Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual

Description

How to fill out Massachusetts Quitclaim Deed From Two Individuals To One Individual?

Acquiring validated templates tailored to your local legislation can be difficult unless you utilize the US Legal Forms repository.

It’s a web-based collection of over 85,000 legal documents for both personal and professional requirements, covering various real-world situations.

All the files are systematically organized by area of application and jurisdiction, making the search for the Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual as straightforward as possible.

Maintain your documents organized and compliant with legal stipulations is critically significant. Take advantage of the US Legal Forms repository to always have important document templates for any requirements right at your fingertips!

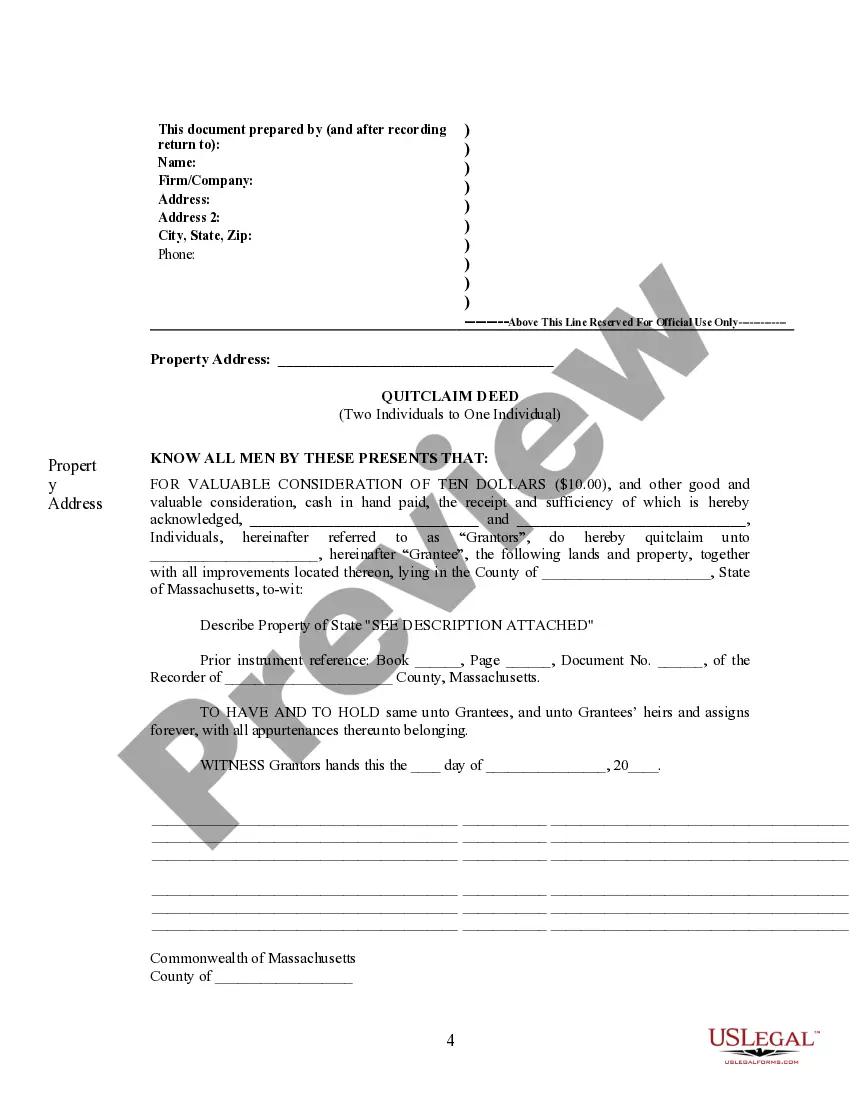

- Examine the Preview mode and document description.

- Ensure you’ve chosen the correct one that fits your needs and completely aligns with your local jurisdiction criteria.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one. If it matches your needs, proceed to the next step.

- Complete the purchase.

Form popularity

FAQ

The best way to add someone to a deed is through a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual. This method is straightforward and efficient, allowing current owners to easily transfer property rights. Make sure the deed is prepared correctly, signed, notarized, and recorded. With uslegalforms, you can access professional resources to ensure your deed is handled properly.

Yes, you can add someone to your deed without refinancing. The process involves executing a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual, which does not require any changes to your mortgage. However, be aware that this may have legal implications, especially concerning liability and ownership. Using a trusted service like uslegalforms can help you navigate this without the need for refinancing.

