Boston Massachusetts IRS EIN Application for Trust

Description

How to fill out Massachusetts IRS EIN Application For Trust?

We consistently aim to reduce or avert legal complications when managing intricate law-related or financial matters.

To achieve this, we request the services of attorneys, which are generally very costly.

However, not every legal issue is equally intricate; many can be handled by ourselves.

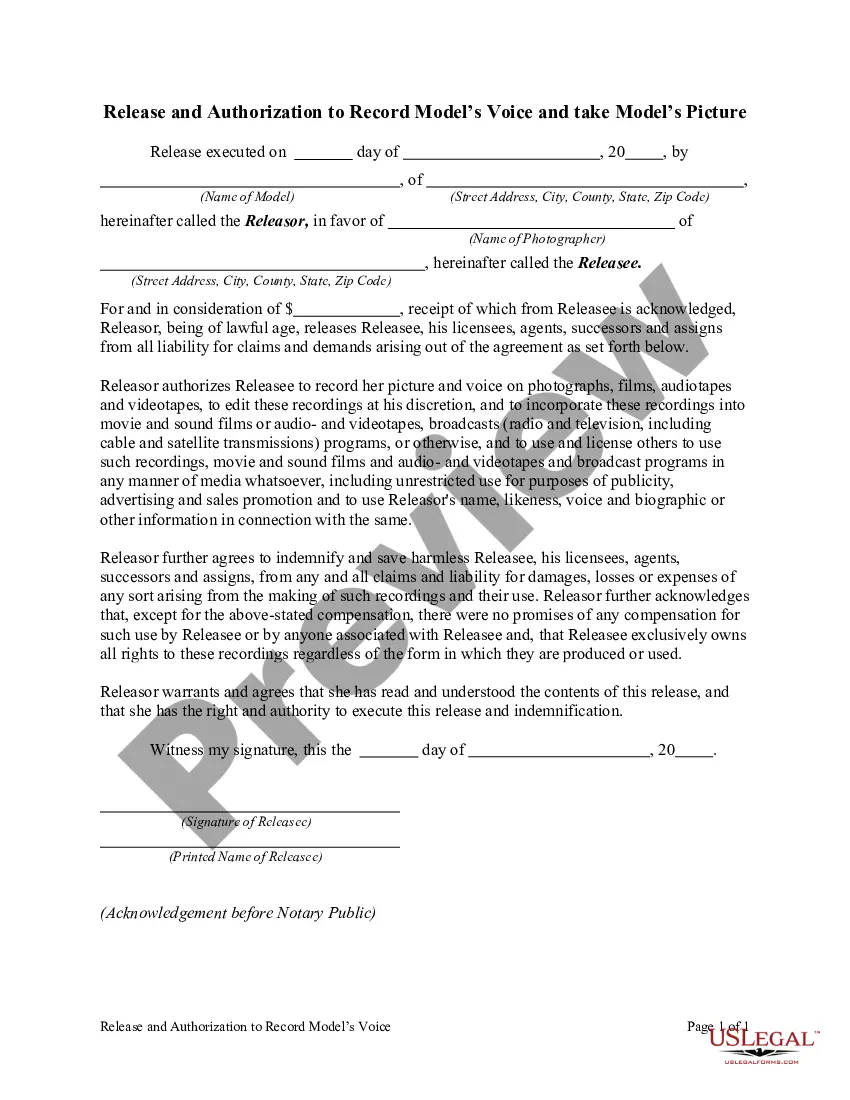

US Legal Forms is an online repository of current do-it-yourself legal documents concerning everything from wills and powers of attorney to incorporation articles and dissolution petitions. Our collection allows you to manage your affairs without relying on a lawyer.

Be sure to verify whether the Boston Massachusetts IRS EIN Application for Trust complies with the legal standards and regulations of your state and region.

- Leverage US Legal Forms whenever you require to find and download the Boston Massachusetts IRS EIN Application for Trust or any other document with ease and security.

- Simply Log In to your account and click the Get button adjacent to it.

- If you misplace the document, you can always retrieve it again from the My documents section.

- The procedure remains just as simple if you're a newcomer to the platform!

