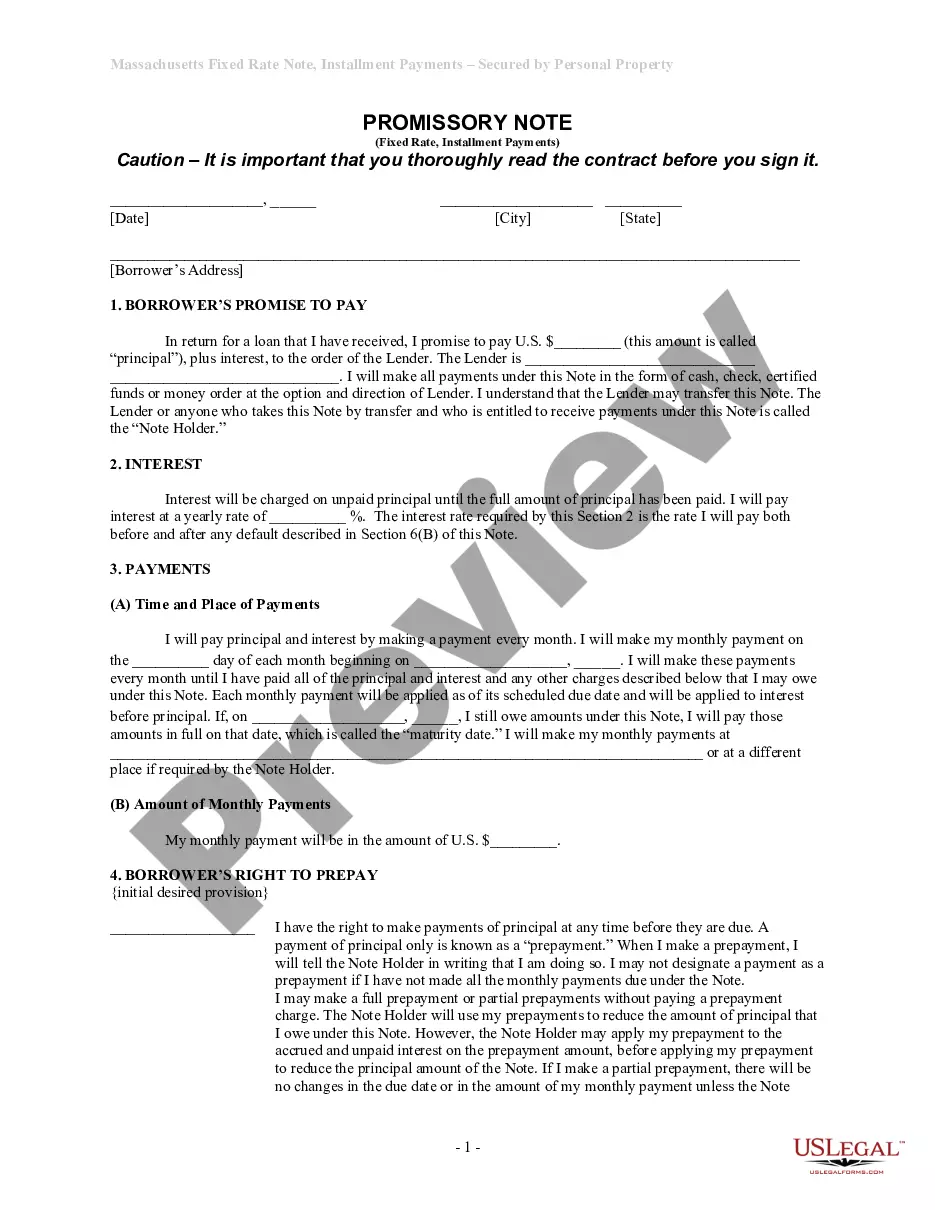

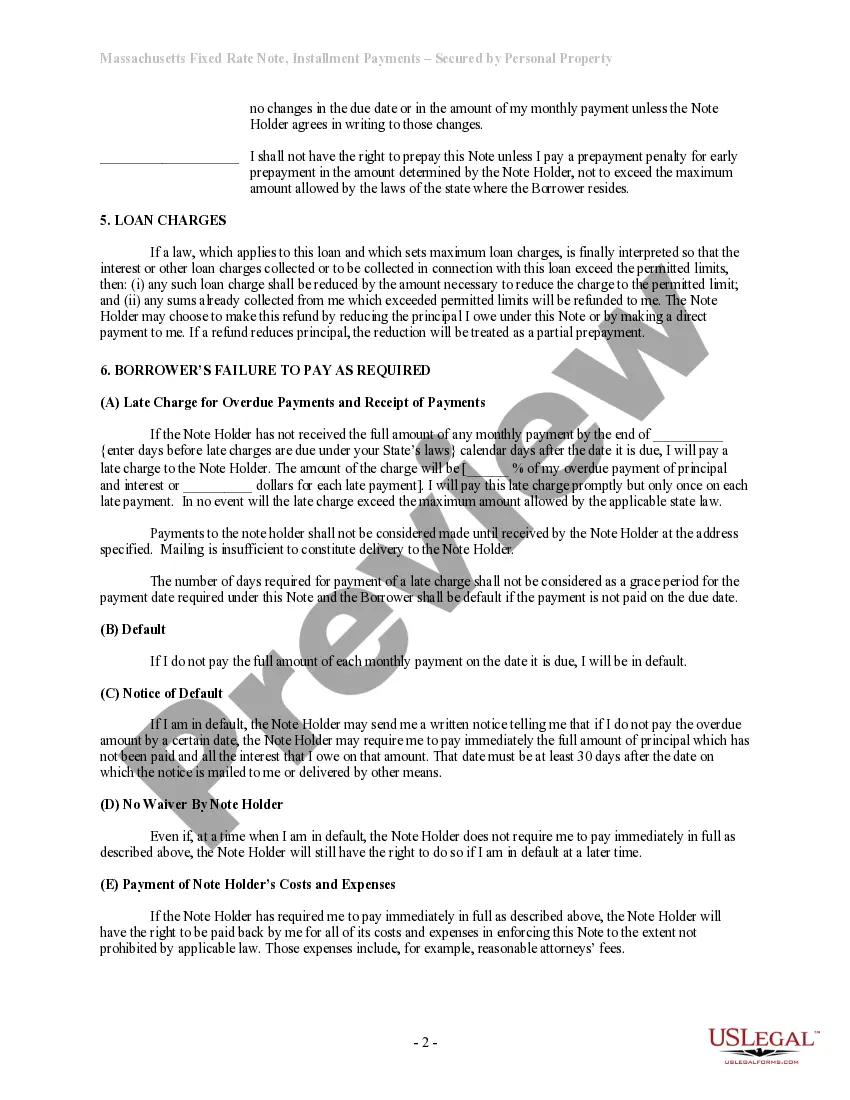

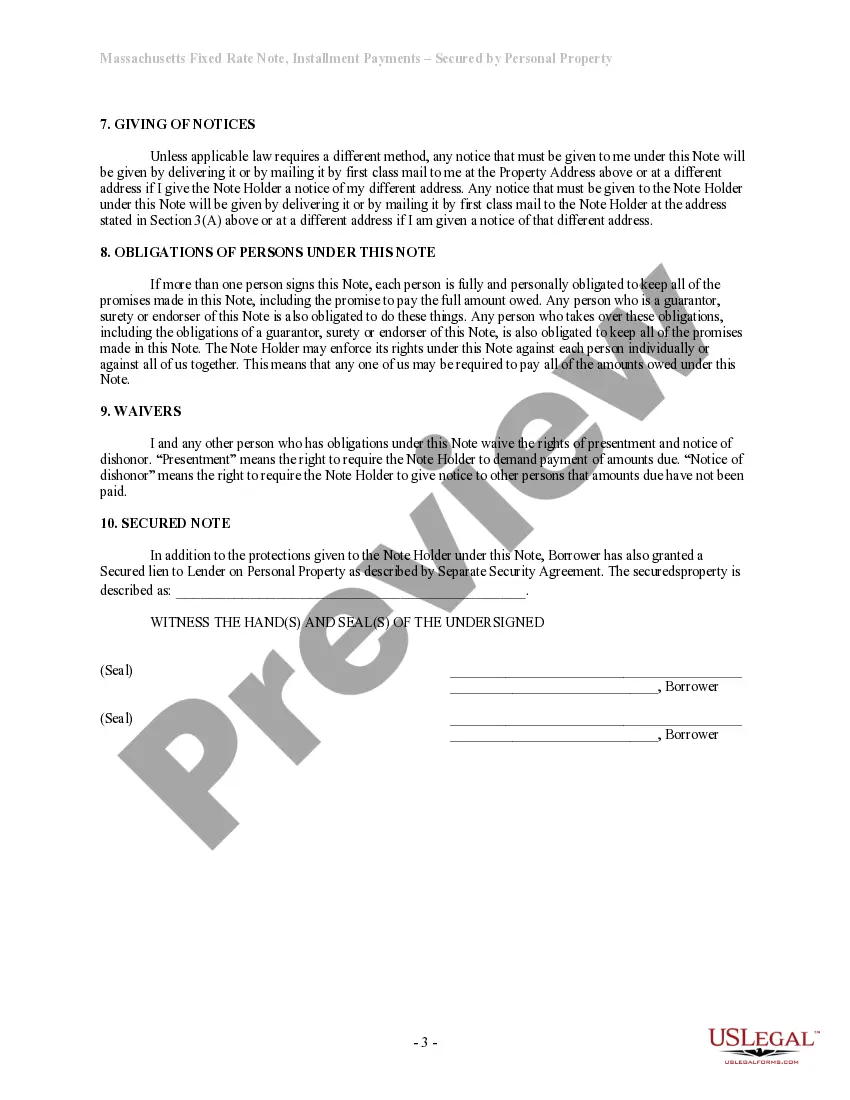

A Lowell Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property is an agreement made between a lender and a borrower in Lowell, Massachusetts. This legally binding document outlines the terms and conditions of a loan, including repayment schedule, interest rate, and the collateral used to secure the loan. The primary purpose of this promissory note is to provide clarity and protection for both parties involved. By signing this agreement, the borrower promises to repay the loan amount, plus any interest due, in regular installments over a predetermined period. This arrangement ensures that the lender receives their funds back in a consistent and timely manner. In Lowell, Massachusetts, there are several types of Installments Fixed Rate Promissory Notes Secured by Personal Property that cater to different financial needs. These may include: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for