Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Massachusetts Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Are you searching for a trustworthy and budget-friendly legal forms provider to obtain the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate? US Legal Forms is your ideal selection.

Whether you require a straightforward contract to establish guidelines for living together with your partner or a bundle of documents to facilitate your separation or divorce through the judicial system, we’ve got you covered. Our site offers over 85,000 current legal document templates for personal and corporate use. All templates we provide access to are not generic and crafted in accordance with the stipulations of particular state and regional requirements.

To acquire the form, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please note that you can retrieve your previously acquired document templates at any time from the My documents tab.

Are you a newcomer to our website? No problem. You can set up an account in minutes, but before that, be sure to follow these steps.

Now you can register your account. Then select the subscription plan and proceed with payment. Once the payment is completed, download the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in any available file format. You can revisit the website at any time and redownload the form without any additional fees.

Locating current legal documents has never been simpler. Try US Legal Forms today, and eliminate the hassle of spending your precious time learning about legal paperwork online once and for all.

- Verify if the Boston Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate complies with the regulations of your state and locality.

- Review the form’s details (if available) to understand who and what the form is designed for.

- Reinitiate the search if the template isn’t suitable for your particular situation.

Form popularity

FAQ

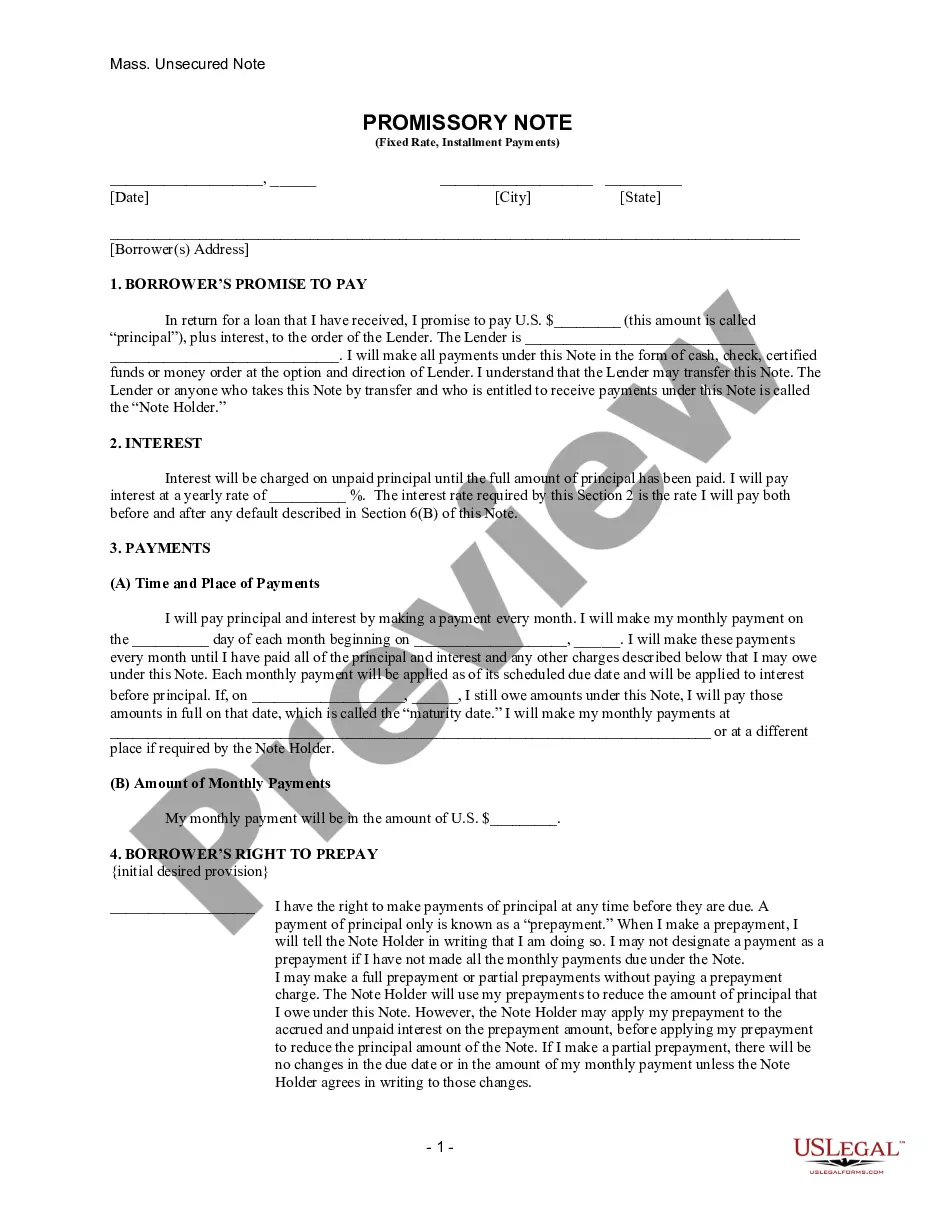

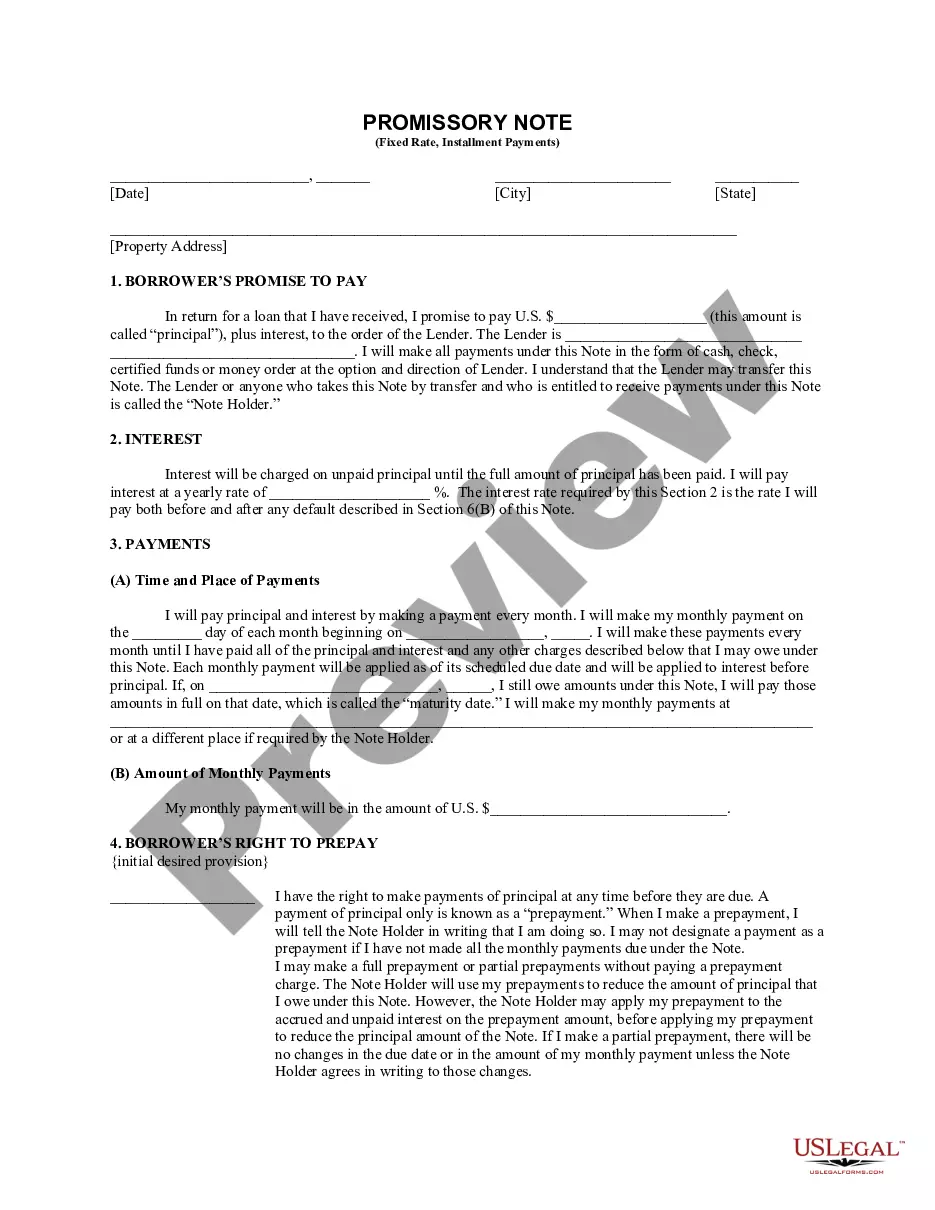

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

A promissory note refers to a written document stating that a certain amount of money will be paid to someone by a specified date. Generally, it is not necessary for the note to be recorded officially. The borrower is required to sign the note, but the lender may choose not to sign it.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

1. Commercial promissory notes: A commercial promissory note is a formal type of promissory note that institutions like credit unions or banks typically issue to borrowers. Commercial lenders might use these for auto loans, personal loans, or business loans to private individuals.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.