The Legal Last Will and Testament Form with Instructions you have found, is for a single person (never married) with adult children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions.

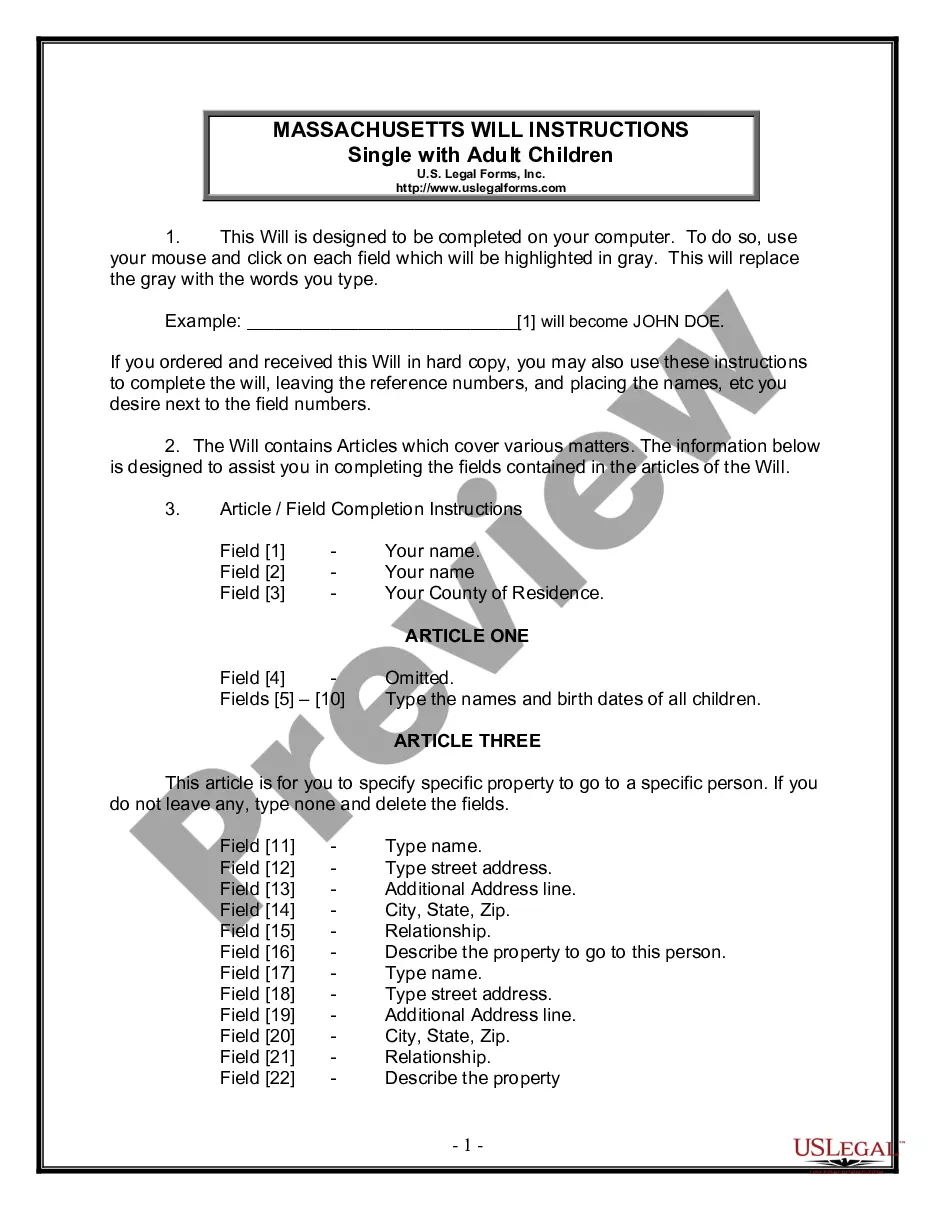

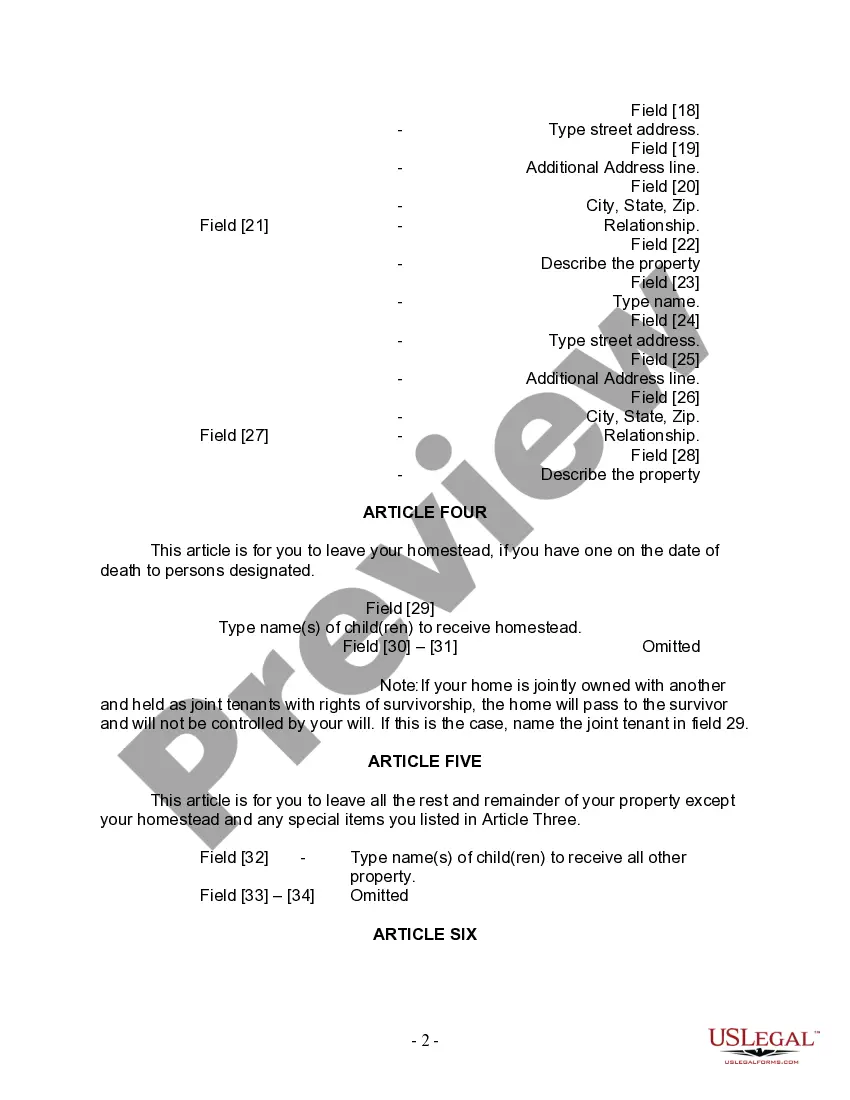

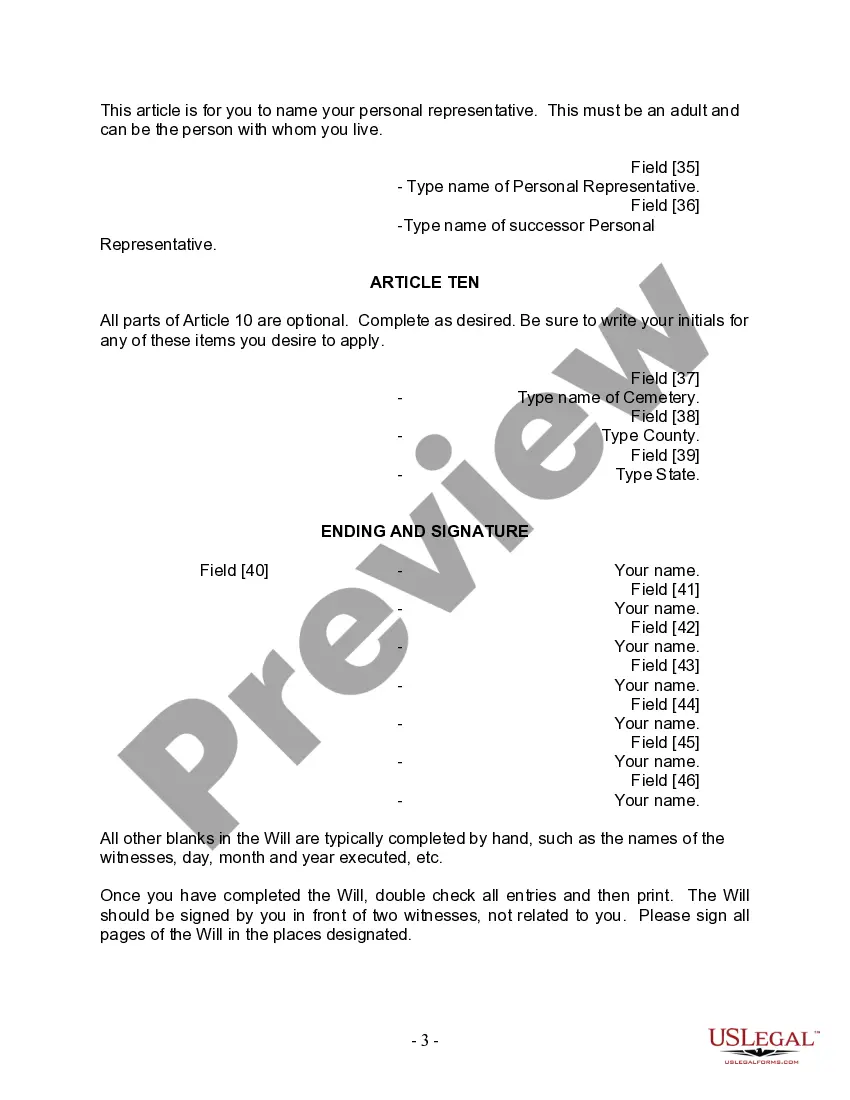

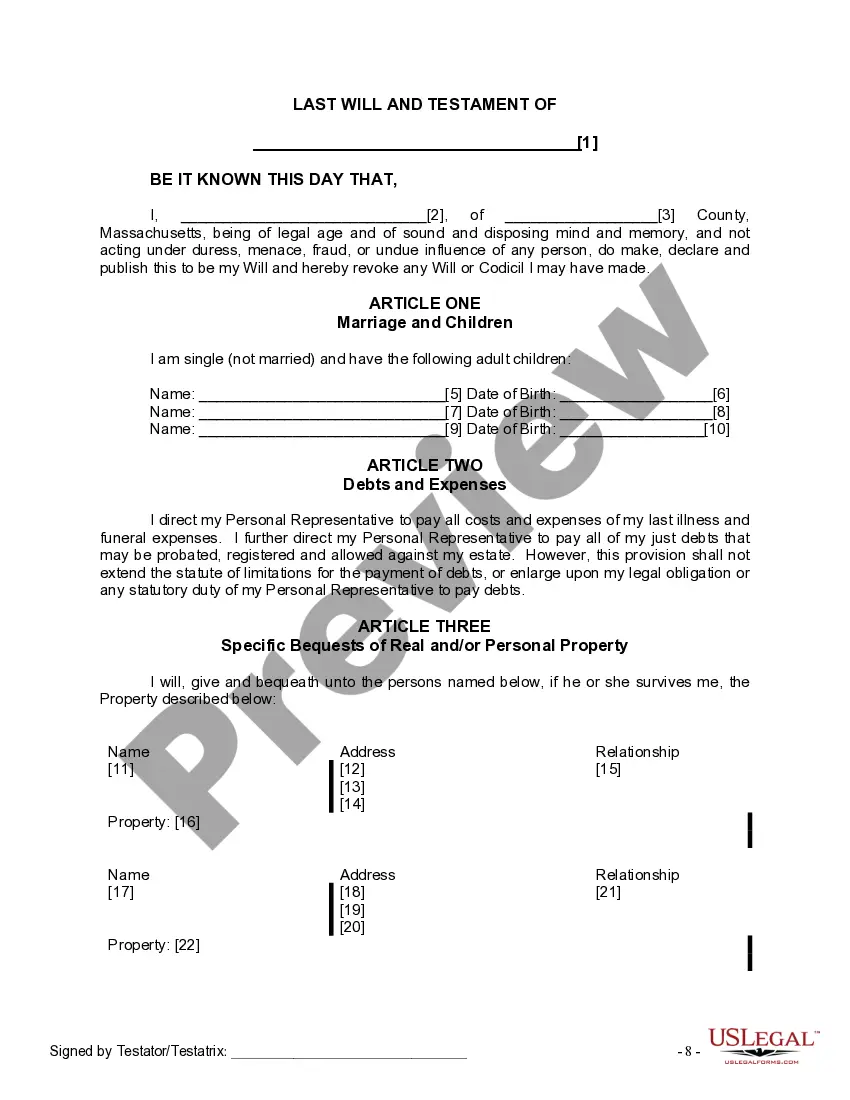

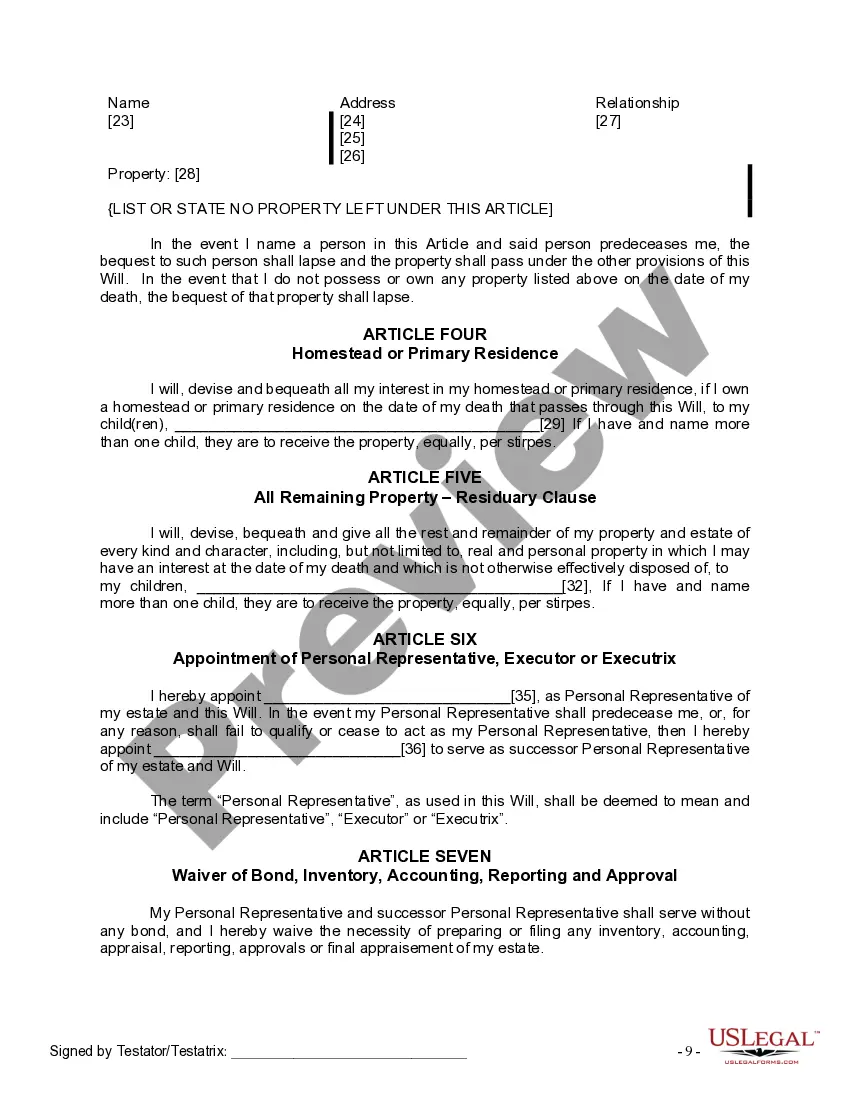

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will. The Boston Massachusetts Legal Last Will and Testament Form for a Single Person with Adult Children is a document that allows an individual residing in Boston, Massachusetts, to outline their wishes regarding the distribution of their assets and the guardianship of any minor children in the event of their death. It serves as a legally binding declaration of how the individual's estate should be handled and who should receive their property, money, and possessions. This particular Last Will and Testament form is specifically designed for individuals who are single and have adult children. It recognizes the unique circumstances faced by single parents with grown-up children and provides a framework to address their estate planning needs. However, it may not be suitable for individuals