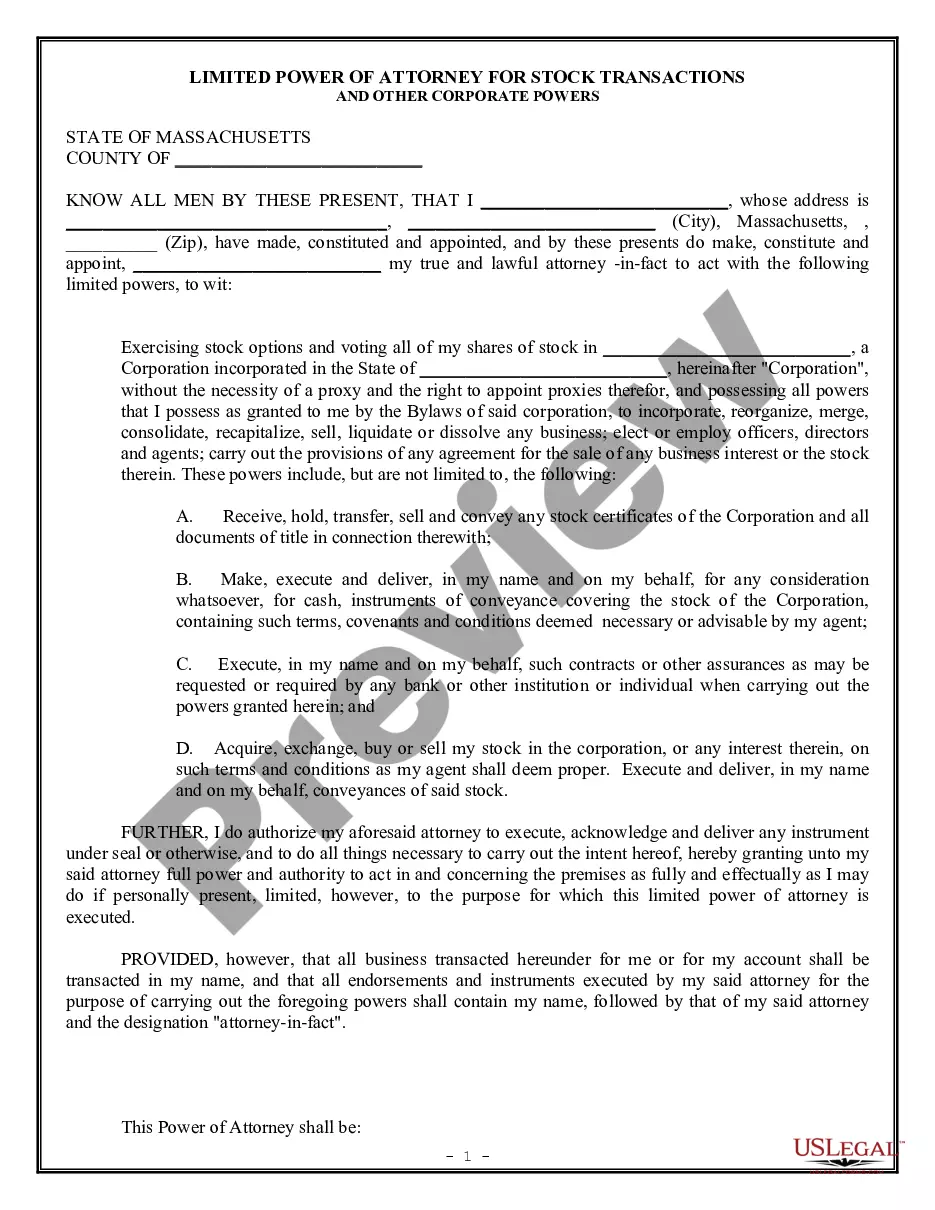

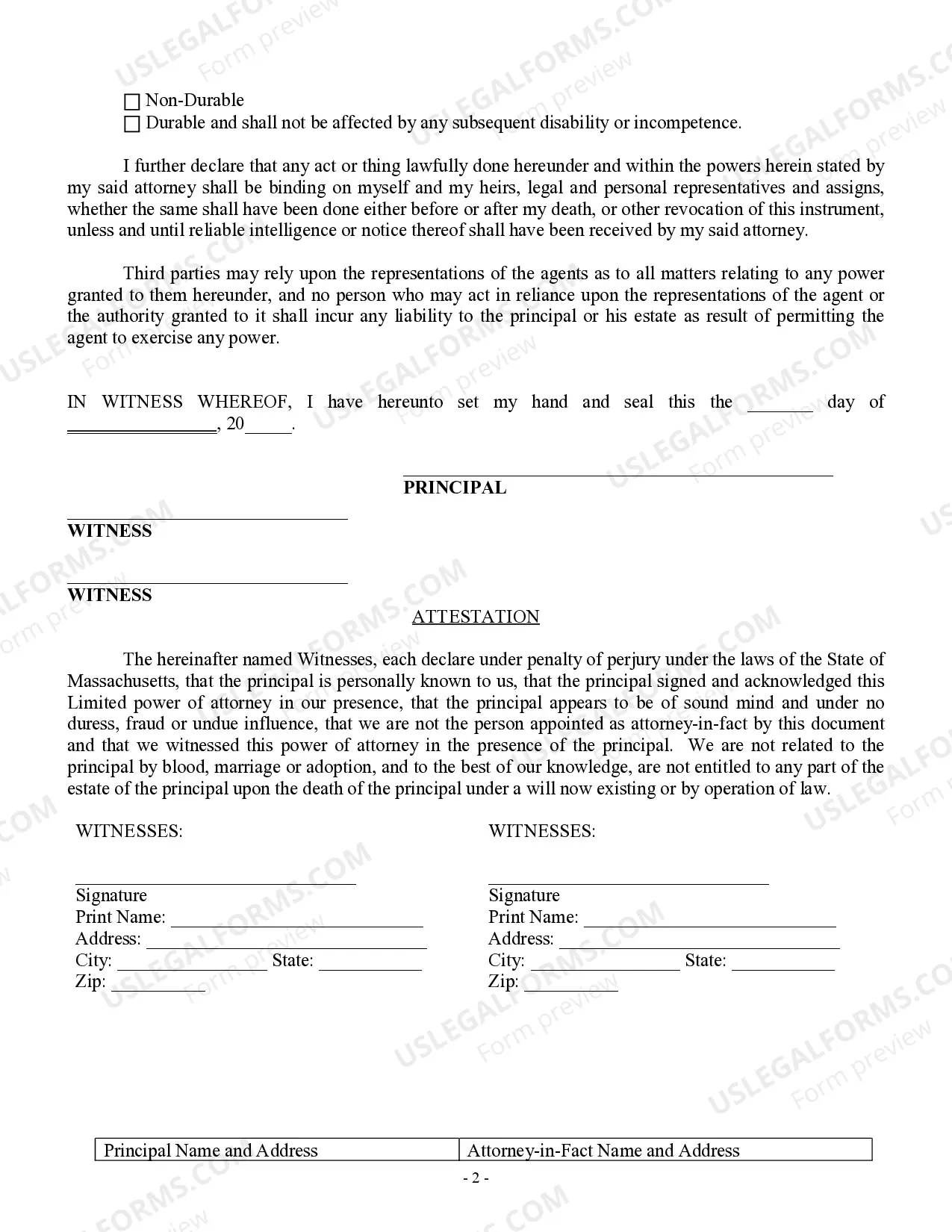

A Limited Power of Attorney for Stock Transactions and Corporate Powers in Boston, Massachusetts is a legal document that grants an individual or entity (the "attorney-in-fact") the authority to act on behalf of another individual or entity (the "principal") in matters related to stock transactions and corporate powers. This power of attorney is "limited" in the sense that it specifically pertains to these particular areas and does not grant authority beyond those outlined powers. The Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers may have various types based on the specific purpose it is intended for. Some common types are: 1. Stock Transactions: This type of limited power of attorney focuses solely on stock-related actions. It empowers the attorney-in-fact to buy, sell, trade, and transfer stocks on behalf of the principal. The attorney-in-fact may have the authority to make investment decisions, manage stock portfolios, and execute various stock-related transactions. 2. Corporate Powers: This type of limited power of attorney grants the attorney-in-fact the authority to represent the principal in broader corporate matters. This may include attending shareholder meetings, voting on behalf of the principal, entering into contracts or agreements on behalf of the principal, managing corporate assets, and undertaking other corporate actions necessary for the principal's business interests. The Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers typically contains key elements to ensure its legal validity. These elements generally include: 1. Identification of the parties: The power of attorney should clearly identify the principal and the attorney-in-fact by their full legal names and contact information. The principal's role as the granter of authority and the attorney-in-fact's role as the recipient of authority should be explicitly stated. 2. Scope of authority: The power of attorney must clearly specify the limits of authority granted to the attorney-in-fact. This includes stating specific actions related to stock transactions and corporate powers that the attorney-in-fact is authorized to undertake. The document may outline particular companies or stock exchanges on which the attorney-in-fact can engage in transactions. 3. Term and revocation: The power of attorney should indicate the duration of its validity, whether it is effective immediately upon execution or if there is a specific start and end date. It should also include provisions for revocation, stating the conditions or processes under which the principal can revoke or terminate the power of attorney. 4. Signatures and notarization: To ensure the document's legality, the power of attorney must be signed by both the principal and the attorney-in-fact. Notarization may also be required to authenticate the signatures and confirm the principal's capacity to grant such authority. It is important to note that the specific content and requirements of a Limited Power of Attorney for Stock Transactions and Corporate Powers may vary based on the preferences and needs of the principal, as well as any applicable state laws or regulations in Massachusetts. Therefore, it is recommended to consult with a legal professional to ensure the power of attorney accurately reflects the principal's intentions and complies with all legal requirements.

Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers

State:

Massachusetts

City:

Boston

Control #:

MA-P099E

Format:

Word;

