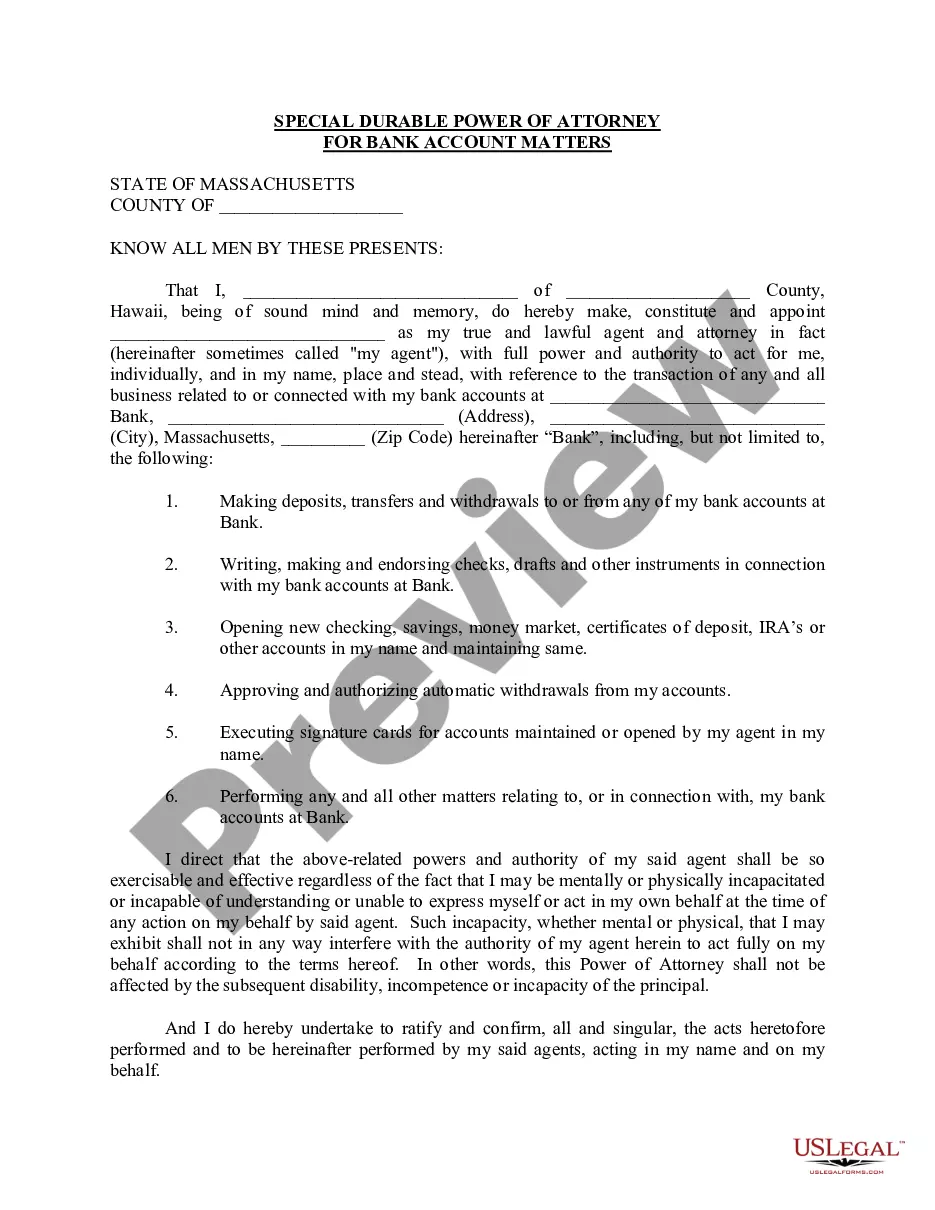

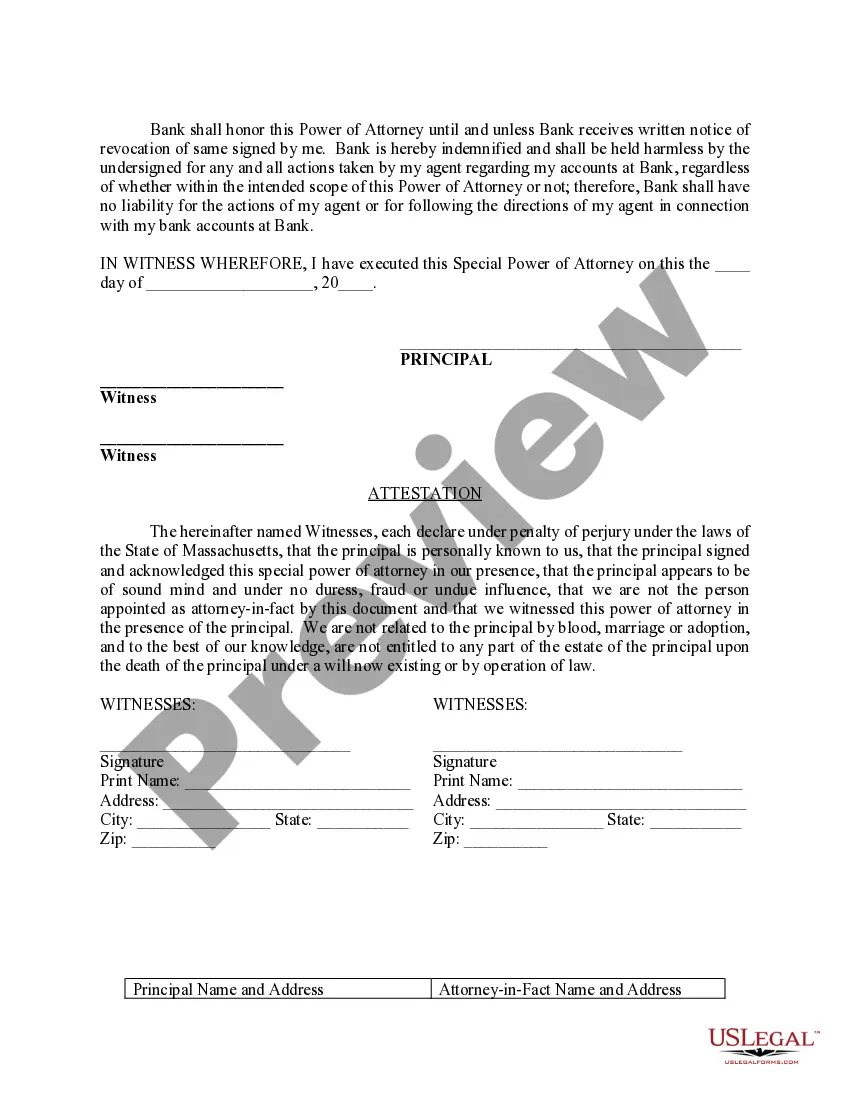

Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a trusted individual, referred to as the agent or attorney-in-fact, the authority to manage specific banking matters on behalf of the principal. This power of attorney is specifically tailored to handle bank account-related affairs, ensuring that financial matters are properly addressed. The Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters provides the agent with the legal capacity to make decisions, perform transactions, and manage the principal's bank accounts according to the principal's wishes. This document is enforceable even if the principal becomes incapacitated or unable to make decisions for themselves. Keywords: Middlesex Massachusetts, special durable power of attorney, bank account matters, legal document, agent, attorney-in-fact, banking matters, financial matters, transactions, manage bank accounts, incapacitated. There may be different types of Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters, each serving a specific purpose: 1. Limited Power of Attorney for Bank Account Matters: This type grants the agent limited authority to manage only specific banking matters and transactions, as defined in the document. Such limitations can include making deposits or withdrawals within a set monetary threshold or conducting specific transactions on behalf of the principal. 2. General Power of Attorney for Bank Account Matters: This version provides the agent with broader authority, allowing them to manage and make decisions regarding various bank account matters on behalf of the principal. It enables them to handle a wide range of transactions and financial affairs related to the principal's bank accounts. 3. Springing Power of Attorney for Bank Account Matters: This type of power of attorney becomes effective only when a predefined event occurs, such as the principal's incapacitation or inability to manage their bank accounts. Until the triggering event takes place, the agent does not possess any authority. 4. Specific Power of Attorney for Bank Account Matters: This document grants the agent authority to handle a specific bank account or banking-related matter exclusively. The agent's power is limited to only those matters specified in the document, providing a narrow scope of authority. Keywords: limited power of attorney, general power of attorney, springing power of attorney, specific power of attorney, banking matters, transactions, authority, principal, incapacitation, legal document.