Form popularity

FAQ

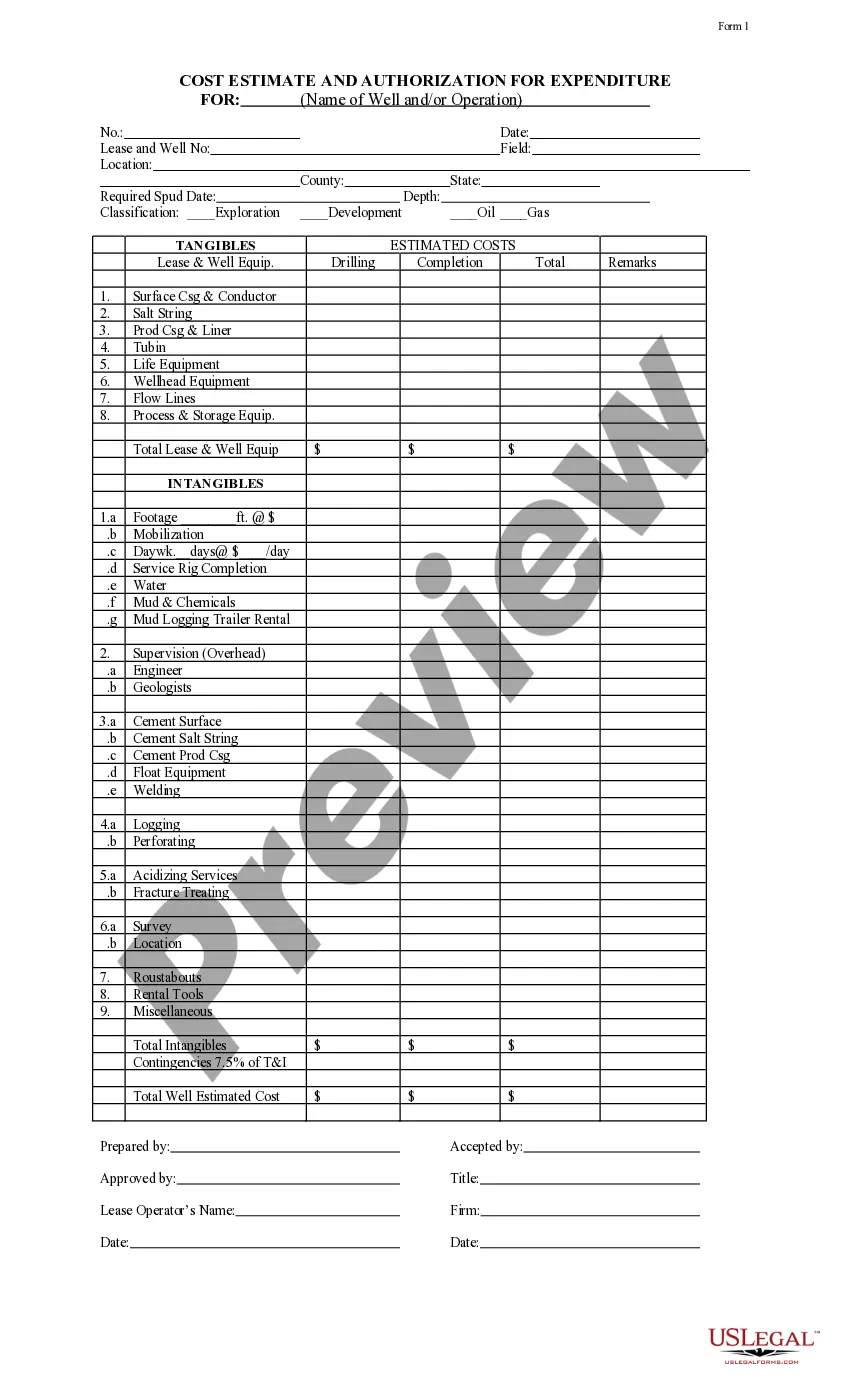

To obtain an EIN for a retirement plan trust, the plan trustee or practitioner can either apply online, or mail or fax Form SS-4, Application for Employer Identification Number to the IRS.

