promissory note is specifically designed for residential properties in Cambridge, Massachusetts. It allows homeowners to secure a loan by pledging their property as collateral while ensuring repayment through scheduled installments and a fixed rate of interest. 2. Commercial Property Promissory Note: This promissory note is tailored for businesses and commercial entities operating within Cambridge, Massachusetts. It enables business owners to secure funding and expand their operations by utilizing their commercial property as collateral. The repayment terms and fixed interest rate are determined by mutual agreement between the lender and borrower. 3. Vehicle Promissory Note: This particular promissory note is meant for individuals seeking financing options to purchase a vehicle in Cambridge, Massachusetts. By pledging the vehicle as collateral, borrowers can secure a loan and repay it in installments, with a fixed interest rate. 4. Inventory Promissory Note: This type of promissory note is suitable for Cambridge-based businesses that need additional capital to expand their inventory. By securing the loan with existing inventory, businesses can benefit from scheduled installments and a fixed interest rate. In conclusion, a Cambridge Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is a versatile financial instrument that provides borrowers in Cambridge, Massachusetts, with the opportunity to secure loans, based on their specific needs. The various types of promissory notes available cater to an array of requirements, from residential and commercial properties to vehicles and inventory. It is important for both lenders and borrowers to carefully read and understand the terms and conditions of these promissory notes before entering into an agreement.