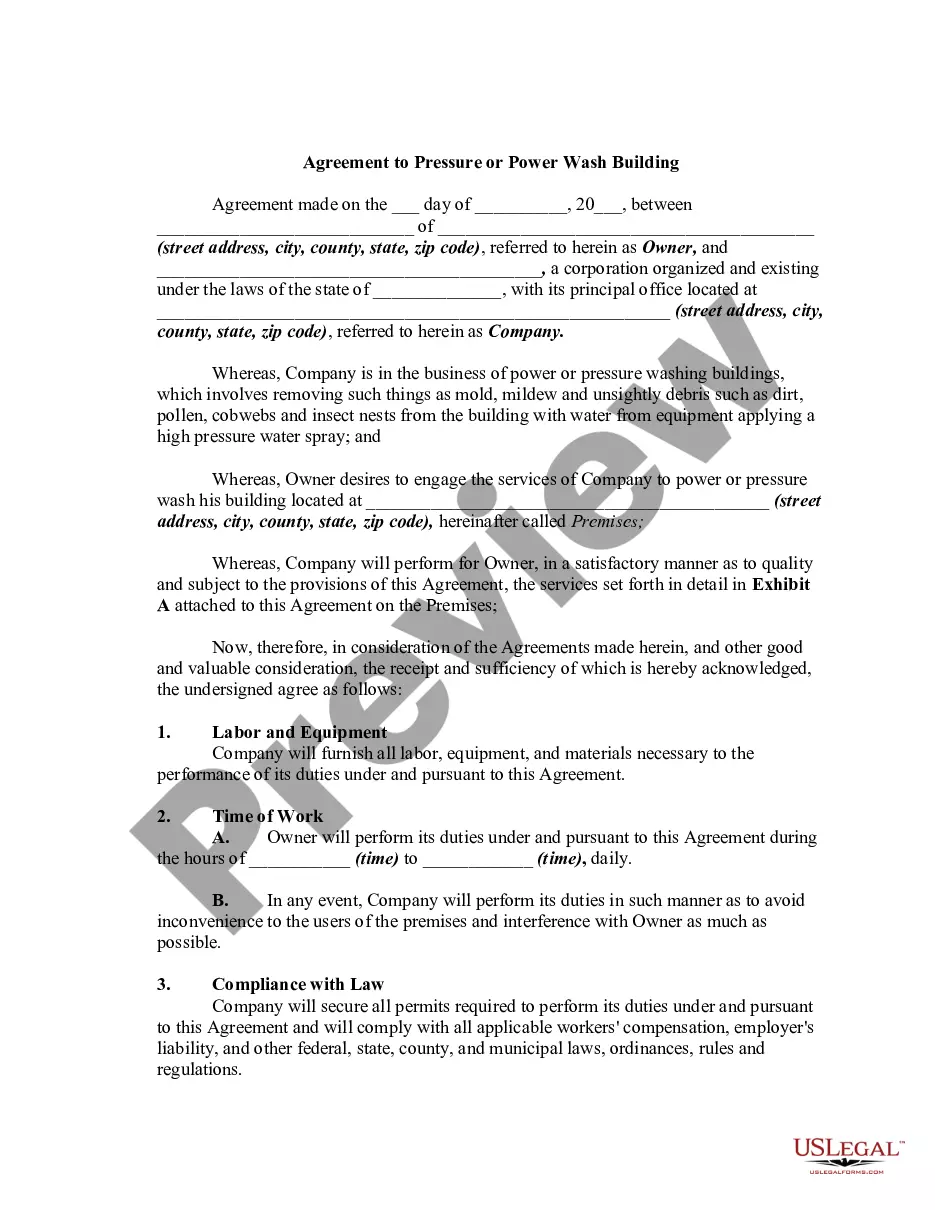

Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters

Description

How to fill out Middlesex Massachusetts Special Durable Power Of Attorney For Bank Account Matters?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for a person with no legal education to draft such papers cfrom the ground up, mostly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our platform offers a massive catalog with more than 85,000 ready-to-use state-specific documents that work for almost any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to save time using our DYI tpapers.

Whether you require the Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters in minutes using our reliable platform. In case you are presently an existing customer, you can go on and log in to your account to download the needed form.

However, if you are unfamiliar with our platform, make sure to follow these steps before obtaining the Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters:

- Be sure the template you have chosen is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Preview the document and go through a short outline (if provided) of cases the document can be used for.

- If the one you selected doesn’t meet your needs, you can start over and look for the suitable document.

- Click Buy now and pick the subscription plan that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Pick the payment method and proceed to download the Middlesex Massachusetts Special Durable Power of Attorney for Bank Account Matters once the payment is done.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any problems locating your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.