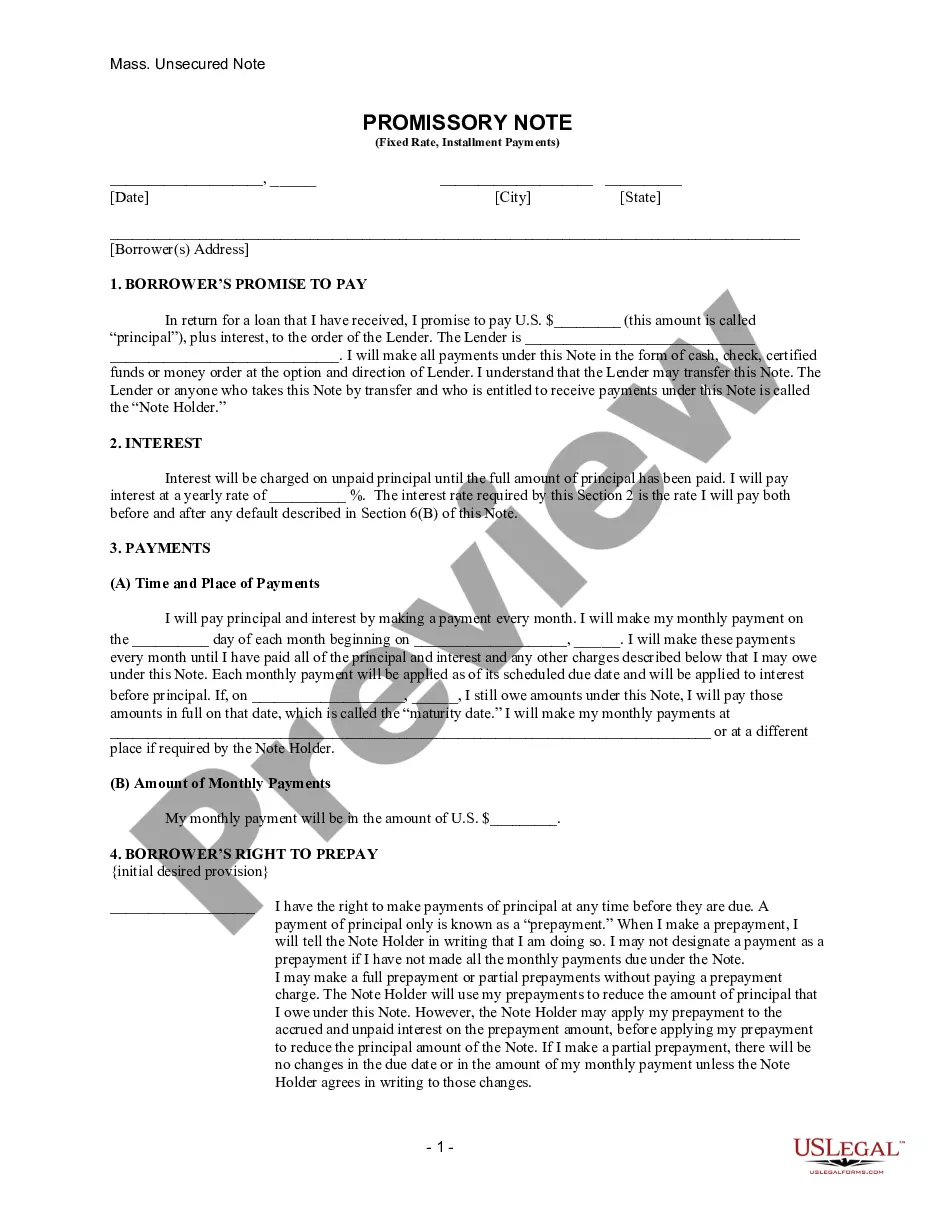

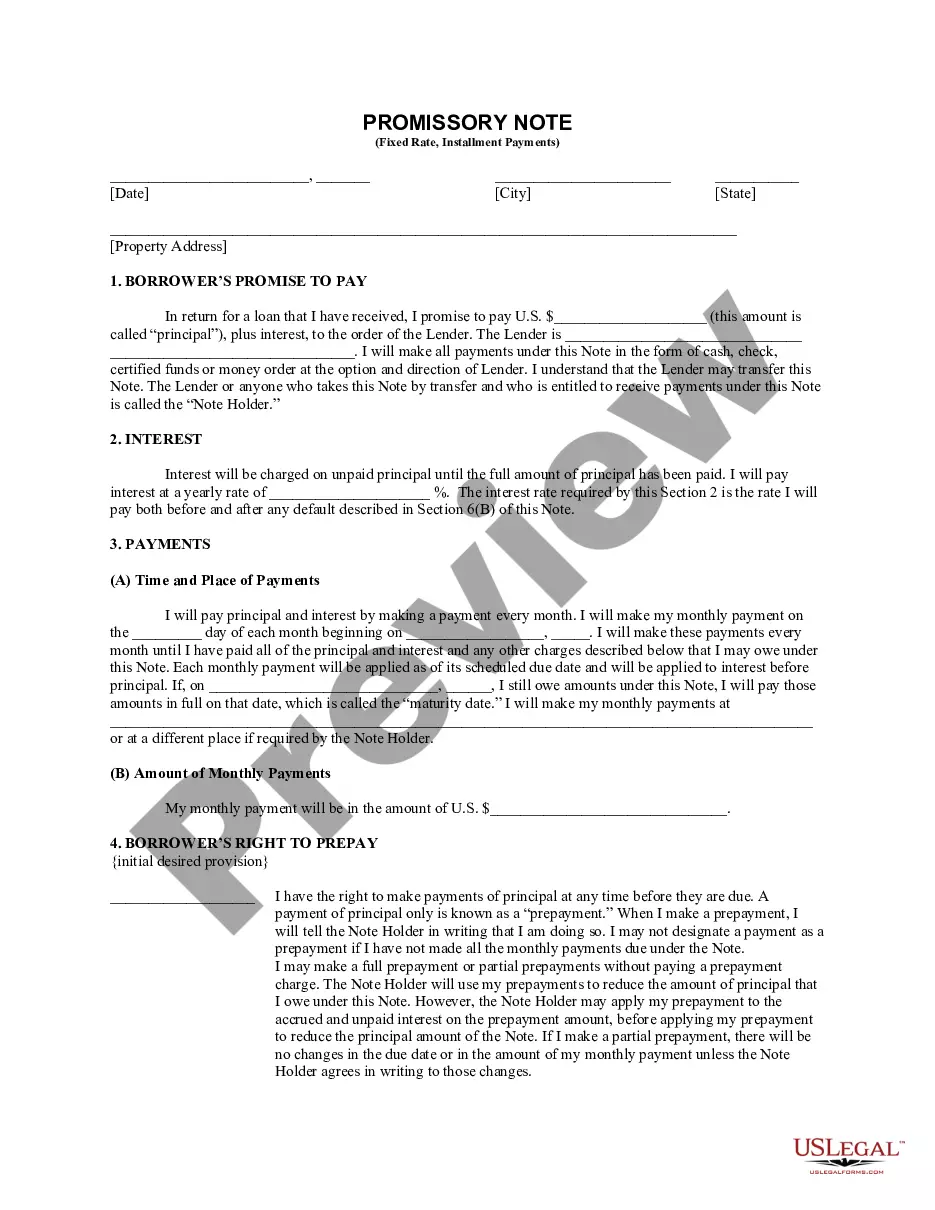

Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Massachusetts Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Do you require a reliable and affordable supplier of legal forms to purchase the Middlesex Massachusetts Installment Fixed Rate Promissory Note Secured by Commercial Real Estate? US Legal Forms is your ideal choice.

Whether you need a simple agreement to establish guidelines for living together with your partner or a bundle of documents to facilitate your divorce proceedings in court, we have you covered. Our platform features over 85,000 current legal document templates for individual and commercial use. All templates we provide are specifically tailored and designed according to the regulations of distinct states and regions.

To acquire the form, you must Log In to your account, locate the desired template, and click the Download button adjacent to it. Please bear in mind that you can retrieve your previously acquired document templates anytime from the My documents tab.

Are you a first-time visitor to our site? No need to worry. You can create an account with great ease, but before that, ensure you do the following.

Now you can establish your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate in any available file format. You can return to the site at any time and re-download the form at no extra cost.

Obtaining current legal documents has never been simpler. Try US Legal Forms today, and stop wasting your precious time learning about legal documents online once and for all.

- Verify that the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate complies with the regulations of your state and locality.

- Review the form's description (if provided) to discover who and what the form is designed for.

- Restart your search if the template isn’t suitable for your particular situation.

Form popularity

FAQ

The document that secures a promissory note to real property is known as a security agreement or a mortgage. This legal instrument establishes the lender's rights to the property, should the borrower fail to meet the repayment obligations. In a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the security agreement is essential for ensuring that both parties have clear understandings of their rights and responsibilities.

The 4 C's of commercial lending refer to Capacity, Character, Capital, and Collateral. These factors help lenders assess the risk of lending to borrowers and determine their creditworthiness. When seeking a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is crucial to present a solid case based on these elements. Understanding and preparing these aspects can enhance your chances of securing financing.

In Massachusetts, notarization of promissory notes is not a strict requirement, but it is highly recommended. Having a note notarized adds an extra layer of verification, which can aid in legal enforceability. This practice is especially important for the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Involving a notary can also provide peace of mind for both parties involved in the transaction.