with different familial situations, such as being married or having minor children. The form typically consists of multiple sections, each addressing a different aspect of estate planning. These sections may include: 1. Introductory Clause: This section establishes the individual's full name, place of residence, and the fact that they are of sound mind, over the age of 18, and not acting under duress or undue influence. 2. Appointment of Executor: The form allows the individual to designate an executor of their estate, who will be responsible for administering the will and ensuring that their wishes are carried out. This person should be someone trusted and capable of handling the tasks involved, such as managing finances, locating assets, and distributing property. 3. Payment of Debts and Funeral Expenses: The individual can specify their preferences regarding the payment of any outstanding debts, taxes, or funeral expenses from their estate. 4. Distribution of Assets: This section enables the individual to outline their desired distribution of assets among their adult children, or other beneficiaries if applicable. They can indicate specific bequests, such as money, real estate, jewelry, or sentimental items, as well as any stipulations or conditions associated with these bequests. 5. Guardianship: If the individual has minor children, they can name a guardian for them in the event of their death. However, since this form caters to single individuals with adult children, this section may not be relevant. 6. Residual Clause: The individual can include instructions for distributing any remaining assets that were not specifically addressed in previous sections. It is important to note that while this general description provides an overview of a common type of Last Will and Testament form, it is advisable to consult a qualified attorney or legal professional to ensure the document complies with Massachusetts state law and is tailored to one's specific needs. Additionally, there may be various versions or templates available, each with its own unique features or provisions.

The Boston Massachusetts Legal Last Will and Testament Form for a Single Person with Adult Children is a document that allows an individual residing in Boston, Massachusetts, to outline their wishes regarding the distribution of their assets and the guardianship of any minor children in the event of their death. It serves as a legally binding declaration of how the individual's estate should