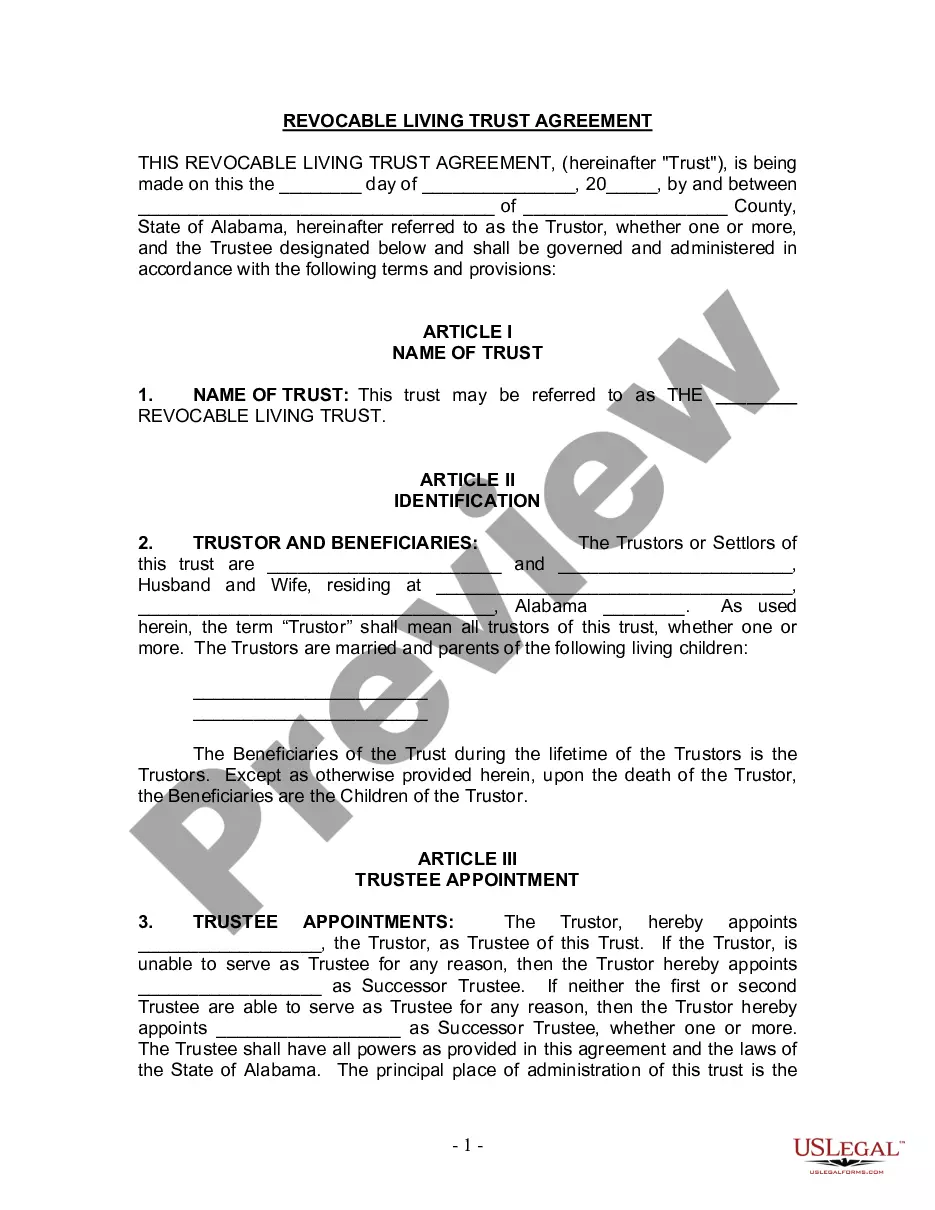

Regardless, once a trust becomes irrevocable, it is no longer in the hands of the individual who created it. An irrevocable trust is going to need a tax ID (also known as an employer identification number) because it can no longer use the SSN or ITIN of the individual (or individuals) who created it.

An irrevocable trust needs an EIN if it produces income. Any irrevocable trust is a separate legal entity from its creator for tax purposes, so it must have a separate tax ID and file its own tax return.

Even with a revocable trust, an EIN may eventually be needed. Once the grantor passes on, the revocable trust will become an irrevocable trust, and it will need its own EIN. Some trust funds are going to be taxed under their own EIN, while other trusts are going to be taxed to the beneficiary instead.

How to get an EIN for a trust Apply for an EIN online through the IRS' EIN application. Submit a paper EIN application by completing Form SS-4 and mailing or faxing it to the IRS. (You will have to pay for postage if mailing your application.)

If the trust is irrevocable, on the other hand, it's a separate legal entity. It cannot be changed by the grantor of the trust. The beneficiary would need to allow for any changes on their own end. Consequently, the irrevocable trust will need its own tax ID number, also known as an EIN.

If an irrevocable trust is not classified as a grantor trust, an EIN is required as the trust is considered a ?separate entity? from the grantor. If your trust requires an EIN, an application is submitted to the IRS as soon as possible.

The EIN application will ask for the trust's ?responsible party?: this will be the trust's grantor, even though the grantor is now deceased. In the section that asks what type of trust the EIN is for, you will respond ?irrevocable,? because the trust actually became irrevocable at the grantor's death.

Income Tax Treatment of Irrevocable Trusts Unlike a revocable trust, an irrevocable trust is treated as an entity that is legally independent of its grantor for tax purposes. Accordingly, trust income is taxable, and the trustee must file a tax return on behalf of the trust.

If an irrevocable trust is not classified as a grantor trust, an EIN is required as the trust is considered a ?separate entity? from the grantor. If your trust requires an EIN, an application is submitted to the IRS as soon as possible.