To secure a promissory note with real property, you will usually create a mortgage or deed of trust that ties the note to the property. This process typically involves filing appropriate documents with your local government to establish the lender's interest in the property. As you navigate these steps, consider using the USLegalForms platform to streamline documentation and ensure compliance with local laws. Doing so will guide you through securing your Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

Yes, a handwritten promissory note can be legal, as long as it meets the essential legal requirements. For the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, ensure that it clearly specifies the amount, terms, and parties involved. However, having a well-structured note may help if disputes arise later. Consider using a professional template for best practices.

Writing a secured promissory note, such as the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, involves specific steps. Start by clearly stating the amount borrowed, the interest rate, and the repayment schedule. Include details about the collateral securing the note and any provisions related to default or breach. Using templates available on platforms like uslegalforms can simplify this process further.

In many cases, a secured promissory note, specifically the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, does need notarization. Notarizing lends credibility to the document and validates the identities of the parties involved. While this is not always a strict requirement, doing so can help prevent disputes later. Check your state laws or consult with a legal expert to ensure compliance.

Yes, a promissory note can go on your public record if it is properly recorded with the county. For any Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this recording can impact your credit profile and show your obligations to lenders. It’s essential to understand that while the note itself becomes a public document, it doesn’t create a negative mark unless there are payment issues. Using US Legal Forms can simplify the process of managing records related to your promissory notes.

When reporting a promissory note on your taxes, you need to consider the interest income it generates. For a Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you must include this interest as taxable income. Additionally, you'll want to keep detailed records of any payments received and expenses related to the note. Consulting a tax professional can provide clarity on specific reporting requirements.

To file a promissory note, you need to record it at the appropriate county office, typically the Registry of Deeds, in Middlesex County, Massachusetts. This action creates a public record of the Middlesex Massachusetts Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. It establishes the note's legal validity and ensures that your rights as a lender are protected. For ease of navigation, you might consider using the US Legal Forms platform to access the correct forms and guidelines.