Rich Text

Instant download

Description

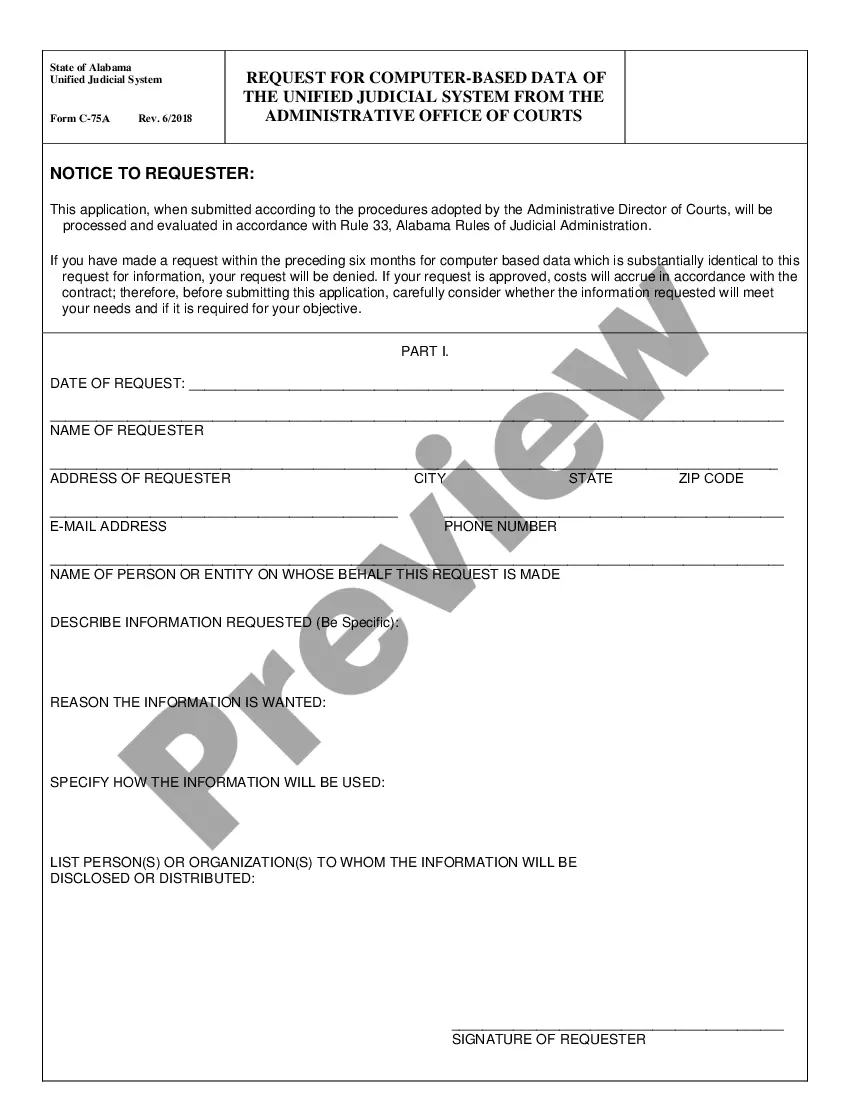

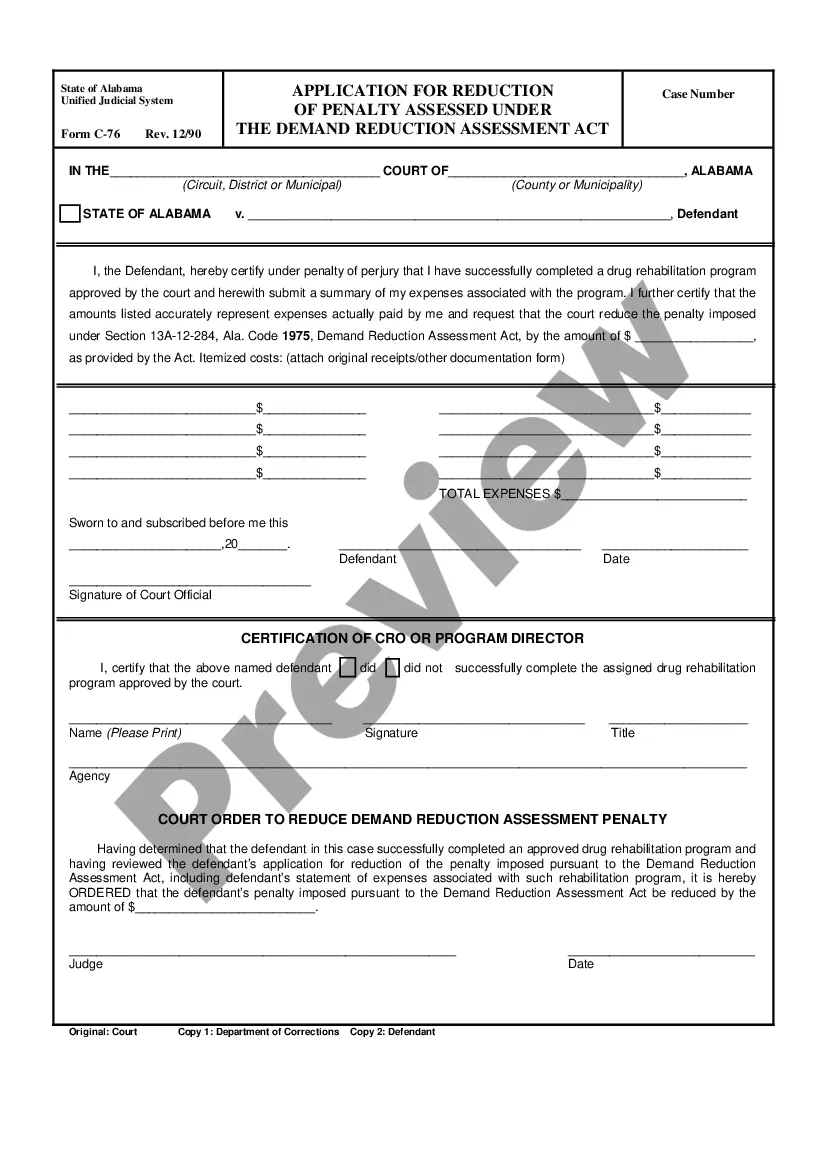

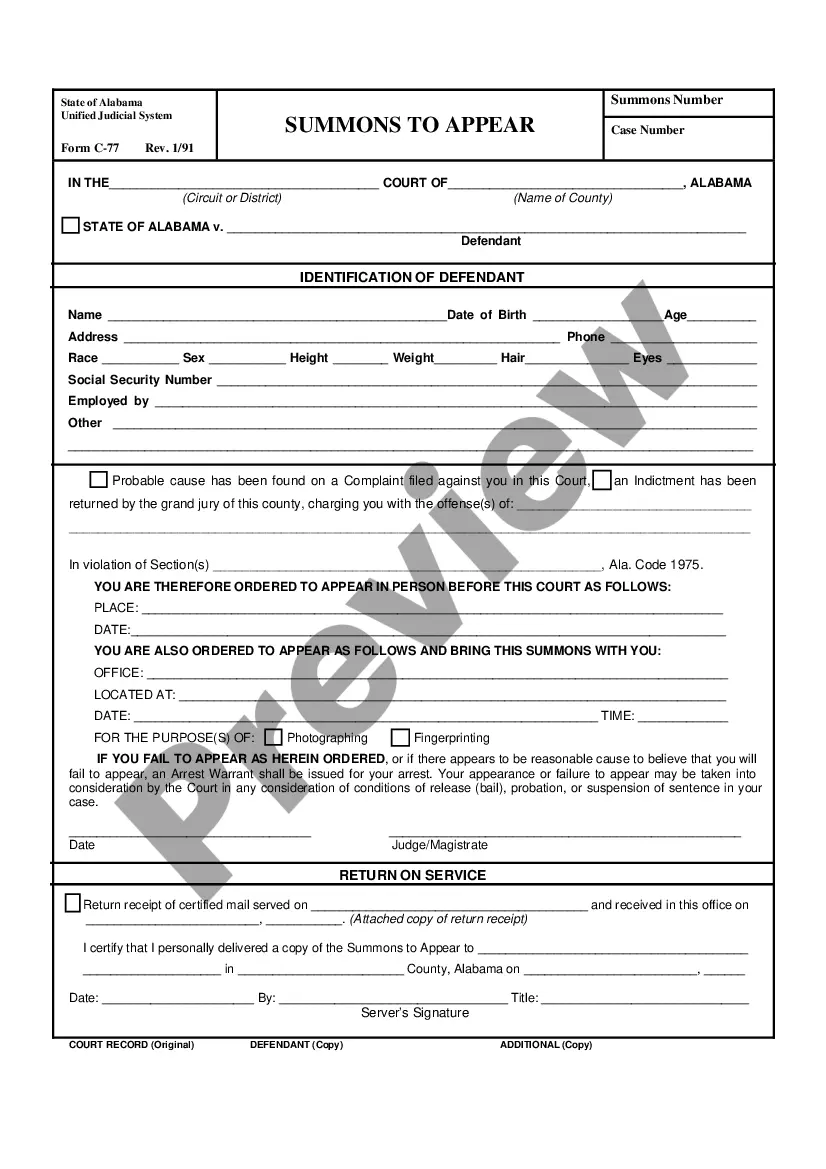

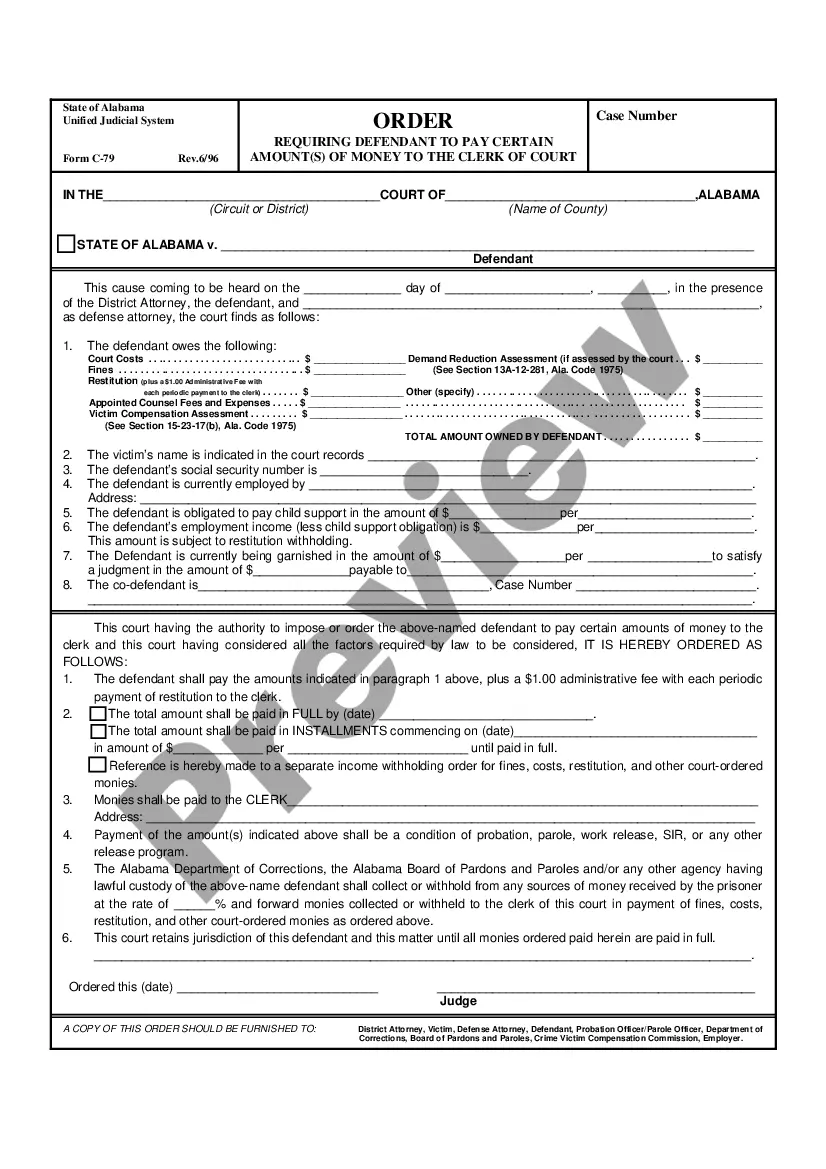

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

A Limited Power of Attorney for Stock Transactions and Corporate Powers in Boston, Massachusetts is a legal document that grants an individual or entity (the "attorney-in-fact") the authority to act on behalf of another individual or entity (the "principal") in matters related to stock transactions and corporate powers. This power of attorney is "limited" in the sense that it specifically pertains to these particular areas and does not grant authority beyond those outlined powers. The Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers may have various types based on the specific purpose it is intended for. Some common types are: 1. Stock Transactions: This type of limited power of attorney focuses solely on