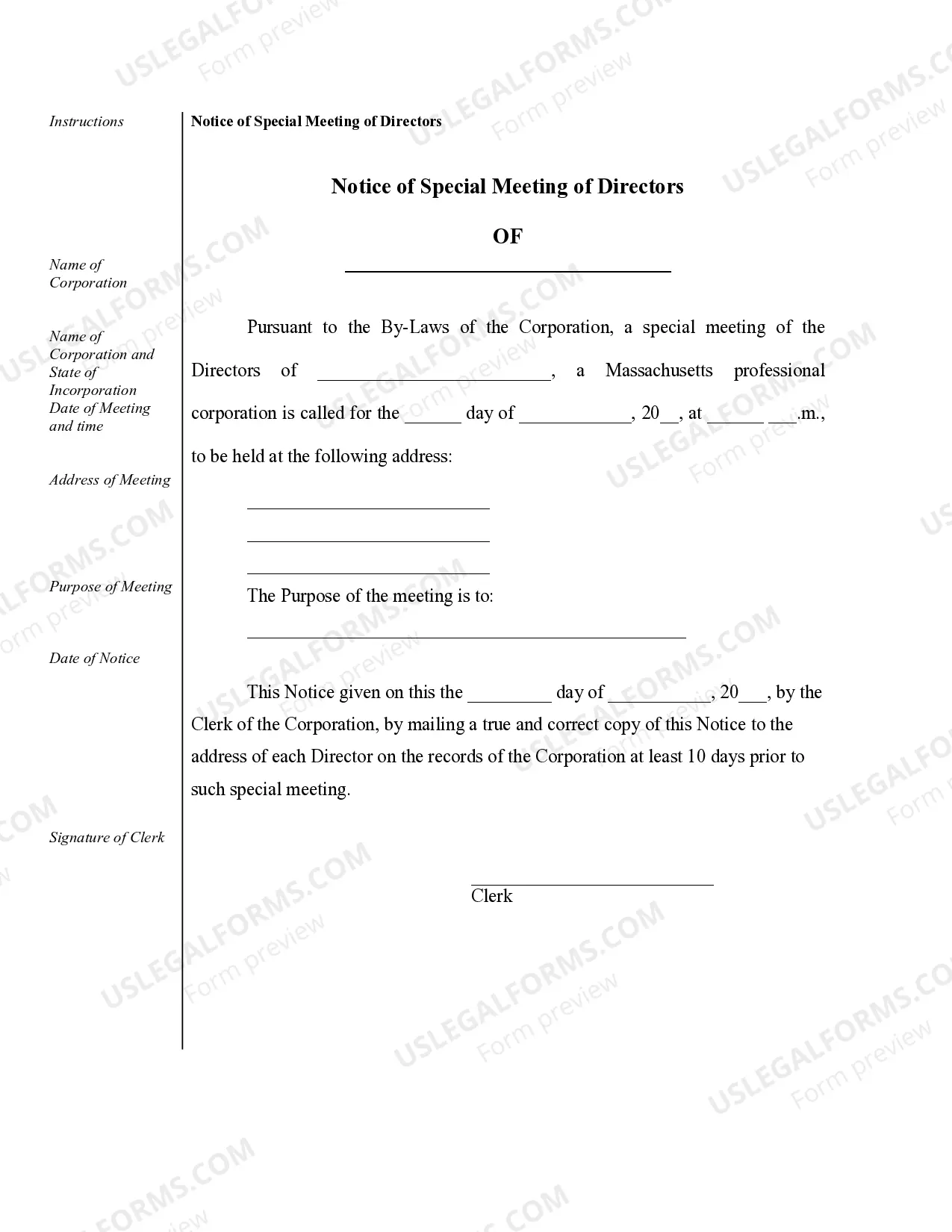

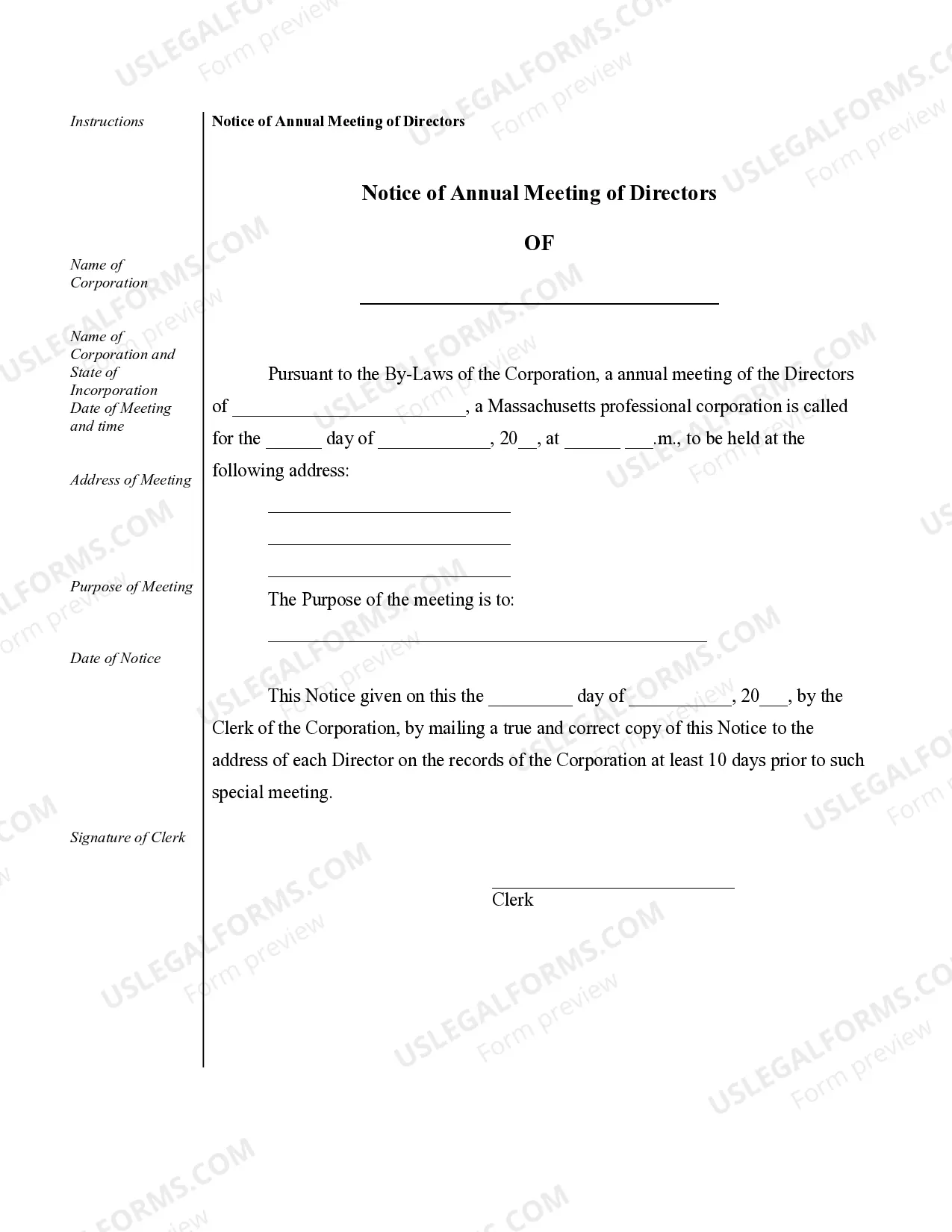

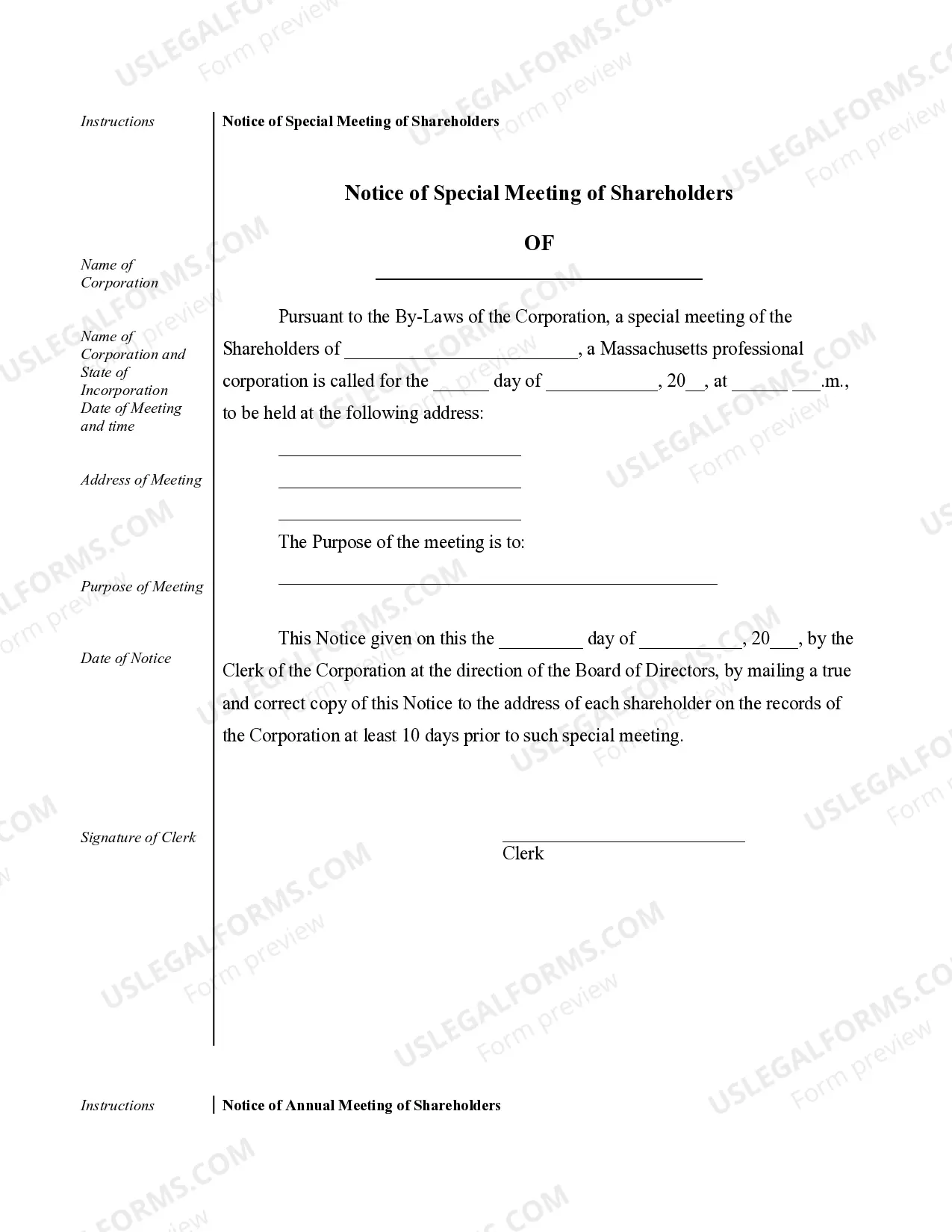

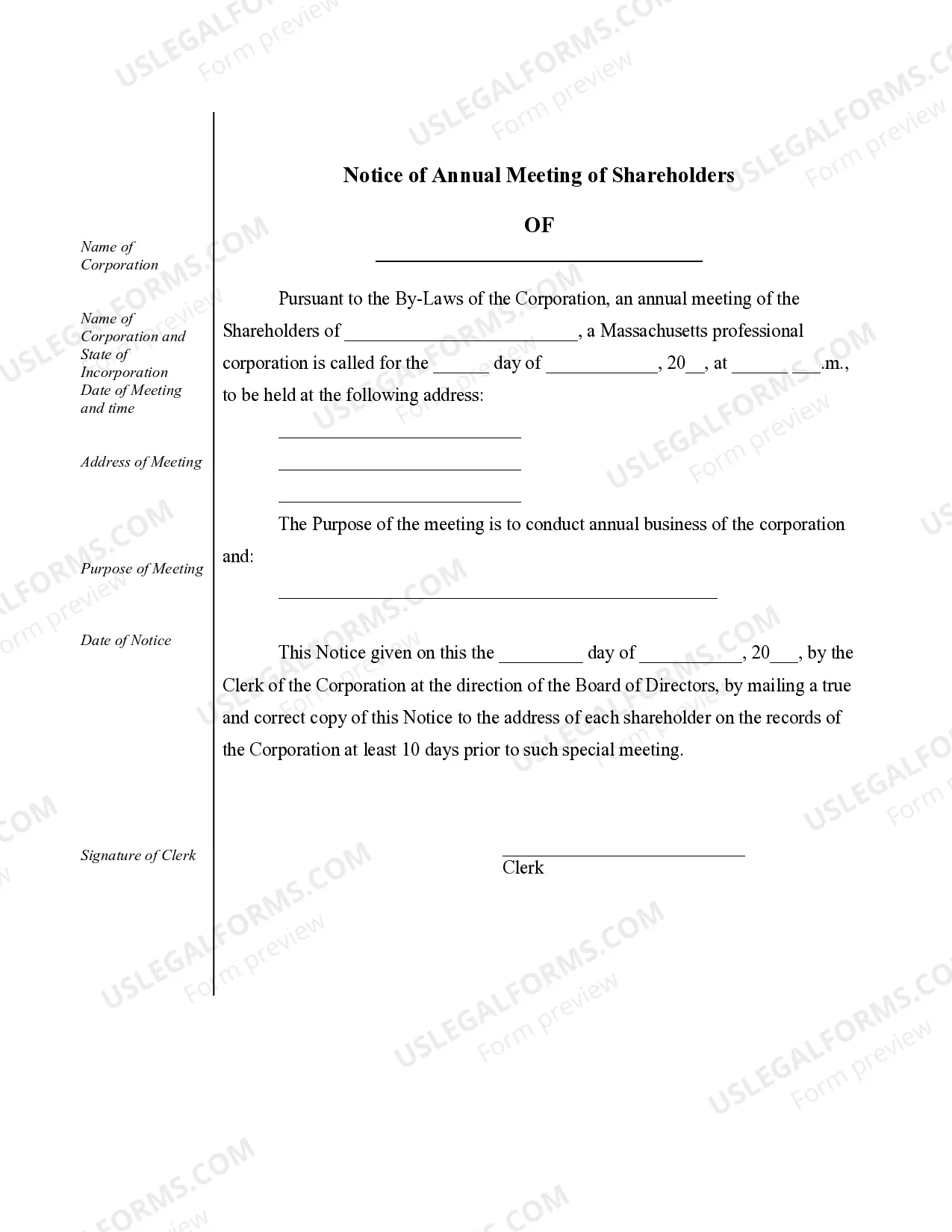

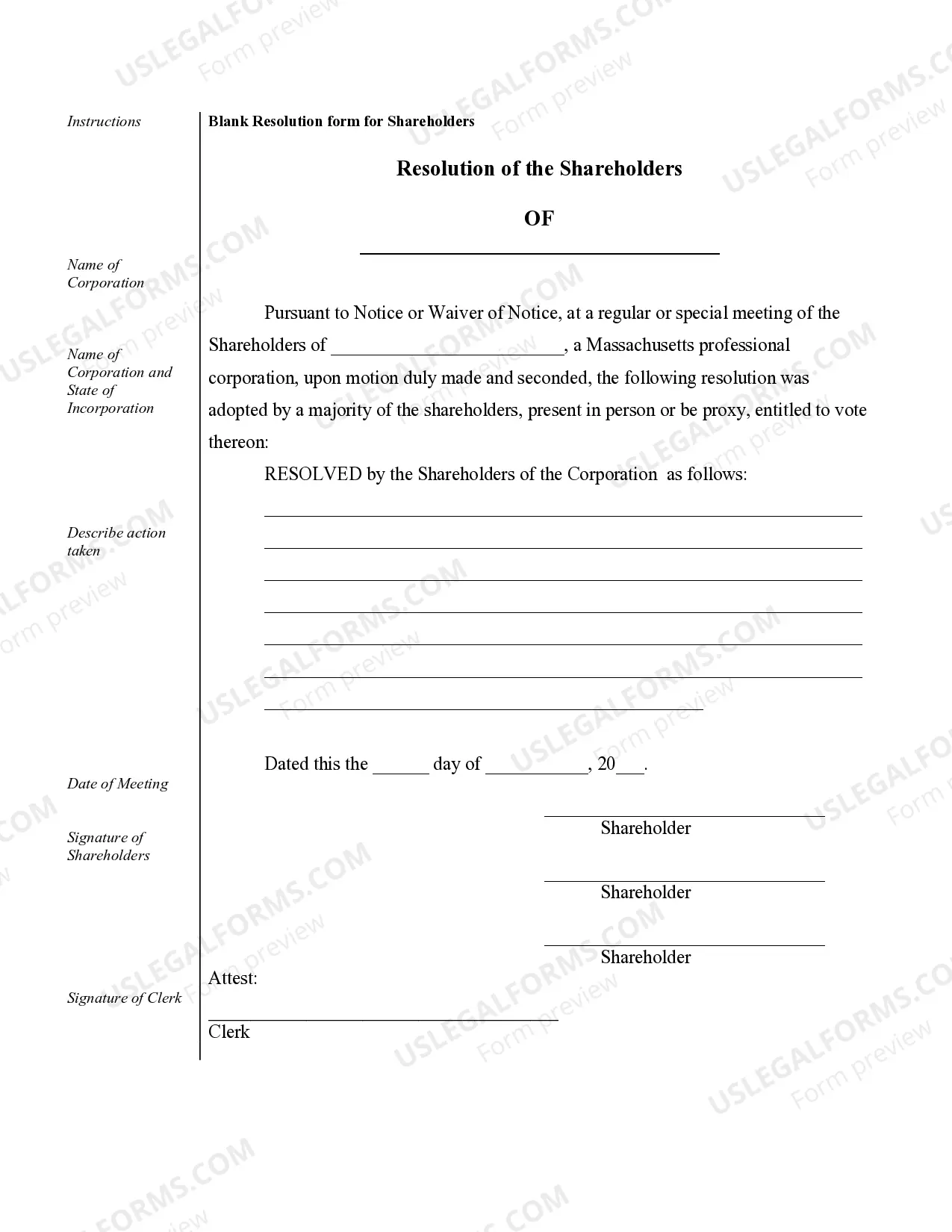

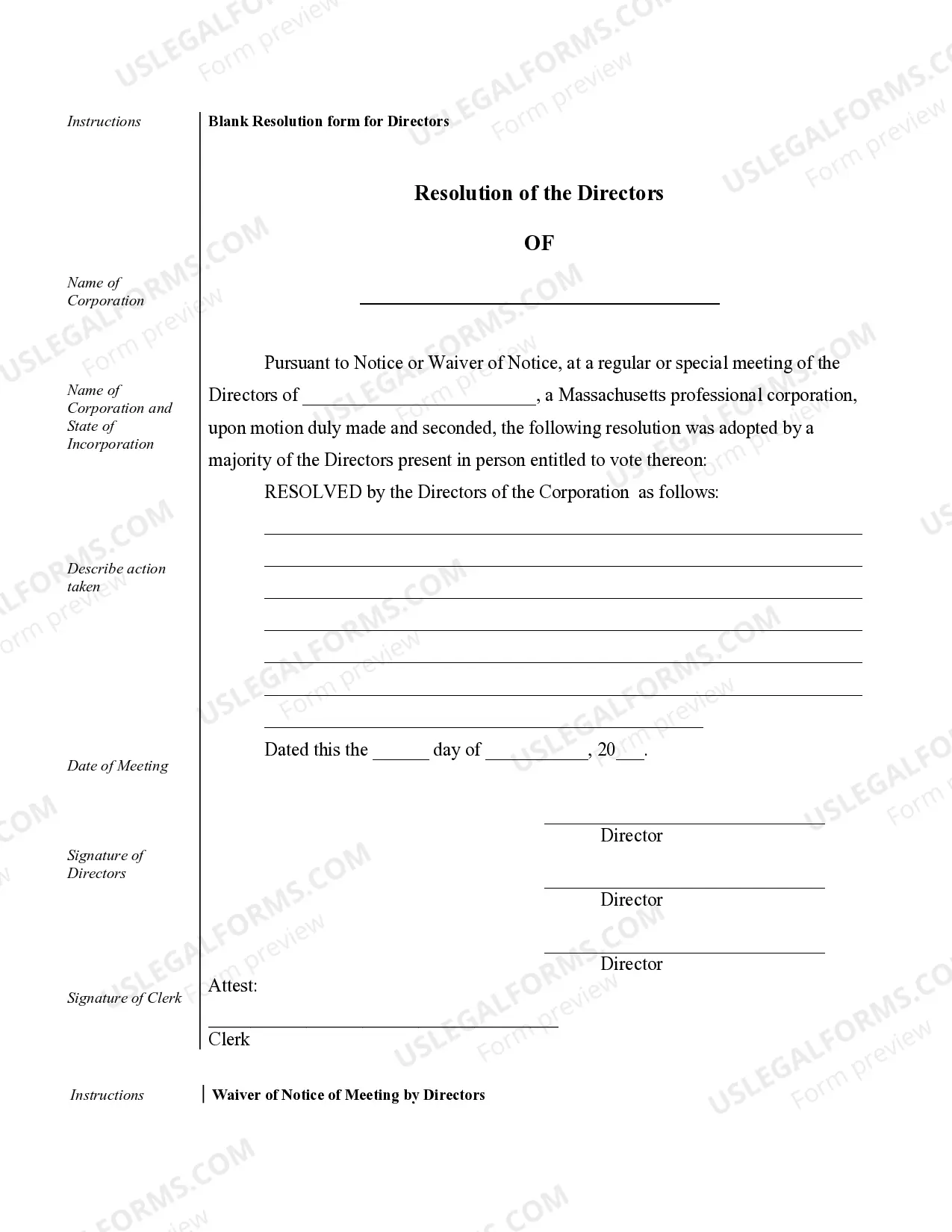

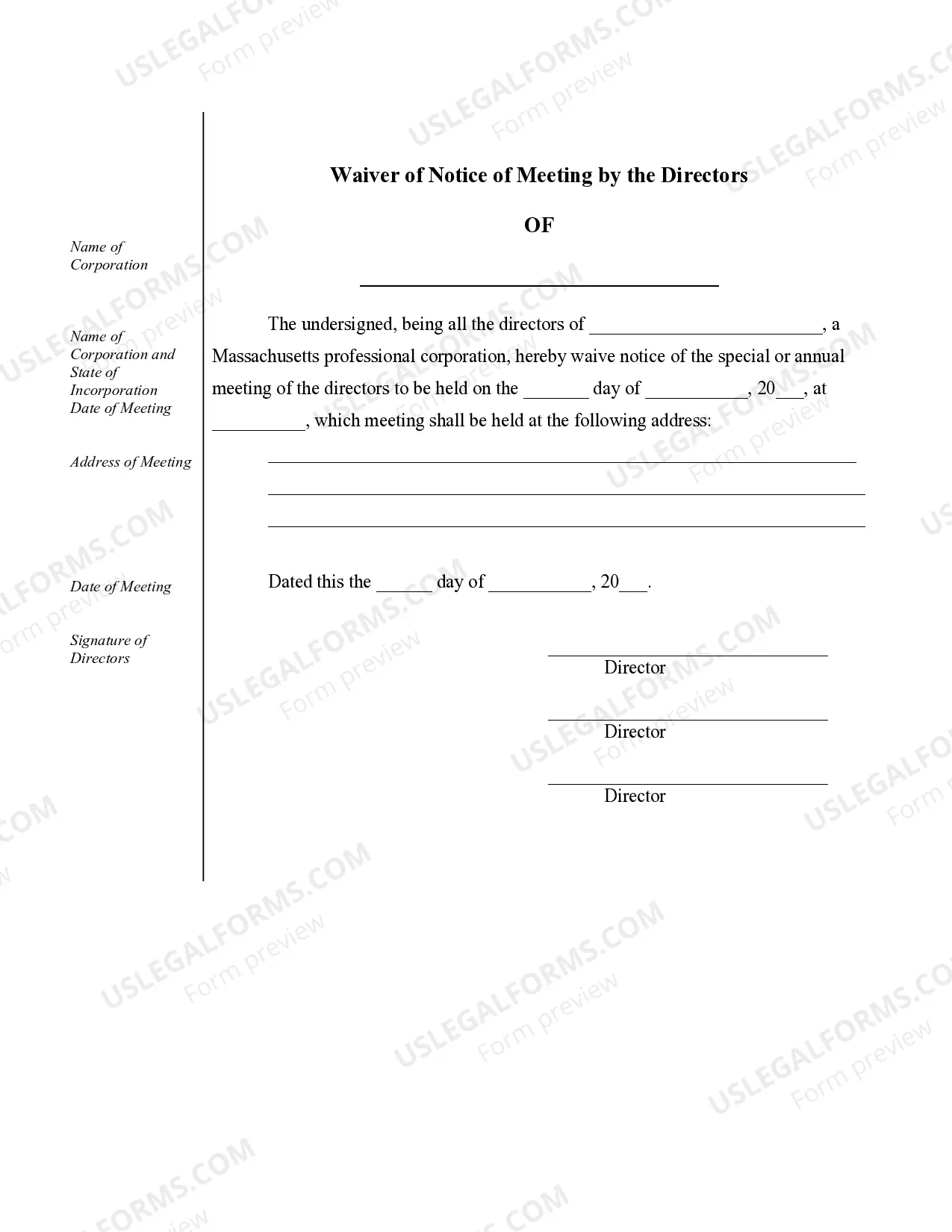

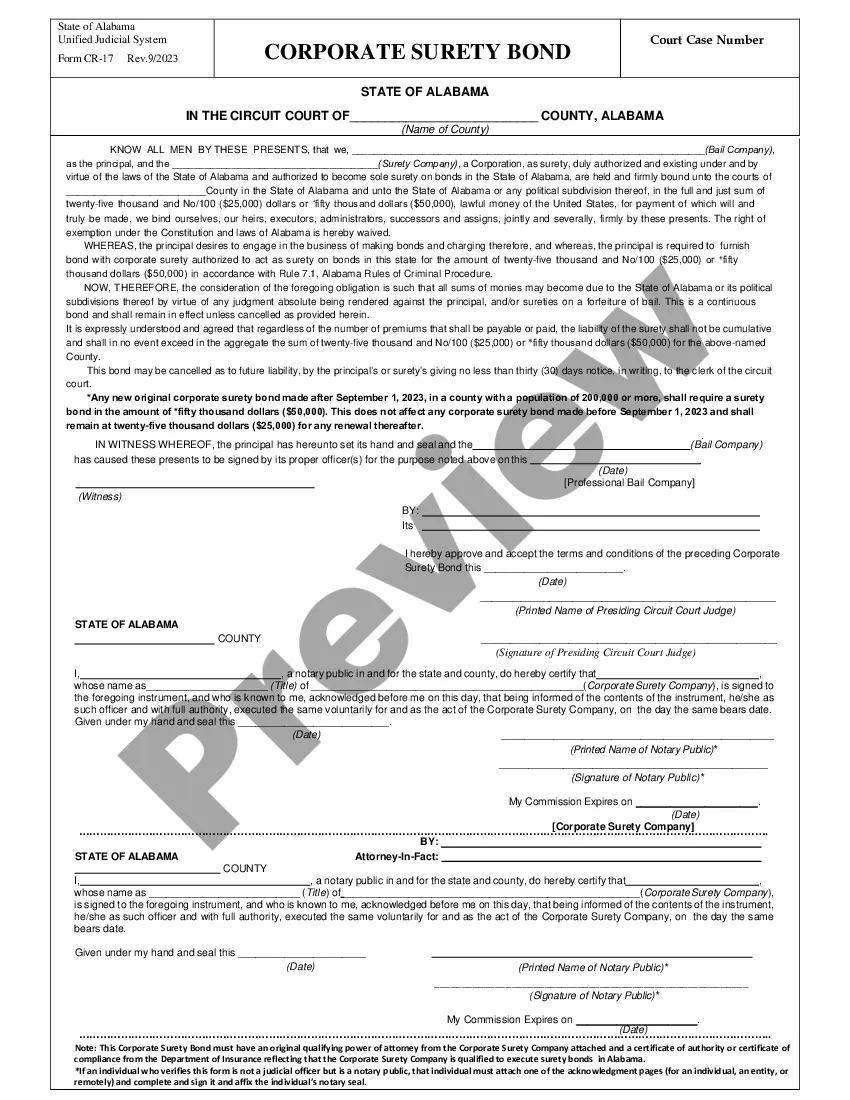

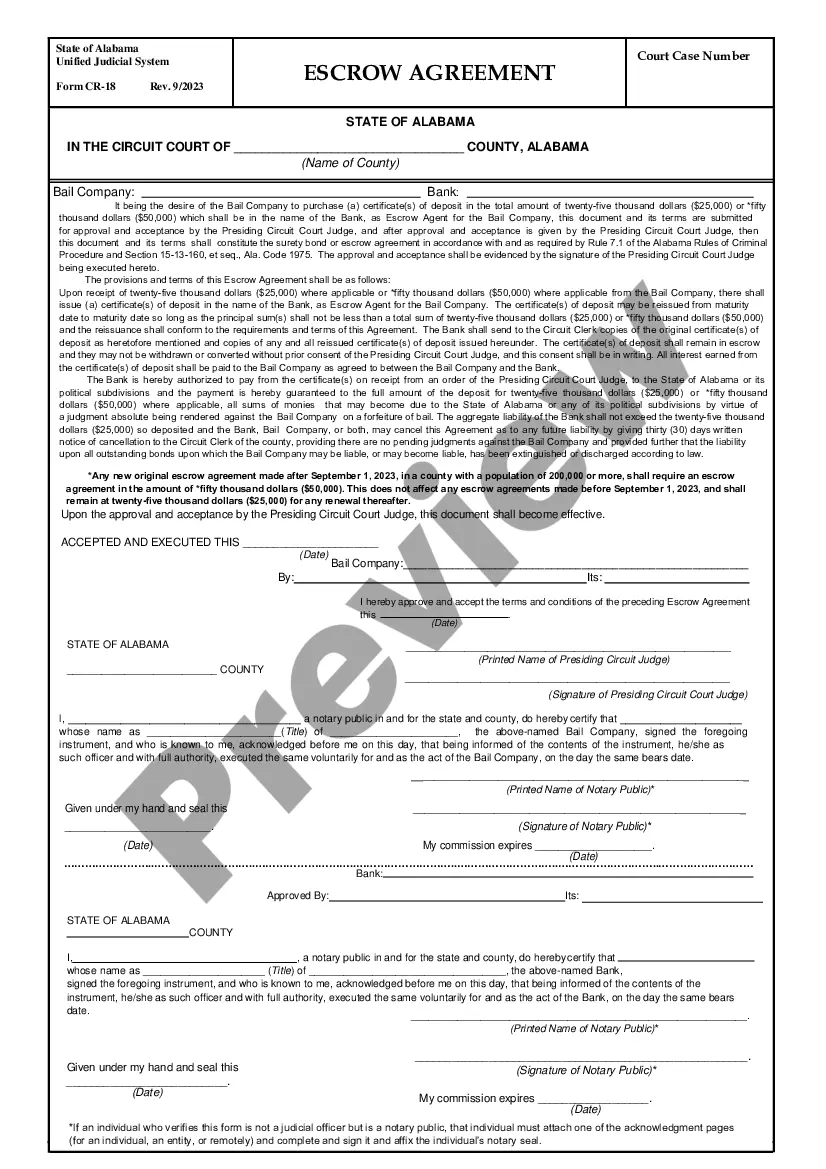

Boston Sample Corporate Records for a Massachusetts Professional Corporation refer to the official documentation that an organization is required to maintain to ensure compliance with the state laws and regulations. These records serve as evidence of the corporation's existence and provide a comprehensive history of its operations. The purpose of these records is to establish transparency, accountability, and legal protection for the corporation and its shareholders. Key components of Boston Sample Corporate Records for a Massachusetts Professional Corporation include: 1. Articles of Incorporation: This document establishes