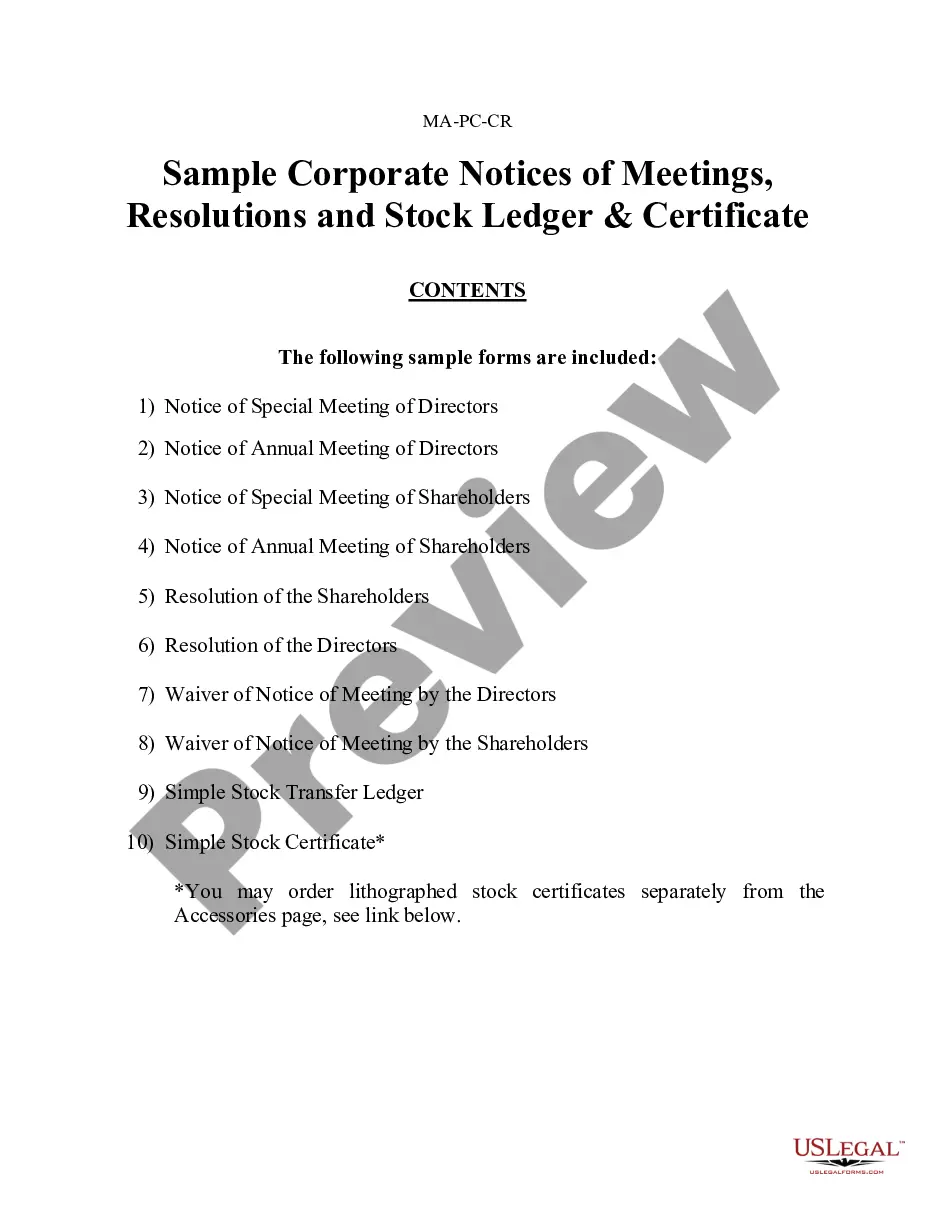

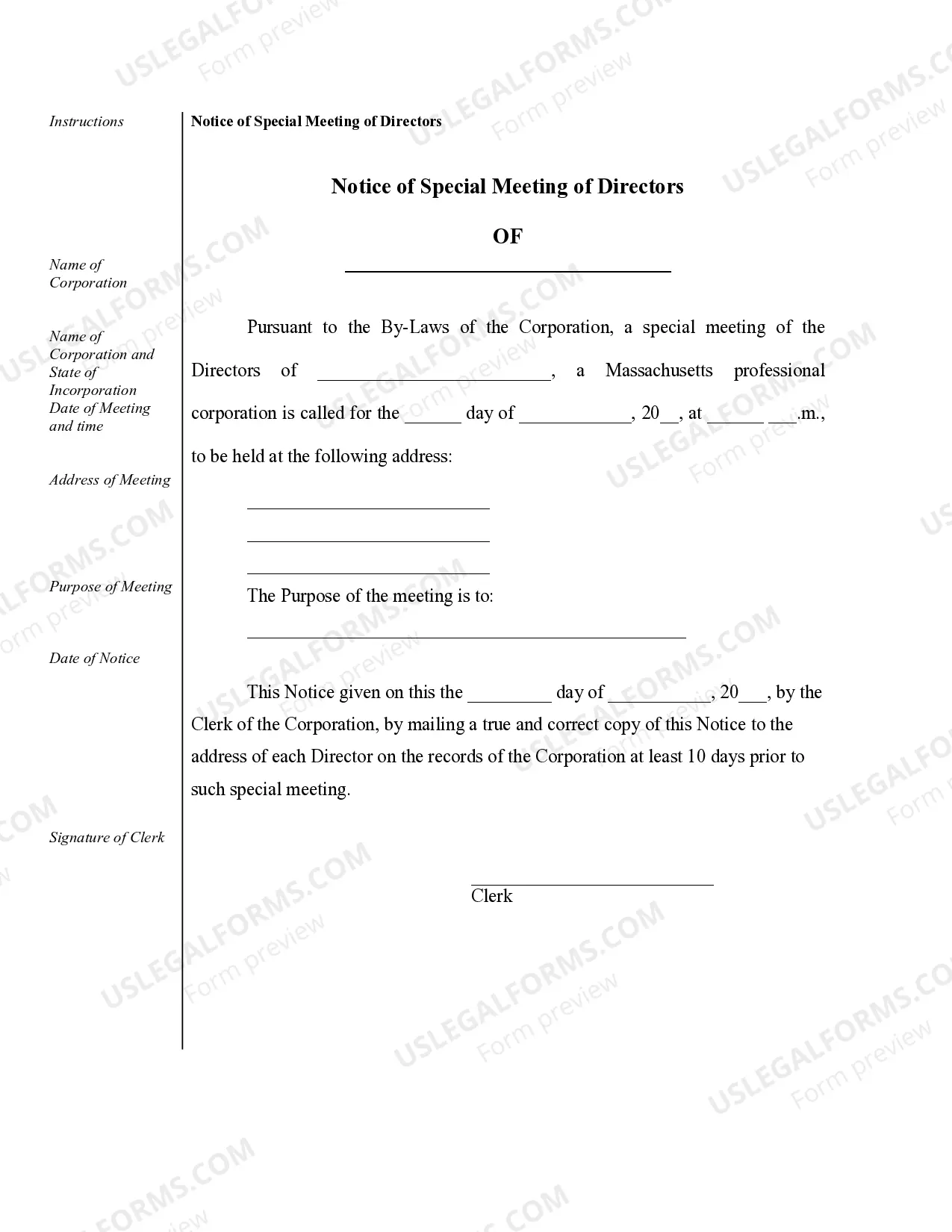

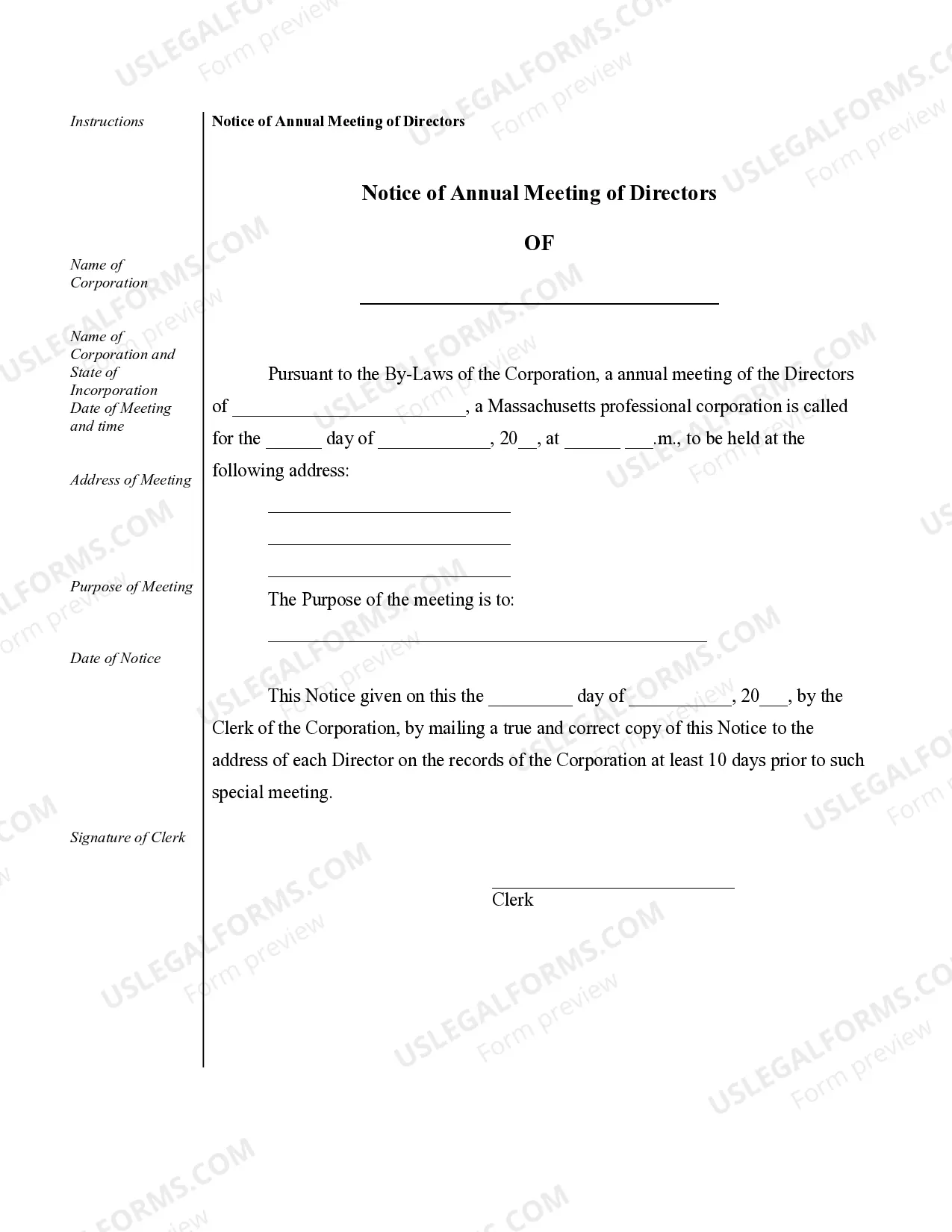

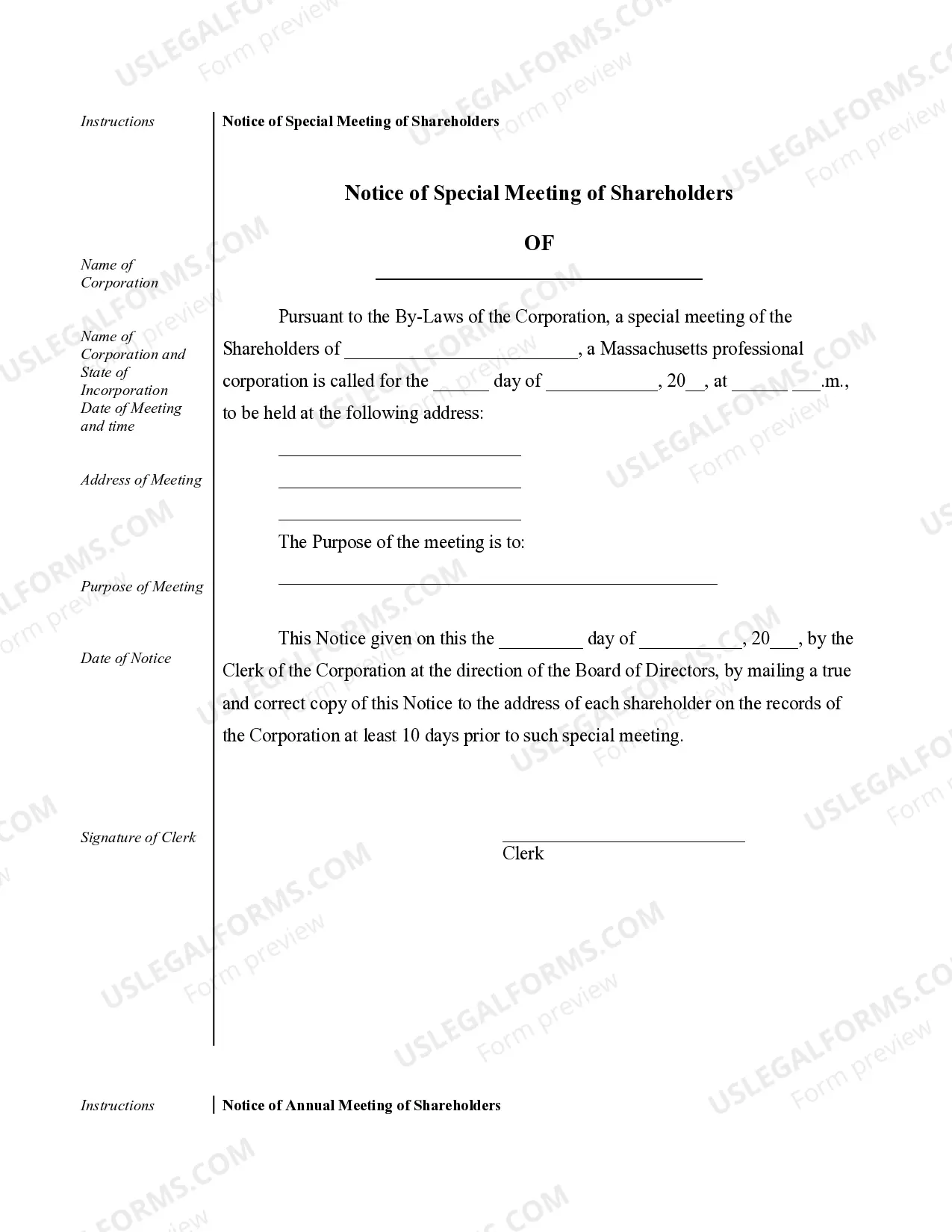

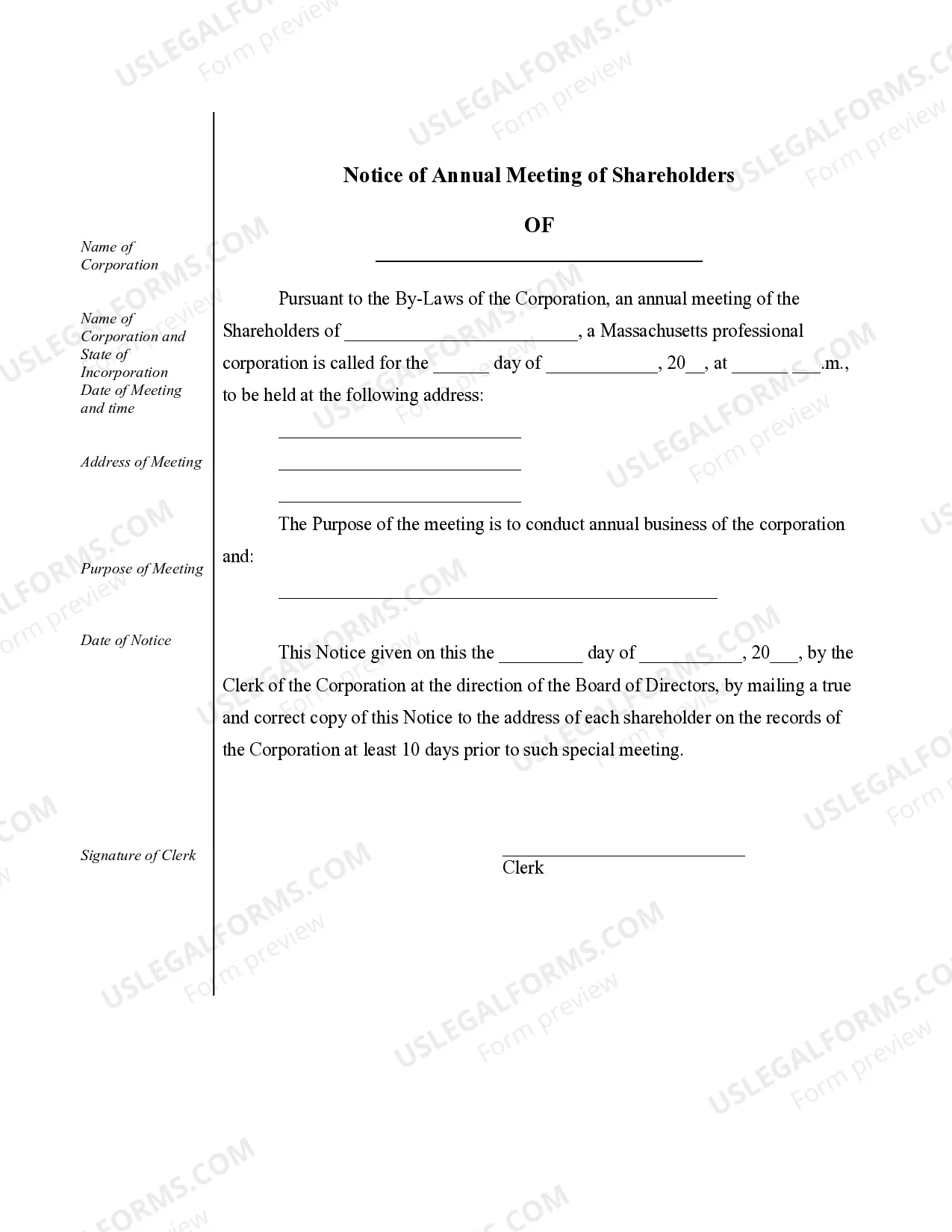

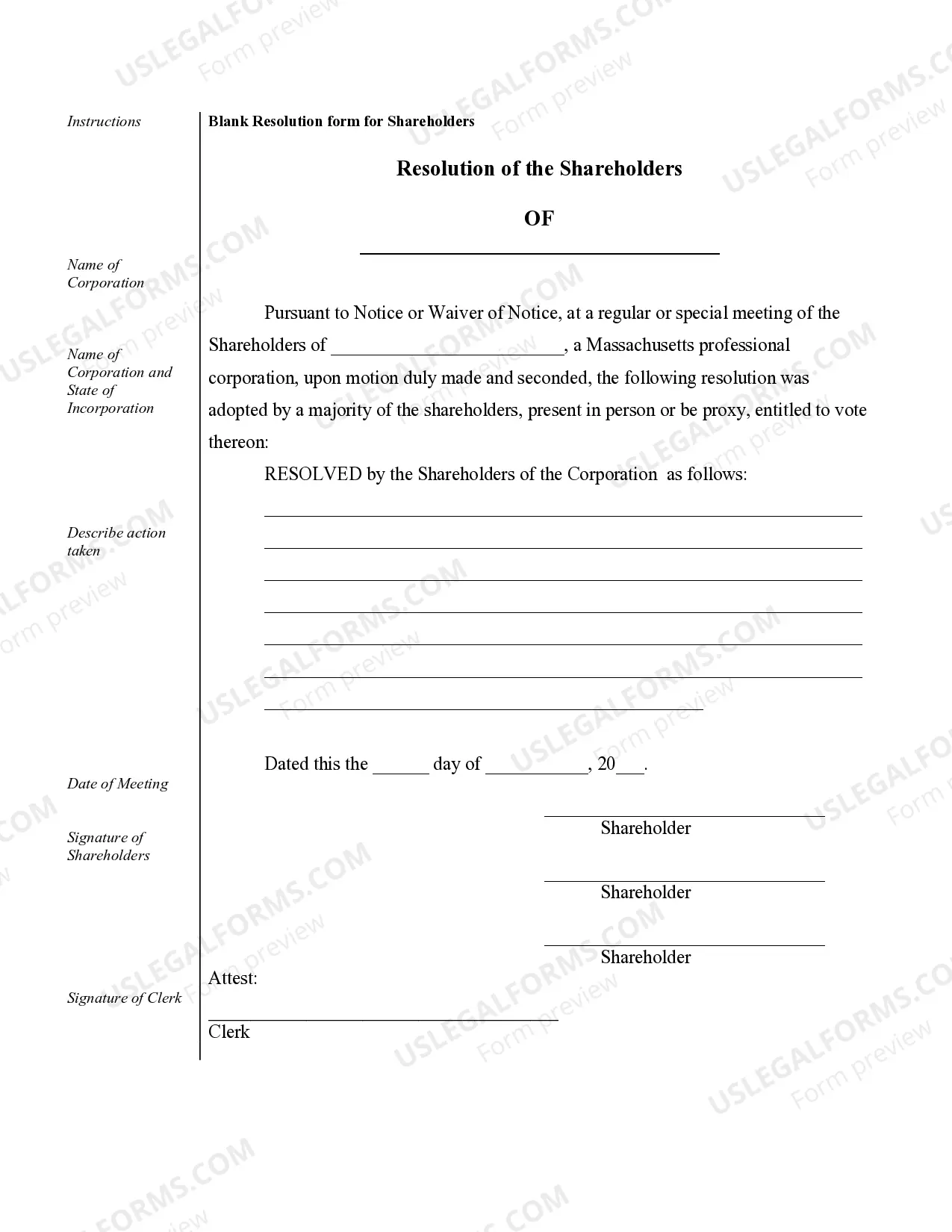

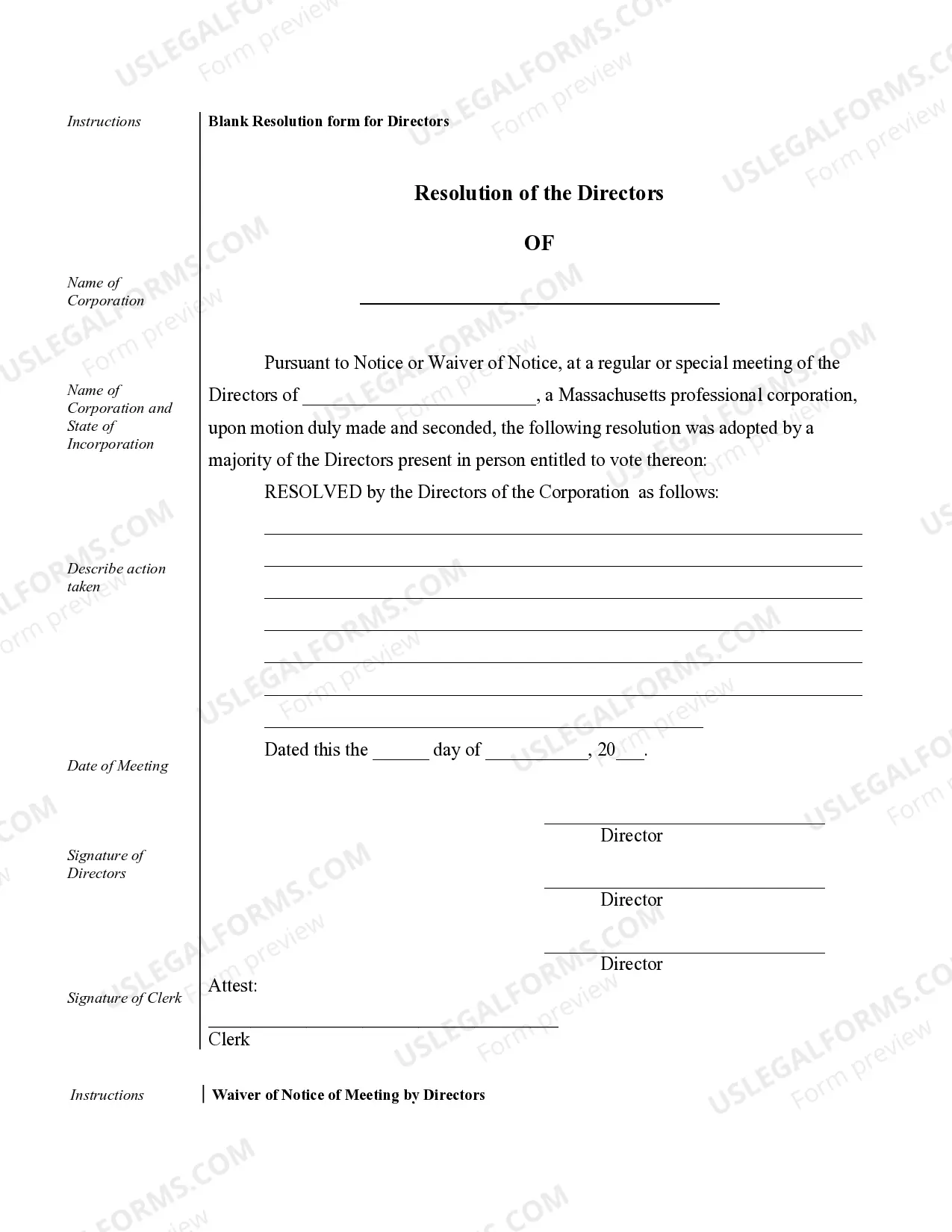

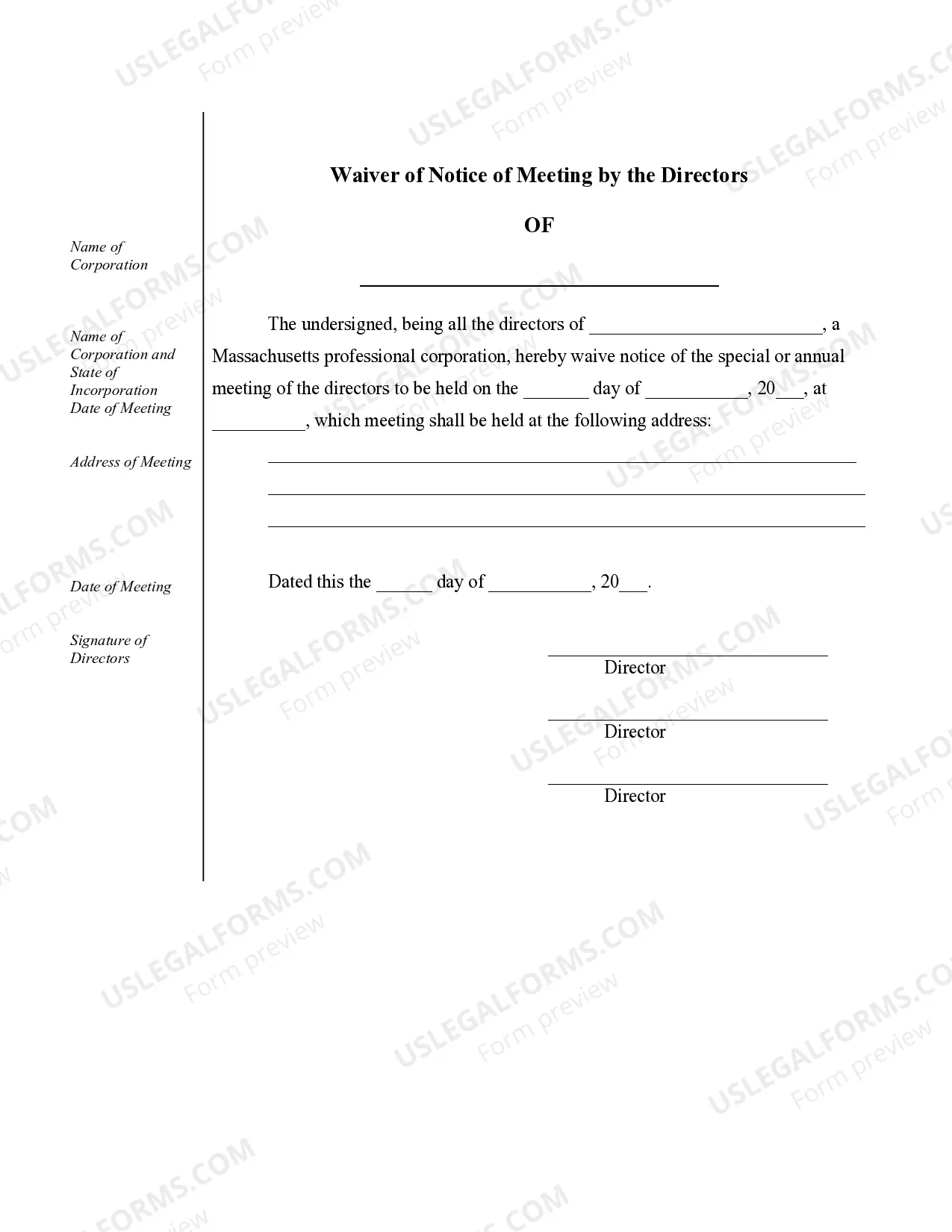

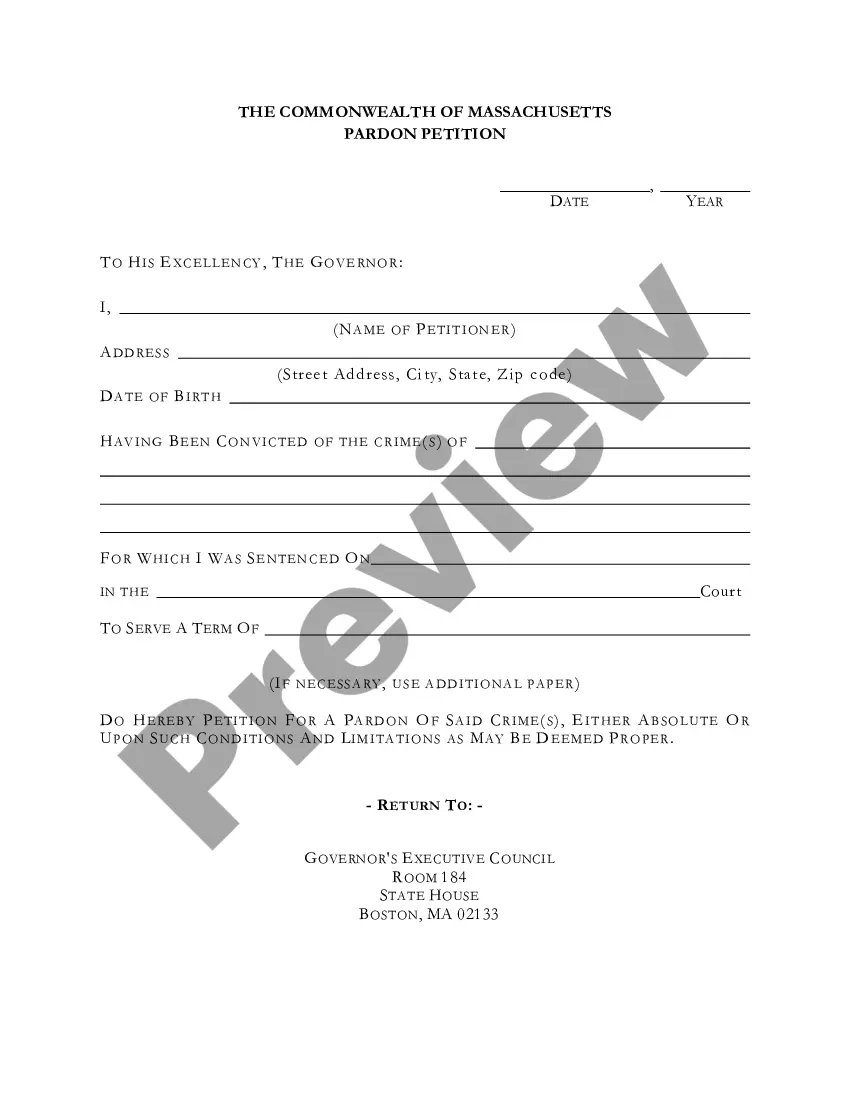

Lowell Sample Corporate Records for a Massachusetts Professional Corporation play a crucial role in maintaining a well-organized business structure and ensuring compliance with