be handled and who should receive their property, money, and possessions. This particular Last Will and Testament form is specifically designed for individuals who are single and have adult children. It recognizes the unique circumstances faced by single parents with grown-up children and provides a framework to address their estate planning needs. However, it may not be suitable for individuals with different familial situations, such as being married or having minor children. The form typically consists of multiple sections, each addressing a different aspect of estate planning. These sections may include: 1. Introductory Clause: This section establishes the individual's full name, place of residence, and the fact that they are of sound mind, over the age of 18, and not acting under duress or undue influence. 2. Appointment of Executor: The form allows the individual to designate an executor of their estate, who will be responsible for administering the will and ensuring that their wishes are carried out. This person should be someone trusted and capable of handling the tasks involved, such as managing finances, locating assets, and distributing property. 3. Payment of Debts and Funeral Expenses: The individual can specify their preferences regarding the payment of any outstanding debts, taxes, or funeral expenses from their estate. 4. Distribution of Assets: This section enables the individual to outline their desired distribution of assets among their adult children, or other beneficiaries if applicable. They can indicate specific bequests, such as money, real estate, jewelry, or sentimental items, as well as any stipulations or conditions associated with these bequests. 5. Guardianship: If the individual has minor children, they can name a guardian for them in the event of their death. However, since this form caters to single individuals with adult children, this section may not be relevant. 6. Residual Clause: The individual can include instructions for distributing any remaining assets that were not specifically addressed in previous sections. It is important to note that while this general description provides an overview of a common type of Last Will and Testament form, it is advisable to consult a qualified attorney or legal professional to ensure the document complies with Massachusetts state law and is tailored to one's specific needs. Additionally, there may be various versions or templates available, each with its own unique features or provisions.