the corporation as a legal entity. It includes essential information such as the corporation's name, purpose, registered office, duration, and the names of the incorporates and initial directors. 2. Bylaws: The bylaws outline the internal rules, procedures, and governance structure of the corporation. It covers matters such as shareholders' rights, board of directors' responsibilities, meeting protocols, and voting procedures. 3. Shareholder Records: These records maintain detailed information about the corporation's shareholders, including their names, addresses, share ownership, and voting rights. It may also include records of share transactions, transfers, and dividends. 4. Board of Directors' Records: These records document the actions and decisions made by the board of directors, including meeting minutes, resolutions, and voting records. They also maintain information about the directors, their terms of office, and any committees established by the board. 5. Annual Reports and Financial Statements: Corporations are required to file annual reports with the state of Massachusetts, providing updated information about the corporation's activities and financial status. Financial statements, including balance sheets, income statements, and cash flow statements, should also be maintained. 6. Meeting Minutes: Meeting minutes document the discussions, decisions, and resolutions made during board meetings, shareholders' meetings, and committee meetings. They should accurately record attendee names, topics discussed, voting results, and any actions taken. 7. Stock Certificates: Stock certificates are official documents that represent ownership of shares in the corporation. Samples of these certificates should be maintained, reflecting the details of the stockholders and their respective shares. 8. Incorporation Filings and Licenses: These records consist of all documentation related to the incorporation process and acquiring any necessary licenses or permits for the corporation to