stock-related actions. It empowers the attorney-in-fact to buy, sell, trade, and transfer stocks on behalf of the principal. The attorney-in-fact may have the authority to make investment decisions, manage stock portfolios, and execute various stock-related transactions. 2. Corporate Powers: This type of limited power of attorney grants the attorney-in-fact the authority to represent the principal in broader corporate matters. This may include attending shareholder meetings, voting on behalf of the principal, entering into contracts or agreements on behalf of the principal, managing corporate assets, and undertaking other corporate actions necessary for the principal's business interests. The Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers typically contains key elements to ensure its legal validity. These elements generally include: 1. Identification of the parties: The power of attorney should clearly identify the principal and the attorney-in-fact by their full legal names and contact information. The principal's role as the granter of authority and the attorney-in-fact's role as the recipient of authority should be explicitly stated. 2. Scope of authority: The power of attorney must clearly specify the limits of authority granted to the attorney-in-fact. This includes stating specific actions related to stock transactions and corporate powers that the attorney-in-fact is authorized to undertake. The document may outline particular companies or stock exchanges on which the attorney-in-fact can engage in transactions. 3. Term and revocation: The power of attorney should indicate the duration of its validity, whether it is effective immediately upon execution or if there is a specific start and end date. It should also include provisions for revocation, stating the conditions or processes under which the principal can revoke or terminate the power of attorney. 4. Signatures and notarization: To ensure the document's legality, the power of attorney must be signed by both the principal and the attorney-in-fact. Notarization may also be required to authenticate the signatures and confirm the principal's capacity to grant such authority. It is important to note that the specific content and requirements of a Limited Power of Attorney for Stock Transactions and Corporate Powers may vary based on the preferences and needs of the principal, as well as any applicable state laws or regulations in Massachusetts. Therefore, it is recommended to consult with a legal professional to ensure the power of attorney accurately reflects the principal's intentions and complies with all legal requirements.

Free preview

How to fill out Boston Massachusetts Limited Power Of Attorney For Stock Transactions And Corporate Powers?

If you’ve already utilized our service before, log in to your account and save the Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Boston Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!