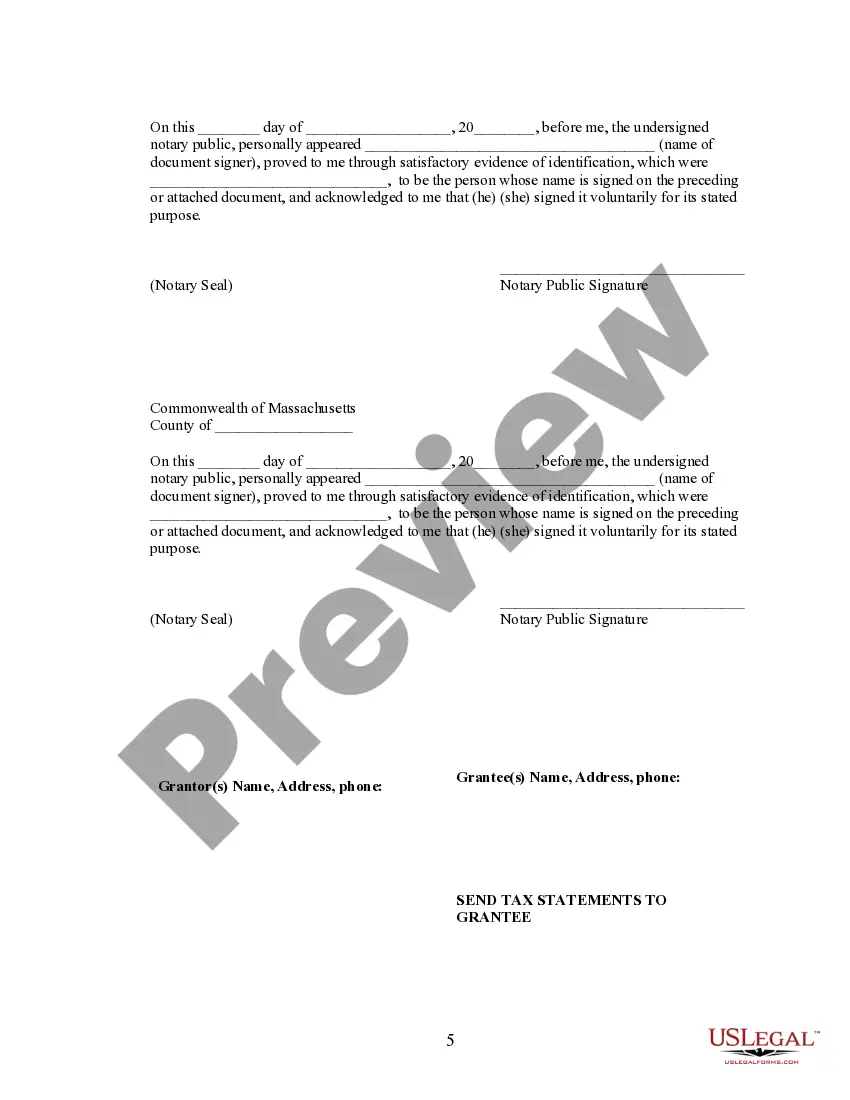

To add someone to your deed in Massachusetts, you need to create a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual. This document transfers rights from the current owners to the new owner you wish to add. Ensure that the deed is signed, notarized, and recorded at your local registry of deeds. Using a platform like uslegalforms can simplify this process by providing the right templates and guidance.

Yes, multiple people can certainly be on the deed of a house. This is common in joint ownership scenarios, especially evident in a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual. If you plan to add or remove names, using the appropriate legal documents helps ensure clear ownership rights for all parties involved.

While quitclaim deeds are useful for transferring property quickly, they have notable disadvantages. For instance, a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual does not provide any warranties regarding title defects. This means that the new owner accepts the property 'as is,' potentially inheriting any liens or claims against it. Conducting thorough research and considering safeguards is critical to protect your interests.

Similar to a quit claim deed, there is no strict limit on the number of names that can appear on a quitclaim deed. When preparing your Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual, each individual must sign the document to validate the transfer of interest. This process ensures that the deed accurately represents the ownership and intentions of all parties involved.

A quitclaim deed can include more than one person's name, which is typical in cases of co-ownership or property transfers within families. When forming a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual, the previous owners can relinquish their rights effectively. However, it is crucial to ensure that all parties agree and understand the terms before executing the deed.

A deed can have multiple names listed on it, allowing for co-ownership of property. When considering a Middlesex Massachusetts Quitclaim Deed from two Individuals to One Individual, it is important to understand the implications of each party's legal rights. In general, you can have as many names as necessary, provided that you follow the legal requirements set by the state.

To add someone to your house deed in Middlesex Massachusetts, you need to complete a quitclaim deed that transfers interest from the current owner(s) to the new individual. This deed must be signed, notarized, and then recorded at the local registry of deeds to make the change official. For assistance, check out the resources available on US Legal Forms to easily complete this task.

Yes, you can add someone to a deed in Middlesex Massachusetts without a lawyer by using a quitclaim deed. However, it’s important to ensure that the document is completed correctly and filed properly with your local registry. Using US Legal Forms can provide you with the necessary templates and guidance, making the process straightforward and efficient.