operate legally. This includes the filing receipt from the Secretary of the Commonwealth of Massachusetts. It is important to note that while the above records are standard for any Massachusetts Professional Corporation, the specific requirements may vary based on the nature of the business and industry. Different professional corporations may have additional record-keeping requirements or specific documents needed, such as professional licenses or certificates. Overall, the purpose of Boston Sample Corporate Records for a Massachusetts Professional Corporation is to demonstrate compliance with legal obligations, maintain accurate financial records, and provide documentation for potential legal disputes or audits.

Boston Sample Corporate Records for a Massachusetts Professional Corporation

Description

How to fill out Boston Sample Corporate Records For A Massachusetts Professional Corporation?

Irrespective of social or professional rank, filling out legal documents is an unfortunate requirement in the modern world.

Frequently, it’s nearly unfeasible for someone without a legal background to generate such documents from the beginning, primarily due to the intricate language and legal subtleties they entail.

This is where US Legal Forms proves to be beneficial.

Ensure the document you have discovered is valid for your region considering that the regulations of one state or county may not apply to another.

Examine the document and consult a brief synopsis (if available) of instances where the document can be utilized.

- Our service offers an extensive collection with over 85,000 ready-to-use state-specific documents sufficient for almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors aiming to conserve time using our DIY templates.

- Regardless of whether you require the Boston Sample Corporate Records for a Massachusetts Professional Corporation or any other document relevant to your state or county, with US Legal Forms, everything is accessible.