small personal loans, such as financing a vehicle or paying for education expenses. Personal property, such as a car or personal belongings, is used as collateral to secure the loan. 2. Home Equity Line of Credit (HELOT) Promissory Note: This note is specific to individuals who have sufficient equity in their homes. By using the home as collateral, borrowers can secure a loan with a lower interest rate and extended repayment terms. This type of promissory note is popular among homeowners seeking to fund major expenses, such as home renovations or medical bills. 3. Business Loan Promissory Note: Entrepreneurs and business owners in Lowell can secure loans to start or expand their ventures. This promissory note utilizes personal property, such as equipment or inventory, as collateral to guarantee repayment. 4. Student Loan Promissory Note: Students pursuing higher education can secure loans to cover tuition fees and other educational expenses. By signing a promissory note, the borrower agrees to repay the loan with fixed monthly installments after graduation. Personal property may not be required as collateral in this type of promissory note. Regardless of the specific type, a Lowell Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property serves as a legal document that protects the lender's interests and ensures the borrower's commitment to repay the borrowed amount. It is essential for both parties to carefully review and understand the terms outlined in the agreement before signing.

Lowell Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out Lowell Massachusetts Installments Fixed Rate Promissory Note Secured By Personal Property?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Lowell Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Lowell Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few more actions to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Lowell Massachusetts Installments Fixed Rate Promissory Note Secured by Personal Property. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!