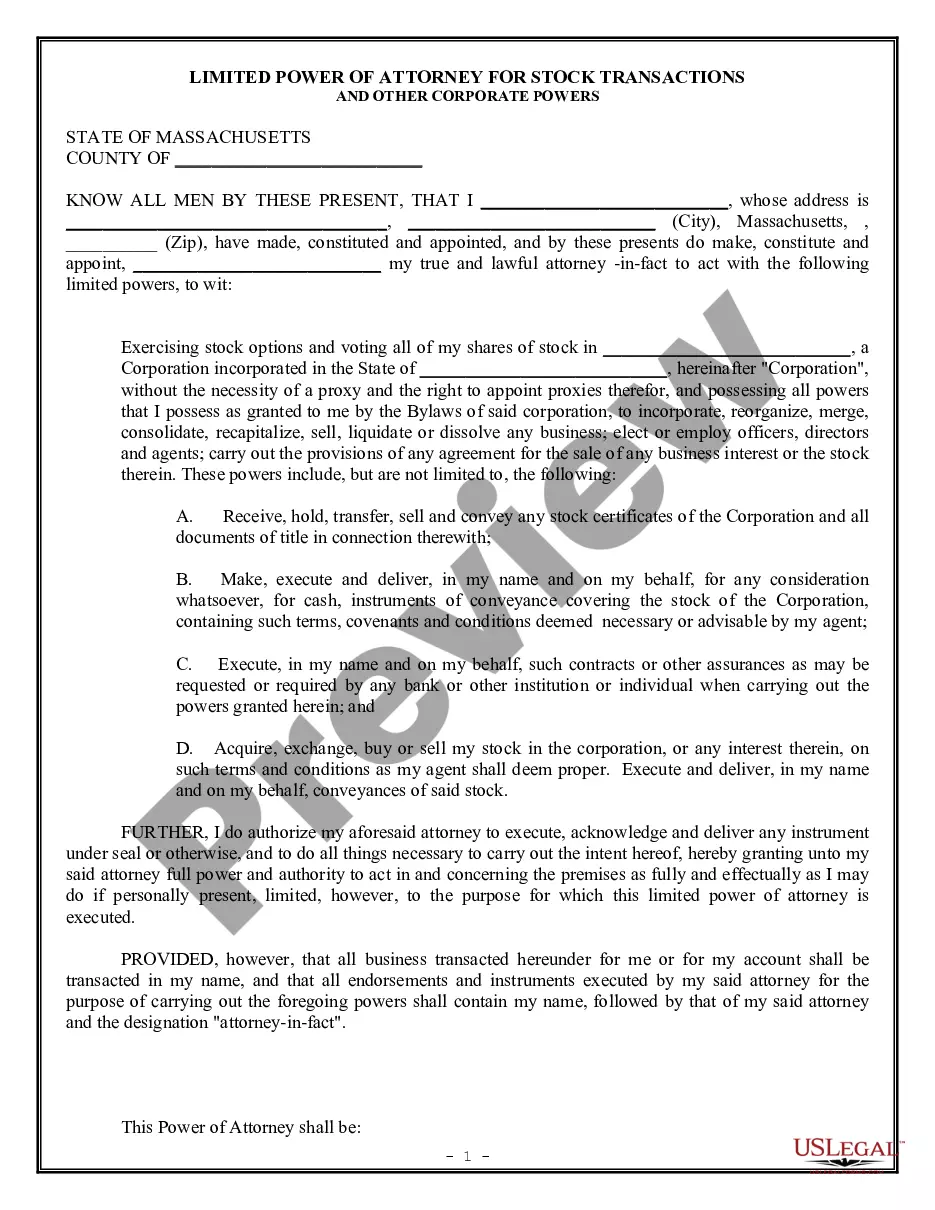

Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers

Description

How to fill out Massachusetts Limited Power Of Attorney For Stock Transactions And Corporate Powers?

Finding authentic templates tailored to your regional laws can be difficult unless you access the US Legal Forms library.

It is an online repository of over 85,000 legal forms catering to both personal and professional requirements and any actual circumstances.

All the documents are appropriately categorized by use area and jurisdiction, making it as simple and straightforward as ABC to search for the Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers.

Maintaining paperwork organized and in accordance with legal standards is crucial. Take advantage of the US Legal Forms library to have essential document templates readily available for any needs!

- Review the Preview mode and form description.

- Ensure you’ve selected the accurate one that satisfies your requirements and fully aligns with your local jurisdiction specifications.

- Look for another template, if necessary.

- If you detect any discrepancies, utilize the Search tab above to locate the correct one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

In Massachusetts, only the principal, or the person who created the power of attorney, can revoke or override the document. Additionally, a court may intervene if there is evidence of abuse or incapacity. It is essential to understand that any limitations placed on the agent must be clearly stated to avoid confusion regarding their powers in stock transactions or corporate responsibilities.

Filing a power of attorney online in Massachusetts is not directly available, as the state requires original, signed documents for recording. However, you can prepare your limited power of attorney for stock transactions and corporate powers using online services like USLegalForms. Once completed, you must print, sign, and file the document with the appropriate authority manually.