- Here’s how you can obtain the Boston Sample Corporate Records for a Massachusetts Professional Corporation in moments using our reliable service.

- If you are currently an existing customer, you can proceed and Log In to your account to retrieve the required form.

- However, if you are new to our library, be sure to adhere to these steps before acquiring the Boston Sample Corporate Records for a Massachusetts Professional Corporation.

Form popularity

FAQ

Pretty much anyone can form a regular corporation. Professional corporations, however, are more limited, as only certain professional groups can form one. Which professions qualify varies from one state to the next, but typical professions include doctors, attorneys, chiropractors, accountants, and similar trades.

7 Steps to Start a Professional Corporation in Massachusetts Select Your Board of Directors.Designate a Registered Agent.Choose a Name for Your Corporation.File your Articles of Incorporation.Establish Your Corporate Record & Hold Your First Board Meeting.Obtain Business Licenses.Set up a Business Bank Account.

The process of forming a corporation and filing Articles of Incorporation falls under Massachusetts statute G.L. c156D. Any information in the Articles of Incorporation/Articles of Organization will become part of the permanent public record.

You can get the Certificate of Organization form directly from the secretary of commonwealth website for Massachusetts. If you opt to file by mail, the applicable filing fee is $500. Make sure you complete all the steps if opting to file this way: Fill in the form by hand with black or blue ink, or on your computer.

Professional corporations provide a limit on the owners' personal liability for business debts and claims. Incorporating can't protect a professional against liability for his or her negligence or malpractice, but it can protect against liability for the negligence or malpractice of an associate.

Step 1: Visit the Massachusetts Entity Name Database. Visit the Massachusetts Secretary of State website. Step 2: Search your Business Name. Enter the name you would like to use in the ?Search by entity name? field.Step 3: Review Results.Step 3: Review Results.

Trying to find information on a private Massachusetts company? The Massachusetts Secretary of State Corporation Records is a good place to start. You can search by entity, identification number, file number, or by individual.

Professional corporations may exist as part of a larger, more complicated, legal entity; for example, a law firm or medical practice might be organized as a partnership of several or many professional corporations.

In Massachusetts, a corporation is only allowed to offer professional services (i.e., be a professional corporation) if every share of stock is owned by a person licensed for the profession.

Go to the Secretary of State's Website in order to lookup a business entity (Corporation, LLC, Limited Partnership) in Massachusetts (Click Here to see if an entity name is available).