legal obligations. These records consist of various documents and forms that document the corporation's activities, financial transactions, and legal matters. Here is a detailed description of the different types of Lowell Sample Corporate Records for a Massachusetts Professional Corporation: 1. Articles of Incorporation: This is the founding document that establishes the corporation as a legal entity in the state of Massachusetts. It includes vital information such as the corporation's name, purpose, registered agent, and authorized shares. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for meetings, shareholder rights, and the board of directors' responsibilities. 3. Meeting Minutes: Detailed records of meetings held by the corporation's board of directors and shareholders. These minutes highlight important decisions, resolutions, and discussions. 4. Financial Statements: Essential records that present the corporation's financial position, including balance sheets, income statements, cash flow statements, and notes to the financial statements. These documents are crucial for financial analysis, accounting purposes, and tax reporting. 5. Shareholder Records: Keep track of the corporation's shareholders, their contact information, and ownership interests. These records may include shareholder agreements, stock certificates, and stock transfer ledgers. 6. Annual Reports: Massachusetts Professional Corporations are required to file annual reports with the Secretary of the Commonwealth. These reports provide updated information about the corporation's officers, directors, and address. 7. Stock Option Plans: If applicable, Lowell Sample Corporate Records may include documentation related to employee stock option plans, including stock option agreements, vesting schedules, and exercise notices. 8. Employment Agreements: These records outline the terms of employment for key executives, including compensation, benefits, termination clauses, and non-disclosure agreements. 9. Legal and Compliance Documents: These incorporate legal matters such as contracts, agreements, licenses, permits, and other regulatory filings relevant to the corporation's operations. 10. Tax Documents: Records of federal, state, and local tax filings, including corporate tax returns, payroll tax forms, and sales tax documents. Having a comprehensive set of Lowell Sample Corporate Records for a Massachusetts Professional Corporation is vital for both legal compliance and strategic decision-making. These records serve as a historical record of the corporation's actions, providing transparency and accountability for all stakeholders involved. It is crucial to maintain these records accurately and securely, ensuring they are readily accessible when required by auditors, government authorities, or potential investors.

Lowell Sample Corporate Records for a Massachusetts Professional Corporation

Description

How to fill out Lowell Sample Corporate Records For A Massachusetts Professional Corporation?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for legal solutions that, as a rule, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without turning to legal counsel. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Lowell Sample Corporate Records for a Massachusetts Professional Corporation or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is just as easy if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Lowell Sample Corporate Records for a Massachusetts Professional Corporation complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Lowell Sample Corporate Records for a Massachusetts Professional Corporation is suitable for your case, you can choose the subscription option and proceed to payment.

- Then you can download the document in any available format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!