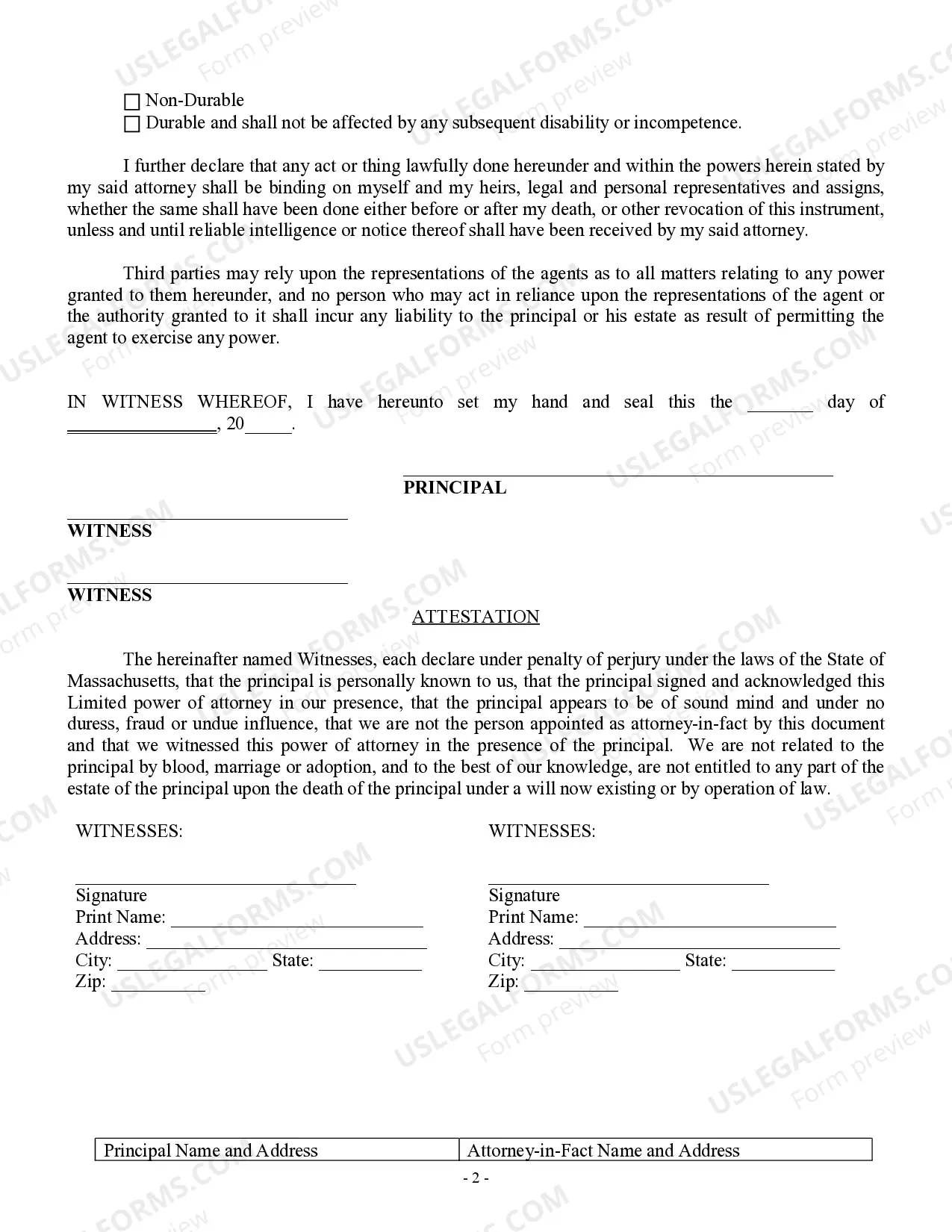

To create a durable power of attorney in Massachusetts, the document must be in writing, explicitly state that it remains in effect even if you become incapacitated, and be signed by you. Furthermore, it should be witnessed by at least one individual. While it is not mandatory to notarize, having a notarized document adds an extra layer of security, particularly for financial institutions.

In Massachusetts, a limited power of attorney generally does not require notarization for it to be valid. However, for enhanced legal standing and to prevent future disputes, it is advisable to have it notarized. Additionally, some institutions may require notarized documents to recognize the authority granted. Thus, it's best to check with the relevant parties or legal advisors.

Filling out a limited power of attorney form for stock transactions and corporate powers in Lowell, Massachusetts, requires you to provide specific details. First, clearly state the powers you wish to grant, such as buy or sell shares. Next, include your name, the agent's name, and any relevant dates. Finally, make sure to sign and date the document to validate it.

To endorse a check using a power of attorney, you must use the name of the principal, followed by the words 'by' and your name as the attorney-in-fact. For example, you would write the principal’s name, then 'by Your Name'. This process is particularly relevant when utilizing a Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers, as it allows you to manage financial transactions effectively. For guidance, consider uslegalforms, which offers templates and instructions for endorsing checks appropriately.

Yes, in Massachusetts, a power of attorney document, including the Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers, must be notarized to be considered valid. This notarization helps verify the identity of the person signing the document and ensures that the powers granted are legally binding. Additionally, having a notary public witness your signature can prevent potential disputes in the future. You can use platforms like uslegalforms to easily create and notarize your power of attorney document.

A legal Power of Attorney cannot make decisions regarding your medical treatment, enforce changes to a will, or make decisions that require the principal's personal presence. Specifically, with the Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers, the agent cannot override those areas, ensuring that such critical choices remain with the principal.

One downside of being a Power of Attorney is the significant responsibility that comes with managing someone else's affairs. This role can lead to potential legal liability if decisions are not made in the principal's best interest. Moreover, handling sensitive financial matters can be stressful, especially when dealing with a Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers.

A limited power of attorney in Massachusetts grants someone specific authority for defined actions, such as stock transactions. This type of document is tailored to meet particular needs, hence the term 'limited.' The Lowell Massachusetts Limited Power of Attorney for Stock Transactions and Corporate Powers falls into this category, ensuring that the agent acts only within the boundaries you establish.